How Disruption in BLS Data Collection May Impact Accurate Price Change Measurement

Appliance CPI Volatility: Signal or Measurement Noise?

Recent data reveal a striking divergence between appliance price trends measured by the OpenBrand CPI and the BLS CPI, raising important questions about data quality, sampling, and methodological challenges.

This deviation emerged immediately following the government shutdown, a period that likely disrupted standard data collection and processing workflows. In particular, the Bureau of Labor Statistics may have faced challenges related to reduced sample sizes for appliance pricing and limitations in applying hedonic adjustments when key product observations were missing. Both factors can materially affect month-to-month price estimates, especially in categories like appliances where product turnover and model replacement are high.

A Problem with BLS Data Collection?

The resulting price movements in the BLS CPI were unusually large. Appliance prices fell 5.1% month-over-month in December, followed by a 4.4% increase in January, both on a non-seasonally adjusted basis. These back-to-back swings are exceptionally large by historical standards and are what one might expect annually, rather than in a given month. The movements contrast sharply with the more stable and continuous pricing trends observed in the OpenBrand CPI, which is built on high-frequency, broad-based market pricing data.

OpenBrand’s depth and breadth of data across the consumer durables industry provides a highly accurate, real-time view of pricing and promotional activity. The OpenBrand CPI leverages millions of continuously observed price points across retailers, brands, and SKUs, allowing us to capture true market dynamics without reliance on small samples or statistical inference. As a result, the OpenBrand CPI is immune to disruptions caused by government shutdowns and does not depend on hedonic adjustments to estimate missing products. This ensures a cleaner, timelier, and more reliable signal of underlying price trends.

Taken together, the magnitude and timing of the BLS swings strongly suggest that temporary measurement disruptions, rather than fundamental market forces, drove recent volatility in appliance price measurement in the BLS CPI. If so, future releases may show partial normalization as standard sampling and processing resume.

We will be paying close attention to this deviation over the coming months, waiting to see if official appliance price measures stabilize and converge back toward broader market-based pricing signals. Understanding whether this episode reflects short-term noise or deeper structural challenges will be critical for accurately interpreting inflation trends in appliance pricing for the remainder of 2026H1.

About the Author

Ralph McLaughlin

Ralph McLaughlin is Chief Economist at OpenBrand, bringing nearly two decades of experience in economics, data analytics, and forecasting. His expertise spans industrial economics, applied econometrics, and housing market dynamics. Previously, he served as Chief Economist at Trulia and Haus, Deputy Chief Economist at CoreLogic, and Senior Economist at Realtor.com. Ralph held academic appointments at USC, San Jose State University, and University of South Australia. He earned a PhD in planning, policy, and design from UC Irvine and a BA in geography and regional development from the University of Arizona. Ralph is also an FAA-certified commercial pilot and instructor.

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and Personal Goods report that covers price movements in January 2026.

DISCLAIMER: This report is provided ‘as is’ for informational purposes only. OpenBrand makes no representations or warranties regarding the accuracy, completeness, or reliability of the data. Users assume all risks associated with their use of this report. OpenBrand shall not be liable for any losses or damages arising from the use of this report.

Inflation Ticks up in January, but Less than Years’ Past

In January, price growth for consumer durables and personal goods accelerated after a slight pickup in December, with a month-over-month (MoM) increase of +0.75%. This is up from a revised monthly +0.43% increase in the month prior. However, it’s important to note that the acceleration was largely driven by a sharp increase in the recreation product group, growing at a rate of +2.44% month-over-month, up from +0.35% in December. Personal care products also added to the acceleration, growing to +0.65% in January from +0.18% in December. The other three product groups – appliances, communications, and home improvement – all showed price growth deceleration on a month-to-month basis, with communications posting the sole negative read month-over-month.

While month-over-month price growth in January was the largest gain in 12 months, it’s not unusual for the first month of the year to bring relatively sharp price increases. A new year is a new opportunity for manufacturers and retailers to adjust pricing, both in response to their holiday season promotions as well in response to broader market forces. If we compare price growth in January 2026 to price growth in January over the past decade, it ranks as fourth lowest (and second of the past five) and well below the +0.96% MoM average. Thus, much of the increase this January is likely due to normal seasonal upticks at the beginning of the year, rather than acceleration of inflationary forces.

Table of Contents

- Key CPI Takeaways for January 2026 & Macroeconomic Outlook

- Product Group Highlights

- CPI 2025 Forecast: Macroeconomic Summary

- Methodology

January 2026 OpenBrand CPI-DPG Summary and Macroeconomic Outlook

Overall OpenBrand Consumer Price Index Movement: The OpenBrand CPI of Durable and Personal Goods recorded a +0.75% monthly change in January, notching the fourteenth consecutive month-over-month increase and 19th of the last 20th months. The sharp price growth this month is building on gains from last month, possibly supported most by the large increase in the prices seen in the recreation group.

Discount Trends: January brought mixed changes in discount activity to the durables and personal goods sector, with frequencies climbing month-over-month to 23.1% of all durable and personal goods from 22.5% in the month prior. The typical magnitude decreased slightly to 20.0%, down from 20.8% the month prior.

Product Group Price Trends: All product groups except communications and home improvement experienced an uptick in the rate of growth from the month prior, with prices of all groups except Communication climbing month-over-month. The group summary is as follows:

- Appliance Group (+0.24%)

- Communication Group (-0.29%)

- Home Improvement Group (+0.69%)

- Personal Care Group (+0.65%)

- Recreation Group (+2.44%)

See the full breakdown of product groupings.

Product Group Highlights

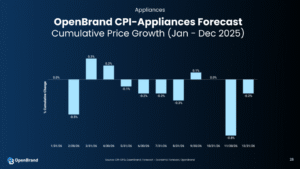

CPI: Appliances

Prices for appliances increased on a month-over-month basis in January to +0.24%, rising from a revised -0.59% in the month prior. The positive price growth was at least partially driven by the typical discount magnitude decreasing to 17.8% from 18.4%, while the frequency of discounts increased to 36.9% from 35.3% the month prior.

CPI: Communication

Prices of communication devices, including phones, tablets, computers, and printers, fell on a month-over-month basis to -0.29%, down sharply from a revised +1.31% the month prior. The frequency and magnitude of discounts were mixed in January. Frequency increased from 14.2% to 15.6%, while magnitude fell about 2 percentage points from 19.8% to 17.6% from December to January. The decrease in prices of communication devices most likely was led by the decent decrease in magnitude of discounts.

CPI: Home Improvement

Prices for home improvement goods decreased by +0.69% on a month-over-month basis in January, falling from a revised +0.88% in the month prior, showing 34 consecutive month-over-month flat or monthly increases. The deceleration in price growth was at least partially driven by a decrease in the magnitude of discounts (17.4% from 18.7% the month prior), while the typical discount frequency remained flat at 9.8%.

CPI: Personal Care

Prices of personal care products grew sharply on a monthly basis in January by +0.65%. Some of this increase may be due to a decrease in the magnitude (falling from 22.7% in December to 22.3% in January) & an increase in the frequency of price discounts (rising from 22.9% in December to 23.6% in January).

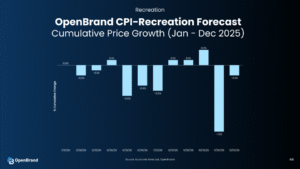

CPI: Recreation

The rate of price growth of recreational products, including TVs, headphones, and speaker systems, increased to +2.44% on a month-over-month basis in January, up sharply from a revised +0.35% in December (growing by more than 2 percentage points in one month’s time). Some of this large increase in the pace of price growth is at least partially due to a decrease in the frequency of discounts – down to 29.7% in January from 30.3% in December – but the average magnitude of discounts remaining relatively flat – up only slightly to 24.6% from 24.5% over the same time period.

Macroeconomic Outlook Update

As of February 2026, the inflation picture for U.S. consumers has continued to improve, particularly when it comes to the everyday goods and big-ticket items that strained household budgets earlier in the decade. While prices remain higher than they were before the pandemic, the pace of price growth has slowed noticeably, and in several durable and personal goods categories, prices are now flat or edging modestly lower. For many households, this marks a tangible shift from inflation anxiety to cautious relief.

