The State of Consumer Durables: Lessons from 2025 and What’s Ahead

Insights from OpenBrand’s January 2026 webinar

As we enter the new year, OpenBrand is reflecting on 2025 and unpacking which consumer durables trends may stick around this year versus those that were just buzz.

During our January webinar, OpenBrand CEO Greg Munves and Chief Economist Ralph McLaughlin analyzed last year’s macroeconomic conditions, durables market performance, and the ways in which consumer sentiment doesn’t always reflect behavior. They also shared OpenBrand’s forecasts for pricing, retail sales, housing, and more in the months ahead.

Watch the webinar in full above, or read on for a recap of what last year taught us about the state of consumer durables and what’s ahead in 2026.

Macroeconomic Conditions in 2025: Tariffs, GDP, and Inflation

New tariffs implemented by President Donald Trump in early 2025 dominated news headlines and drove uncertainty and fear for economists and retailers alike. Some forecasters expected a near-term recession as well as runaway inflation.

The good news is that the catastrophic predictions largely didn’t materialize. The United States didn’t fall into a recession, and instead experienced only a minor slowdown in GDP growth. Meanwhile, inflation didn’t reaccelerate to concerning levels, and the Fed delivered three rate cuts.

In April of last year, we predicted slower economic growth, though not a contraction, and a modest increase in inflation. We also expected consumers to make some spending adjustments but not make drastic changes to their behavior. Those outcomes proved to be in line with what the data from 2025 now reflects, particularly when it comes to consumer behavior.

Consumer Emotions Don’t Always Match Spending Patterns

The way consumers say they feel about economic conditions often doesn’t line up with how they behave in practice, particularly when there’s a change in political leadership or economic policy.

That dynamic unfolded last year, when consumer sentiment surveys dropped to some of their lowest readings on record following President Trump’s inauguration and the implementation of new global tariffs. Despite the negative outlook, there wasn’t an associated drop in retail sales.

OpenBrand’s MindShare consumer survey, which accounts for both sentiment and behavior, shows that tariffs were only a modest purchase filter in 2025. As the year progressed, more consumers delayed purchases due to higher prices but it was modest and gradual. In March 2025 over half of consumers said that tariffs didn’t impact their purchase decisions; that figure fell by only five percentage points by November.

The modest price pressure that resulted from tariffs ultimately shifted value within categories, not demand out of them. That’s because when tariffs matter to consumers, they are more likely to trade down on quality and not exit the market entirely. In 2025, 62% of the consumers who delayed purchases traded down. This helps explain why demand remained intact but why brands felt pressure on mix, margin, and price realization.

U.S. Tariffs and Housing Drove Durables Spending Patterns Last Year

Two major factors impacted the market for durable goods and home improvement in 2025: tariffs and the housing market.

While prices for appliances picked up mid-year, they’ve since been on a downward trajectory. That suggests that tariffs caused turbulence in the immediate term but that prices likely won’t remain elevated. One reason is that major appliance brands like Whirlpool manufacture a majority of products in the US, making them immune to duties. Additionally, tariffs on foreign-made appliances are charged on the wholesale price. Unless the margins for a particular product are razor-thin, the percentage increase for the consumer ends up being smaller than expected.

Meanwhile, the housing market experienced its slowest period since the Great Recession, with buyers holding back on both new and existing homes. As a result, consumers became more selective, gravitating toward lowest-priced options that met their immediate needs or premium products that clearly justified the cost, while largely ignoring mid-range choices—a trend known as “value discipline.” This same behavior showed up in DIY projects, where customers chose the cheapest options for smaller jobs but were willing to pay more for products that were critical to performance.

Looking Ahead: Macroeconomic Stabilization and Housing Market Rebound

With short-term tariff volatility and economic policy uncertainty seemingly behind us, we expect 2026 to be a year of stabilization, particularly for the durables market.

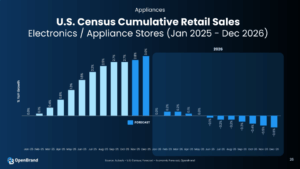

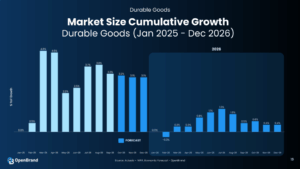

Much of the modest growth in market size that we expect this year will come from incremental price increases resulting from Fed rate cuts. We forecast durables market size growth to peak in July, around the time of the largest price increase, and then decelerate for the remainder of the year.

Recent rate cuts by the Federal Reserve are expected to bring mortgage rates down and stimulate the housing market, while a steady labor market will help support a resilient consumer. Both of those dynamics are important for durable goods like appliances and electronics, which depend on demand for new and existing homes, as well as healthy shopping patterns. The state of the durables market, in other words, appears durable for the foreseeable future.

We anticipate that existing home sales will rebound in the second quarter, fueling demand for appliances and items like tile, roofing, and paint for DIY projects. Sales of new homes will pick up in the fourth quarter, after owners of existing homes sell and look to upgrade. That will then drive demand for more premium, professional tools and appliances that are associated with construction and trading-up.

Key Takeaways: What The Data Says About The Year Ahead

We expect a more constructive outlook for consumer durables in 2026, with stabilization replacing volatility and demand coming largely from a healthier housing market.

- The tariff shock is fading, and conditions are stabilizing. After a period of disruption, consumer durables categories are adjusting to the post-tariff cost environment.

- The housing market rebound will be a critical demand catalyst. As home sales and construction activity recover, demand for big-ticket durables—appliances, furniture, and home-related goods—is poised to accelerate.

- Sentiment can be misleading. Consumer confidence surveys often reflect economic anxiety, but spending behavior tells a different story. Income growth, employment levels, and balance sheets are more closely correlated with durables demand than headline sentiment measures.

- Focus on fundamentals, not headlines. As 2026 approaches, the outlook for consumer durables is increasingly driven by tangible indicators—housing turnover, replacement cycles, and employment—rather than short-term noise. For industry leaders and investors alike, the data points to cautious optimism, not retrenchment.

About OpenBrand’s CPI: OpenBrand delivers a Durables-grade Consumer Price Index that provides a more nuanced look at price inflation specific to the market.

About OpenBrand’s Economic Forecasting: From scenario-based forecasting products to custom projections, out economic forecasts equip retail companies with the ability to know and respond to what’s happening before it happens.

Contact Us

Contact us to see how OpenBrand can help you make stronger business decisions around inflation, retail sales, and other macroeconomic factors.

Announcing Market Pricing Forecast Products, Delivering Unmatched Accuracy in Inflation Prediction

March 19, 2025 – [San Diego, California] – OpenBrand, a leader in real-time market intelligence data, announces the launch of two groundbreaking Market Pricing Forecast products, designed to provide unparalleled accuracy in predicting price movements for consumer durables and personal goods. The new products feature a Monthly CPI Forecast and Weekly CPI Index, enabling businesses, retailers, financial analysts, and manufacturers to navigate and react confidently to inflationary trends.

With inflation playing a critical role in financial and strategic decision-making, OpenBrand’s new offering delivers timely, data-driven insights. The OpenBrand Monthly CPI Forecast anticipates the U.S. Bureau of Labor Statistics (BLS) Consumer Price Index (CPI) for durables and personal goods, while the Weekly CPI Index offers near real-time updates, tracking over 200,000 individual products—more than double the BLS sample size.

“At OpenBrand, we are committed to transforming how businesses understand and act on market inflections. Our Market Pricing Forecast products provide brands, retailers, and financial analysts with real-time, predictive insights that traditional inflation measures simply can’t match. Whether you’re setting pricing strategies, optimizing revenue forecasts, or trying to gain an edge on the market, this product ensures you stay ahead of the competition.” said Greg Munves, Chief Executive Officer at OpenBrand.

