Find Your Winning Segments With MindShare + Claritas PRIZM® Premier

OpenBrand added Claritas PRIZM® Premier segmentation to their MindShare solution, which delivers insights from the longest-running durables consumer tracking survey. This allows you to connect “who’s moving” in the market to “who they really are” – and then activate those audiences across media with precision.

MindShare captures what, where, and why people buy durables. PRIZM Premier shows who they are and how to reach them. Together, they close the insight-to-action gap without extra tools or manual mapping.

If you are new to MindShare or PRIZM Premier, here is exactly what you gain when you use them together.

What you get when you combine MindShare + PRIZM® Premier

- See the segments for the whole category and your brand. PRIZM coding is applied across the entire category in MindShare. Tie brand momentum, consideration, and purchase intent to PRIZM Premier lifestyles at a zip+4 level of granularity to understand which households are moving — and why.

- Activate in one step. Push selected PRIZM Premier audiences into Claritas-powered channels (programmatic, social, streaming/CTV, direct mail, mobile) to reduce waste and raise relevance.

- Prove impact where it matters. Track lift by PRIZM Premier segment (not just at the national level) so you can reallocate budget with confidence.

Now let’s turn those benefits into real work your team can do this quarter.

High-value use cases

-

- Hyper-targeted brand awareness: Match rising consumer-reported mind share to PRIZM® segments and activate only those households to reduce waste and raise relevance.

- Competitive conquest: Find segments where a rival over-indexes and build switcher programs that target those groups.

- Segment-level lift measurement: Quarterly updates show brand and ad-recall change by PRIZM segment so you adjust creative and budgets with evidence, not averages.

- Creative personalization at scale: Blend MindShare insights with PRIZM psychographics to craft messages that match values, life stage, and media habits.

- Push button activation: With a single click, marketers can activate Claritas audiences across integrated platforms (DSPs, social, CTV, direct mail, email, etc.), eliminating the lag between audience discovery and execution.

By using both products, you get the what, where, and why tied to the who and how to reach them, along with a repeatable quarterly loop to track your marketing campaigns.

Here’s what that looks like in practice, using an anonymized retailer example.

Regional Retailer Example: Tires

A Mountain West DMA showed a gap in performance for tire share. PRIZM Premier pinpointed which lifestyle segments drive most of the category’s performance: tire demand. Since coding is category-wide, this read works for any regional or national tire retailer in the market.

What the data shows

- MindShare surfaced a DMA-level shortfall in performance around tire consideration and intent.

- PRIZM identified the segments responsible for the bulk of performance: tire purchases in that DMA, for example, Middleburg Managers, Big Sky Families, Country Strong, Country Casuals.

How to act this quarter

- Prioritize those four segments for creative and offers that match their motivations, for example premium grip and handling for Middleburg Managers, safety and versatility for Big Sky Families.

- Use geo-targeted media and local events in ZIP codes where these segments cluster.

- Build retailer-specific landing pages that speak to segment values and feature needs.

What to watch next

- Segment-level lift in intent and store visits, redemption rates on segment-targeted offers, and revenue per ZIP code across the targeted clusters.

Why it matters

Focusing budget on the top segments and DMAs turns a small share gap into measurable revenue within a quarter, with a clear playbook to scale into adjacent markets.

The same approach extends beyond one DMA or category. Here are other ways to mine segment insights at scale.

How to Generate More Insights

By retailer

- Identify which PRIZM segments drive consideration or intent at Retailer A versus Retailer B. Where competitors over-index and where you have headroom.

- So what: Build retailer-specific conquest or co-op plans that target the right lifestyles.

By price tier

- Which segments disproportionately choose premium, mid, or value, and how willingness to pay varies by lifestyle.

- So what: Shift mix and offers to the tiers each segment will actually buy.

By product type

- Segment preferences across subcategories, for example front-load versus top-load, gas versus electric, corded versus battery.

- So what: Aim product development and merchandising where segment demand is rising.

By spec or feature

- Which segments over-index for features like smart connectivity, counter-depth, brushless motors, or quiet operation, and how those tie to media habits.