The most visible progress has been in durable goods. Prices for appliances, consumer electronics, and other household durables have stabilized after years of volatility. Retailers entered the year with healthier inventory levels and face a more price-sensitive consumer, prompting more frequent discounts and promotions. With demand no longer overheating and supply chains functioning more smoothly, sellers have less pricing power than they did just a few years ago. As a result, consumers shopping for replacement or discretionary items are increasingly finding that prices are no longer rising—and in some cases are slipping modestly.

Personal goods are following a similar trajectory, and are seeing slower price increases than in prior years. Many brands are working to hold prices steady to protect market share. The competitive nature of these categories, combined with easing input and transportation costs, has reduced the need for frequent price hikes. For consumers, this translates into more predictable spending and fewer unwelcome surprises at checkout.

A key driver behind this moderation is the continued fading of tariff-related cost pressures. The inflationary effects of Trump-era tariffs, which briefly raised prices across a wide range of imported consumer goods earlier last year, are now largely behind us. Companies have had time to adjust sourcing strategies, renegotiate supplier contracts, and absorb or offset costs that once flowed directly into retail prices. By early 2026, those tariff effects are no longer a major force pushing consumer goods prices higher.

The broader economic environment reinforces this trend. Economic growth remains steady but subdued, limiting demand-driven inflation. The labor market has cooled further, easing wage pressures that often spill over into goods prices. While employment remains stable, slower wage growth is helping keep overall cost pressures in check without undermining consumer purchasing power.

Interest rates also continue to shape the consumer landscape. Financial conditions remain restrictive enough to discourage excessive borrowing, particularly for large purchases, but expectations of gradual rate relief later in the year have improved consumer sentiment. This balance has encouraged cautious spending rather than the kind of demand surge that would reignite goods inflation.

For consumers in February 2026, the practical takeaway is that the inflation environment feels calmer and more manageable. Prices for durable and personal goods are no longer racing ahead, and in some categories are beginning to drift slightly lower. While this does not mean a return to pre-pandemic price levels, it does suggest that the era of sharp, goods-driven inflation has ended.

In short, early 2026 is shaping up as a period of stabilization for consumer goods prices. As tariff effects fade fully and competitive pressures intensify, households are benefiting from slower price growth, better availability, and a renewed sense of control over everyday spending decisions—a meaningful improvement after several challenging years.

Note: This summary is based on data available as of early February 2025 and may be subject to revisions in future releases.

For questions about the report, please contact Ralph McLaughlin at ralph@openbrand.com

For press inquiries, please contact press@openbrand.com

About the OpenBrand CPI

This report offers insights into price trends across major consumer product categories representing a select mix of both durable and personal goods (see methodology below for more details). The data used in this report leverages OpenBrand’s industry-leading library of durable and personal goods pricing, promotion, and availability for over 1.4 million individual products. This is more than ten times the coverage by the monthly Bureau of Labor Statistics (BLS) Consumer Price Index, allowing more timely and granular reporting of price changes in the market.

This free monthly report provides a broad summary of price changes (including promotional activity), category-specific pricing and promotional trends, and macroeconomic context. For those seeking deeper insights, weekly CPI reporting and monthly CPI forecasts (released next week) are available on a subscription basis with up to same-day SKU-level pricing data available in bulk downloadable files.

Subscribe

Get CPI & Real-Time Pricing Data Updates

The OpenBrand CPI-DPG is released monthly. Join our subscription list to be notified when new CPI data is available.

OpenBrand Methodological Notes

The OpenBrand CPI of Durable and Personal Goods is constructed using a data-driven methodology that ensures accuracy, timeliness, and transparency in measuring price trends for both short and long-lasting consumer products. The methodology consists of the following key components:

- Data Collection

- Real-Time Price Tracking: Prices are sourced daily from online marketplaces, retail websites, and brick-and-mortar store listings.

- Retailer & Manufacturer Data: Aggregates pricing information from major retailers, direct-to-consumer brands, and wholesale suppliers into broader consumer categories.

- Temporal Coverage: Captures price variations over time, including daily discounts and price promotions

- Product Selection & Tracking

- Durable and Personal Goods Focus: The index includes products with an expected lifespan of three years or more, such as home appliances, consumer electronics, and tools, as well as personal care products with a shorter lifespan, such as hair and skin care products, vitamins, over-the-counter medications, and oral care products.

- Brand & Model Tracking: Individual brands and models are monitored to reflect pricing shifts within competitive product segments, including both permanent changes in listing price as well as temporary promotional pricing.

- Price Calculation, Adjustments, and Weighting

- Price Calculation: Tracks month-over-month and year-over-year price movements to measure price stability in the marketplace and take into account both longer-term changes in pricing (such as changes in manufacturer’s suggested retail price) as well as more short-term changes in pricing, such as promotional discounts and sales prices.

- SKU-Removal Instead of Hedonic Adjustments: When a product (or SKU) becomes unavailable in the BLS goods basket, the BLS implements a SKU-replacement procedure whereby the next most similar product is used in its place, and a quality (hedonic) adjustment procedure is performed to get closer to an apples-to-apples price comparison. Since OpenBrand has data on nearly 100% of the SKUs pricing history in a given product category, we can simply remove that SKU from the basket and rely on price changes of the remaining SKUs in that basket. This eliminates the need for hedonic adjustment in the OpenBrand CPI basket.

- Weighting and Aggregation Method: A weighted geometric mean formula is used to minimize volatility and improve stability in price trend analysis at both the product grouping and category level. Instead of using sales-volume weights when aggregating the index, we take an alternative approach by using persistence-based weights for aggregation. Instead of more frequently purchased items getting more weight in the BLS’ CPI calculation, OpenBrand takes a more novel approach by weighting items with a more established price history in the market more heavily in our CPI calculation than items with a less established history.

- Reporting & Updates

- High-Frequency Updates: Published freely on a monthly basis, with a subscription option for daily summaries across categories, sub-categories, and individual products.

- Comparative Benchmarks: We aggregate pricing as analogously as possible to traditional BLS CPI measures for benchmarking purposes.

- Transparency & Accessibility: Provides both open and paid data access for journalists, researchers, businesses, and policymakers.

By leveraging real-time data and advanced statistical techniques, the OpenBrand CPI offers an accurate and dynamic measure of pricing trends, helping businesses and consumers make informed decisions in an evolving economic landscape.

OpenBrand CPI - Durable and Personal Goods

Groups and Products

Appliance Group

Air Conditioners

Air Purifiers

Beverage Coolers

Blenders

Coffee Makers

Cooktops & Wall Ovens

Countertop Cooking

Countertop Microwaves

Dehumidifiers

Dishwashers

Dryers

Freezers

Icemakers

Laundry

Ranges

Refrigerators

Vacuums

Washers

OTR (Over-the Range Microwaves)

Communications Group

Business Printers

Desktops

Headsets

HED

Ink

Large Printers

MFP Copiers

Monitors

Notebooks

Personal & SOHO Printers

Projectors

Smartphones

Tablets & Detachables

Toner

Wearables

Wireless Routers

Recreation Group

Bluetooth Speakers

Bluray

Digital Camcorders

Digital Cameras

Headphones

Media Players

Photo Paper

Sewing Machines

Sound Bars

Speaker Systems

TVs

VAW Speakers

Home Improvement Group

Bathroom Faucets

Bathroom Sinks

Bathroom Vanity

Bathtubs

Cutting Machines

Carpets

Door Locks

Exterior Paints

Exterior Stains

Floor Tiles

Garden Hoses

Generators

Grass Seed

Handhelds

Hand Tools

Hardwood Flooring

Interior Paints

Interior Stains

Kitchen Cabinets

Kitchen Cleanup

Kitchen Faucets

Lawn Fertilizer

Lawn Products

Log Splitters

Mowers

Outdoor Cooking

Outdoor Cooking Accessories

Paint Supplies

Pesticides

Shower Stall and Enclosures

Power Tools

Power Tools Accessories

Pressure Washer

Replacement Batteries

Shower Doors

Shower Heads

Smart Doorbells

Smart Locks

Smart Cameras

Smart Thermostats

Snow Throwers

Spray Paint

Toilets

Vinyl Flooring

Water Filtration

Weed Killer

Personal Care Group

Anti-Smoking Products

Adult Incontinence

Baby Products

Bath Products

Contraceptives

Cosmetics (Eye, Facial, Nail)

