Vacuums: 2025 Year-In-Review

Our Floor Care (Vacuums): 2025 Year-in-Review report recaps Vacuum launches, placements, pricing and advertising and promotional activity captured throughout 2025. The report features data and insights from OpenBrand’s Floor Care category, which feature products sold through the US ecommerce and brick-and-mortar channels.

Read through all the 2025 pricing and promotions insights below or email the report to read later.

You can also check out our 2025 Year-in-Review reports for other Home Appliance categories.

Floor Care Market: 2025 Product Updates

The US floor care industry entered 2025 with innovation cycles accelerating across nearly all major segments, driven by rising competition and a steadily expanding pool of international and emerging brands. Increased pressure from these manufacturers shortened product lifecycles and raised baseline expectations for automation, performance, and convenience. Brands were no longer competing solely on incremental upgrades but on how quickly they could introduce new capabilities that aligned with evolving consumer standards and shifting definitions of value.

Much of this acceleration can be traced back to structural changes that began earlier in the decade, particularly the expansion of e-commerce marketplaces. Platforms such as Amazon and Walmart lowered barriers to entry, allowing international brands to establish US credibility without relying on traditional brick-and-mortar distribution. These channels streamlined logistics, reduced upfront risk, and enabled rapid brand building, with successful online brands later expanding into physical retail. By 2024, this shift was clearly visible, with brands such as Dreame and Roborock securing placements at Target and Best Buy. Momentum continued in 2025 as channel access expanded further, including the launch of Best Buy’s marketplace in August, creating additional pathways for brands and sub-brands to scale their presence.

As access widened, competition intensified across both online and in-store environments, increasing pressure on incumbent manufacturers to defend share. Against this backdrop, portfolio diversification emerged as an executional necessity rather than a growth experiment. Broader portfolios allowed brands to absorb pressure within individual segments, while narrower portfolios increased exposure to demand volatility and faster-moving innovation standards. These conditions set the foundation for the strategic decisions and market outcomes that defined the floor care industry throughout 2025.

Impact Summary

- Competition accelerated innovation cycles across floor care segments

- Portfolio breadth proved critical as pricing and demand pressures rose

- Multifunctionality may shape premium floor care innovation heading into 2026

- Portfolio Diversification as a Competitive Playbook

As innovation cycles compressed, portfolio diversification functioned as a core competitive strategy rather than a reactive response. Brands with exposure across multiple categories were better positioned to manage volatility, balance pricing pressure, and sustain relevance as expectations rose and differentiation windows narrowed. In contrast, brands concentrated in fewer segments faced heightened risk when individual categories slowed or innovation standards reset.

SharkNinja remains one of the clearest examples of diversification executed at scale. Expansion into new product categories has long been a stated growth pillar for the company, alongside increasing market share in existing segments and expanding its international footprint. Within floor care, this strategy translated into sustained investment across robotics, uprights, stick vacuums, floor washers, and carpet cleaners. Rather than relying on strength in a single category, Shark consistently leveraged brand equity and engineering capabilities to expand adjacently, allowing the company to remain resilient despite intensifying competition from both legacy and emerging brands.

International brands followed a similar playbook, often entering the US through technology-forward categories before expanding outward. Roborock’s trajectory highlights this approach. After establishing a strong robotic vacuum business and expanding into floor washers, the brand announced its return to the stick vacuum segment in mid-2025 with the H60 series. The re-entry followed earlier exits from the category and reflected confidence built through success in adjacent segments. By introducing auto-empty functionality into its stick lineup, Roborock extended automation-driven features beyond robotics and aligned its portfolio more closely with broader category expectations. Across the market, diversification increasingly determined which brands could sustain momentum as innovation cycles accelerated.

Vacuum Market: Accelerating Innovation Cycles

Innovation across floor care accelerated further in 2025, delivering gains in automation, hygiene, and cleaning performance across multiple product types. Advances in wet and dry integration, maintenance automation, suction power, surface detection, and navigation raised performance baselines while compressing acceptable timelines for feature adoption. As a result, brands faced growing pressure to keep pace with rapidly evolving standards rather than relying on prior leadership positions.

These conditions placed heightened strain on brands with limited portfolios, particularly those concentrated in discretionary categories. iRobot’s experience during 2025 illustrates how faster innovation cycles and softer consumer demand can compound structural weaknesses. With a portfolio focused exclusively on robotic floor care, the brand remained exposed to a segment more sensitive to economic pressure than traditional vacuum categories.