Unlike traditional economic indicators that rely on lagging data, OpenBrand’s proprietary approach harnesses real-time pricing, promotions, and marketplace shifts to produce highly responsive and actionable forecasts.

Industry-Leading Accuracy and Methodology

What sets OpenBrand apart is the depth, granularity, and immediacy of its data. OpenBrand doesn’t just track an extensive range of consumer goods; it continuously aggregates real-time pricing, promotions, and product availability across major retailers and regional markets. This allows for a faster and more precise understanding of inflation trends than traditional methods that often rely on static or delayed data points.

The Monthly CPI Forecast boasts a mean absolute percentage error (MAPE) of just 2.4% for CPI-Durables and 4.0% for CPI-Personal Goods, while the Weekly CPI Index demonstrates strong alignment with BLS-reported trends, providing a forward-looking edge to decision-makers. See the full summary and proofing statistics below.

“Our clients need more than just historical inflation data—they need a predictive and actionable view of market trends,” said Ralph McLaughlin, Chief Economist at OpenBrand. “By combining AI-driven analytics with our vast pricing dataset, we provide an unprecedented level of precision and insight into inflation forecasting.”

A Tool for Financial Planning, Revenue Forecasting, and Market Strategy

The OpenBrand Market Pricing Forecast products are designed to serve a broad range of stakeholders:

- Financial analysts & investors: Gain a competitive edge in inflation-sensitive investment strategies.

- Retailers & manufacturers: Optimize pricing, revenue planning, and promotional strategies with real-time market intelligence.

- Brands & businesses: Improve demand forecasting and profitability through enhanced market visibility.

Available Now

The OpenBrand Monthly CPI Forecast and Weekly CPI Index are now subscription-based, with forecasts updated regularly to reflect evolving market conditions. These forecasts are in addition to OpenBrand’s publicly available CPI-Durable and Personal Goods Index, released ahead of the monthly BLS CPI report.

For more information, visit openbrand.com or contact press@openbrand.com.

Proofing of the OpenBrand BLS Monthly Consumer Price Index Forecast and the OpenBrand Weekly Consumer Price Index

OpenBrand Monthly CPI Forecast and Weekly CPI Boasts Single-Digit Error Rates

In an economic landscape where inflation monitoring and forecasting shape financial strategies and policymaking, the accuracy of current and predictive metrics is crucial for helping stakeholders make wise investment and policy decisions.

OpenBrand’s weekly CPI and monthly forecast of the BLS’s CPI – Durables and CPI-Personal Goods, both launched this month, aims to provide two unique – but timely and accurate – metrics for both weekly monitoring and monthly forecasting of price movements in consumer durable and personal goods. These forecasts are available on a subscription basis and are revised monthly, and are in addition to the publicly available OpenBrand CPI-DPG released the day prior to the monthly BLS CPI release each month. But how well do these new metrics perform in monitoring and forecasting price movements? In each case, the error rates are, on average, in the low-mid single digits. See below for more details.

Methodology and Data Sources

Monthly Forecast

OpenBrand’s monthly forecast of the BLS’s CPI-Durables and CPI-Personal Goods – along with forecasts of the group breakouts – employs the most contemporary machine learning forecasting techniques combined with both publicly available and proprietary macroeconomic and marketplace inputs. The forecast is revised on a monthly basis, reflecting evolving market conditions.

The OpenBrand BLS CPI forecast is an apples-to-apples forecast of the BLS’s CPI-Durables and CPI-Personal Goods, as it uses past observations of the BLS CPI-Durables and CPI-Personal Good to predict future values of the same metrics. As such, it more closely tracks movements in the BLS CPI-Durables and CPI-Personal Goods than the OpenBrand monthly and weekly CPI.

Weekly CPI

OpenBrand’s weekly CPI is built on OpenBrand’s vast and growing dataset of real-time pricing and promotion data, tracking over 200,000 individual products—more than double the number covered by the Bureau of Labor Statistics (BLS). The weekly CPI leverages OpenBrand’s AI-powered analytics and real-time data collection from major retailers and regional markets to provide precise and up-to-date pricing insights in the marketplace.

The calculation of the metric is identical to the OpenBrand monthly CPI-DPG except that it is aggregated to weeks instead of months. Though the basket of goods included in the monthly and weekly OpenBrand CPI-DPG and weighting is purposely different from the equivalent BLS measures, as we demonstrate below the two metrics do trend closely over time. More details on the calculation of the OpenBrand CPI and rationale for deviations from the BLS methodology can be found here.

Forecast Performance: A Look at Recent Data

To proof both the OpenBrand forecast of the monthly BLS CPI-Durables and CPI-Personal Goods, as well as the weekly OpenBrand CPI-DPG, we present the mean absolute percentage error (MAPE) for each metric relative to the monthly BLS CPI-Durables and CPI-Personal Goods. The MAPE is the average percent deviation between two indicators on an absolute basis, and a MAPE value closer to zero is more accurate than a number further away from zero. In other words, the lower the MAPE the better the accuracy of a metric.

The MAPE for the OpenBrand forecast of the monthly BLS CPI-Durables is 2.4% and for the CPI-Personal Goods is 4.0% for blind monthly forecasts across each month of 2024. To generate the OpenBrand forecast MAPE, we generated monthly forecasts of the BLS CPI-Durables (and sub-groups) and BLS CPI-Personal Goods for each month in 2024 using input that only would have been available in 2023. We then calculated the MAPE across all months in 2024 using the actual reported number for each month. Our MAPE gets even lower when looking at specific groups that comprise the BLS CPI-Durables. For example, the MAPE for CPI-Appliances is 2.7%, 1.5% for CPI-Communication, 1.2% for CPI-Home Improvement (Tools), and 1.8% for CPI-Recreation.

The long-run MAPE for the OpenBrand weekly CPI-DPG and the monthly BLS CPI-Durables is 3.8% and BLS CPI-Personal Goods is 1.5%. To generate the OpenBrand weekly CPI-DPG MAPE, we compare the long-run monthly deviation between the OpenBrand CPI-DPG and BLS CPI-Durables and BLS CPI-Personal Goods.

Since the OpenBrand CPI-DPG is created using our own pricing data that is independent of, and prior to, the release of the BLS measures, each monthly release can be considered a “blind” calculation. Our weekly CPI-DPG MAPE does vary when looking at specific groups that comprise the BLS CPI-Durables. For example, the MAPE for CPI-Appliances is 6.3%, 2.5% for CPI-Communication, 5.8% for CPI-Home Improvement (Tools), and 16.8% for CPI-Recreation. While these MAPEs are higher than the MAPEs of our monthly forecast, as mentioned above this is to be expected since the basket of goods in each weekly group – as well as the methodological approach to calculating the CPI – is purposely different from the BLS.

Use Cases

While at face value it may seem redundant to produce both a weekly (and monthly) OpenBrand CPI and a monthly BLS CPI forecast, in practice the individual metrics represent two different types of indicators designed for specific use cases.

The monthly OpenBrand forecast of the BLS CPI discussed above is provided as a gauge of both medium and long-run price trajectories based on current and anticipated macroeconomic and marketplace conditions. As such, it is useful for tasks such as financial planning, revenue forecasts, futures trading, policymaking, and long-run estimates of inflation.

On the other hand, the weekly (and monthly) OpenBrand CPI-DPG provides short-term insights into price trends across and within major consumer product categories using a select mix of OpenBrand price observations of both durable and personal goods.

The data used in the OpenBrand monthly CPI-DPG leverages OpenBrand’s industry-leading library of durable and personal goods pricing, promotion, and availability for over 200,000+ individual products. This short-term and granular focus is useful for tasks such as price setting, policy evaluation (for example, tariff implementation), discount/promotional strategy.