Deodorants

Diabetic Products

Digestive (Lower GI, Upper GI, Hemorrhoidal)

Ear Care Products

Eye Care Products

Feminine Needs (Sanitary Napkins/Tampons & Women’s Care)

First Aid Accessories & Treatments

Foot Care Products

Fragrance

Hair Care (Coloring, Growth, Shampoo, Conditioner, Styling)

Hair Dryers

Home Health Care

Lip Preparations

Oral Care (Breath Fresheners, Accessories, Dentures, Mouthwash, Oral Hygiene, Toothpaste)

Pain (Analgesic, External & Internal)

Sexual Wellness

Shave (Non-Razor Blades, Creams, Razors)

Skin Care (Acne, Facial, Hand & Body)

Sleeping Remedies

Soap

Sun Care

Upper Respiratory (Cold/Allergy/Sinus Liquids & Tablets, Cough Drops/Lozenges, External, Nasal Products)

Vitamins, Minerals & Supplements

Wt Ctl/Nutrition (Tablets & Liquid, Powder Wipes, Towelettes)

PREPARED BY

Ralph McLaughlin

Ralph McLaughlin is Chief Economist at OpenBrand, bringing nearly two decades of experience in economics, data analytics, and forecasting. His expertise spans industrial economics, applied econometrics, and housing market dynamics. Previously, he served as Chief Economist at Trulia and Haus, Deputy Chief Economist at CoreLogic, and Senior Economist at Realtor.com. Ralph held academic appointments at USC, San Jose State University, and University of South Australia. He earned a PhD in planning, policy, and design from UC Irvine and a BA in geography and regional development from the University of Arizona. Ralph is also an FAA-certified commercial pilot and instructor.

Contact Us

For questions about the report, contact Ralph McLaughlin at ralph@openbrand.com

For press inquiries, contact press@openbrand.com

For full data access on a subscription basis, click the button below to request a demo of the offering.

Price Forecasts for Durables in 2026: Consumer Electronics, Appliances & Home Improvement

Modest inflation will drive incremental durables market growth in the year ahead

As short-term tariff swings ease and economic policy uncertainty fades, we anticipate 2026 will mark a period of stabilization, including within the durables sector. Though we expect stabilization, it’s important to acknowledge that short-term political volatility will likely continue as a strategic tool of the current administration. The durables industry has proven to be durable (pun intended), and we expect that durability to persist through it.

The limited expansion in market size we expect this year is likely to be driven primarily by incremental price increases following recent Fed rate cuts. We project durables market growth to reach its high point in July, coinciding with the largest price adjustment, before slowing through the rest of the year.

One of the large wildcards this year will be the tone set by the Federal Reserve Chair nominee Kevin Warsh. We expect Warsh to push for a lower interest rate environment, and there is a reasonable possibility of a moderate upside deviation to our forecasts below.

Read on for OpenBrand’s price and growth expectations across consumer electronics, appliances, and home improvement in the year ahead.

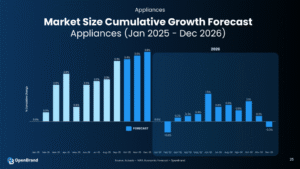

Appliances: Market Size Growth Hindered by Price Deceleration

Prior to the new tariffs that were implemented in 2025, appliances (see appliance product list) had been on a downward price trajectory for a number of years. While short-term tariff-related price increases led to growth in the cumulative size of the appliance market last year, we anticipate that prices will decelerate again in the months ahead.

The deflationary environment for appliances will outpace our forecast for a slight pickup in unit sales this year, resulting in modest to negative market size growth. In other words, we expect that more appliances will be sold in 2026, but at lower, or slower, growing prices. OpenBrand daily pricing data and durables tracking survey shows that consumers are still buying appliances, but they are delaying upgrades when possible and trading down on features rather than exiting the category. That means that incremental, mid-tier upgrades are under the most pressure.

Regardless of the economic cycle, appliances are a replacement-driven category which makes it more resilient. In 2026, the most successful businesses will likely be the ones that implement pricing discipline and clear value positioning.

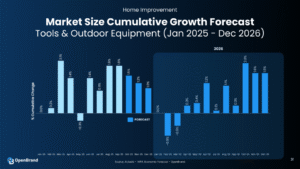

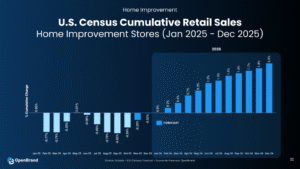

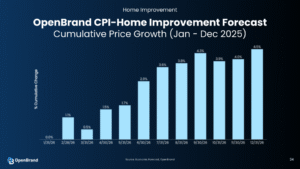

Home Improvement: Rate Cuts Will Support DIY, Construction Rebound

The home improvement category (see HI product list) depends largely on the health of the housing market, which we expect will begin to show signs of a turnaround in 2026. That recovery is largely tied to the Fed’s recent rate cuts, which will also drive down borrowing costs. We expect existing home sales to recover in the second quarter, boosting demand for DIY-related categories like tile, roofing, and paint. New home sales should gain momentum in the fourth quarter, which is likely to support increased demand for higher-end, professional-grade tools tied to new construction and home upgrades.

While growth in retail sales at home improvement stores was negative for nearly all of 2025, we expect a recovery this year, particularly in the second half. The return to growth doesn’t necessarily indicate a boom for home improvement retailers, but it does reflect a normalization after a slow year.

As is the case for appliances, a share of the increase in the growth of the home improvement market will come from price increases. We anticipate that prices will show modest growth in the first quarter, before picking up more significantly in April and beyond.

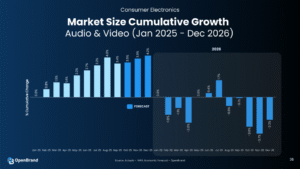

Consumer Electronics: Expect Muted 2026 Growth

In 2025, we saw stronger-than-expected growth in consumer electronics categories (see CE product list) like audio and video. That was largely because consumers pulled their spending forward in anticipation of tariff-related price increases and economic uncertainty.

As a result, our outlook for consumer electronics growth is more muted for the year ahead. We expect flat to slightly negative growth in consumer electronics, not because demand disappeared, but because much of it happened earlier than anticipated.

Getting the attention of the consumer will be more difficult in the year ahead; the retailers and manufacturers that come out on top will be the ones that focus on feature-laden products—like bluelight-blocking technology for screens—that were buzzy at CES in January.

Cumulative prices are expected to contract across consumer electronics this year, with the most pronounced drop toward the end of the year. That’s good news for consumers, who will be able to get great deals on new gadgets, and difficult for brands, who will now compete in an even more price-competitive market.

Key Takeaways: What Our 2026 Durables Outlook Means For Your Business

Despite softening last year, the durables market has held up through the worst housing market in 15 years and big swings in consumer sentiment. Looking ahead, we’re anticipating a year of normalization, with market growth influenced largely by price changes and the tone set by the incoming Fed chair. Whether you’re a retailer or a manufacturer, here are three things to consider as you plan for the months to come:

- Consumers are adjusting, not disappearing. We’re seeing trade‑down at entry prices and resilience at the premium tier. In other words, consumers are opting for products that either minimize spend or deliver obvious value, with fewer decisions centered on mid-priced items.

- Housing matters for appliances and home improvement. As the housing market normalizes and eventually improves, that’s a structural tailwind for durables, even if the mix by category and price tier continues to shift.

- Competition is growing more intense for consumer electronics. That underscores the need for innovators to invest in new features that are going to get buyers’ attention. Manufacturers need to be thinking about competing not just on prices, but also product characteristics.

State of Durables Webinar

I spoke on this 2026 forecast data, as well as a look back at 2025, in OpenBrand’s recent State of Durables webinar. Check it out below.

Contact Us

Interested in getting more granular 2026 price forecasts for appliances, consumer electronics, and home improvement? OpenBrand has monthly scenario-based forecasting for durables by category and sub-group. Contact us below to learn more or request a forecast preview.

About OpenBrand CPI & Economic Forecasting Solutions

About OpenBrand’s CPI: OpenBrand delivers a Durables-grade Consumer Price Index that provides a more nuanced look at price inflation specific to the market.