- So what: Match creative and channel to the features that convert each lifestyle.

Find the Segments That Will Move Your Share

MindShare plus PRIZM reveals the few audiences that matter most, across the whole category, and shows how to reach them. PRIZM® Premier coding is available as an add-on for MindShare subscribers.

Request a demo today to review your category and priority retailers, then map the next-quarter plan.

Prime Day Insights: How Durable Goods Shoppers Differ from CPG

Why durable-goods brands need purpose-built data (and what happens when you don’t).

You’ve probably seen the big, splashy Prime-Day recaps:

“Half of shoppers said the discounts were just… fine.”

“Only one in ten walked away disappointed.”

Those numbers are technically true for all Amazon shoppers. But “all” includes those shoppers stuffing their carts with protein shakes, household items and home decor. If you sell cordless drills or countertop ovens, that data can steer you straight out of your next sale.

What durable-goods shoppers actually told us

OpenBrand ran the only Prime-Day survey focused solely on consumer-durable buyers.

Here’s how their experience stacked up during Prime Day:

| Responses | Durables Buyers | Non-Durables Buyers |

| Discounts exceeded expectations | 48.6% | 15.9% |

| Selection exceeded expectations | 46.5% | 19.7% |

| Discounts “Just met expectations” | 45.0% | 70.5% |

| Selection “Just met expectations” | 45.6% | 63.6% |

| Flat-out disappointed on selection or discounts | ~5% | 13% – 17% |

Three critical truths

- Durables shoppers were thrilled. About half of durable-goods buyers said discounts and selection beat the hype (48.6% and 46.5%).

- CPG shoppers were meh. Roughly seven in ten non-durable shoppers settled for ‘just met expectations’ (70.5% for discounts, 63.6% for selection).

- Complaints plummeted for durables. Non-durable buyers were nearly three times as likely to feel disappointed (13-17% vs. ~5 %).

Source: OpenBrand Prime Week Survey Tracker. More information on the survey methodology can be found here.

Why the gap exists

1) Category & Industry specific beats one-size-fits-all. Our platform was engineered specifically to track the behavior of durable goods. Why? Because the buying behaviors are different – longer consideration cycles, higher perceived risk, and bigger baskets. Systems tuned for pantry fill-ups simply miss those signals and nuance.

2) Bigger isn’t always better. Bringing an 800-pound data gorilla into your business sounds impressive, right up until you’re stuck feeding it insights you can’t act on. Depth of focus beats raw bulk every time.

3) Mix the two audiences and you bend reality. When CPG and durables data get averaged together, the strong positives from big-ticket shoppers flatten into mediocrity. That’s why generic Prime-Day stats don’t just blur the picture, they warp it.

The moral for durable-goods brands & retailers

- If you want to know how many people buying hydration powder felt “okay” about discounts, stick with the reports that are not tailored to your buyer.

- If you want to know that durable-goods buyers were more than twice as likely to say Amazon’s deals blew them away—and far less likely to be disappointed—come to the source built for your category.

OpenBrand spends 100% of our time collecting and analyzing the signals that move your margin, not the guys hawking powdered drink mixes.

OpenBrand Prime Day 2025 Survey Methodology Overview

Survey Structure and Timing

OpenBrand conducted three distinct consumer surveys to capture attitudes, behaviors, and comparisons over time across stages of the shopping journey surrounding Amazon Prime Day 2025:

- Pre–Prime Day Survey (n=725)

Fielded: July 2 – July 7, 2025

Purpose: Gauge planned participation, expectations, and awareness of Prime Day promotions - During–Prime Day Survey (n=700)

Fielded: July 8 – July 11, 2025

Purpose: Capture real-time reactions, purchases, frustrations, and ad exposure during the sales event - Post–Prime Day Survey (n=700)

Fielded: July 12 – July 17, 2025

Purpose: Understand downstream purchasing, satisfaction, returns, and follow-on intent

All surveys were fielded online using our MindShare proprietary panel syndication process. Respondents were a random sampling of U.S. adults (18+) screened for awareness of Amazon Prime Day 2025.