Following the termination of its proposed acquisition by Amazon in early 2024, iRobot entered 2025 amid a turnaround effort centered on preserving the Roomba brand and realigning its product strategy with faster innovation cycles. Under new leadership, the company launched its largest portfolio refresh to date, introducing eight new robotic vacuum and mop models that incorporated LiDAR-based navigation, dual spinning mop pads, ultrasonic carpet detection, and expanded self-cleaning dock functionality. While these updates brought iRobot closer to prevailing segment standards, they also underscored how little margin remained for delayed feature adoption as innovation cycles continued to compress. Financial pressure persisted throughout the year, ultimately leading iRobot to file for Chapter 11 restructuring in December 2025 and agree to an acquisition by its primary contract manufacturer, PICEA. The outcome highlighted the risks associated with limited portfolio exposure in a market where innovation standards reset annually.

The broader market demonstrated how quickly new technologies now move from differentiation to expectation. Continuous self-cleaning roller mop systems provide a clear example. First introduced in mid-2024 with Eufy’s S1 Pro Omni, the format gained visibility at CES 2025 as brands such as Narwal and ECOVACS showcased competing implementations. By the end of 2025, the feature had moved toward near-standard inclusion among premium robotic vacuums, with most major players either implementing it or announcing upcoming flagships. Roborock stood out as one of the last major brands yet to adopt the format, with its Qrevo Curv 2 Flow expected to debut at CES 2026, reinforcing how quickly innovation expectations now propagate across the market.

Vacuum Pricing Pressure & Tariff Impacts

While innovation cycles defined much of the competitive landscape in 2025, the rollout of US tariffs introduced an additional layer of pressure that influenced pricing behavior and consumer demand. As costs rose, brands were forced to balance margin protection against demand sensitivity, particularly as broader economic uncertainty pushed consumers away from discretionary purchases such as robotic floor care.

Pricing impacts were not evenly distributed across the market. The robotic segment remained comparatively insulated from direct price inflation, as brands worked to remain competitive in a category already facing softer demand and rapid feature turnover. In contrast, price increases were more visible across non-robotic categories, including uprights, stick vacuums, and wet and dry cleaners, where manufacturers had greater flexibility to adjust pricing without materially altering purchase intent.

Emerging international brands largely avoided tariff-driven price increases despite manufacturing exposure in China. Strong international revenue bases and higher-margin premium positioning likely allowed these brands to offset US cost pressure elsewhere, further limiting the ability of legacy robotic-focused brands to raise prices without losing share. Among established manufacturers, Shark was the earliest and most aggressive responder, announcing tariff-related pricing actions during its Q1 2025 earnings call and implementing broad increases beginning in the second quarter, followed by additional increases later in the year. Other brands adopted more gradual approaches. Tineco introduced selective and fluid adjustments, while Dyson delayed its first tariff-related price increases until August, followed by further increases in September. Hoover and Dirt Devil also began adjusting prices in late summer, while Bissell stood out for maintaining largely stable pricing throughout the year. Unlike other industries, most floor care brands delayed widespread pricing changes until late summer, reflecting the category’s competitive intensity and sensitivity to demand.

2026 Vacuum Market Outlook

Looking ahead to 2026, attention is shifting toward how brands translate accelerated innovation into solutions that deliver practical value rather than incremental complexity. Developments late in 2025 point toward a potential next phase of competition centered on broader functionality across surface types and use cases. While still emerging, this direction mirrors trends seen across other premium small appliance categories, where multifunctionality has gained traction as a way to reduce device count and improve convenience.

The floor washer segment offers an early signal of how this evolution may unfold. Traditionally positioned for hard floors only, the category has required separate devices for carpeted areas, limiting adoption in mixed-surface homes. Dreame’s H15 Pro CarpetFlex, introduced ahead of IFA 2025, addresses this limitation by enabling hard floor mopping and carpet vacuuming through interchangeable brush heads with automatic mode detection. The approach reflects growing interest in reducing friction between adjacent cleaning tasks rather than treating them as isolated categories. Similar thinking is evident in products such as Shark’s late-2025 EveryMess, which combines portable wet and dry shopvac functionality and stain cleaning capabilities.