About OpenBrand’s Economic Forecasting: From scenario-based forecasting products to custom projections, out economic forecasts equip retail companies with the ability to know and respond to what’s happening before it happens.

OpenBrand CPI - Durable and Personal Goods

Groups and Products

Appliance Group

Air Conditioners

Air Purifiers

Beverage Coolers

Blenders

Coffee Makers

Cooktops & Wall Ovens

Countertop Cooking

Countertop Microwaves

Dehumidifiers

Dishwashers

Dryers

Freezers

Icemakers

Laundry

Ranges

Refrigerators

Vacuums

Washers

OTR (Over-the Range Microwaves)

Communications Group

Business Printers

Desktops

Headsets

HED

Ink

Large Printers

MFP Copiers

Monitors

Notebooks

Personal & SOHO Printers

Projectors

Smartphones

Tablets & Detachables

Toner

Wearables

Wireless Routers

Recreation Group

Bluetooth Speakers

Bluray

Digital Camcorders

Digital Cameras

Headphones

Media Players

Photo Paper

Sewing Machines

Sound Bars

Speaker Systems

TVs

VAW Speakers

Home Improvement Group

Bathroom Faucets

Bathroom Sinks

Bathroom Vanity

Bathtubs

Cutting Machines

Carpets

Door Locks

Exterior Paints

Exterior Stains

Floor Tiles

Garden Hoses

Generators

Grass Seed

Handhelds

Hand Tools

Hardwood Flooring

Interior Paints

Interior Stains

Kitchen Cabinets

Kitchen Cleanup

Kitchen Faucets

Lawn Fertilizer

Lawn Products

Log Splitters

Mowers

Outdoor Cooking

Outdoor Cooking Accessories

Paint Supplies

Pesticides

Shower Stall and Enclosures

Power Tools

Power Tools Accessories

Pressure Washer

Replacement Batteries

Shower Doors

Shower Heads

Smart Doorbells

Smart Locks

Smart Cameras

Smart Thermostats

Snow Throwers

Spray Paint

Toilets

Vinyl Flooring

Water Filtration

Weed Killer

Personal Care Group

Anti-Smoking Products

Adult Incontinence

Baby Products

Bath Products

Contraceptives

Cosmetics (Eye, Facial, Nail)

Deodorants

Diabetic Products

Digestive (Lower GI, Upper GI, Hemorrhoidal)

Ear Care Products

Eye Care Products

Feminine Needs (Sanitary Napkins/Tampons & Women’s Care)

First Aid Accessories & Treatments

Foot Care Products

Fragrance

Hair Care (Coloring, Growth, Shampoo, Conditioner, Styling)

Hair Dryers

Home Health Care

Lip Preparations

Oral Care (Breath Fresheners, Accessories, Dentures, Mouthwash, Oral Hygiene, Toothpaste)

Pain (Analgesic, External & Internal)

Sexual Wellness

Shave (Non-Razor Blades, Creams, Razors)

Skin Care (Acne, Facial, Hand & Body)

Sleeping Remedies

Soap

Sun Care

Upper Respiratory (Cold/Allergy/Sinus Liquids & Tablets, Cough Drops/Lozenges, External, Nasal Products)

Vitamins, Minerals & Supplements

Wt Ctl/Nutrition (Tablets & Liquid, Powder Wipes, Towelettes)

Consumer Price Index: Durable and Personal Goods | December 2025

This is the January 2025 release of the OpenBrand Consumer Price Index (CPI) – Durable and Personal Goods report that covers price movements in December 2025.

DISCLAIMER: This report is provided ‘as is’ for informational purposes only. OpenBrand makes no representations or warranties regarding the accuracy, completeness, or reliability of the data. Users assume all risks associated with their use of this report. OpenBrand shall not be liable for any losses or damages arising from the use of this report.

2025 Ends Year with Uptick in Price Growth, Modest Outlook for 2026

In December, price growth for consumer durables and personal goods accelerated after a significant slowdown in November, with a month-over-month increase of +0.24%. This is up from a revised monthly +0.04% increase in the month prior. While the rate of price growth accelerated in four out of our five product groups, the Appliance group continued to show significant price deceleration in December, with prices in that group now falling in three out of the past four months.

Now that 2025 is behind us, we can now conduct an annual look-back on price trends across our five product groups over the past 12 months. This is especially important in light of the new presidential administration’s trade policies that began in the early part of the year. Overall, the OpenBrand CPI-DPG grew by 3.0% between January and December, with relatively smooth growth throughout the year. Just after the year’s halfway point passed in July, aggregate prices were up by just 1.6%. The Communications group followed a similar trajectory, with 2.1% of the annual 4.0% growth occurring in the first half of the year. Home Improvement also followed a similar trend, with 2.8% of the annual 6.3% occurring by July.

However, the trend was noticeably different in both the Appliances and Personal Care groups, where price growth peaked earlier in the year followed by a decline. Appliances reached a peak cumulative price growth rate of 2.0% by August, before falling to a cumulative rate of 1.2% in December. Personal Care followed a similar path, peaking at 1.5% in September before ending the year with a cumulative growth rate of 1.0% in December.

Table of Contents

- Key CPI Takeaways for December 2025 & Macroeconomic Outlook

- Product Group Highlights

- CPI 2025 Forecast: Macroeconomic Summary

- Methodology

December 2025 OpenBrand CPI-DPG Summary and Macroeconomic Outlook

Overall OpenBrand Consumer Price Index Movement: The OpenBrand CPI of Durable and Personal Goods recorded a +0.24% monthly change in December, notching the thirteenth consecutive month-over-month increase and 18th of the last 19th months. The sharp price growth this month occurred alongside a decent increase in the frequency of discounts, suggesting that the rise was partially driven by an increase in non-discounted list prices.

Discount Trends: December brought an increase in discount activity to the durables and personal goods sector, with frequencies climbing month-over-month to 23.5% of all durable and personal goods from 19.2% in the month prior. The typical magnitude increased slightly to 20.9%, up only slightly from 20.7% the month prior. All product groups except the Communications Group & the Recreation Group experienced the highest discount magnitude for 2025, while the Communications Group experienced the highest discount frequency for 2025.

Product Group Price Trends:

All product groups except the Appliance group experienced both an uptick in the rate of growth from the month prior & an increase in prices month-over-month. The group summary is as follows:

- Appliance Group (-0.75%)

- Communication Group (+0.76%)

- Home Improvement Group (+0.86%)

- Personal Care Group (+0.03%)

- Recreation Group (+0.31%)

See the full breakdown of product groupings.

Product Group Highlights

CPI: Appliances

Prices for appliances decreased on a month-over-month basis in December to -0.75%, falling from a revised +0.10% in the month prior. The negative price growth was at least partially driven by the typical discount magnitude increasing to 18.4% – the highest month this year- from 17.7%, while the frequency of discounts increased by almost 10 percentage points to 35.3% from 25.6% the month prior.

CPI: Communication

Prices of communication devices, including phones, tablets, computers, and printers, grew on a month-over-month basis to +0.76%, up slightly from a revised +0.06% the month prior. The frequency and magnitude of discounts were mixed in December. Frequency increased from 12.7% to 18.6%, while magnitude remained relatively flat, falling only in the slightest from 20.4% to 20.3% from November to December. The increase in prices of communication devices most likely was led by the significant increase in frequency of discounts, which rose this month by almost 6 percentage points compared to the month prior & boasts the highest frequency of discounts by quite a bit for 2025.

CPI: Home Improvement

Prices for home improvement goods increased by +0.86% on a month-over-month basis in December, growing from a revised +0.56% in the month prior, showing 33 consecutive month-over-month flat or monthly increases. The acceleration in price growth was at least partially driven by an increase in the magnitude of discounts (18.7% from 18.2% the month prior) – the highest for 2025, while the typical discount frequency remained flat at 10.2%.

CPI: Personal Care

Prices of personal care products grew on a monthly basis in December by +0.03%. Some of this increase may be due to an increase in both the magnitude (rising from 22.1% in November to 22.7% in December – recording the highest magnitude of discounts for 2025) & frequency of price discounts (rising from 22.9% in November to 23.4% in December).

