Our laundy year-in-review report recaps the most critical activity captured throughout 2024. The report features data and insights from OpenBrand’s Laundry categories, which feature laundry products sold through the US ecommerce and brick-and-mortar channels.

- Overview

- Front Load Laundry Segment Expansion

- Heat Pump Technology Drives Growth in the Laundry Market

- Outlook

Read through all the 2024 pricing and promotions insights below or email the report to read later.

Methodology

Data included in this report is sourced from the OpenBrand Laundry categories. Data in this analysis (except for advertising data) was captured between Q1 2023 (week of January 1) and Q4 2024 (week of December 8). Advertising data runs through December 31, 2024. Retail advertisements include Banner Ads and Retail Circulars captured at retailers and their dot com counterparts (i.e. Staples and Staples.com). The merchants were updated to only the brick-and-mortar name regardless of channel for simplicity (i.e. any Staples.com ads were updated to Staples). Additionally, the following advertising section features SKU-specific ads.

Overview

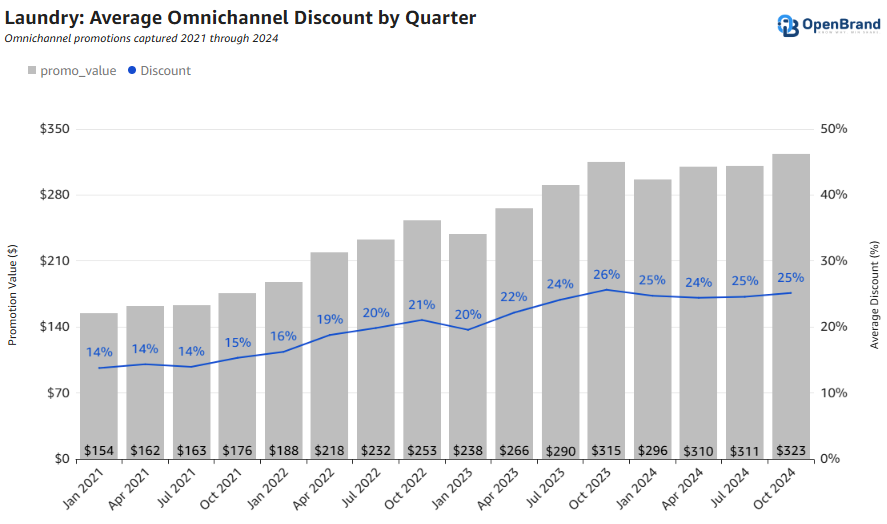

The major appliance industry has experienced transformative shifts in recent years, with 2024 standing out as a year of stabilization in inventory and promotional activity. Following the disruptions caused by the COVID-19 pandemic, manufacturers have worked steadily to align operations with evolving consumer behavior and market dynamics. By the second half of 2023, inventory levels and supply chain reliability showed significant improvement, enabling a return to pre-pandemic promotional trends throughout 2024.

For consumers, this translated into heightened savings and discounts across appliance categories. However, the industry continued to grapple with challenges linked to constrained consumer spending. Elevated inflationary pressures and a weak housing market further restricted disposable income, driving demand primarily toward replacement purchases. This shift contrasted with pre-pandemic trends that included higher sales volumes tied to new home purchases and remodeling projects.

Front Load Laundry Segment Expands in 2024

While top load laundry solutions remain the most popular configuration, the front load segment has seen significant growth throughout the year, posting towards upcoming trends for 2025. Looking at the front load segment, Samsung released its first BESPOKE all-in-one model and laundry towers, representing an expansion of its offerings for the configuration.

LG released its WashCombo all-in-one model, growing its combination portfolio to directly compete with GE Profile’s 2023 4.8' Carbon Graphite Front Load AIO (PFQ97HSPVDS), with competing models in the combination segment extending to GE Profile, LG, and Samsung in 2024.

