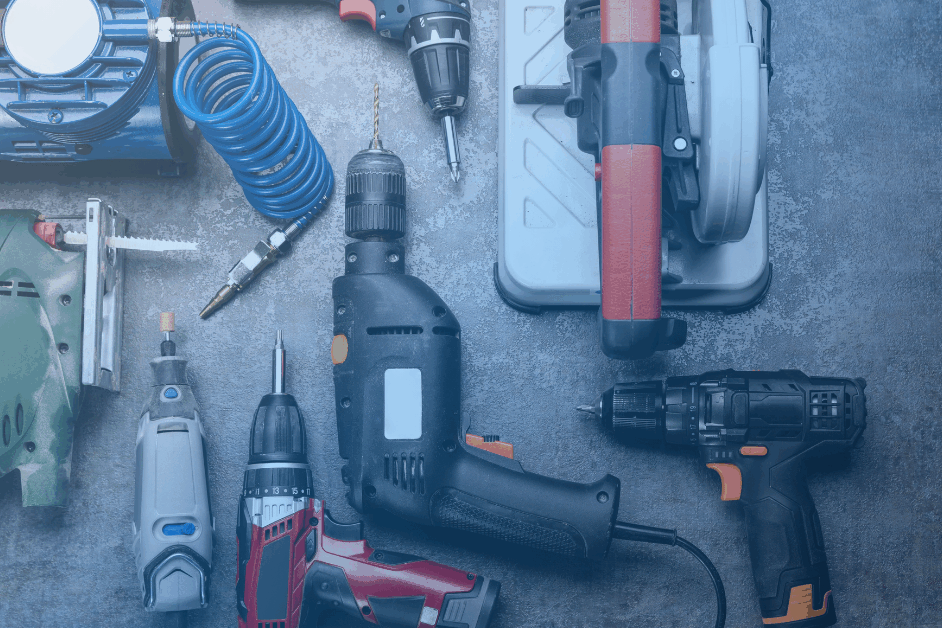

Every day, new stories emerge that claim Amazon is taking over the retail world. Amazon and its online competitors take a bigger slice of the retail pie each year. But some industries appear to resist the march to online sales more than others. Power tools continue to maintain the majority of their sales through traditional home improvement locations. This trend occurs even with a stratified market for brands and holds steady across the generational lines that often indicate future growth for Amazon and other online-only retailers.

What the best merchandisers provide — and what Amazon lacks–is the tactile experience that tools on display provide. Home improvement stores offer all the top brands across multiple price points and lay them out in a way that allows customers to both visualize and feel how they fit into home improvement projects. The line will not hold forever, but traditional venues and marketing remain the focus of the immediate future for power tools.

Power Tools Sales and Store Loyalty

For many kinds of products, loyalty creates barriers to entry for new brands but provides little impediment to online delivery channels. For power tools, though, brand loyalty lies not at the product level, but rather at the store level. Home improvement chains have used retailing experience and prowess to build and expand their customer bases, regardless of the type or brand of tool those customers seek to buy.

Based on TraQline’s research, three traditional home improvement stores dominate the landscape for sales of power tools: Home Depot, Lowe’s, and Sears. The three combine for over 57% of sales for both Millennials and Generation X, and over 53% among Baby Boomers. Amazon sales, in contrast, hover at between 7% and 8% for all three groups. In a world where Amazon has pushed further into almost every product group for increased sales, it continues to lag in the power tools arena.

Hands-On Experience Matters

In analyzing these pieces of data, one immediate aspect that jumps out is the importance of a hands-on retail experience. Online shopping works well for many kinds of products, and that list continues to expand every year. But power tools represent hard, manual labor, and the ability to work with one’s hands. Whether this means drilling, sawing, or any other workbench or garage kind of task, seeing and feeling the product before buying continues to matter.

The products lend themselves to a shopping experience that is as much tactile as it is visual. Generations both young and old purchase their power tools in brick and mortar stores more frequently than online.

Further, outlets such as Home Depot and Lowe’s offer a clear advantage over their competitors by providing a one-stop shopping experience for home improvement. A consumer can go to either of these stores and find all the tools required for a job, as well as other equipment and supplies, organized and displayed to provide what consumers need. With an array of brands to fit every budget on hand, the store retailing experience reduces the need to comparison shop on that front after the ideas take hold.

Looking Beyond Brand Loyalty

Indeed, one of the interesting aspects the TraQline research notes is the limited extent to which brand loyalty for individual tools seems to matter. DeWalt tools enjoy significant market share, but not so much that the many other available brands fall by the wayside. Retailers can focus on placing products in the best environments to succeed, with an interactive display to allow a hands-on experience.

Online availability will still matter. When over 7% of power tool purchases come from Amazon, the outlet should receive some attention. But home improvement stores dominate well beyond the extent to which the power tools’ brand names inspire loyalty. The ability to create a one-stop shopping environment seems much more efficient for power tools than for other categories of product. Stores simply provide ideas and options in a format that lets consumers get a real feel for solutions to home improvement problems they face.

Delivering on What Today’s Customers Want

Even with the strength of in-person, hands-on marketing, stores are finding ways to incorporate technology into their retailing. Unlike marketing for other products, power tools lend themselves to a less high-tech, more traditional kind of in-store marketing. The knee-jerk reaction to this may be that staying current courses should be the order of the day. Focus on the right brand, form factor, and product mix, build in-store displays and let the people come, so long as those products sell in big home improvement stores.

This is an oversimplification though. Other factors, such as how different generations shop for products, should be taken into consideration. Millennials have different expectations for shopping experiences than older generations. Rather than a simple display, a recent Forbes article notes that they look for personalization and a customer-centric experience when they shop. For the leading home improvement retailers, delivering on this expectation fits well with how they already do business. They give their customers the ability to see and feel many of the tools they are purchasing, efficiently providing a one-on-one experience with the products.

Further, the displays aren’t where the shopping experience ends. For example, Business Insider highlights how Home Depot has focused on developing its mobile app to enhance its in-store shopping experience. Rather than merely turn customers loose to wander in the giant warehouse-style store, Home Depot uses technology to make the shopping process more straightforward and help customers access additional ideas while shopping in a tactile-focused environment.

Driving Sales into the Future

The future of power tools sales should continue to focus on putting them in the right retail environments to succeed. The lack of generational differences in purchasing behavior points to stability in what customers want and expect. A hands-on shopping experience tweaked to maximize a customer focus through a combination of technology, and project-based display should deliver the most significant impact on retail power tool sales.

Related blogs

Prime Day 2025 for Durables: Shopper Intent, Promotions & Where to Focus

Prime Day 2025 broke the mold. For the first time, Prime Day ran four full days, spanning July 8–11, twice the usual length, and emerged as Amazon’s…

Related blogs

Pros & Cons of Consumer Data Collection Types

Consumer data is a critical tool for understanding your market and improving your business…

Home Depot Market Share Breakdown: Q3 2025 Earnings Call Analysis

Inside the Home Depot Q3 2025 Earnings Call Home Depot’s Q3 2025 earnings call confirmed solid…

The Power Tools Market is Changing: Here’s How | Q2 2025 Share & Rankings

The Power Tools market is moving faster than ever, shaping how consumers shop, which brands command…

Lowe’s Earnings: Market Share Breakdown | Q2 2025

Q2 2025 EARNINGS UPDATED 08/27/2025 Inside the Q2 2025 Lowe’s Earnings Call Lowe’s earnings for Q2…