Multifunctionality is also beginning to surface within robotic floor care. At CES 2026, Robotin is showcasing a robotic model designed to vacuum, mop, and clean carpets within a single platform. While early and supported through a Kickstarter-funded development model, the concept reflects interest in expanding robotic systems beyond maintenance cleaning and toward broader surface coverage. Execution risks remain high, and not all multifunctional concepts will scale. If implemented effectively, however, these approaches may support adoption in newer segments such as wet and dry floor washers and hybrid carpet cleaners. Success in 2026 will depend less on feature count and more on whether consolidation meaningfully improves cleaning outcomes in increasingly complex home environments.

Get more information

Visit our Consumer Durables industry page to learn more about the data we deliver for the Floor Care market – or reach out to our analyst below to ask questions about this report or get specific insights you need.

About the Analyst

Jordan Carter

Jordan Carter is a market analyst specializing in the home appliance industry. Her research focuses on the latest trends and innovations that are reshaping this dynamic market.

What the Kitchen Market Needs to Know About Appliance Tariffs, Pricing & More

Updated August 2025

For the most recent data on inflation for Durable Goods & Personal Care, check out OpenBrand’s latest CPI Data Releases.

Throughout the first half of 2025, the kitchen appliance industry is facing a period of noteworthy disruption, driven by influences such as the housing market, new and upcoming tariffs, and evolving consumer demand and preferences.

During our recent webinar, “Cooking Up Insights in Kitchen: Top Industry Highlights,” my colleague Val Alde-Hayman and I took a look at these areas and more, exploring the top trends shaping both large and small kitchen appliances in 2025.

We uncover how:

- How much appliance prices are increasing with tariffs

- Why the housing market is slowing large appliance sales

- Why premium small appliances might see an increase in sales in late 2025

You can read through some of the key takeaways from the webinar in this article, but make sure to check out the webinar below to hear the full details.

1. The Housing Market’s Ripple Effect on Large Appliances

One external force significantly impacting large appliance sales is the housing market. Mortgage rates remain high, causing home sales to cool down — and with fewer people buying or moving, large appliance purchases have also slowed.

Here’s how this breaks down:

- High mortgage rates are causing a decrease in home purchases

- Fewer home purchases equates to fewer large appliance purchases

- Consumers are buying out of necessity instead, with replacements accounting for over 70% of major appliance purchases

🔍 Our Assessment: With home sales slowing in 2025, most large appliance purchases now come from necessity-driven replacements. For sellers and procurement professionals alike, this shifts the focus from outfitting new homes to meeting urgent, budget-conscious demand.

Success for sellers may hinge on securing dependable, energy-efficient models, negotiating favorable terms, and leveraging promotions or financing to move inventory until housing-driven demand rebounds.

2. Renters & Small Appliance Growth

As home purchases slow, rental households rise, especially among younger consumers. And with rental households increasing nearly 3x faster than homeowner households in 2024, demand for small, portable kitchen tools is rising. Here’s what we are seeing as a result:

- Smaller kitchens mean less room to store or display appliances

- This increases the appeal of small appliances, which take up less space

- However, when small appliances get put away, they’re forgotten and used less

- Brands are responding with space-saving and multifunctional designs

Example: Ninja’s DoubleStack air fryer and Cuisinart’s SpaceSaver oven align with counterspace-conscious shoppers.

🔍 Our Assessment: With rental households outpacing homeowner households, small appliances are benefiting from a surge in demand — particularly among younger, space-conscious consumers.

For sellers and procurement professionals, the opportunity lies in curating compact, multifunctional models that justify their footprint on limited countertops. Expect success when highlighting versatility, easy storage, and modern design.

3. Innovation in Features & Format in the Kitchen Market

Brands are responding to space and price sensitivity with innovative designs and multifunctional features. We’re seeing:

- Vertical air fryers like Ninja’s DoubleStack

- Flip-up appliances like Cuisinart’s SpaceSaver air fryer and the Ninja Flip

- Hybrid appliances that combine air fry, toast, and bake in one unit such as the air fry ovens from Frigidaire and GE which bridge major and small appliance capabilities

Multifunctionality isn’t a new capability but it is growing in popularity, rising as a consumer expectation. Whether it’s a coffee maker that handles both single-serve and multi-cup or an ice cream maker that also whips up frozen drinks, shoppers want more value and less appliances.

🔍 Our Assessment: As consumers grow more space- and price-conscious, multifunctional appliances shift from niche perk to expected standard.