DISCLAIMER: This report is provided 'as is' for informational purposes only. OpenBrand makes no representations or warranties regarding the accuracy, completeness, or reliability of the data. Users assume all risks associated with their use of this report. OpenBrand shall not be liable for any losses or damages arising from the use of this report

OpenBrand Expands Market Measurement to New Categories

Plus additional retailer coverage

We are excited to announce the expansion of our Market Measurement solution, which brings our modeled market share data (MarketShare) to products within new categories: Outdoor Cooking, Hand Tools, and Small Appliances. (See all available products)

Through the addition of MarketShare data, brands and retailers within these industries can now take advantage of OpenBrand’s full Market Measurement offering — which delivers the critical combination of market share and consumer insights for more in-depth and actionable market understanding.

Market Measurement is also available for Major Appliances, Outdoor Power Equipment, and Power Tools. The full list of currently available Market Measurement products by category can be found below.

OpenBrand is continuously improving our Market Measurement solution, with new category rollouts for MarketShare a key priority. Subscribe to our product updates for email notifications when new data is available.

OpenBrand Insights Accelerator Program

Join our exclusive Insights Accelerator Program for early access to pre-release market share insights. You’ll be able to help influence data models, spot emerging trends, and shape industry benchmarks for a competitive edge.

Secure your spot and apply now to join the Insights Accelerator Program.

Additional Retailer Coverage: Amazon, Costco, Walmart

As another part of our continuous improvement efforts, MarketShare insights are now available for more retailers. Across relevant categories, users will now see data for Amazon, Costco, and Walmart.

Increasing our retailer coverage is a key priority as we strive to give clients the most comprehensive view of their market. These new retailers are live now, with regional retailer expansion coming in Q2.

What This Expansion Delivers

With this release, customers within these four new categories will now be able to know where they are winning or losing the market (MarketShare) and why consumers are purchasing (MindShare).

MarketShare eliminates traditional market share data limitations by using multiple data inputs and a proprietary dynamic data model that accounts for disparate sample sizes — delivering a holistic and reliable view of market share.

Powered by this mosaic of data sources, MarketShare gives our clients access to the most accurate market share data available so they can understand who is winning, the factors impacting share shifts, and opportunities to get ahead.

Specifically, with access to MarketShare data, they can:

- Know who leads the market — and why — with unit and dollar share leaderboards

- Monitor market share gains and losses with the ability to drill down into specific brands and/or retailers

- Discover which models are driving share for brands and retailers with SKU ranking data and ability to look at share by configuration (e.g. battery-powered leaf blowers)

- Uncover competitive assortment and pricing strategies with the ability to see how these areas impact share

- Stay ahead of trends and changes in product lines, market movement, and brand performance with period comparison metrics

See the Market Measurement Data for Your Business

OpenBrand is dedicated to delivering critical and reliable market insights across the consumer durables categories — furthering our concentrated focus on leading innovation within the durables market.

To see our market share and consumer insights data in action, request a demo now and we will walk you through a personalized tour of our platform, illustrating how our data will help you win more business.

Available MarketShare Categories

UPDATED OCTOBER 2025

CONSUMER ELECTRONICS

Desktops

Notebooks

Monitors

Smart Thermostats

Tablets & Detachables

TVs

Wearables

Wireless Routers

HAND TOOLS

Cutting Tools

Hammers

Measurement Tools

HARDWARE

Door Locks

HVAC

Air Conditioners

LAWN CARE

Lawn Fertilizer

Weed Killer

MAJOR APPLIANCES

Cooktops

Dishwashers

Freezers

Laundry

Ranges

Refrigerators

Wall Ovens

OUTDOOR POWER

Chain Saws

Edgers

Generators

Hedge Trimmers

Leaf Blowers

Line Trimmers

Log Splitters

Pressure Washers

Riding Mowers

Robotic Mowers

Snow Removal

Walk-Behind Mowers

ZTR Mowers

OUTDOOR COOKING

BBQ Grills

Griddles

Kamado Grills

Pellet Grills

Pizza Oven

Smokers

POWER TOOLS

Air Compressors

Circular Saws & Blades

Jig/Sabre Saws

Power Drills

Reciprocating Saws

Rotary Tools

Wet-Dry Vacs

SMALL APPLIANCES

Air Fryers

Air Purifiers

Blenders

Countertop Microwaves

Electric Grills

OTR Microwaves

Slow Cookers

Toaster Ovens

Vacuums

Coming Soon

APPLIANCES: Air Conditioners, Compact Refrigerators, Dehumidifiers, Toasters

CONSUMER ELECTRONICS: Headphones, Printers, Projectors, Smart Home, Smartphones, Soundbars, VAW Speakers

HAND TOOLS: Pliers, Rachets/Sockets/Torque Wrenches, Screwdrivers, Staple Guns, Stud Finders, Tool Sets, Wrenches

LAWN & GARDEN: Grass Seed, Pesticides

PAINT: Interior Paint, Exterior Paint, Interior Stains, Exterior Stains, Spray Paint, Supplies, Tools

PERSONAL CARE: Diabetes Care, Eye Care, Pain Relief, Vitamins & Supplements

OpenBrand Launches Consumer Price Index for Durable and Personal Goods

Appoints Ralph McLaughlin as Chief Economist

February 12, 2025 — OpenBrand, a leader in real-time market intelligence data, proudly announces the launch of the OpenBrand Consumer Price Index (CPI) – Durable and Personal Goods. This monthly report provides unparalleled insights into pricing trends across major consumer product categories, offering businesses, policymakers, and other market participants timely, granular data to make informed decisions in a rapidly evolving market.

OpenBrand’s CPI covers a growing list of over 200,000 individual products, more than double the scope of the Bureau of Labor Statistics’ CPI, delivering a deeper and more comprehensive view of pricing shifts across appliances, communication devices, home improvement products, personal care items, and recreational goods. The inaugural report reveals a 0.6% increase in prices for January 2025, reflecting inflationary pressures ahead of anticipated tariffs on imports from Canada, China, and Mexico.

“With the launch of our CPI, OpenBrand is setting a new standard for retail intelligence,” said Ralph McLaughlin, OpenBrand’s newly appointed Chief Economist. “Our ability to provide the largest and most real-time, SKU-level pricing data for consumer durables and personal care products empowers businesses to respond swiftly to market changes, giving them a competitive edge in understanding and navigating pricing dynamics.”

“OpenBrand brings unique data to the market,” added Greg Munves, CEO of OpenBrand. “Unlike traditional pricing indices, our data leverages the most accurate, robust, and dependable large-scale pricing dataset across the broadest set of consumer durables and personal care products, dives deeper into sub-category and SKU-level insights, offering unparalleled granularity. This rich dataset empowers retailers and manufacturers to anticipate shifts and optimize their strategies with a level of precision previously unavailable in the market. We are excited to bring additional insights to market participants with our own consumer price indices."

Introducing Ralph McLaughlin, Chief Economist

OpenBrand is excited to welcome Ralph McLaughlin as Chief Economist, bringing a wealth of experience in economic analysis and data science. His distinguished career has encompassed industrial economics, applied econometrics, economic geography, and housing market economics, establishing him as a leading voice in market pricing, analytics, and forecasting.

Before joining OpenBrand, Ralph served as Chief Economist at Trulia and Haus, Deputy Chief Economist at CoreLogic, and Senior Economist at Realtor.com. Ralph held academic appointments at USC, San Jose State University, and the University of South Australia. He earned a PhD in planning, policy, and design from UC Irvine and a BA in geography and regional development from the University of Arizona. Ralph is also an FAA-certified commercial pilot and instructor.