CPI: Recreation

The rate of price growth of recreational products, including TVs, headphones, and speaker systems, increased to +0.31% on a month-over-month basis in December, up sharply from a revised -0.19% in November. Some of this increase in the pace of price growth is at least partially due to an increase in the frequency of discounts – up sharply to 29.7% in December from 24.8% in November – but a decrease in the average magnitude of discounts – down to 24.6% from 25.0% over the same time period.

Macroeconomic Outlook Update

As 2026 begins, U.S. consumers are likely to experience a welcome shift in the inflation story—one defined less by sticker shock and more by gradual stabilization. While prices are unlikely to fall broadly across the economy, the pace of price growth for durable and personal goods is expected to moderate meaningfully and, in some categories, edge modestly lower as lingering cost pressures from earlier trade policies and supply disruptions continue to unwind.

After several years of uneven inflation, the fundamentals for consumer goods pricing are improving. Supply chains are more normalized, inventories are healthier, and competitive pressures have returned in many retail categories. Importantly, the inflationary impulse from Trump-era tariffs—which raised costs on a wide range of imported consumer goods—has largely worked its way through the system. As contracts reset, sourcing adjusts, and global logistics remain relatively stable, the tariff pass-through that once pushed prices higher is fading into the background.

For consumers, this shift should be most noticeable in durable goods. Prices for big-ticket items such as appliances, furniture, electronics, and household equipment surged during and after the pandemic, only to cool sharply as demand softened and retailers worked through excess inventory. In 2026, those prices are expected to rise much more slowly than in prior years, and in some cases may drift lower in nominal terms as manufacturers and retailers compete more aggressively for value-conscious buyers. While prices are unlikely to return to pre-pandemic levels, the era of rapid increases in durable goods appears firmly behind us.

Personal goods—including clothing, footwear, household supplies, and everyday consumer items—are also poised for a more favorable pricing environment. These categories tend to be highly competitive and sensitive to changes in input costs. As tariff effects fade and global production stabilizes, retailers are increasingly able to limit price increases or offer promotions without sacrificing margins. For many households, this means fewer surprise price hikes and more predictable spending on everyday items.

The broader economic backdrop supports this moderation. Economic growth in 2026 is expected to remain steady but unspectacular, which helps limit demand-driven inflation. At the same time, the labor market is cooling gradually, easing wage pressures that often filter into consumer prices. While wages are still rising, they are doing so at a pace that is more consistent with long-run price stability rather than inflation acceleration.

Interest rates are also likely to play a role in shaping consumer prices. As inflation continues to cool, the Federal Reserve is expected to move cautiously toward a less restrictive policy stance. Lower borrowing costs would help households manage debt and support spending, but not at a level that would reignite runaway demand. This balance—moderate growth without overheating—creates a favorable environment for stable pricing.

For consumers, the practical takeaway in 2026 is not a return to deflation, but a return to normalcy. Price growth for durable and personal goods is expected to slow to modest levels and, in select categories, flatten or decline slightly. The intense inflation pressures of the early 2020s are giving way to a period where shopping decisions feel less urgent and budgets become easier to plan.

In short, 2026 looks to be a year of inflation relief rather than inflation reversal for U.S. consumers. As the residual effects of tariffs and supply disruptions fade, goods prices should become more stable, competitive, and predictable—offering households a long-awaited sense that the worst of goods-driven inflation is finally in the rearview mirror.

Note: This summary is based on data available as of early January 2025 and may be subject to revisions in future releases.

For questions about the report, please contact Ralph McLaughlin at ralph@openbrand.com

For press inquiries, please contact press@openbrand.com

About the OpenBrand CPI

This report offers insights into price trends across major consumer product categories representing a select mix of both durable and personal goods (see methodology below for more details). The data used in this report leverages OpenBrand’s industry-leading library of durable and personal goods pricing, promotion, and availability for over 1.4 million individual products. This is more than ten times the coverage by the monthly Bureau of Labor Statistics (BLS) Consumer Price Index, allowing more timely and granular reporting of price changes in the market.

This free monthly report provides a broad summary of price changes (including promotional activity), category-specific pricing and promotional trends, and macroeconomic context. For those seeking deeper insights, weekly CPI reporting and monthly CPI forecasts (released next week) are available on a subscription basis with up to same-day SKU-level pricing data available in bulk downloadable files.

Subscribe

Get CPI & Real-Time Pricing Data Updates

The OpenBrand CPI-DPG is released monthly. Join our subscription list to be notified when new CPI data is available.

OpenBrand Methodological Notes

The OpenBrand CPI of Durable and Personal Goods is constructed using a data-driven methodology that ensures accuracy, timeliness, and transparency in measuring price trends for both short and long-lasting consumer products. The methodology consists of the following key components:

- Data Collection

- Real-Time Price Tracking: Prices are sourced daily from online marketplaces, retail websites, and brick-and-mortar store listings.

- Retailer & Manufacturer Data: Aggregates pricing information from major retailers, direct-to-consumer brands, and wholesale suppliers into broader consumer categories.

- Temporal Coverage: Captures price variations over time, including daily discounts and price promotions

- Product Selection & Tracking

- Durable and Personal Goods Focus: The index includes products with an expected lifespan of three years or more, such as home appliances, consumer electronics, and tools, as well as personal care products with a shorter lifespan, such as hair and skin care products, vitamins, over-the-counter medications, and oral care products.

- Brand & Model Tracking: Individual brands and models are monitored to reflect pricing shifts within competitive product segments, including both permanent changes in listing price as well as temporary promotional pricing.

- Price Calculation, Adjustments, and Weighting

- Price Calculation: Tracks month-over-month and year-over-year price movements to measure price stability in the marketplace and take into account both longer-term changes in pricing (such as changes in manufacturer’s suggested retail price) as well as more short-term changes in pricing, such as promotional discounts and sales prices.

- SKU-Removal Instead of Hedonic Adjustments: When a product (or SKU) becomes unavailable in the BLS goods basket, the BLS implements a SKU-replacement procedure whereby the next most similar product is used in its place, and a quality (hedonic) adjustment procedure is performed to get closer to an apples-to-apples price comparison. Since OpenBrand has data on nearly 100% of the SKUs pricing history in a given product category, we can simply remove that SKU from the basket and rely on price changes of the remaining SKUs in that basket. This eliminates the need for hedonic adjustment in the OpenBrand CPI basket.

- Weighting and Aggregation Method: A weighted geometric mean formula is used to minimize volatility and improve stability in price trend analysis at both the product grouping and category level. Instead of using sales-volume weights when aggregating the index, we take an alternative approach by using persistence-based weights for aggregation. Instead of more frequently purchased items getting more weight in the BLS’ CPI calculation, OpenBrand takes a more novel approach by weighting items with a more established price history in the market more heavily in our CPI calculation than items with a less established history.

- Reporting & Updates

- High-Frequency Updates: Published freely on a monthly basis, with a subscription option for daily summaries across categories, sub-categories, and individual products.

- Comparative Benchmarks: We aggregate pricing as analogously as possible to traditional BLS CPI measures for benchmarking purposes.

- Transparency & Accessibility: Provides both open and paid data access for journalists, researchers, businesses, and policymakers.

By leveraging real-time data and advanced statistical techniques, the OpenBrand CPI offers an accurate and dynamic measure of pricing trends, helping businesses and consumers make informed decisions in an evolving economic landscape.