Looking to win on the showroom floor? The winning products are likely those that solve real kitchen constraints, combining multiple functions, fitting smaller spaces, and delivering everyday value.

4. Appliance Pricing & Promotions: What’s Changed Since the Pandemic?

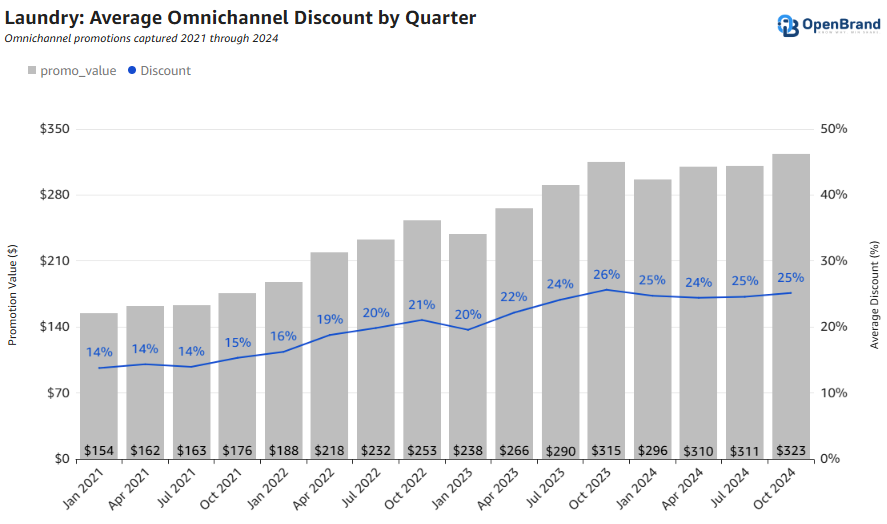

In 2021, high demand and low inventory allowed brands to pull back on discounts. But in 2022 and beyond, promotions ramped up again, especially for large appliances, as price-sensitive shoppers returned.

- Major appliances saw sharp price hikes post-pandemic; now major appliance prices are softening due to promo pressure

- Small appliances stayed more stable but trend downward in average price

- Value-focused sub-brands (e.g. So Yummy by Bella) are gaining traction

🔍 Our Assessment: With large appliance prices easing under promotional pressure and small appliance prices trending down, buyers are once again prioritizing value.

For sellers, the growth of affordable sub-brands signals an opportunity to meet demand without sacrificing margin — especially in high-turn categories like single-serve products. Strategic discounting, bundling, and clear value messaging must be part of your strategy to capture price-sensitive shoppers in 2025.

5. Will Appliances Be Affected by Tariffs in 2025?

While the full picture is still developing, early indicators show that new tariffs will moderately increase appliance costs, especially for major appliances.

- Tariffs are expected to modestly raise prices, especially in large appliances

- Small appliance prices expected to rise gradually, unlike large appliances

- Price increases may be temporary, and consumers are likely to remain price-sensitive

🔍 Our Assessment: With new tariffs set to raise costs in large appliances, pricing strategies need to balance consumers’ heightened price sensitivity. The near-term play will be managing cost pressures while using promotions to protect demand.

Small appliance price hikes are expected to be slower and less pronounced, creating opportunities to shift focus toward these categories if large appliance margins tighten.

Forecast: Expect higher shelf prices but aggressive promos to maintain consumer interest. Small appliances may be an avenue to help fill the gap in revenue.

To see how this plays out for large versus small appliances, check out the full webinar recording! And for more forecast and tariff impact, I highly recommend you check out our new CPI and Market Forecast products launched this year by our Chief Economist, Ralph McLaughlin.

6. 2025 Outlook: What’s Ahead for the Kitchen Market

Major Appliances Forecast

- Large Appliances Impacted Most: Large appliances might see the biggest shift in consumer purchasing as rising everyday costs and potentially tariff-related impacts shrink the market for new purchases

- Shrinking Demand for Home Purchases: Higher resource costs could push home prices up, reducing new home purchases and demand for large appliances

- Increased Competition: Tariff effects on low-margin items may intensify competition, driving deeper discounts to capture limited spending

- Replacement-Purchase Only: Trend of replacement-based purchases expected to continue

Small Appliances Forecast

- Slight, but Real Impact on Small Appliances: Small appliance prices may rise slightly due to parts and labor sourced from countries impacted by tariffs

- Demand Remains Stable: Despite price increases, demand may remain stable or improve as consumers are less sensitive to lower-priced appliances

- Consumers More Willing to Upgrade?: With more time spent at home consumers may upgrade small appliances such as coffee makers to avoid spending money out

- Larger Brands Less Impacted: Smaller brands may see slight price increases, while leading brands are likely to diversify supply chains to adapt quickly

Watch the Full Webinar for More Kitchen Market Insights

Want a deeper dive into these insights? Get a more in-depth look into these trends and hear the extended Q&A in the webinar recording — including a guest appearance from our Chief Economist, Ralph McLaughlin, who provides more insights into tariff related questions from our live attendees!

