The consumer durables market in 2024 was anything but static. Retail market share shifted, pricing strategies evolved, online sales evolved, and consumer behaviors changed in ways that will continue to shape the competitive landscape in 2025.

For brands and retailers looking to get ahead, understanding what changed — and why — is the key to making more strategic and impactful business decisions.

Our 2024 Year in Review report provides a data-packed overview of the state of the consumer durables industry in 2024. Check out 10 key takeaways below or download the full report now!

Delivering 30 pages of insights, the report highlights:

- Market Leaders: Who dominated in 2024 across top categories

- E-commerce vs. In-Store: 5-year sales trends & market shifts

- Pricing & Promotions: How brands adjusted strategy to influence demand

- Retailer Spotlight: Amazon: Competitive placements & sales trends

- Category Deep Dive: Major Appliances: Brand leaders, top SKUs & promo data

- Consumer Behavior: What influenced buying decisions this year

The report captures insights across multiple product categories as well as the industry overall, offering a clear view of the areas that defined the year.

10 Key Consumer Durables Industry Insights

Delivering a glimpse into our 2024 report, here are 10 highlights from the report. Make sure to download the full report to access all the data.

1. Home Depot and Amazon both took the top spot as leading outlet across three different categories.

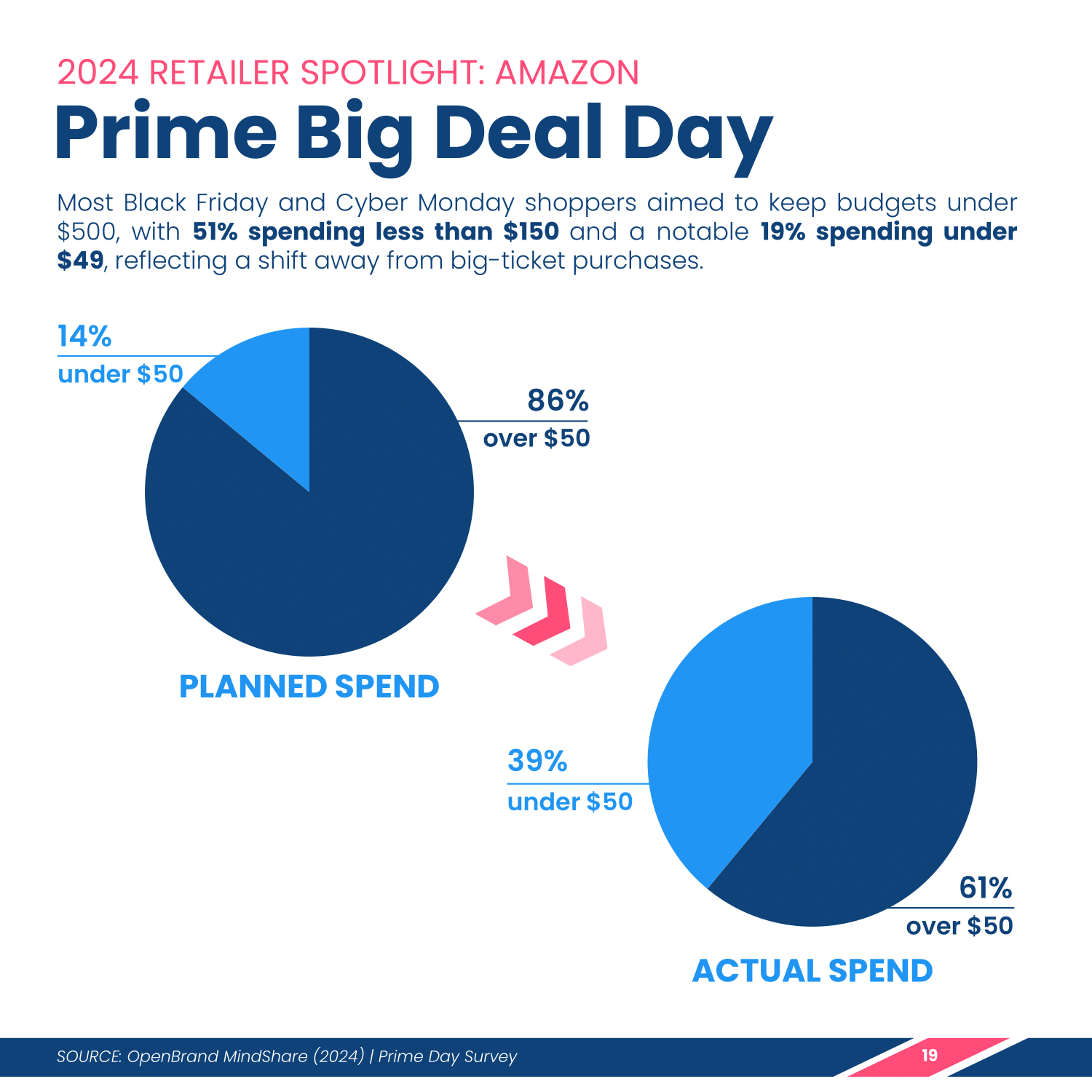

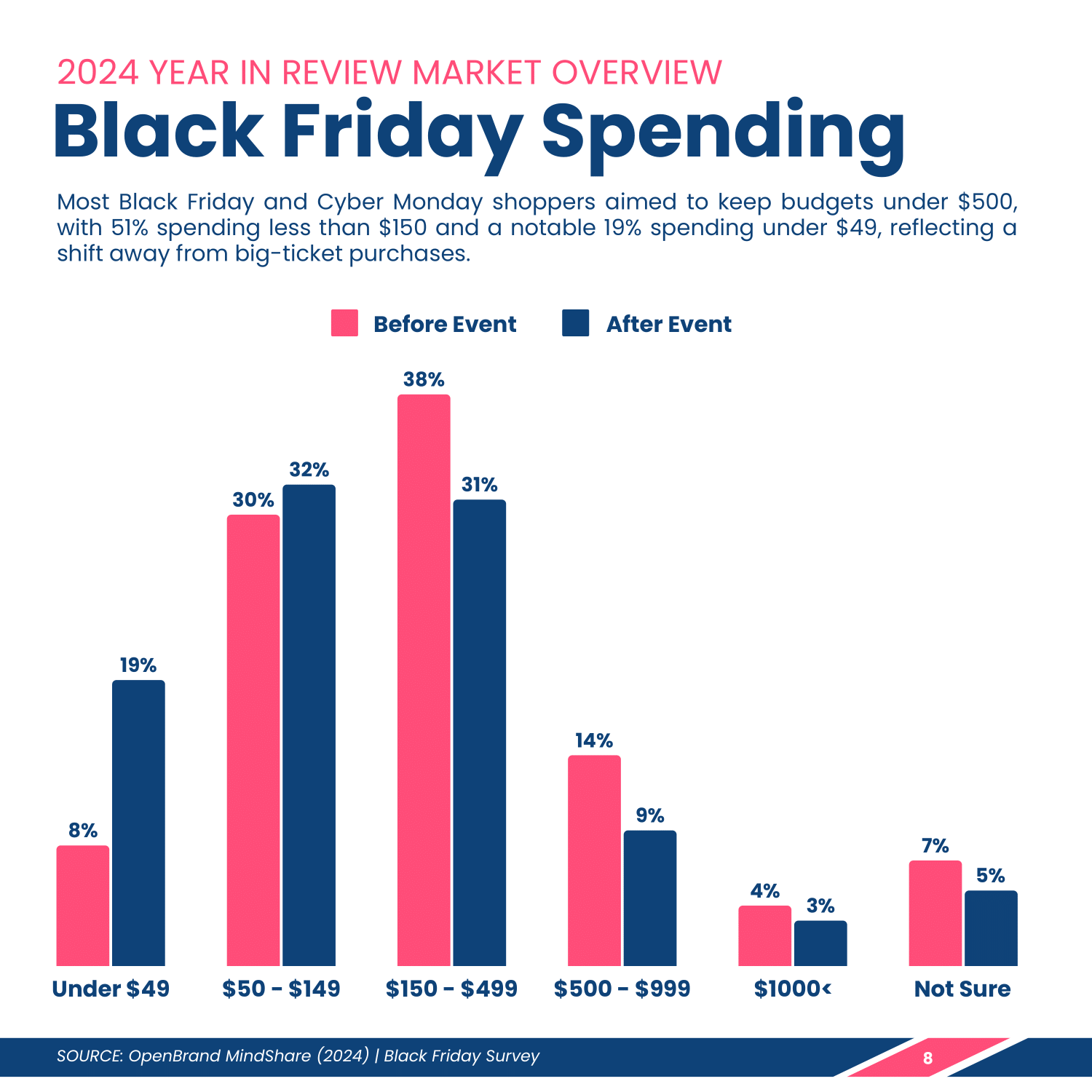

2. Consumers planned to spend more on Black Friday sales than what they ultimately spent, with home goods as the leading consumer durable category purchased.