OpenBrand CPI - Durable and Personal Goods

Groups and Products

Appliance Group

Air Conditioners

Air Purifiers

Beverage Coolers

Blenders

Coffee Makers

Cooktops & Wall Ovens

Countertop Cooking

Countertop Microwaves

Dehumidifiers

Dishwashers

Dryers

Freezers

Icemakers

Laundry

Ranges

Refrigerators

Vacuums

Washers

OTR (Over-the Range Microwaves)

Communications Group

Business Printers

Desktops

Headsets

HED

Ink

Large Printers

MFP Copiers

Monitors

Notebooks

Personal & SOHO Printers

Projectors

Smartphones

Tablets & Detachables

Toner

Wearables

Wireless Routers

Recreation Group

Bluetooth Speakers

Bluray

Digital Camcorders

Digital Cameras

Headphones

Media Players

Photo Paper

Sewing Machines

Sound Bars

Speaker Systems

TVs

VAW Speakers

Home Improvement Group

Bathroom Faucets

Bathroom Sinks

Bathroom Vanity

Bathtubs

Cutting Machines

Carpets

Door Locks

Exterior Paints

Exterior Stains

Floor Tiles

Garden Hoses

Generators

Grass Seed

Handhelds

Hand Tools

Hardwood Flooring

Interior Paints

Interior Stains

Kitchen Cabinets

Kitchen Cleanup

Kitchen Faucets

Lawn Fertilizer

Lawn Products

Log Splitters

Mowers

Outdoor Cooking

Outdoor Cooking Accessories

Paint Supplies

Pesticides

Shower Stall and Enclosures

Power Tools

Power Tools Accessories

Pressure Washer

Replacement Batteries

Shower Doors

Shower Heads

Smart Doorbells

Smart Locks

Smart Cameras

Smart Thermostats

Snow Throwers

Spray Paint

Toilets

Vinyl Flooring

Water Filtration

Weed Killer

Personal Care Group

Anti-Smoking Products

Adult Incontinence

Baby Products

Bath Products

Contraceptives

Cosmetics (Eye, Facial, Nail)

Deodorants

Diabetic Products

Digestive (Lower GI, Upper GI, Hemorrhoidal)

Ear Care Products

Eye Care Products

Feminine Needs (Sanitary Napkins/Tampons & Women’s Care)

First Aid Accessories & Treatments

Foot Care Products

Fragrance

Hair Care (Coloring, Growth, Shampoo, Conditioner, Styling)

Hair Dryers

Home Health Care

Lip Preparations

Oral Care (Breath Fresheners, Accessories, Dentures, Mouthwash, Oral Hygiene, Toothpaste)

Pain (Analgesic, External & Internal)

Sexual Wellness

Shave (Non-Razor Blades, Creams, Razors)

Skin Care (Acne, Facial, Hand & Body)

Sleeping Remedies

Soap

Sun Care

Upper Respiratory (Cold/Allergy/Sinus Liquids & Tablets, Cough Drops/Lozenges, External, Nasal Products)

Vitamins, Minerals & Supplements

Wt Ctl/Nutrition (Tablets & Liquid, Powder Wipes, Towelettes)

PREPARED BY

Ralph McLaughlin

Ralph McLaughlin is Chief Economist at OpenBrand, bringing nearly two decades of experience in economics, data analytics, and forecasting. His expertise spans industrial economics, applied econometrics, and housing market dynamics. Previously, he served as Chief Economist at Trulia and Haus, Deputy Chief Economist at CoreLogic, and Senior Economist at Realtor.com. Ralph held academic appointments at USC, San Jose State University, and University of South Australia. He earned a PhD in planning, policy, and design from UC Irvine and a BA in geography and regional development from the University of Arizona. Ralph is also an FAA-certified commercial pilot and instructor.

Contact Us

For questions about the report, contact Ralph McLaughlin at ralph@openbrand.com

For press inquiries, contact press@openbrand.com

For full data access on a subscription basis, click the button below to request a demo of the offering.

Consumer Price Index: Durable and Personal Goods | November 2025

This is the December 2025 release of the OpenBrand Consumer Price Index (CPI) – Durable and Personal Goods report that covers price movements in November 2025.

DISCLAIMER: This report is provided ‘as is’ for informational purposes only. OpenBrand makes no representations or warranties regarding the accuracy, completeness, or reliability of the data. Users assume all risks associated with their use of this report. OpenBrand shall not be liable for any losses or damages arising from the use of this report.

Prices Fall For First Time in a Year, Even Before Black Friday Deals Hit

In November, price growth for consumer durables and personal goods decreased for the first time in a year, with a month-over-month decrease of -0.11%. This is down sharply from a revised monthly +0.21% increase in October. Prices of all product groups fell in November with the exception of the Home Improvement product group. What’s more, price growth was already negative before Black Friday deals hit on November 28th, with a month-over-month decrease in prices of -0.05% for the month-to-date prior to Black Friday. In addition, November brought the highest discount magnitude since January 2024.

However, when it comes to Black Friday weekend (we define it as the Friday, Saturday, and Sunday after Thanksgiving) 2025 also brought the greatest frequency of product discounts on a Black Friday weekend in the post-COVID era with 42.2% of products coming with a discount. This surpass the prior post-COVID high of 38.0% seen in 2022 and last year’s 34.0%.

Table of Contents

- Key CPI Takeaways for November 2025 & Macroeconomic Outlook

- Product Group Highlights

- CPI 2025 Forecast: Macroeconomic Summary

- Methodology

November 2025 OpenBrand CPI-DPG Summary and Macroeconomic Outlook

Overall OpenBrand Consumer Price Index Movement: The OpenBrand CPI of Durable and Personal Goods recorded a -0.11% monthly change in November, the first month-over-month decrease in 2025. The month-over-month slowdown in the pace of price growth was only the fourth slowdown of the calendar year.

Discount Trends: November brought an increase in discount activity to the durables and personal goods sector, with frequencies climbing month-over-month to 24.8% of all durable and personal goods from 24.3% in the month prior. The typical magnitude increased slightly to 20.9%, recording the highest magnitude in 2025 so far, and up from 20.6% the month prior. All product groups except the Communications Group experienced the highest discount magnitude for 2025 thus far.

Product Group Price Trends: All product groups except the personal care group experienced a slowdown in the rate of growth from the month prior, with prices of all groups except Home Improvement declining month-over-month. The group summary is as follows:

- Appliance Group (-0.68%)

- Communication Group (-0.03%)

- Home Improvement Group (+0.51%)

- Personal Care Group (-0.21%)

- Recreation Group (-0.16%)

See the full breakdown of product groupings.

Product Group Highlights

CPI: Appliances

Prices for appliances decreased sharply on a month-over-month basis in November to -0.68%, falling from a revised -0.19% in the month prior. The negative price growth was at least partially driven by the typical discount magnitude increasing to 17.5% – the highest month so far this year- from 17.1%, while the frequency of discounts decreased to 42.1% from 42.7% the month prior).

CPI: Communication

Prices of communication devices, including phones, tablets, computers, and printers, fell on a month-over-month basis to -0.03.%, down sharply again from a revised +0.63% the month prior. The frequency and magnitude of discounts were mixed in November, moving from 13.7% to 19.1% and 21.2% to 20.3% from October to November, respectively. The sharp decrease in prices of communication devices most likely was led by the significant increase in frequency of discounts, which rose this month by over 5 percentage points compared to the month prior & is also the highest frequency of discounts by quite a bit for 2025 so far.

CPI: Home Improvement

Prices for home improvement goods increased by +0.51% on a month-over-month basis in November, slowing from a revised +0.52% in the month prior, showing 32 consecutive month-over-month flat or monthly increases. The deceleration in price growth was at least partially driven by an decrease in the frequency of discounts (12.2% from 13.8% the month prior), while the typical discount magnitude grew to 18.7% – the highest for this year thus far – from 18.3%.

CPI: Personal Care

Prices of personal care products fell on a monthly basis in November by -0.21%. Some of this decrease may be due to an increase in the magnitude of price discounts (rising from 21.7% in October to 22.5% in November – recording the highest magnitude of discounts for 2025 so far) in conjunction with the frequency of discounts remaining relatively flat (falling only slightly from 22.8% in October to 22.6% in November).

CPI: Recreation

The rate of price growth of recreational products, including TVs, headphones, and speaker systems, decreased to -0.16% on a month-over-month basis in November, down sharply from a revised +0.48% in October. Some of this decrease in the pace of price growth is at least partially due to a decrease in the frequency of discounts – down to 27.9% in November from 28.4% in October – but an increase in the average magnitude of discounts – up to 25.4% from 24.8% over the same time period – showcasing the highest magnitude of discounts thus far in 2025.

Macroeconomic Outlook Update

As December 2025 begins, the U.S. economy is slowing but not stalling, and the question dominating financial markets is whether the Federal Reserve will deliver its third interest-rate cut this year at the December 10 FOMC meeting. The economy has made steady—though uneven—progress on inflation throughout the year, and the Fed now faces a delicate balance between sustaining disinflation and preventing an overly sharp deceleration in growth.