About the OpenBrand CPI

The OpenBrand Consumer Price Index (CPI) – Durable and Personal Goods is a free monthly report offering detailed analysis of price movements, promotional trends, and macroeconomic factors impacting key product categories. To stay ahead of market shifts, OpenBrand will soon introduce more targeted indexes focused on specific industries and product segments, providing even greater granularity and actionable insights. Subscribers can access these targeted indexes with weekly updates and same-day, SKU-level pricing data, enabling businesses to get ahead of the curve and respond proactively to emerging trends.

For more information and to access the full report visit the OpenBrand CPI - January 2025 page.

Media Contact:

Sidney Waterfall, VP of Marketing, OpenBrand

press@openbrand.com

sidney@openbrand.com

About OpenBrand

OpenBrand is the leading real-time market intelligence platform for the consumer durables market. Its unique optical web collection and AI-based processing technology enable the creation and delivery of the most accurate, dependable, and timely competitive intelligence and market measurement data. Brands and retailers leverage the data and analytics to understand why they are winning or losing so they can make the strategic adjustments they need to succeed.

Consumer Durables Industry: 2024 Year in Review

The consumer durables market in 2024 was anything but static. Retail market share shifted, pricing strategies evolved, online sales evolved, and consumer behaviors changed in ways that will continue to shape the competitive landscape in 2025.

For brands and retailers looking to get ahead, understanding what changed — and why — is the key to making more strategic and impactful business decisions.

Our 2024 Year in Review report provides a data-packed overview of the state of the consumer durables industry in 2024. Check out 10 key takeaways below or download the full report now!

Delivering 30 pages of insights, the report highlights:

- Market Leaders: Who dominated in 2024 across top categories

- E-commerce vs. In-Store: 5-year sales trends & market shifts

- Pricing & Promotions: How brands adjusted strategy to influence demand

- Retailer Spotlight: Amazon: Competitive placements & sales trends

- Category Deep Dive: Major Appliances: Brand leaders, top SKUs & promo data

- Consumer Behavior: What influenced buying decisions this year

The report captures insights across multiple product categories as well as the industry overall, offering a clear view of the areas that defined the year.

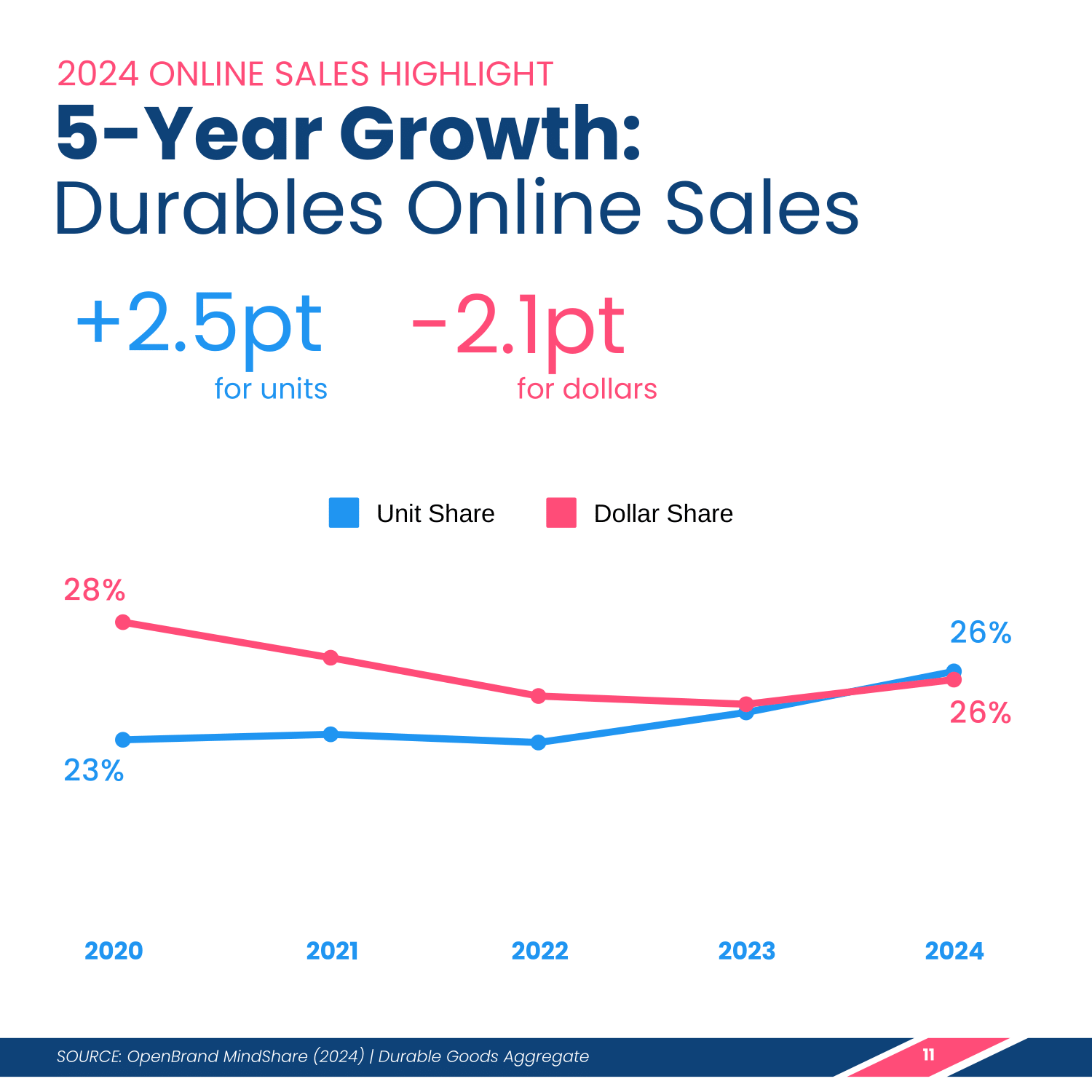

10 Key Consumer Durables Industry Insights

Delivering a glimpse into our 2024 report, here are 10 highlights from the report. Make sure to download the full report to access all the data.