Sample Composition

- Total Sample Size: 2,125

- Sample Stratification: Each wave analyzed separately and in aggregate for trend validation

Durable vs. Non-Durable Shopper Classification

Respondents were classified based on the types of products they reported shopping for or purchasing:

Durable Goods Categories:

- Appliances

- Electronics

- Tools & Equipment

- Home Goods (e.g., storage, décor, furniture)

Non-Durable Categories:

- All other

Respondents could be included in both groups if they shopped across categories. However, segment-specific insights are based on exclusive or majority-category behaviors.

Sidney Waterfall

Sidney Waterfall is the VP of Marketing at OpenBrand, leading strategic initiatives that connect brands and retailers with real-time market intelligence. With deep expertise in digital marketing and data-driven strategies, she helps drive OpenBrand’s growth and impact in the consumer durables space. Passionate about innovation and market insights, Sidney ensures OpenBrand stays ahead in delivering actionable intelligence to its clients.

How to Leverage Competitive Pricing Intelligence to Stay Ahead of Tariffs and Market Volatility

Introduction: Why Competitive Pricing Intelligence Matters in an Uncertain Market

For brands and retailers in the durable goods sector—including consumer electronics, major and small appliances, and office equipment—pricing decisions are more complex than ever. With ongoing tariffs on key components, fluctuating supply chain costs, and evolving consumer demand, companies must react quickly to maintain profitability and market share.

Unlike fast-moving consumer packaged goods, durable products have longer purchase cycles, higher price points, and greater sensitivity to external cost pressures. As a result, competitive pricing intelligence is critical for brands and retailers to anticipate tariff-driven price shifts and make proactive, data-driven decisions.

In this article, we’ll break down five key pricing signals to monitor, the actions to take based on the data, and who in your organization should act on these insights to stay ahead in a volatile market.

What Pricing Data Can Tell You—and What to Do About It

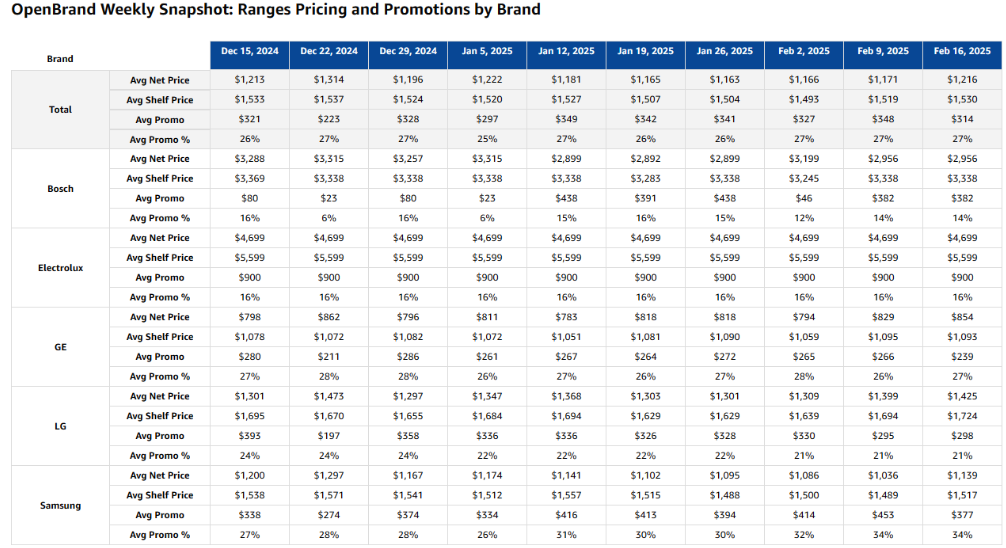

1. Sudden Price Increases in Key Product Categories

What to Watch:

- Sharp price jumps across specific categories or SKUs that have import-reliant components or raw materials, such as appliances, consumer electronics, and office equipment.