Inflation is continuing its gradual descent. Headline consumer price growth is now firmly in the low 3% range year over year, down from the elevated levels seen earlier in the tightening cycle. Core inflation is cooling, though at a slower pace, weighed down by persistent pressures in services. Shelter costs remain a particular challenge: while new-lease rent growth has softened considerably, the lagged impact of earlier increases is still flowing through the index. Health care, insurance, and other labor-intensive service categories are also contributing to stickiness. Yet the overall trend remains encouraging, and for the first time in many months, policymakers can observe a pattern of month-after-month improvement.

The labor market is showing clearer signs of cooling as well. Hiring has slowed to a modest pace, unemployment is hovering just over 4%, and wage growth—once a key source of inflationary pressure—has eased back toward a more sustainable range. Importantly, labor market softness is not yet translating into a collapse in job opportunities or a surge in layoffs. Instead, it points to an economy moving closer to balance: still expanding, but losing momentum as businesses grow more cautious.

Consumer spending remains surprisingly resilient, supported by positive real wage growth and continued demand for services heading into the holiday season. But household budgets are stretched, particularly among lower-income consumers. High interest rates on mortgages, auto loans, and credit cards continue to act as a drag, and delinquencies are rising from historically low levels. The result is a consumer sector that is still driving the expansion—but doing so at a slower and more fragile pace.

Business investment has softened, especially in interest-sensitive sectors, while global conditions continue to limit export growth. Manufacturing activity is subdued, and companies are increasingly focused on efficiency rather than expansion. These dynamics are consistent with an economy that remains fundamentally sound but increasingly vulnerable to weaker demand.

All of this places the Federal Reserve in a difficult but not impossible position as it approaches its December 10 decision. On one hand, the Fed has long maintained that it would need “greater confidence” that inflation is on a durable path back to 2% before cutting rates. Recent data has moved in the right direction, but not overwhelmingly so. On the other hand, keeping rates at restrictive levels risks tightening financial conditions too much at a moment when the economy is already slowing and the labor market is gradually loosening.

Market expectations ahead of the meeting reflect this tension. Investors are split: some anticipate that the Fed will use December to signal the beginning of a gradual normalization process with a modest quarter-point cut. Others expect the Fed to wait until early 2026, particularly if service-sector inflation remains sticky or labor market conditions strengthen unexpectedly. The Fed itself has remained cautious in its public communications, emphasizing data dependence and maintaining flexibility.

Ultimately, the likelihood of a December rate cut hinges on the final readings of inflation and labor market conditions released in the days leading up to the meeting. If both show continued cooling, the Fed may judge that the balance of risks has shifted sufficiently toward supporting growth. If not, policymakers may prefer to hold rates steady and begin easing early in the new year.

In short, the December 2025 outlook reflects an economy moving through the late stages of disinflation, with growth softening and monetary policy nearing an inflection point. Whether another cut arrives on December 10 or a few months later, the direction of policy is now clearly turning—and the next phase of the economic cycle will depend on how smoothly that transition unfolds.

Note: This summary is based on data available as of early December 2025 and may be subject to revisions in future releases.

For questions about the report, please contact Ralph McLaughlin at ralph@openbrand.com

For press inquiries, please contact press@openbrand.com

About the OpenBrand CPI

This report offers insights into price trends across major consumer product categories representing a select mix of both durable and personal goods (see methodology below for more details). The data used in this report leverages OpenBrand’s industry-leading library of durable and personal goods pricing, promotion, and availability for over 1.4 million individual products. This is more than ten times the coverage by the monthly Bureau of Labor Statistics (BLS) Consumer Price Index, allowing more timely and granular reporting of price changes in the market.

This free monthly report provides a broad summary of price changes (including promotional activity), category-specific pricing and promotional trends, and macroeconomic context. For those seeking deeper insights, weekly CPI reporting and monthly CPI forecasts (released next week) are available on a subscription basis with up to same-day SKU-level pricing data available in bulk downloadable files.

Subscribe

Get CPI & Real-Time Pricing Data Updates

The OpenBrand CPI-DPG is released monthly. Join our subscription list to be notified when new CPI data is available.

OpenBrand Methodological Notes

The OpenBrand CPI of Durable and Personal Goods is constructed using a data-driven methodology that ensures accuracy, timeliness, and transparency in measuring price trends for both short and long-lasting consumer products. The methodology consists of the following key components:

- Data Collection

- Real-Time Price Tracking: Prices are sourced daily from online marketplaces, retail websites, and brick-and-mortar store listings.

- Retailer & Manufacturer Data: Aggregates pricing information from major retailers, direct-to-consumer brands, and wholesale suppliers into broader consumer categories.

- Temporal Coverage: Captures price variations over time, including daily discounts and price promotions

- Product Selection & Tracking

- Durable and Personal Goods Focus: The index includes products with an expected lifespan of three years or more, such as home appliances, consumer electronics, and tools, as well as personal care products with a shorter lifespan, such as hair and skin care products, vitamins, over-the-counter medications, and oral care products.

- Brand & Model Tracking: Individual brands and models are monitored to reflect pricing shifts within competitive product segments, including both permanent changes in listing price as well as temporary promotional pricing.

- Price Calculation, Adjustments, and Weighting

- Price Calculation: Tracks month-over-month and year-over-year price movements to measure price stability in the marketplace and take into account both longer-term changes in pricing (such as changes in manufacturer’s suggested retail price) as well as more short-term changes in pricing, such as promotional discounts and sales prices.

- SKU-Removal Instead of Hedonic Adjustments: When a product (or SKU) becomes unavailable in the BLS goods basket, the BLS implements a SKU-replacement procedure whereby the next most similar product is used in its place, and a quality (hedonic) adjustment procedure is performed to get closer to an apples-to-apples price comparison. Since OpenBrand has data on nearly 100% of the SKUs pricing history in a given product category, we can simply remove that SKU from the basket and rely on price changes of the remaining SKUs in that basket. This eliminates the need for hedonic adjustment in the OpenBrand CPI basket.

- Weighting and Aggregation Method: A weighted geometric mean formula is used to minimize volatility and improve stability in price trend analysis at both the product grouping and category level. Instead of using sales-volume weights when aggregating the index, we take an alternative approach by using persistence-based weights for aggregation. Instead of more frequently purchased items getting more weight in the BLS’ CPI calculation, OpenBrand takes a more novel approach by weighting items with a more established price history in the market more heavily in our CPI calculation than items with a less established history.

- Reporting & Updates

- High-Frequency Updates: Published freely on a monthly basis, with a subscription option for daily summaries across categories, sub-categories, and individual products.

- Comparative Benchmarks: We aggregate pricing as analogously as possible to traditional BLS CPI measures for benchmarking purposes.

- Transparency & Accessibility: Provides both open and paid data access for journalists, researchers, businesses, and policymakers.

By leveraging real-time data and advanced statistical techniques, the OpenBrand CPI offers an accurate and dynamic measure of pricing trends, helping businesses and consumers make informed decisions in an evolving economic landscape.

OpenBrand CPI - Durable and Personal Goods

Groups and Products

Appliance Group

Air Conditioners

Air Purifiers

Beverage Coolers

Blenders

Coffee Makers

Cooktops & Wall Ovens

Countertop Cooking

Countertop Microwaves

Dehumidifiers

Dishwashers

Dryers

Freezers

Icemakers

Laundry

Ranges

Refrigerators

Vacuums

Washers

OTR (Over-the Range Microwaves)

Communications Group

Business Printers

Desktops

Headsets

HED

Ink

Large Printers

MFP Copiers

Monitors

Notebooks

Personal & SOHO Printers

Projectors

Smartphones

Tablets & Detachables

Toner

Wearables

Wireless Routers

Recreation Group

Bluetooth Speakers

Bluray

Digital Camcorders

Digital Cameras

Headphones

Media Players

Photo Paper

Sewing Machines

Sound Bars

Speaker Systems

TVs

VAW Speakers

Home Improvement Group

Bathroom Faucets

Bathroom Sinks

Bathroom Vanity

Bathtubs

Cutting Machines

Carpets

Door Locks

Exterior Paints

Exterior Stains

Floor Tiles

Garden Hoses

Generators

Grass Seed

Handhelds

Hand Tools

Hardwood Flooring

Interior Paints

Interior Stains

Kitchen Cabinets

Kitchen Cleanup

Kitchen Faucets

Lawn Fertilizer

Lawn Products

Log Splitters

Mowers

Outdoor Cooking

Outdoor Cooking Accessories

Paint Supplies

Pesticides

Shower Stall and Enclosures

Power Tools

Power Tools Accessories

Pressure Washer

Replacement Batteries

Shower Doors

Shower Heads

Smart Doorbells

Smart Locks

Smart Cameras

Smart Thermostats

Snow Throwers

Spray Paint

Toilets

Vinyl Flooring

Water Filtration

Weed Killer

Personal Care Group

Anti-Smoking Products

Adult Incontinence

Baby Products

Bath Products

Contraceptives

Cosmetics (Eye, Facial, Nail)