1. Home Depot and Amazon both took the top spot as leading outlet across three different categories.

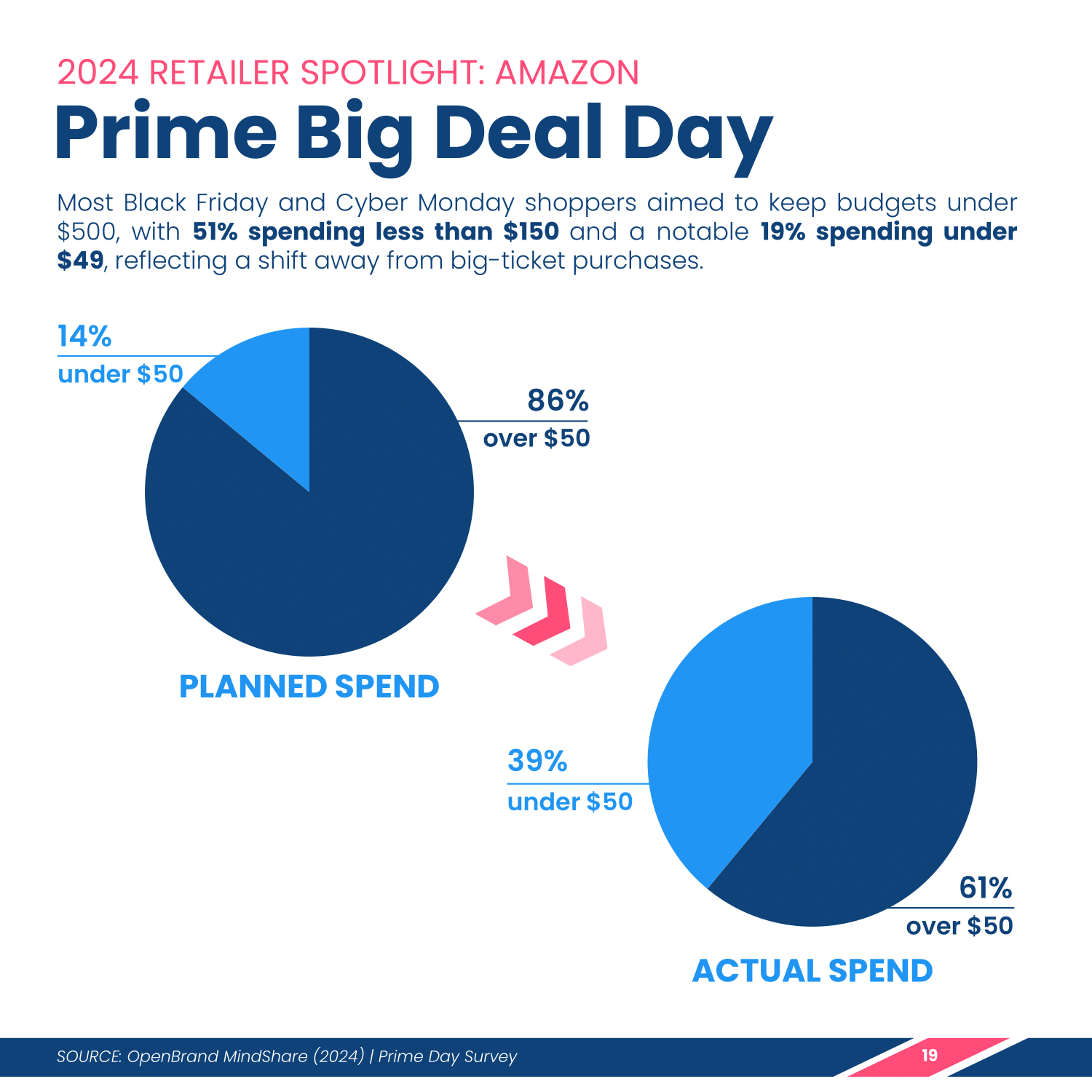

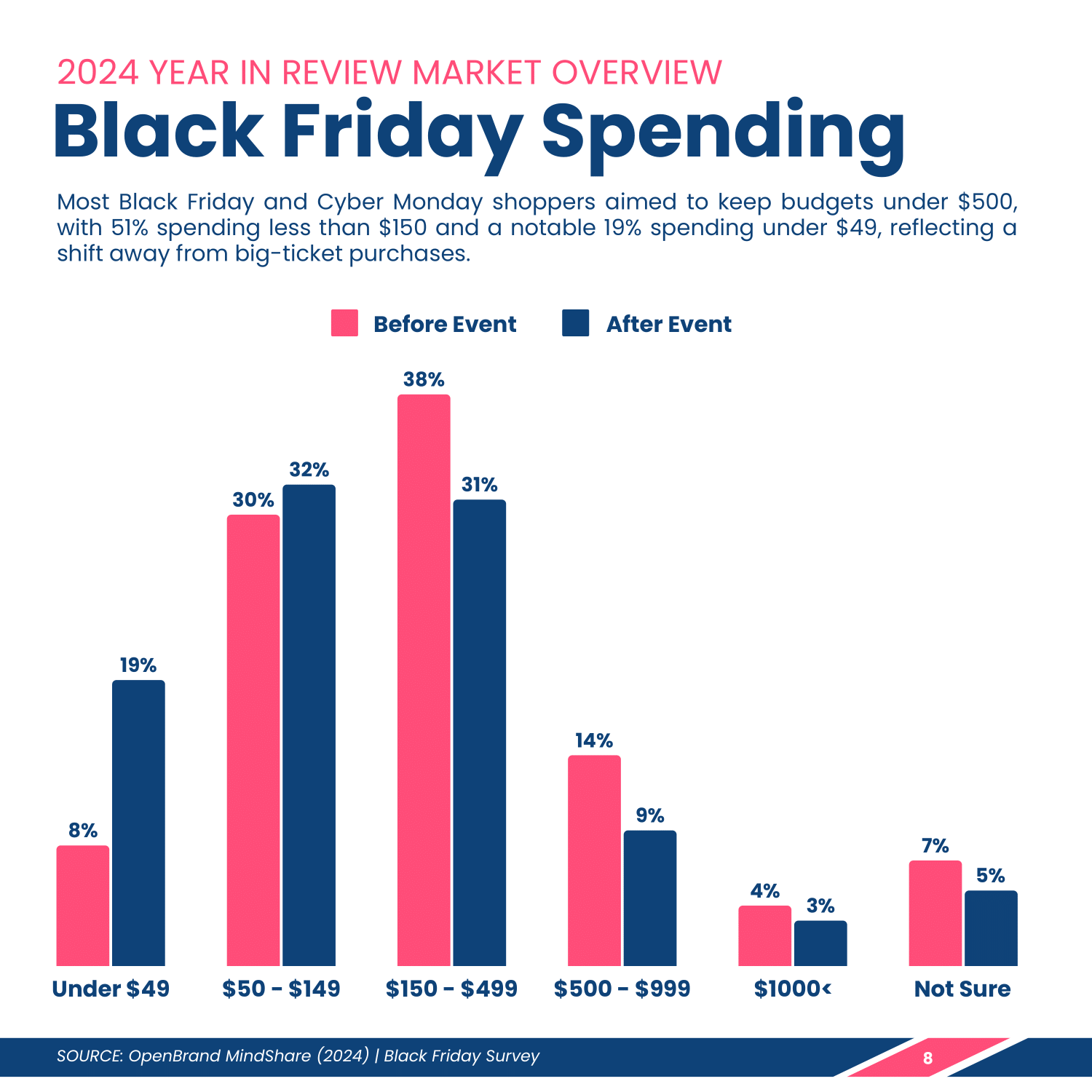

2. Consumers planned to spend more on Black Friday sales than what they ultimately spent, with home goods as the leading consumer durable category purchased.

3. Over the past 5 years, sales in consumer durables continue to see an increase in the number of units purchased online but a decrease in dollars spent, which is reflected in the year-over-year decrease in average price paid.

4. Fitness equipment has the highest percentage of online sales versus in-store — and is also the top consumer durables category purchased on Amazon.

5. Amazon is growing year-over-year, climbing 4 percentage points since 2020 in consumer durables sales.

6. Amazon’s net prices in the small appliance category are historically lower than other retailers, with an average of $52 less than other retailers. This is driven by strong discounts for the category, as seen during Prime Day events.

7. While the majority of consumer durables are still purchased by Millennials, Gen X, and Baby Boomers, purchases by Gen Z are on the rise.