Watch now → What’s Cooking in Kitchen Webinar Recording

Thanks for reading, and if you attended the live webinar, thanks for joining us! The team here at OpenBrand, myself included, are here to help you navigate the kitchen market with clarity and confidence.

Get the answers you need: connect with our team

If you have questions, please reach out to me directly using the form below or request a demo to see our appliance data in action.

Jordan Carter

Jordan Carter is a market analyst specializing in the home appliance industry. Her research focuses on the latest trends and innovations that are reshaping this dynamic market.

Floor Care: 2024 Year-In-Review

Our floor care year-in-review report recaps the most critical activity captured throughout 2024. The report features data and insights from OpenBrand’s Floor Care categories, which feature floor care products sold through the US ecommerce and brick-and-mortar channels.

- Overview

- Portfolio Diversification & Industry Impact

- Innovations Redefining Floor Care in 2024

- Growing US Competitive Landscape

- Outlook

Read through all the 2024 pricing and promotions insights below or email the report to read later.

Overview

The floor care industry underwent significant changes in 2024, with growth seen across nearly all segments. Stick vacuums saw a notable rise in auto-empty models, with releases such as Eureka’s Stylus Elite, Tineco’s Pure One Station and GO series, and Shark’s Clean & Empty and PowerDetect lineups. These additions expanded auto-empty functionality beyond LG and Samsung’s offerings, broadening consumer options within the segment. Innovation also drove the growth of the combination market, as brands like Tineco and ECOVACS introduced models that provided multiple floor care solutions through interchangeable motors or singular docking stations.

Manufacturers also diversified their portfolios across price bands and segments.

- Eufy shifted towards more premium models, moving beyond its entry-level positioning, while iRobot expanded its Roomba Essential lineup to strengthen its presence in the entry-level segment.

- Shark launched its most premium model to date, the $999 PowerDetect robotic vacuum and mop, surpassing its previous $799 upper limit.

- Dyson entered new segments with the release of the 360 Vis Nav robotic vacuum and WashG1 floor washer.

- Tineco grew its carpet cleaning portfolio with the Carpet One Cruiser, announced at IFA 2024, emphasizing categories beyond its core floor washer lineup. This move followed Shark’s 2023 entry into the carpet cleaning segment, intensifying competition in a category historically dominated by Bissell and Hoover.

These innovations and portfolio expansions reflect the increasingly competitive nature of the floor care industry, driven by an influx of emerging brands. While the US floor care market has traditionally been led by a handful of well-known manufacturers, the landscape is shifting.

Tineco’s rise began with a strong Amazon presence before its entry into Walmart stores in late 2020, and 2024 saw additional international brands gaining traction. Narwal expanded its reach through major online channels such as Best Buy, Costco, and Target, Dreame entered Target.com, and Roborock secured nationwide representation in Best Buy’s retail locations.

This growing emphasis on US expansion is expected to drive further innovation among established manufacturers as they work to maintain market share and brand presence in an increasingly competitive marketplace.

Portfolio Diversification and Its Impact on the Floor Care Industry

Portfolio diversification became a defining strategy for the floor care industry in 2024, as manufacturers sought to address increasing competition and evolving consumer demands. By expanding into new subcategories such as robotic vacuums, carpet cleaners, and bare floor cleaners, brands are reducing risk, appealing to broader consumer demographics, and strengthening brand loyalty. This approach enables manufacturers to balance performance across segments and positions them for long-term growth in an increasingly competitive market.