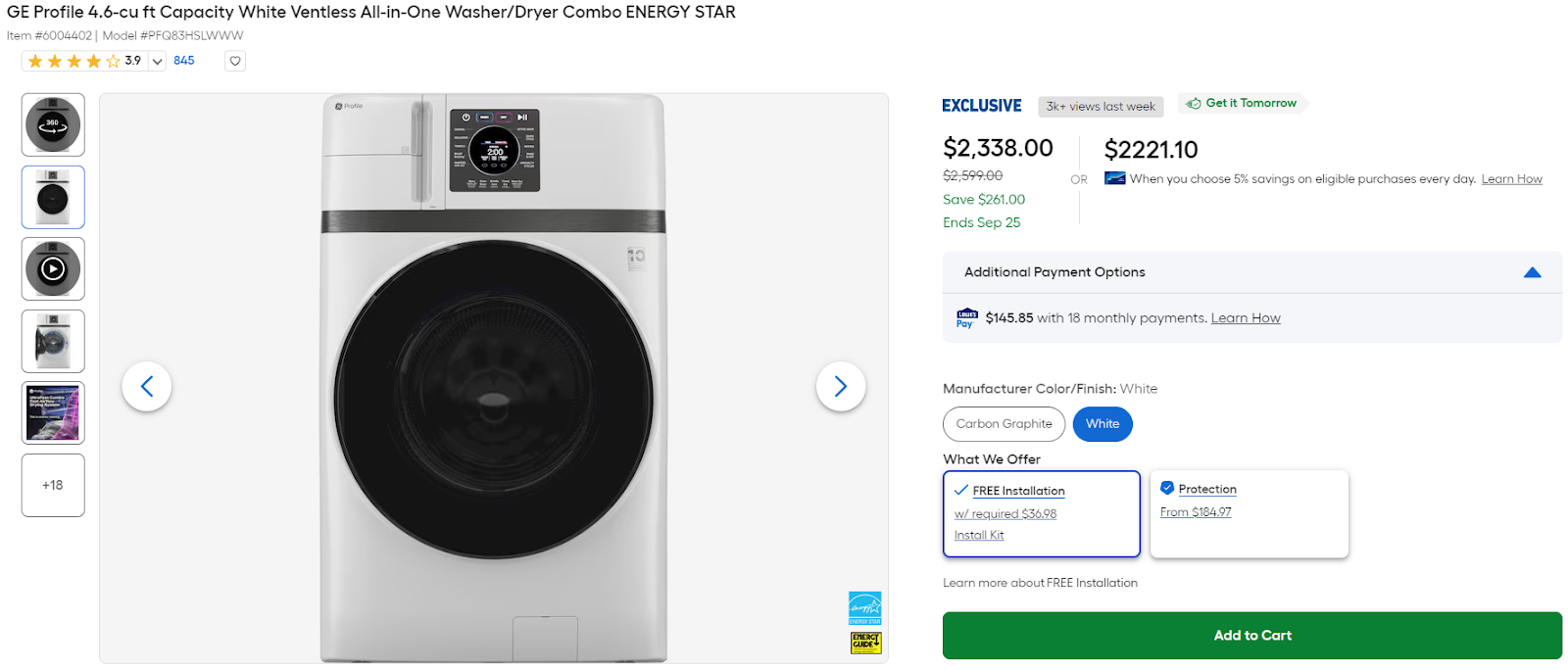

Additionally, 2024 brought new all-in-one models from GE Profile, with the brand expanding its portfolio to include three new combination models in the third quarter, releasing merchant-exclusive models at Lowe’s and Home Depot and a more widely distributed variation that gained exposure through Best Buy and regional merchants.

While the all-in-one segment remains a small portion of the laundry category, the increased efforts from leading manufacturers over the past two years signify a growing emphasis for the segment going forward, with additional brands likely to release competing models in the near future, further bolstering the expanding front load laundry market.