8. While most rewards programs remained flat year-over-year, MyLowe’s Rewards ramped up in 2024.

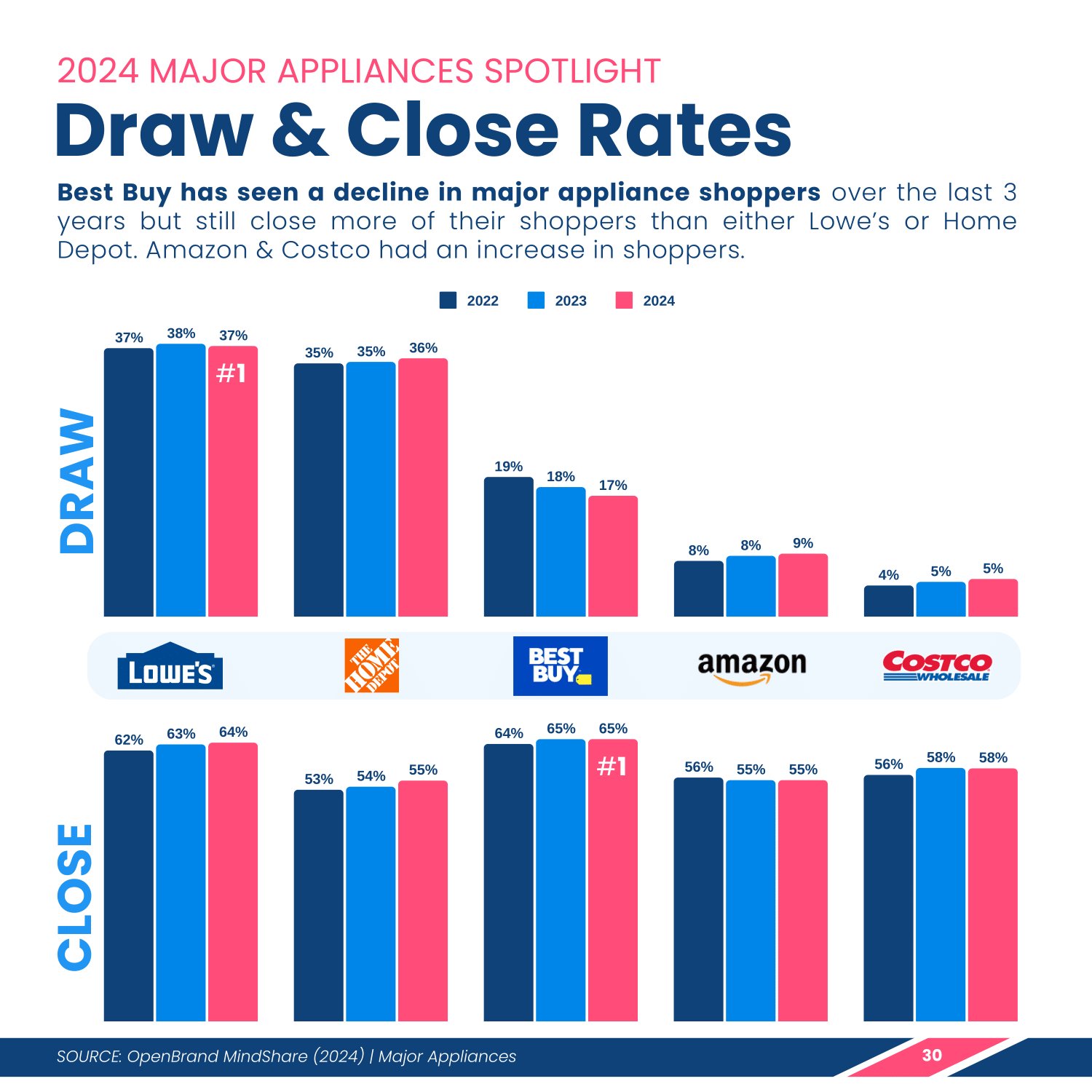

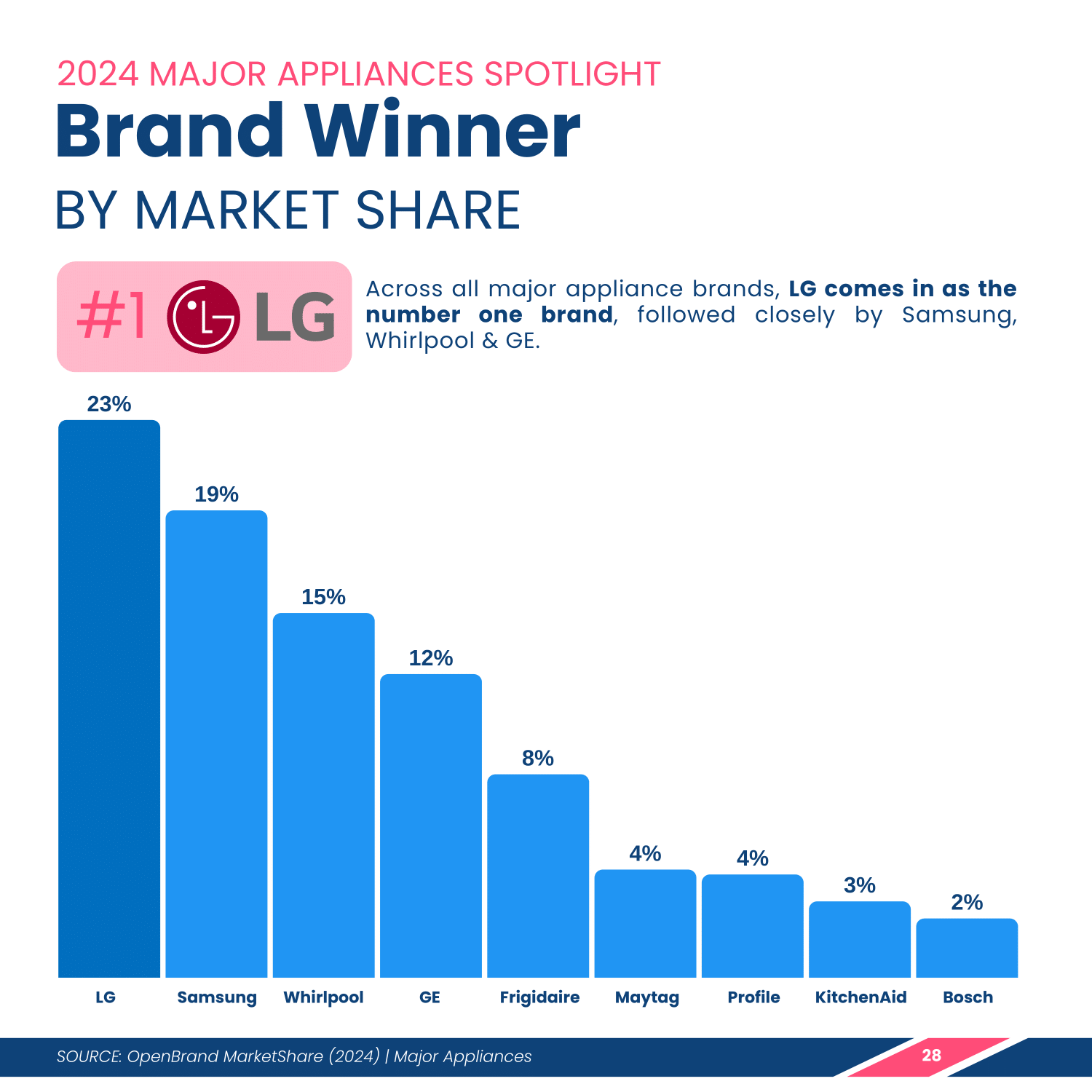

9. LG and Lowe’s won as top brand and retailer for major appliances, bringing in the most consumer dollars in 2024. Out of all the top retailers, Lowe’s draws in the most major appliance consumers — however, despite a decline in draw, Best Buy closes the most shoppers.

10. Ranges represent the majority of online major appliance placements at 44% share, with Home Depot outlet leading in placement count at 1855.

Download the Full Report

Monitor Your Market With OpenBrand

OpenBrand offers market measurement and competitive intelligence intelligence solutions that give consumer durables brands and retailers the data they need to fill in gaps in their market understanding, build stronger business strategy, and win share. These data solutions deliver everything from where competitors are gaining market share, to product line opportunities, consumer purchase behaviors, and so much more.

To see the data available for your brand, contact us today.

Advancing Market Intelligence: Announcing Our Collaboration With NIQ

NIQ and OpenBrand Announce Strategic Collaboration to Revolutionize Market Intelligence for Global Consumer Electronics Industry

New product suite is positioned to redefine market intelligence, integrating AI-driven analytics with robust multi-sourced datasets such as POS and consumer panel data

CHICAGO (January 7, 2025) [BusinessWire] – NielsenIQ (NIQ), a global leader in consumer intelligence, and OpenBrand, an innovator in AI-powered market measurement and competitive intelligence, are joining forces to revolutionize market intelligence solutions. By combining their unparalleled data, cutting-edge technology, and deep expertise, the two companies will deliver AI-powered tools that address the most pressing challenges faced by retailers, manufacturers, and institutional investors across 50+ countries.