Shark has demonstrated a strong commitment to diversification through its strategic expansion into multiple floor care categories. The brand bolstered its presence in the bare floor washer segment throughout 2024 with models like the MessMaster HydroVac and, most recently, the HydroDuo, released at the end of 2024. The HydroDuo serves as Shark’s direct response to Dyson’s WashG1, which debuted shortly before and marked Dyson’s first entry into the floor washing category. Both models exclude the need for suction to collect dry debris, with Shark positioning the HydroDuo at a significantly lower price point, offering consumers a competitive budget alternative. This release highlights Shark’s focus on expanding its portfolio to address evolving consumer needs and maintaining its competitive edge in the bare floor cleaning market that is led by Bissell and Tineco.

Beyond bare floor cleaning, Shark has made significant strides in the carpet cleaning category with its CarpetXpert series. Introduced in 2023, the CarpetXpert lineup marked Shark’s entry into a category historically dominated by Bissell and Hoover. By offering portable and full-size carpet cleaning solutions, Shark has provided direct competition to established players in both online and brick-and-mortar channels. This has broadened consumer options and intensified competition in a segment that has long been controlled by Bissell and Hoover. Further diversification in the carpet cleaning market came from Tineco, which announced its Carpet One Cruiser at IFA 2024. This marks Tineco’s first new carpet cleaner since the initial Carpet One series debuted in 2022. The Carpet One Cruiser refreshes Tineco’s carpet cleaning capabilities, reflecting the brand’s ongoing commitment to innovation and its intention to challenge established competitors.

These efforts by leading manufacturers underscore the importance of portfolio diversification in the evolving floor care market. By expanding into complementary categories and leveraging new technologies, brands are not only addressing shifting consumer preferences but also positioning themselves to compete more effectively in a crowded and dynamic industry landscape.

Innovations Redefining Floor Care in 2024

Following the diversification efforts seen throughout 2024, the floor care industry introduced several notable innovations aimed at addressing shifting consumer demands for enhanced convenience and functionality. Key developments included the expanded adoption of auto-empty technology in the stick vacuum category, advancements in combination models, and continued innovation in the floor washing segment.

Auto-empty capabilities in the stick vacuum segment are not entirely new but were previously limited to premium models from LG and Samsung. This began to change in 2023 with Tineco’s Pure One Station and Shark’s Detect Pro. Throughout 2024, both brands expanded their offerings in this area, with Tineco releasing its GO series and Shark introducing its Clean & Empty and PowerDetect lineups. Additionally, Eureka entered the market with its first auto-empty stick vacuum in 2024, further broadening access to this technology. These advancements reflect an ongoing industry trend toward making high-end features more widely available to meet consumer expectations for convenience and ease of use.

Combination models also gained significant attention in 2024, with Tineco, ECOVACS, and LG making notable strides. Tineco introduced its Switch and Combo models, while ECOVACS expanded its portfolio with its DEEBOT Combo models. These products incorporate interchangeable motors or docking stations, enabling diverse cleaning modes within a single device. At IFA 2024, LG announced a combination model of its own, signaling its entry into this segment. While LG’s model is not yet released, it is expected to make its way into the US market in the near future. By offering a full suite of floor care solutions in one product, combination models reduce the need for consumers to purchase multiple devices from different brands. This strategy allows manufacturers to capture a larger share of the consumer’s floor care budget while aligning with the industry’s focus on efficiency and integration.

Bissell, a long-standing leader in the floor washing segment, also focused on innovation within its CrossWave series throughout 2024. The brand introduced multiple advancements, including its CrossWave OmniFind and OmniForce models, which feature the new FurFinder Headlight for improved pet hair detection and ZeroGap technology for enhanced cleaning reach. These additions reflect Bissell’s commitment to maintaining its leadership position in the floor washing category through continuous product enhancements as more brands look to compete within the floor care segment.

These innovations highlight the floor care industry’s efforts to address evolving consumer needs through advanced technologies and expanded product capabilities. As manufacturers continue to refine and expand their offerings, the market is positioned for further advancements that will shape product features and competitive dynamics in the years to come.

Growing Competitive Landscape in the US Floor Care Market

The US floor care market saw intensified competition in 2024 as international brands expanded their presence through strategic placements across key merchants and the growth of their product offerings. Roborock led the charge with retail placements in over 850 Best Buy locations, featuring models like the S8 MaxV Ultra and Qrevo Pro, while brands such as Dreame and Narwal focused on online channels.

Dreame entered Target’s online assortment with the Z10T Station auto-empty stick vacuum and E30 Ultra robotic vacuum and mop, while Narwal added its Freo Mate to BestBuy.com and its flagship Freo model to Costco.com, despite being limited to Amazon in previous years.

