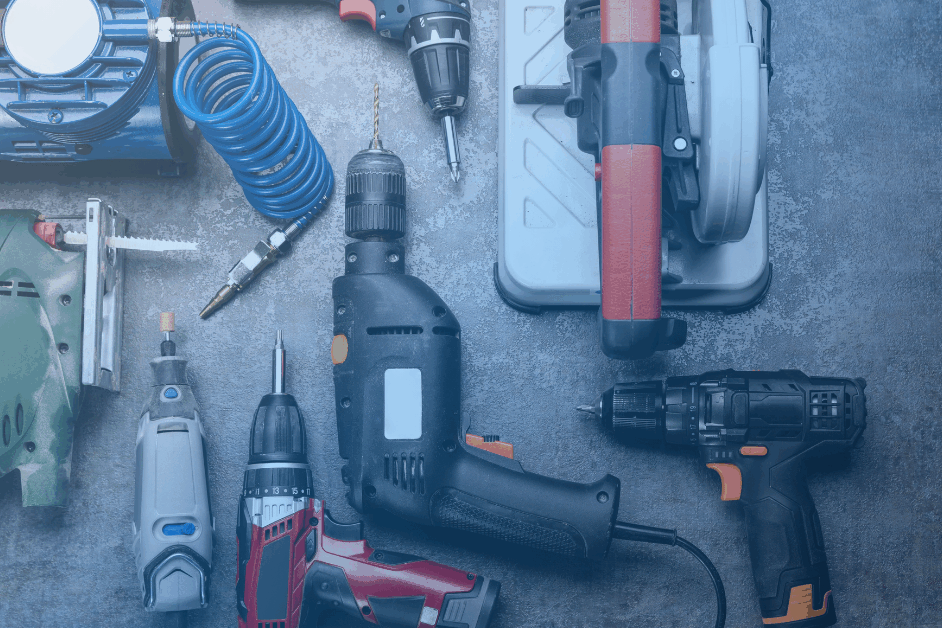

It’s the holiday season, the perfect time to get that special someone the power tools they’ve been dreaming of all year. Changing battery technology has made significant impact on cordless tools in the past few years, especially with lithium ion batteries. However, despite their increased power and decreased weight and cost, portable power tools are having a difficult time breaking 60% penetration.

Now, that isn’t to say that some cordless power tools haven’t become overwhelmingly popular. When looking at which products consumers purchase for the past several years, power drills and impact drivers make up almost exactly half of the eleven portable power tools being tracked by TraQline. Not only are drilling/driving tools dominant, cordless has been the form factor of choice for years (over 80% of the time). Due to this dominance, other portable tools haven’t gained much ground, which has affected overall penetration. For example, according to TraQline, in 2007 the percentage of portable power tools purchased was 53%; in 2017, that number rose marginally to 56%. However, as technology continues to pack more power into a smaller lithium ion (or the next great technology) battery, the market will continue to shift towards cordless.

“Grinding” down in corded

Certain tools have started to gain ground – but they had (and still have) some catching up to do. Routers and grinders have a relatively small impact on the overall portable power tool market, in 4Q end Sept 2017 making up only 6% of all portable power tools sold, but they’re showing large increases in cordless growth. These two categories now boast not only being among the lowest percentage of products sold as cordless but also fastest adoption of cordless: in the 4Q ending September 2008, only 13% of consumers purchased cordless routers. By the 4Q ending September 2017, that has increased to 26%. Similarly, only 7% of consumers purchased cordless grinders in 4Q ending September 2018. In the 4Q ending September 2017, that’s more than doubled, to 15%.

Capping the list of top three corded products purchased is the orbital sander. In order, the current top three corded power tools are:

- Orbital Sander: 87% corded (cordless 13%)

- Grinder: 86% corded (cordless 14%)

- Router: 76% corded (cordless 24%)

On the flip side, the three most commonly purchased cordless power tools are:

- Impact Driver: 84% cordless

- Drill: 82% cordless

- Multi tool: 58% cordless

Cordless impact drivers and drills have a significant impact in this portable power tool category. The next most common item in the mix, the cordless multi tool, is still 24% less than cordless power drills.

Cordless. It’s not just for tools anymore.

The impact of cordless technology is spreading to other categories as well. Battery technology is enabling a similar shift to cordless Outdoor Power Equipment. Recent years have seen the emergence of battery leaf blowers, walk-behind, and even riding lawn mowers. Currently, 20% of the ten outdoor power equipment products tracked are battery powered. The top battery powered products for outdoor power equipment are:

- Line Trimmers: 34% cordless

- Power Leaf Blowers: 31% cordless

- Hedge Trimmer: 30% cordless

Cordless portable power tools are more common than corded, but they have yet to take over every portable power tool product category on the market. What battery technology will change the landscape? Stay tuned for our post on battery technology to see what batteries are next that will revolutionize the market.

Related blogs

Prime Day 2025 for Durables: Shopper Intent, Promotions & Where to Focus

Prime Day 2025 broke the mold. For the first time, Prime Day ran four full days, spanning July 8–11, twice the usual length, and emerged as Amazon’s…

Related blogs

The Power Tools Market is Changing: Here’s How | Q2 2025 Share & Rankings

The Power Tools market is moving faster than ever, shaping how consumers shop, which brands command…

Consumer Durables Industry: 2024 Year in Review

The consumer durables market in 2024 was anything but static. Retail market share shifted, pricing…

Home Improvement Market: 2024 Mid-Year Review

OpenBrand conducted a data analysis of the 2024 Home Improvement market, highlighting insights…

The Power Tools Market is Changing: Here’s How

OpenBrand answers the who, what, when, why, and how of Power Tool market share — delivering…