The co-developed product suite will provide clients with actionable intelligence that bridges critical gaps in market understanding. Leveraging AI-driven analytics, robust, multisource datasets, and a variety of calibration sources, these solutions will give the most accurate view of omnichannel market performance available across Tech & Durable categories, while addressing longstanding industry challenges.

Key benefits of the new products will include:

- Eliminating Black Holes: Resolves critical issues such as masking, sample bias, timeliness, and disconnected data for clearer and more accurate insights.

- Integrated Insights: Combines AI with diverse datasets to deliver a complete market view and advanced, data-driven decision-making tools.

- Designed Collaboratively: Co-developed with retailers, manufacturers, and trade associations to ensure the solutions are practical, actionable, and tailored to real-world needs.

- Making a Global Impact: Designed for scalability, these solutions will be deployed in 50+ countries, driving meaningful change across diverse markets worldwide.

“POS data has long been a cornerstone of market intelligence, providing essential insights into consumer behavior,” said Elizabeth Buchanan, President of NIQ North America. “By collaborating with OpenBrand, we’re building on this foundation, leveraging our combined data assets with advanced AI-driven solutions to address common challenges in the tech and durables industry. Together, we’re delivering a more comprehensive and timely view of the market, designed for today’s fast-paced landscape.”

Greg Munves, CEO at OpenBrand, added, “Our alliance with NIQ is about setting a new standard. By leveraging our proprietary AI and integrating our diverse datasets, we’re providing stakeholders with timely, unified, and actionable intelligence that drives better decisions and more profitable outcomes.”

NIQ and OpenBrand are committed to empowering businesses and their investors with the tools they need to succeed in an increasingly competitive landscape. The first wave of these market intelligence solutions will launch in 2025.

For more information, visit www.NIQ.com and www.OpenBrand.com

About NIQ

NielsenIQ (NIQ) is the world’s leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. NIQ combined with GfK in 2023, bringing together the two industry leaders with unparalleled global reach. Today NIQ has operations in more than 95 countries covering 97% of GDP. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View™.

For more information, please visit www.niq.com

About OpenBrand

OpenBrand is the leading real-time market intelligence platform for the consumer durables market. Its unique optical web collection and AI-based processing technology enable the creation and delivery of the most accurate, dependable, and timely competitive intelligence and market measurement data. Brands and retailers leverage the data and analytics to understand why they are winning or losing so they can make the strategic adjustments they need to succeed.

Media Contacts

NIQ

- Abbey Benn (abbey.benn@niesleniq.com)

- Ketner Group (for NIQ) (catherine@ketnergroup.com)

OpenBrand

- Sidney Waterfall (sidney@openbrand.com)

Want to see what this collaboration means for your business?

Book a demo with our team for a personalized overview.

OpenBrand Expands Market Intelligence Capabilities With Its Third Acquisition: TraQ.line

OpenBrand, a leading market intelligence platform powered by AI-driven insights, announced the acquisition of TraQ.line, marking a significant step in the company's expansion into the market measurement space.

This acquisition is the third by OpenBrand, following the combination with Gap Intelligence and Deep.ad in October 2023, and the acquisition of Competitive Promotion Report (CPR) in March 2024.

TraQ.line, known for its detailed consumer durables market data and analysis, significantly enhances OpenBrand’s ability to offer comprehensive market insights. By integrating TraQ.line’s market measurement expertise, OpenBrand can now provide clients with an unparalleled understanding of both the causes and impacts of market share shifts across a wider range of industries, including home appliances, consumer electronics, information technology products, and key home improvement categories. Dave Stevenson, President of TraQ.line, will aid in the seamless integration of the two teams, allowing OpenBrand to offer deeper insights and expand research coverage beyond current sectors, further enhancing clients' ability to make informed decisions.

Greg Munves, CEO of OpenBrand, stated, "The acquisition of TraQ.line is a strategic move that significantly enhances the power and reach of our platform. By integrating TraQ.line’s rich market measurement data with our existing 4Ps and Media data, we can now provide a comprehensive solution that helps our customers not only understand why market share shifts are occurring, but also measure the magnitude of those shifts. Customers will benefit from deeper, more actionable insights, enabling them to make informed decisions and stay ahead of the competition in their markets. This acquisition is a critical step in our mission to deliver unparalleled market intelligence and create an unfair advantage for our customers."

Dave Stevenson, President of TraQ.line, added, “When I was approached by Greg and the team at OpenBrand, it was clear that this was an ideal opportunity for TraQ.line to enter its next phase of growth. The capabilities that OpenBrand offers in capturing and delivering timely, accurate data align perfectly with our mission. This partnership will provide our clients with data and insights they cannot get anywhere else.”

OpenBrand will continue to look for acquisitions like TraQline to bring its data and insights offerings to new industries and product categories.

About OpenBrand

OpenBrand (created from the ParkerGale-backed combination of Gap Intelligence, Deep.ad, Competitive Promotion Report, and TraQline) is one of the world’s most respected market intelligence companies. OpenBrand’s data and market research products give manufacturers, resellers, and industry players a competitive edge across a wide range of industries (including IT, consumer electronics, home appliances, health, wellness, beauty, small appliances, and other consumer durables) and help marketing, product, sales, and pricing teams make more informed decisions and stay competitive in a rapidly changing market environment. For more information, please visit www.OpenBrand.com.

OpenBrand Acquires TraQ.line: Elevating Market Intelligence

Nearly 20 years ago, TraQ.line was founded as The Stevenson Company, a market research insights firm dedicated to bringing consumer data to the Durable Goods industry.

Since the launch of the now well-known, industry-leading, and still unparalleled market survey (the TraQ.line survey, now Durable IQ), the company has grown and shifted alongside movement in the industry and the world overall. Technology has advanced, new companies have entered the space, and the needs of the market are ever-changing. TraQ.line did the same, advancing, growing, and moving forward.

Joining the OpenBrand family of data solutions, TraQ.line is once again poised to provide unmatched market intelligence to the Durable Goods industry — now with greater depth and breadth than ever before.

Read the full release below to learn more about what this acquisition means for TraQ.line and our clients — or contact us to see how we’re changing.

OpenBrand Expands Market Intelligence Capabilities With Its Third Acquisition: TraQ.line

July 9, 2024 – OpenBrand, a leading market intelligence platform powered by AI-driven insights, announced the acquisition of TraQ.line, marking a significant step in the company’s expansion into the market measurement space.

This acquisition is the third by OpenBrand, following the combination with Gap Intelligence and Deep.ad in October 2023, and the acquisition of Competitive Promotion Report (CPR) in March 2024. TraQline, known for its detailed consumer durables market data and analysis, significantly enhances OpenBrand’s ability to offer comprehensive market insights. By integrating TraQ.line’s market measurement expertise, OpenBrand can now provide clients with an unparalleled understanding of both the causes and impacts of market share shifts across a wider range of industries, including home appliances, consumer electronics, information technology products, and key home improvement categories. Dave Stevenson, President of TraQline, will aid in the seamless integration of the two teams, allowing OpenBrand to offer deeper insights and expand research coverage beyond current sectors, further enhancing clients’ ability to make informed decisions.

Greg Munves, CEO of OpenBrand, stated, “The acquisition of TraQ.line is a strategic move that significantly enhances the power and reach of our platform. By integrating TraQ.line’s rich market measurement data with our existing 4Ps and Media data, we can now provide a comprehensive solution that helps our customers not only understand why market share shifts are occurring, but also measure the magnitude of those shifts. Customers will benefit from deeper, more actionable insights, enabling them to make informed decisions and stay ahead of the competition in their markets. This acquisition is a critical step in our mission to deliver unparalleled market intelligence and create an unfair advantage for our customers.”