In addition to robotic vacuums, emerging brands expanded their portfolios to compete in adjacent categories after using their innovative robotic vacuum portfolios to penetrate the US market. Roborock introduced its Flexi Pro and Flexi Lite floor washers, growing its floor washer portfolio, while Narwal debuted the S10 Pro floor washer, marking its first non-robotic product. These expansions reflect a broader strategy among international brands to leverage their new footholds in the US market to gain a presence in growing subcategories. By securing strategic placements and broadening offerings, these brands are challenging established manufacturers, driving innovation, and reshaping the competitive landscape of the US floor care industry.

Market Outlook for 2025

As the floor care industry moves into 2025, key themes such as portfolio diversification, convenience-focused innovations, and intensified competition are expected to shape the market.

The adoption of auto-empty capabilities in stick vacuums and the rise of combination models offering multi-functional cleaning solutions highlight manufacturers’ focus on addressing evolving consumer needs. Diversification efforts, including expansions into categories like bare floor cleaners and carpet cleaners, reflect a broader strategy to capture a greater share of consumer spending while appealing to diverse demographics across price tiers.

The competitive landscape will likely continue to intensify as international brands such as Roborock, Dreame, and Narwal build on their 2024 momentum. By securing strategic placements at retailers like Best Buy, Target, and Costco, these brands are challenging established manufacturers and driving innovation. Their success in leveraging robotic vacuums as a market entry point, followed by expansions into floor washers and stick vacuums, signals a shift in industry dynamics. Heading into 2025, these trends are poised to deliver greater consumer choice while compelling established brands to adapt and evolve in a rapidly changing market.

Get more information

About the Author

Jordan Carter

Jordan Carter is a market analyst specializing in the home appliance industry. Her research focuses on the latest trends and innovations that are reshaping this dynamic market.

Laundry: 2024 Year-In-Review

Our laundy year-in-review report recaps the most critical activity captured throughout 2024. The report features data and insights from OpenBrand’s Laundry categories, which feature laundry products sold through the US ecommerce and brick-and-mortar channels.

- Overview

- Front Load Laundry Segment Expansion

- Heat Pump Technology Drives Growth in the Laundry Market

- Outlook

Read through all the 2024 pricing and promotions insights below or email the report to read later.

Methodology

Data included in this report is sourced from the OpenBrand Laundry categories. Data in this analysis (except for advertising data) was captured between Q1 2023 (week of January 1) and Q4 2024 (week of December 8). Advertising data runs through December 31, 2024. Retail advertisements include Banner Ads and Retail Circulars captured at retailers and their dot com counterparts (i.e. Staples and Staples.com). The merchants were updated to only the brick-and-mortar name regardless of channel for simplicity (i.e. any Staples.com ads were updated to Staples). Additionally, the following advertising section features SKU-specific ads.

Overview

The major appliance industry has experienced transformative shifts in recent years, with 2024 standing out as a year of stabilization in inventory and promotional activity. Following the disruptions caused by the COVID-19 pandemic, manufacturers have worked steadily to align operations with evolving consumer behavior and market dynamics. By the second half of 2023, inventory levels and supply chain reliability showed significant improvement, enabling a return to pre-pandemic promotional trends throughout 2024.

For consumers, this translated into heightened savings and discounts across appliance categories. However, the industry continued to grapple with challenges linked to constrained consumer spending. Elevated inflationary pressures and a weak housing market further restricted disposable income, driving demand primarily toward replacement purchases. This shift contrasted with pre-pandemic trends that included higher sales volumes tied to new home purchases and remodeling projects.

Front Load Laundry Segment Expands in 2024

While top load laundry solutions remain the most popular configuration, the front load segment has seen significant growth throughout the year, posting towards upcoming trends for 2025. Looking at the front load segment, Samsung released its first BESPOKE all-in-one model and laundry towers, representing an expansion of its offerings for the configuration.

LG released its WashCombo all-in-one model, growing its combination portfolio to directly compete with GE Profile’s 2023 4.8' Carbon Graphite Front Load AIO (PFQ97HSPVDS), with competing models in the combination segment extending to GE Profile, LG, and Samsung in 2024.

Additionally, 2024 brought new all-in-one models from GE Profile, with the brand expanding its portfolio to include three new combination models in the third quarter, releasing merchant-exclusive models at Lowe’s and Home Depot and a more widely distributed variation that gained exposure through Best Buy and regional merchants.