- Competitor pricing adjustments occur before a new tariff goes into effect.

What to Do:

- Act preemptively: If competitors are raising prices in anticipation of a tariff, review supplier agreements and adjust inventory orders before costs escalate.

- Assess component-level exposure: Many durable goods rely on imported semiconductors, steel, aluminum, and plastic resins—factor these costs into pricing decisions.

- Strategically time price adjustments: Instead of sudden spikes, test phased increases or bundling strategies to maintain sales volume.

- Understanding different promotion types, including bundles, can give you insights into various pricing strategies outside of hard-shelf price cuts.

Who Should Act on This?

- Product Managers & Pricing Analysts → Monitor real-time competitor pricing fluctuations.

- Competitive Intelligence Teams → Adjust pricing and promotional plans based on cost forecasts.

- Supply Chain & Sales Teams → Negotiate contracts before tariffs impact costs.

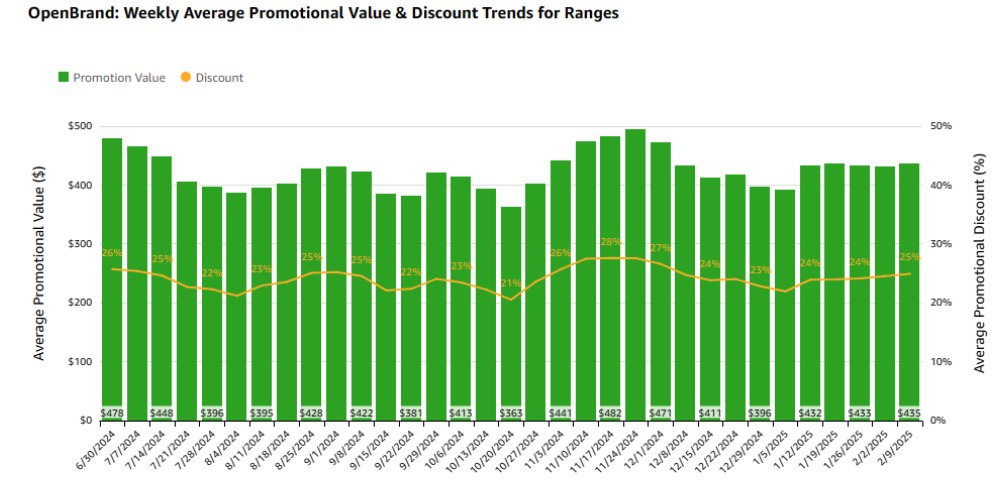

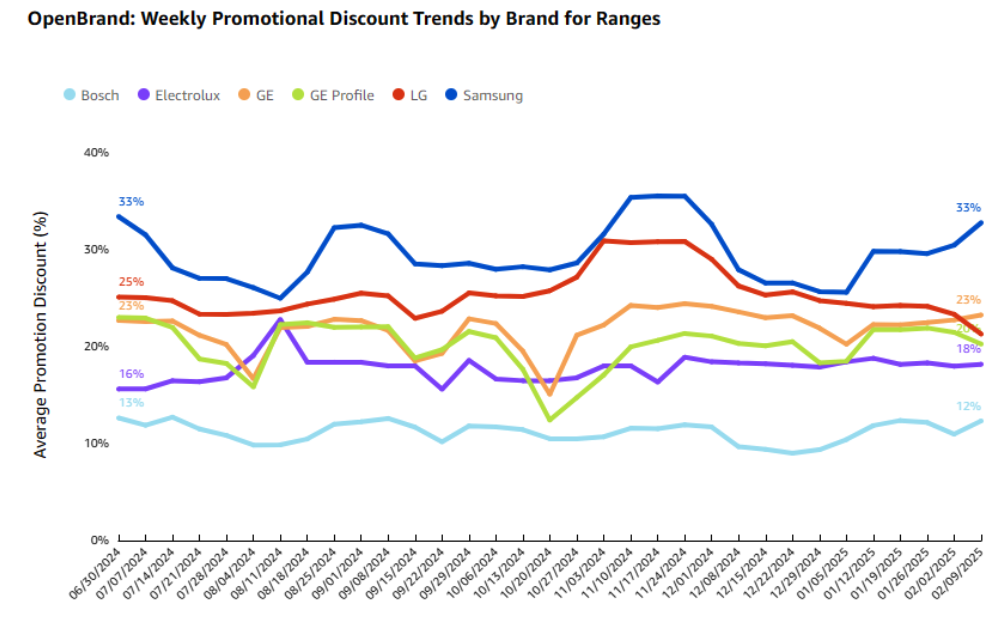

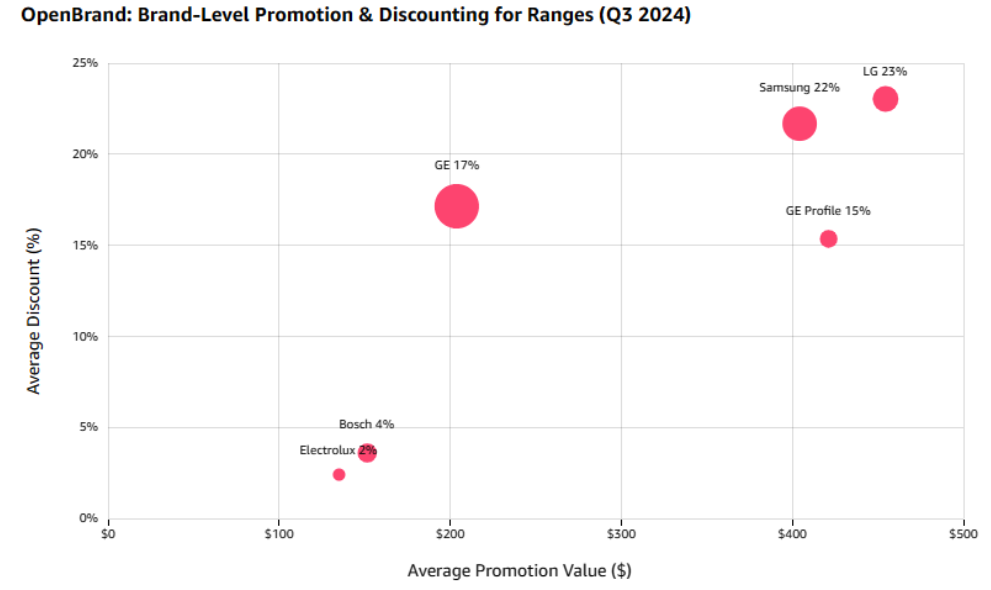

2. Competitor Promotional Activity as a Cost-Absorption Strategy

What to Watch:

- More aggressive discounting on high-margin durable goods (e.g., home appliances, large electronics) indicating competitors are absorbing costs rather than passing them to consumers.

- Fewer promotions or shallower discounts signaling that competitors are struggling with rising costs and protecting their margins.

What to Do:

- Re-evaluate promotions: If competitors are still discounting despite rising costs, determine if matching these promotions is sustainable.

- Monitor elasticity trends: Durable goods have longer purchase cycles. For example, major appliances remain in the brick-and-mortar channel for 3 years on average. Track how price-sensitive customers are before adjusting your strategy.

- Shift promotional messaging: Instead of discounting deeply, emphasize warranty extensions, retailer loyalty programs with key retailers, financing options, or value-added services to maintain demand.

Who Should Act on This?

- Sales Team & Buyers → Track competitor pricing trends and adjust strategies to balance volume and margins. Work with trade partners to stay competitive without unnecessary discounting.

- Trade & Promotions Managers → Optimize promotional spend based on competitive behavior.

- Channel Marketing & Brand Teams → Adjust campaign and promotional plans to compete without eroding margin.

3. Retailer-Supplier Price Divergences

What to Watch:

- If retailer prices rise faster than manufacturer’s suggested retail prices (MSRP), it may indicate that retailers are anticipating higher costs or tightening margins.

- If some retailers hold prices steady while others increase them, there may be an opportunity to gain market share with competitive pricing.

