As 2025 kicks off, understanding the consumer electronics trends that shaped buyer behavior in 2024 is crucial to locking in business strategies that will leave an impact this year.

In our recent webinar, “2024 CE Trends & the Year Ahead,” my colleague Valerie Alde-Hayman and I dove into the key takeaways from the holiday season, insights from the CES 2025 show floor, and actionable predictions that consumer electronics brands and retailers should consider in 2025. Val and I are both Senior Analysts here at OpenBrand, bringing over 25 years of combined analyst experience in the consumer electronics and information technology industries.

If you missed the live session, don’t worry you can watch the full webinar and check out our recap below.

Holiday Trends: Shifting Dynamics & Key Insights

The 2024 holiday season painted a clear picture of evolving consumer behavior as well as brand and retailer strategies. Below are select highlights presented in the 40-minute webinar.

Shorter Holiday Season, Earlier Promotions

With only 27 days between Thanksgiving and Christmas, consumers experienced a shorter shopping window than usual. This shortened holiday season also prompted the early rollout of promotions — beginning as early as October, when Amazon’s Big Deal Days served as the unofficial holiday shopping season kickoff.

This earlier start reshaped the calendar, yet Black Friday and Cyber Monday remained anchor events, drawing significant consumer interest.

Black Friday & Cyber Monday: Evolving Roles

While Black Friday and Cyber Monday continue to dominate, they’re changing in nature.

Black Friday: 2024 trends show that shoppers prioritized value and favored mobile shopping over other methods. For in-store shopping, Best Buy emerged as a standout destination, leveraging aggressive promotions on exclusive brands and big-ticket items like TVs.

Cyber Monday (or Cyber Week?): With the highest proportion of products on promotion (e.g., 47% for vacuums, 38% for headphones), this week-long sales bonanza rewarded patient shoppers. However, early-season deals tempered the urgency, leading to slightly lower promotional saturation than in previous years.

Online Sales Surged

During the 2024 holiday season, US consumers spent a remarkable $241.1 billion online, representing a year-over-year increase of 8.7%. Electronics contributed heavily to this charge, with sales growing 8.8% to $55.3 billion.