All-in-one models offer a unique space-saving design with both the washer and dryer condensed to a singular unit. Additional benefits include the elimination of the need to transfer laundry from the washer to the dryer, decreasing the time that wet clothes are sitting in a machine. With more consumers living in smaller spaces, such as apartments, as a result of the poor housing market, the compact all-in-one laundry models offer a solution for consumers and builders. Notably, the competing all-in-one models released throughout 2023 and 2024 all use heat pump technology to dry clothes, providing additional savings to consumers through rebates. The 2022 Inflation Reduction Act offers Home Electrification and Appliance Rebates for both induction cooking appliances and heat pump-equipped appliances, further incentivizing adoption and underscoring the industry’s shift toward electrification.

Heat Pump Technology Drives Growth in the Laundry Market

The Inflation Reduction Act (IRA) has accelerated the adoption of heat pump technology in the laundry segment, reshaping industry strategies and consumer options. Heat pump technology, first introduced to the US laundry market in 2014 by LG and Whirlpool, initially faced challenges due to less effective drying performance. Over the past decade, advancements have significantly improved the technology, making it a practical and energy-efficient alternative. The IRA’s Home Electrification and Appliance Rebates (HEAR), offering up to $840 for qualifying heat pump dryers, have further reduced barriers to adoption, encouraging manufacturers to expand their portfolios and consumers to prioritize electrification.

In 2024, LG introduced an expanded lineup of heat pump laundry solutions, including all-in-one models, laundry towers, and dryers, as part of its sustainability initiatives. Whirlpool released its first new heat pump dryer in years, the WHD5220RW, which is currently available through regional retailers and is expected to expand to national merchants in 2025.

These developments highlight the growing importance of heat pump technology across the industry, with manufacturers like GE Profile and Samsung also investing in this segment to align with consumer preferences and government incentives.

Heat pump-equipped models now deliver improved energy efficiency, lower operational costs, and reduced reliance on fossil fuels, making them an attractive option for environmentally conscious consumers. Supported by federal rebates, the adoption of this technology is driving innovation and growth in the laundry segment.

As manufacturers continue to develop and promote heat pump solutions, the market is poised for sustained advancements in sustainability and energy efficiency, bolstered by the expanding availability of rebate programs.

Market Outlook for 2025

Looking ahead to 2025, several key trends are expected to influence the laundry segment.

Configurations

The front-load category is set for continued growth, driven by expanding offerings in all-in-one models and laundry towers. Manufacturers such as LG, Samsung, and GE Profile have heavily invested in these configurations, emphasizing their space-saving designs and advanced features, including heat pump technology. Electrolux entered the laundry tower segment in the second half of 2023, further underscoring the importance of this category. Notably, Electrolux’s laundry portfolio is exclusively limited to front-load models, highlighting its focus on this configuration. The all-in-one and laundry tower categories are likely to gain further traction, supported by consumer interest in compact and energy-efficient solutions.

Promotional Strategies

Promotional strategies are expected to mirror 2024’s trends, reflecting a return to pre-pandemic levels of discounts and savings. However, persistent economic challenges, including high mortgage rates, currently at 6.91% as of January 2, 2025, are likely to suppress large-ticket purchases, including appliances. This economic pressure is anticipated to maintain a competitive landscape among laundry manufacturers as they vie for limited consumer spending with targeted pricing and promotional strategies.

Electrification of Laundry

Additionally, the push for electrification, fueled by the Inflation Reduction Act (IRA), continues to reshape the market. As of today, 10 states have launched Home Electrification and Appliance Rebate programs under the IRA, with all other states, except South Dakota, actively working to implement these savings initiatives. Rebates for heat pump dryers and other energy-efficient appliances have reduced barriers for consumers, spurring manufacturers to prioritize heat pump technology. With more models expected in 2025 and the potential for expanded retailer availability, electrification will remain a critical focus.

The combination of economic headwinds and technological advancements will continue to shape a dynamic and competitive laundry market in the year ahead.

Get more information

About the Author

Jordan Carter

Jordan Carter is a market analyst specializing in the home appliance industry. Her research focuses on the latest trends and innovations that are reshaping this dynamic market.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…

Refrigerators: 2025 Year-In-Review

Our Refrigerators: 2025 Year-in-Review report recaps product launches, placements, pricing and…