What to Do:

- Ensure channel-wide price consistency: If some retailers are holding prices steady while others increase them, re-align pricing strategy to prevent undercutting.

- Negotiate with key retail partners: Ensure pricing integrity across wholesale and DTC channels to prevent profit dilution.

- Monitor price floors: If certain retailers undercut MAP pricing, reevaluate distribution agreements to maintain value perception.

Who Should Act on This?

- Retail Buyers & Category Managers → Identify price discrepancies across retail partners.

- Sales & Key Account Managers (for manufacturers/brands) → Work with retailers to maintain price consistency.

- Product Managers → Adjust forecasts based on wholesale vs. retail pricing trends

4. Channel-Based Price Variability

What to Watch:

- Price differences between online marketplaces and in-store retail.

- Retailers adjusting pricing inconsistently across regions or fulfillment centers.

What to Do:

- Adjust direct-to-consumer (DTC) pricing based on marketplace trends: If resellers undercut brand-owned channels, adjust pricing or offer exclusive bundles to drive DTC sales.

- Optimize omnichannel strategy: Track SKU inventory and strategically shift inventory to maximize profitability in higher-margin markets.

- Enforce MAP pricing: For durable goods brands, protecting value perception is critical—monitor and address unauthorized price cutting.

Who Should Act on This?

- Retail Buyers & Category Managers → Identify which brands or products are experiencing price discrepancies across retailers.

- Sales & Key Account Managers (for manufacturers/brands) → Work with retailers to ensure consistent pricing and prevent channel conflict.

- Pricing Strategy & Analyst Teams → Adjust regional pricing strategies based on demand elasticity.

- GTM and Sales Ops Teams → Enforcing and maintaining pricing strategies.

5. Consumer Price Elasticity and Competitive Response

What to Watch:

- If competitors raise prices but maintains market share, customers may be less price-sensitive, giving you room to adjust.

- If a competitor raises prices and market share drops, the market may be hitting a price ceiling.

What To Do:

- Test gradual price increases: Instead of sharp hikes, experiment with incremental adjustments and monitor conversion rates.

- Monitor brand perception: If competitors lose market share after raising prices, position yourself as the best-value alternative.

Who Should Act on This?

- Pricing Teams → Determine optimal price points based on consumer demand.

- Customer Insights Teams → Understand how price changes impact buying decisions.

- Sales & Product Managers (for manufacturers/brands) → Collaborate and adapt sales strategies based on consumer price sensitivity.

How OpenBrand’s Competitive Pricing Intelligence Can Help

At OpenBrand, our Competitive Intelligence product provides:

✔ Daily and same-day SKU-level price tracking across online and in-store channels

✔ Promotional activity insights to understand cost-absorption trends

✔ Competitor pricing benchmarks to spot industry-wide shifts

✔ Key SKU availability to monitor inventory by region and retailer

✔ Multi-level pricing insights to see pricing, inventory, and promotional details from a brand-to-SKU level

Pricing data provides a real-time view of market movements, competitive strategies, and emerging trends. To take it one step further, we recommend combining competitive intelligence with market measurement to give you a holistic view. Our customers use Market Measurement to monitor share, track competitive shifts, and uncover how their customers behave and why

By layering these insights, businesses can anticipate pricing thresholds, optimize promotions, and adjust inventory strategies based on market dynamics and consumer behavior. This holistic approach allows brands to make proactive, not reactive, decisions—aligning pricing strategies with actual demand to maximize revenue and market share.

Want to see how OpenBrand can help you track daily price movements and outmaneuver the competition? Request a demo today.

About the Author

Sidney Waterfall

Sidney Waterfall is the VP of Marketing at OpenBrand, leading strategic initiatives that connect brands and retailers with real-time market intelligence. With deep expertise in digital marketing and data-driven strategies, she helps drive OpenBrand’s growth and impact in the consumer durables space. Passionate about innovation and market insights, Sidney ensures OpenBrand stays ahead in delivering actionable intelligence to its clients.