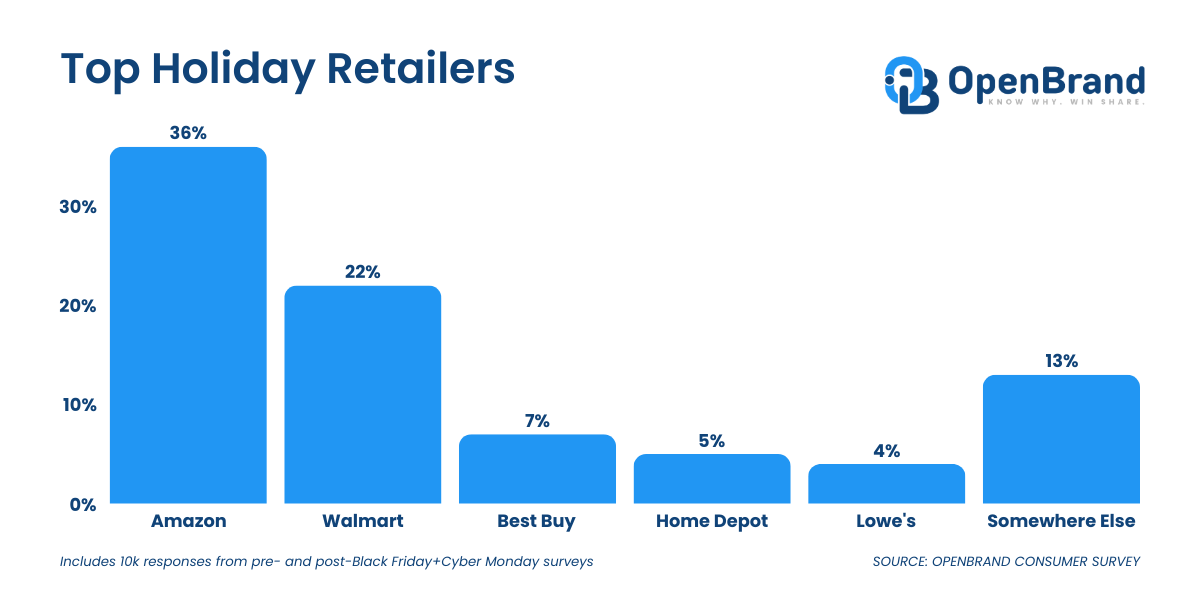

Top Holiday Retailers

Given the growth in YOY online sales, it’s no surprise that Amazon was the top destination for 2024 Black Friday and Cyber Monday shoppers. More than 35% of consumers reported shopping at the ecommerce giant, illustrating how shopping on its platform has become a popular destination for US consumers.

Meanwhile, 22% of respondents reported that they shopped at Walmart, whose strong omnichannel presence caters to value-driven purchases, definitely tying in to what we saw earlier around budget-focused buys.

Notably, Best Buy made up 7% of the 2024 holiday purchase activity reported in the survey, two and three points stronger respectively than Home Depot and Lowe’s as consumer electronics stayed ahead of appliance purchases during Black Friday and Cyber Monday.

These trends underscore Amazon’s dominance, Walmart’s ability to capture value-focused shoppers, and the continued consumer preference for electronics over appliances during these key holiday sales events.

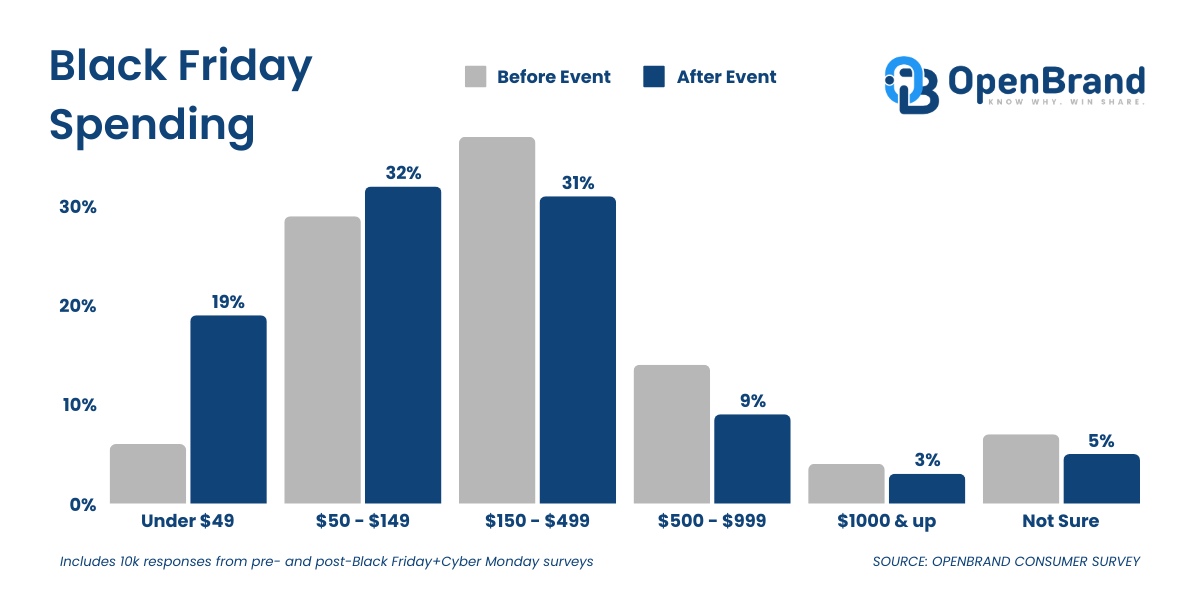

Budget-Conscious Shoppers

Many consumers opted for low-cost purchases on Black Friday, spending under $500 (about 1 in 5 shoppers spent less than $49). Notably, many shoppers, when surveyed before the holiday shopping events, intended to spend more.