Dave Stevenson, President of TraQ.line, added, “When I was approached by Greg and the team at OpenBrand, it was clear that this was an ideal opportunity for TraQ.line to enter its next phase of growth. The capabilities that OpenBrand offers in capturing and delivering timely, accurate data align perfectly with our mission. This partnership will provide our clients with data and insights they cannot get anywhere else.”

OpenBrand will continue to look for acquisitions like TraQline to bring its data and insights offerings to new industries and product categories.

About OpenBrand

OpenBrand (created from the ParkerGale-backed combination of Gap Intelligence, Deep.ad, Competitive Promotion Report, and TraQ.line) is one of the world’s most respected market intelligence companies. OpenBrand’s data and market research products give manufacturers, resellers, and industry players a competitive edge across a wide range of industries (including IT, consumer electronics, home appliances, health, wellness, beauty, small appliances, and other consumer durables) and help marketing, product, sales, and pricing teams make more informed decisions and stay competitive in a rapidly changing market environment. For more information, please visit www.OpenBrand.com.

Contact us to see how TraQ.line is changing.

A New Chapter Begins: Gap Intelligence is Now OpenBrand

We at Gap Intelligence are excited to share some big news: we are now renamed OpenBrand. This decision follows our recent combination with Deep.ad and acquisition of Competitive Promotion Report (CPR) and reflects our commitment to open access to the data and insights brands need to win more market share. To do this we are creating a real-time market intelligence platform to help customers understand why they are winning or losing in their markets and pinpoint rapidly the exact place to take corrective measures and sell more. Our journey as a company started with Gap Intelligence’s data, analytical tools and in-person channel checks, grew with Deep.ad’s AI-driven data collection technologies, and was enriched by CPR’s insights into health, beauty, and wellness. With backing from ParkerGale Capital, we’ve come together to pave a new path in market intelligence, offering data and insights across a range of industries from a single, modernized platform, and we are just getting started!

OpenBrand is more than just a new name. It reflects our commitment to create transparency by leveraging the latest technology, including AI, to not only collect data but also to make it understandable and actionable. We’re here to help brands of all sizes understand how their products are performing in-market, dig into the drivers of the trend, and make quick, confident decisions. Our technology aggregates data from across the web and is designed to cut through the noise, providing clear insights to guide businesses in today’s complex market.

From our CEO, Greg Munves: "We have big plans for OpenBrand. We’re not just sticking to the categories we know; our aim is to aggressively expand to support brands across the board. We chose the name OpenBrand because it speaks to our ability to open up access to data and insights and that means we can cater to a wide range of needs and fulfill our desire to create an unfair advantage for our clients by helping them leverage data to make more-informed decisions, quickly and confidently. At the end of the day, our success is measured by our customers’ ability to leverage data to assess why they are winning or losing in the market, and to take action to win more share. We believe that if you know the “why”, you will win more. We’re opening up a world of data-driven possibilities for every client we work with, and we wanted a name to reflect what we can do and where we’re going as a company.”

If your company is wondering how to fill in the gaps in your market understanding, why you are experiencing share shifts, or curious about how AI-driven data and insights can help reveal new perspectives about your product’s performance, we want to talk to you. OpenBrand is all about providing the data and insights you need to transform data into smart, strategic decisions that get consumers to choose your products over alternatives. We're here to change how you see market intelligence, making every piece of data work for you.

About OpenBrand

OpenBrand (created from the private-equity-backed combination Gap Intelligence, Deep.ad, and Competitive Promotion Report) is one of the world’s most respected market intelligence companies. OpenBrand’s data and market research products give manufacturers, resellers, and industry players a competitive edge across a wide range of industries (including IT, consumer electronics, home appliances, health, wellness, and beauty) and help marketing, product, sales, and pricing teams make more informed decisions and stay competitive in a rapidly changing market environment. www.OpenBrand.com

Samplecon: Helping Shape the Future of Market Research & Data Quality

Written by Brian Lamar, Strategic Director of Survey Products at TraQline

Welcome to Samplecon: Uniting the World of Market Research

I spent last week in Lake Oconee Georgia at Samplecon, a marketing research conference that exists to create a collaborative environment for the transparent exchange of information and ideas to facilitate the evolution of consumer data. Basically, it’s a chance for us research nerds to get together and discuss best practices and challenges in the industry, focused on online sampling.

Well over 250 researchers attended this 2.5-day conference, which has become incredibly collaborative since its existence, allowing clients and vendors — many of whom are competitors — to work together to improve survey data and the insights we gain from it ultimately giving more confidence in decision making.

This year the primary topics were surrounding artificial intelligence and improving data quality. I wanted to give some high-level information about the ongoing data quality initiatives.

The Data Quality Revolution in Market Research

Quality challenges are not new to our industry. They took place when door-to-door methodology was most prominent and continued through the era of telephone surveys and persist even now, where market research is heavily conducted through the internet. However, this appears to be the most collaborative approach to minimizing the problem.

The Global Data Quality partnership is a group of industry associations across the globe working together to address ongoing and emerging risks to data quality in the market and social research, consumer insights, and analytics industries. With the goal of increasing information and building trust, each organization leads a workstream that delivers global quality resources to improve the conversation and outcomes.

2023 Achievements

The Insights Association (IA) is one of the organizations helping advance this initiative in North America, and I am fortunate to be the co-chair. We have had numerous accomplishments in the past year and a variety of workstreams that I am excited about including:

- Creating a glossary – It is imperative that the industry speaks the same language. The Global Data Quality glossary is the beginning of ensuring the industry is speaking from a common place when discussing research and data quality.

- Educational microsite – Located on the IA website, updates to best practices and to the toolkit can be found here.

- Updating the data integrity toolkit – With this update, we ensure that the data integrity toolkit has the latest information included.

- Journey map – Developed a visual map that defines the data quality process, requirements for validation, and how to monitor progress across the research journey.

- Pledge & badge – Created a commitment for individuals and companies to stay informed, engaged, and committed to ensuring high quality data standards.

- Data fraud & quality member survey: Conducted to understand the impact of fraud, to what degree it’s experienced, and protection measures currently used.

2024 Initiatives for Enhanced Data Quality

Additionally, there are numerous 2024 initiatives taking place to improve data quality, including:

- Establishing data quality benchmarks – For example, what is an acceptable removal rate, or dropout rate? What are the key metrics we should be looking at to measure quality?

- Efforts to improve the respondent experience to increase sample supply – One way this is being accomplished is to create a “Respondents Bill of Rights” which is a primary objective this year. What should researchers tell study participants? How should participants be treated?

- Collaboration labs – We conducted a collaboration lab at Samplecon and will provide other opportunities to provide input at IA National in Atlanta in April

- Fraud technology guidance

- Incentives guidance – Growing understanding of best practices in terms of incentives

- Data cleaning guidance

- AI guidance – Building understanding around how artificial intelligence will impact our industry

- Data quality training module – Development of a “class” that researchers can take to learn more about best practices

Conclusion: The Quest for Improving Data Quality Continues

In summary, significant progress has been made in improving the quality of data within market research in the past year. However, there are two key things to keep in mind:

- We will never have perfect quality data.

- While these initiatives will help improve quality, it is still necessary to design a good screener and questionnaire, ensure the ideal sample and analytic plan, and have numerous people testing the survey to ensure it is programmed correctly.

I will be leading the data quality track at the Insights Association Annual Conference April 8-10 in Atlanta Georgia and am excited to see our industry improve and help our clients make smart business decisions.

If you’d like to learn more about these initiatives or connect with TraQline to discuss our commitment to accurate and reliable data, contact us below.