While the all-in-one segment remains a small portion of the laundry category, the increased efforts from leading manufacturers over the past two years signify a growing emphasis for the segment going forward, with additional brands likely to release competing models in the near future, further bolstering the expanding front load laundry market.

All-in-one models offer a unique space-saving design with both the washer and dryer condensed to a singular unit. Additional benefits include the elimination of the need to transfer laundry from the washer to the dryer, decreasing the time that wet clothes are sitting in a machine. With more consumers living in smaller spaces, such as apartments, as a result of the poor housing market, the compact all-in-one laundry models offer a solution for consumers and builders. Notably, the competing all-in-one models released throughout 2023 and 2024 all use heat pump technology to dry clothes, providing additional savings to consumers through rebates. The 2022 Inflation Reduction Act offers Home Electrification and Appliance Rebates for both induction cooking appliances and heat pump-equipped appliances, further incentivizing adoption and underscoring the industry’s shift toward electrification.

Heat Pump Technology Drives Growth in the Laundry Market

The Inflation Reduction Act (IRA) has accelerated the adoption of heat pump technology in the laundry segment, reshaping industry strategies and consumer options. Heat pump technology, first introduced to the US laundry market in 2014 by LG and Whirlpool, initially faced challenges due to less effective drying performance. Over the past decade, advancements have significantly improved the technology, making it a practical and energy-efficient alternative. The IRA’s Home Electrification and Appliance Rebates (HEAR), offering up to $840 for qualifying heat pump dryers, have further reduced barriers to adoption, encouraging manufacturers to expand their portfolios and consumers to prioritize electrification.

In 2024, LG introduced an expanded lineup of heat pump laundry solutions, including all-in-one models, laundry towers, and dryers, as part of its sustainability initiatives. Whirlpool released its first new heat pump dryer in years, the WHD5220RW, which is currently available through regional retailers and is expected to expand to national merchants in 2025.

These developments highlight the growing importance of heat pump technology across the industry, with manufacturers like GE Profile and Samsung also investing in this segment to align with consumer preferences and government incentives.

Heat pump-equipped models now deliver improved energy efficiency, lower operational costs, and reduced reliance on fossil fuels, making them an attractive option for environmentally conscious consumers. Supported by federal rebates, the adoption of this technology is driving innovation and growth in the laundry segment.

As manufacturers continue to develop and promote heat pump solutions, the market is poised for sustained advancements in sustainability and energy efficiency, bolstered by the expanding availability of rebate programs.

Market Outlook for 2025

Looking ahead to 2025, several key trends are expected to influence the laundry segment.

Configurations

The front-load category is set for continued growth, driven by expanding offerings in all-in-one models and laundry towers. Manufacturers such as LG, Samsung, and GE Profile have heavily invested in these configurations, emphasizing their space-saving designs and advanced features, including heat pump technology. Electrolux entered the laundry tower segment in the second half of 2023, further underscoring the importance of this category. Notably, Electrolux’s laundry portfolio is exclusively limited to front-load models, highlighting its focus on this configuration. The all-in-one and laundry tower categories are likely to gain further traction, supported by consumer interest in compact and energy-efficient solutions.

Promotional Strategies

Promotional strategies are expected to mirror 2024’s trends, reflecting a return to pre-pandemic levels of discounts and savings. However, persistent economic challenges, including high mortgage rates, currently at 6.91% as of January 2, 2025, are likely to suppress large-ticket purchases, including appliances. This economic pressure is anticipated to maintain a competitive landscape among laundry manufacturers as they vie for limited consumer spending with targeted pricing and promotional strategies.

Electrification of Laundry

Additionally, the push for electrification, fueled by the Inflation Reduction Act (IRA), continues to reshape the market. As of today, 10 states have launched Home Electrification and Appliance Rebate programs under the IRA, with all other states, except South Dakota, actively working to implement these savings initiatives. Rebates for heat pump dryers and other energy-efficient appliances have reduced barriers for consumers, spurring manufacturers to prioritize heat pump technology. With more models expected in 2025 and the potential for expanded retailer availability, electrification will remain a critical focus.

The combination of economic headwinds and technological advancements will continue to shape a dynamic and competitive laundry market in the year ahead.

Get more information

About the Author

Jordan Carter

Jordan Carter is a market analyst specializing in the home appliance industry. Her research focuses on the latest trends and innovations that are reshaping this dynamic market.