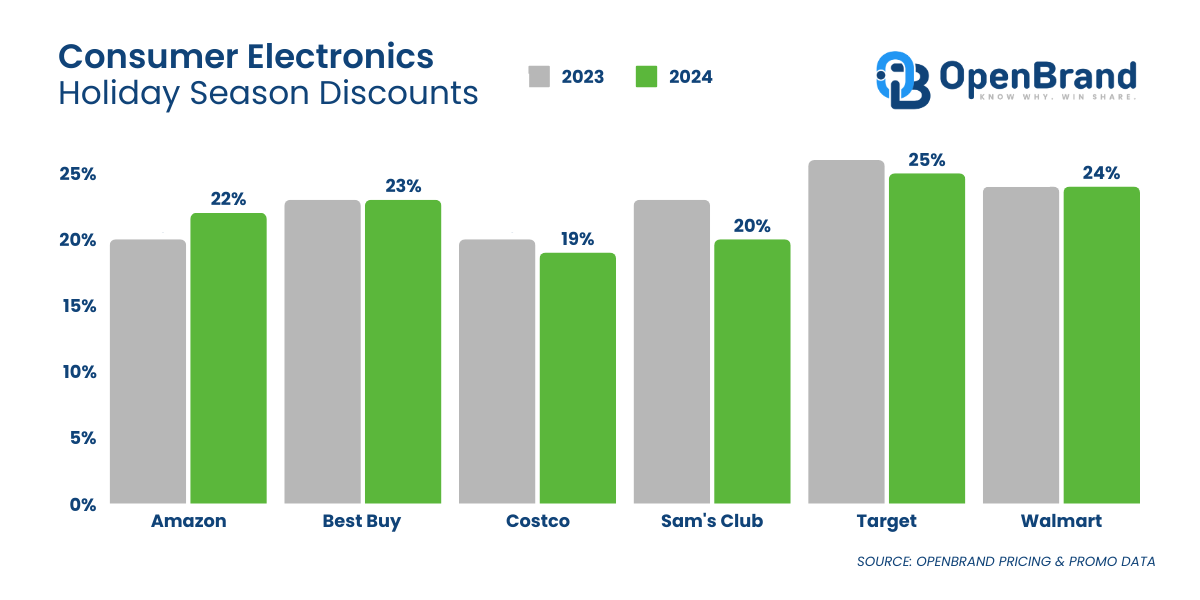

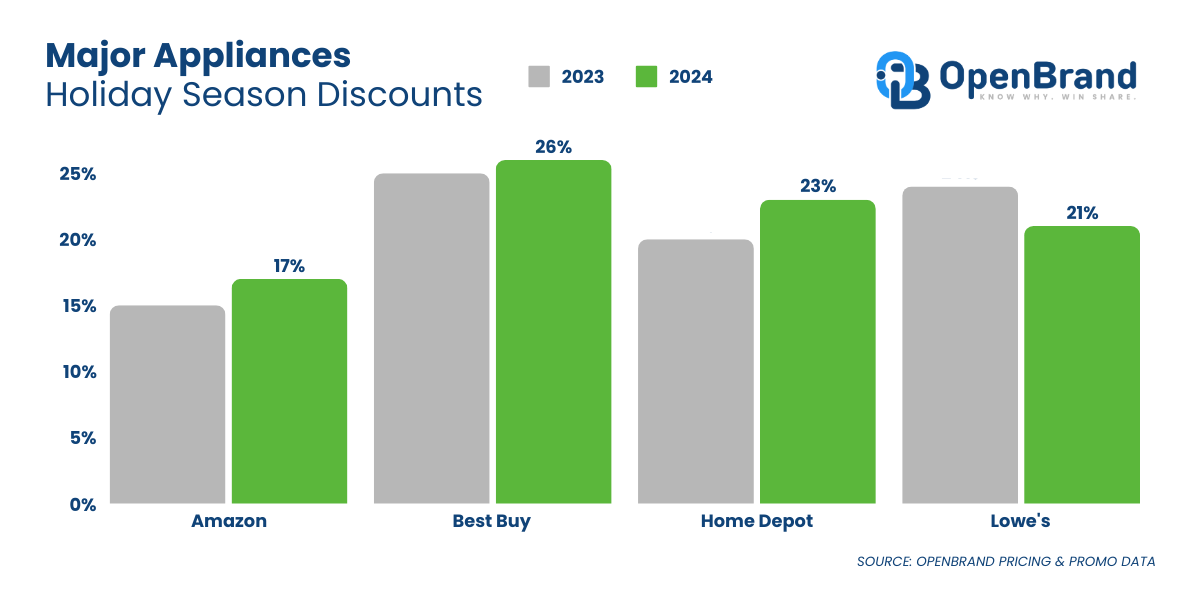

Promotions & Standout Categories

With budgets on the mind, discounts played a pivotal role in driving consumer interest, with a few standouts in the following categories and products:

- Electronics: TVs and monitors saw deeper discounts compared to 2023, with Samsung, LG, and HP leading the charge. Premium items like QLED TVs and gaming monitors were heavily promoted to entice tech enthusiasts.

- Appliances: Average discounts hit 39%, with brands like Samsung and GE dominating. Floor care products, particularly stick vacuums, saw discounts as high as 66%.

- AirPods Pro 2: Despite not being the latest model, Apple’s AirPods Pro 2 stood out, thanks to strategic price adjustments by retailers like Best Buy and Walmart, which sparked real-time competition.

CES 2025: Highlights from the show floor

Each year, as holiday shopping wraps, CES swoops in to serve as a crystal ball for what’s to come, offering a glimpse into the technologies and trends that will shape the market.

Our team was on the floor during CES 2025, connecting with clients and getting a feel of what is to come in the future of consumer electronics. Key highlights include:

- AR Glasses: With improving functionality and pricing, augmented reality is poised to transform daily interactions and consumer expectations.

- Air-to-Water Technology: Kara Water introduced a coffee maker that eliminates refilling by converting air into water, showcasing innovation in sustainability.

- AI-Enhanced Home Products: Roborock’s Saros Z70 AI vacuum with a foldable OmniGrip arm marks a step toward smarter, more capable in-home robots.

View our recent CES 2025 recap video for more highlights from the show floor.

Predictions for 2025

Based on the holiday season and the focus CES 2025, here’s what our category experts foresee coming this year:

- Focus on spring refresh: With uncertainty on the horizon, industry entities will be focusing on what they can control. Meaning we will see a strong and early spring refresh season as retailers and brands across industries work to get ahead of any forthcoming inflation, tariff increase, or the like.

- Aggressively strategic promotions: Expect to see savvy media plays and well-timed promotions for key periods. All signs from the 2024 holiday season show that promotions will become strategic and more aggressive around traditional seasonal events.

- Continued Early Holiday Promotions: Retailers will double down on early-season deals to get ahead of macroeconomic challenges like inflation and supply chain uncertainty. Earlier deals are reshaping holiday dynamics, creating opportunities for brands to capture early spenders while maintaining momentum for legacy events like Black Friday.

- Value Meeting Innovation: Consumers will demand not just affordability but also quality, particularly in maturing tech categories like AR/VR and wearable devices. With value-conscious shoppers dominating 2024 sales, opting for promotions and smaller, unplanned purchases over big-ticket items. Retailers that align deep discounts with consumer expectations can expect to see the greatest success.

- Emerging Product Categories: Innovations showcased at CES will become more accessible, driving growth in areas like smart home technology and next-gen wearables.

The Insights Don’t Stop Here

The 2024 holiday season and CES have set the stage for a consumer landscape that values early, targeted promotions and innovative, value-driven products. Brands and retailers that adapt to these shifting dynamics will be best positioned to thrive in 2025.

Want to dive deeper? Watch the full webinar to hear more on the insights and 2024 trend data — and contact us today to see what trends are taking place in your market, for your brand(s), and your competitors.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…

Refrigerators: 2025 Year-In-Review

Our Refrigerators: 2025 Year-in-Review report recaps product launches, placements, pricing and…