Deodorants

Diabetic Products

Digestive (Lower GI, Upper GI, Hemorrhoidal)

Ear Care Products

Eye Care Products

Feminine Needs (Sanitary Napkins/Tampons & Women’s Care)

First Aid Accessories & Treatments

Foot Care Products

Fragrance

Hair Care (Coloring, Growth, Shampoo, Conditioner, Styling)

Hair Dryers

Home Health Care

Lip Preparations

Oral Care (Breath Fresheners, Accessories, Dentures, Mouthwash, Oral Hygiene, Toothpaste)

Pain (Analgesic, External & Internal)

Sexual Wellness

Shave (Non-Razor Blades, Creams, Razors)

Skin Care (Acne, Facial, Hand & Body)

Sleeping Remedies

Soap

Sun Care

Upper Respiratory (Cold/Allergy/Sinus Liquids & Tablets, Cough Drops/Lozenges, External, Nasal Products)

Vitamins, Minerals & Supplements

Wt Ctl/Nutrition (Tablets & Liquid, Powder Wipes, Towelettes)

PREPARED BY

Ralph McLaughlin

Ralph McLaughlin is Chief Economist at OpenBrand, bringing nearly two decades of experience in economics, data analytics, and forecasting. His expertise spans industrial economics, applied econometrics, and housing market dynamics. Previously, he served as Chief Economist at Trulia and Haus, Deputy Chief Economist at CoreLogic, and Senior Economist at Realtor.com. Ralph held academic appointments at USC, San Jose State University, and University of South Australia. He earned a PhD in planning, policy, and design from UC Irvine and a BA in geography and regional development from the University of Arizona. Ralph is also an FAA-certified commercial pilot and instructor.

Contact Us

For questions about the report, contact Ralph McLaughlin at ralph@openbrand.com

For press inquiries, contact press@openbrand.com

For full data access on a subscription basis, click the button below to request a demo of the offering.

Avoiding the Pitfalls of Receipt-Only Inflation Measures With a Mosaic-Based CPI

The Takeaway: Receipt-only data creates an incomplete and biased view of inflation due to self-selection, biased reporting, poor product detail, lag, and misaligned incentives. Discover how the OpenBrand Consumer Price Index uses a comprehensive mosaic of price observations that better captures what consumers are seeing on the shelf, what they see on discount, and what they actually pay for.

In a world where prices can change at the tap of a screen, measuring inflation accurately is both more difficult and more critical than ever. As economists and data scientists seek better tools, one approach that often attracts attention is the consumer receipt panel: a dataset built from shopper-submitted receipts, either photographed with an app or uploaded manually.

While receipt panels can provide useful insights into consumer behavior, building a consumer price index (CPI) based only on receipt-panel data introduces a series of structural weaknesses. These flaws aren’t always obvious, but they have real consequences for anyone relying on the index—policymakers, businesses, forecasters, or households trying to make sense of, and decisions on, their economic landscape.

At OpenBrand, we designed the OpenBrand Consumer Price Index with these limitations squarely in mind. Our CPI is built on a mosaic of data that captures what prices consumers see on the shelf, what they see on discount, and what they actually pay for. This mosaic approach helps insulate the OpenBrand Consumer Price Index from the weaknesses that sole reliance upon receipt-panel data can bring.

Let me explain.

1. Representativeness Problem in Receipt Panels

When a CPI relies only on receipt uploads, the index is built on the behaviors of people who:

- Take the time to photograph receipts

- Participate in incentive programs

- Shop at stores that provide itemized paper or digital receipts

- Shop for specific items incentivized by receipt panel collectors

- Are comfortable sharing data with an app

That’s not a representative snapshot of the U.S. consumer. It’s a convenience sample, useful for some analyses, but not for a core inflation indicator.

Why OpenBrand’s CPI is immune:

The OpenBrand CPI uses a broad data set drawn from prices observed on millions of products on store shelves, online, on discount, on receipts, and from the longest-running consumer durables survey in the United States. This ensures representation across income groups, regions, retailer types, and product categories, without relying on a self-selected, opt-in behavior.

2. Receipt Panels Capture What’s Scanned vs What Consumers Actually Buy

Consumers often fail to upload receipts for:

- Small purchases

- Routine purchases

- Purchases split across payment methods

- Online orders where the receipt is buried in email

This creates erratic sampling frequency and inconsistent product coverage.

Why OpenBrand’s CPI is immune:

The OpenBrand CPI is based on a dataset of exhaustive price observations, not voluntary uploads. That means we capture the full pattern of consumer spending, including the mundane and the automatic—the things households rarely document but always pay for such as personal care products – toothpaste, hair care, toiletries, etc.

3. Product-Detail Gap in Receipt-Based Inflation Measures

Even when receipts are uploaded, they often list abbreviated product codes or generic descriptions—“LGE MILK,” “SHAMPOO,” “SERV CHG”—with no SKU, UPC, or version detail.

That makes:

- Product matching difficult or limited

- Quality adjustments nearly impossible

- Substitution tracking unreliable

- New-product introduction invisible

Receipt-only CPIs can confuse a price change with a product change.

Why OpenBrand’s CPI is immune:

OpenBrand uses structured product-level data, including SKU and UPC detail, manufacturing codes, and metadata. That lets us track true product equivalence, properly adjust for new product variation, and separate real inflation from quality-driven price shifts.

4. Receipt-Only CPI Approaches Struggle With Timeliness

Even the best receipt panels suffer from lag:

- Purchase date on receipts may not easily be tracked

- Consumers delay uploads

- Apps batch receipts

- Processing pipelines take time

For an inflation indicator, this latency can be a major drawback, especially during volatile periods.

Why OpenBrand’s CPI is immune:

The OpenBrand CPI is built on near-real-time price observation data, updating quickly enough to reflect active price dynamics, promotions, and category-specific shifts as they happen. With the OpenBrand in-store and online optical collection methods, spacing between same-SKU price observations is consistently a matter of days, not months. This allows a timely and true apples-to-apples comparison of price changes.

5. Incentive-Driven Distortions in Receipt Upload Behavior

To maintain participation, many receipt apps offer:

- Cashback

- Points

- Sweepstakes entries

- Fraud

These incentives often encourage users to upload certain types of receipts (e.g., grocery) while ignoring others, skewing the sample further, while also incentivizing nefarious behavior such as submission of fraudulent receipts.

Why OpenBrand’s CPI is immune:

Our CPI is predominantly driven by our dense pricing database that doesn’t rely on incentivizing consumer uploads to collect data. The OpenBrand CPI is grounded in naturally occurring price observation, free of incentive-driven distortions.

A Modern, Comprehensive Approach to Inflation Measurement

Receipt panels offer valuable micro-insights into consumer shopping behavior. But a receipt-panel-only CPI is not an inflation measure you want when setting pricing strategy, steering monetary policy, forecasting business cycles. The structural limitations – self-selection, biased reporting, poor product detail, lag, and misaligned incentives – are baked into the methodology of a CPI that relies solely on a receipt-panel-only data set. No amount of statistical modeling can fully remove them.

The OpenBrand Consumer Price Index was designed to overcome these limitations from day one. By grounding inflation measurement on a comprehensive mosaic of data gathered across merchants, channels, categories, and product types, we deliver a CPI that is more accurate, more representative, more granular, and more timely than any index built solely on consumer receipts.

Inflation is too important to measure with partial visibility. With OpenBrand, we measure it the way households actually live it.

Contact Us

For questions about OpenBrand’s CPI, contact Ralph McLaughlin at ralph@openbrand.com

For press inquiries, contact press@openbrand.com

For full data access on a subscription basis, click the button below to request a demo of the offering.

Ralph McLaughlin