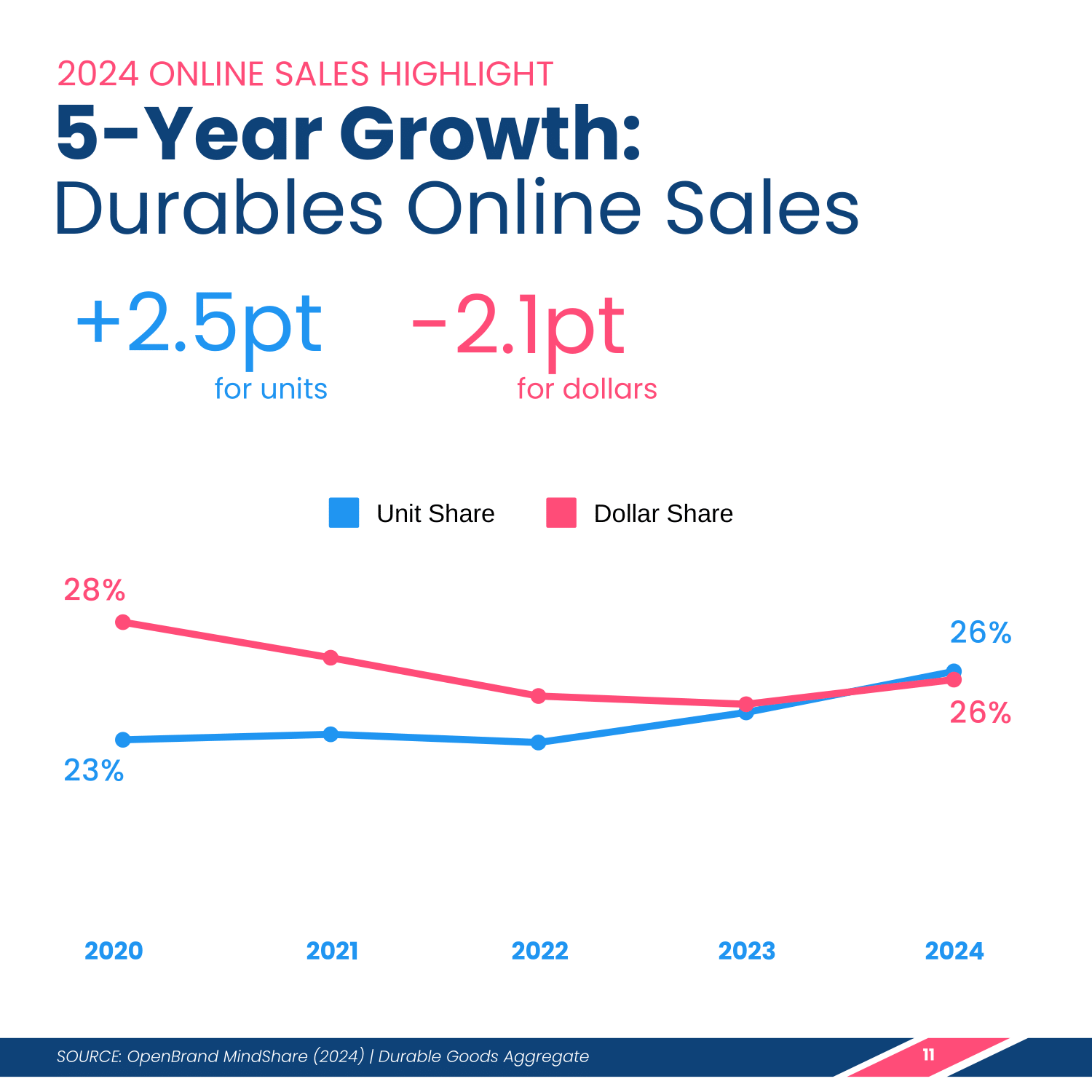

3. Over the past 5 years, sales in consumer durables continue to see an increase in the number of units purchased online but a decrease in dollars spent, which is reflected in the year-over-year decrease in average price paid.

4. Fitness equipment has the highest percentage of online sales versus in-store — and is also the top consumer durables category purchased on Amazon.

5. Amazon is growing year-over-year, climbing 4 percentage points since 2020 in consumer durables sales.

6. Amazon’s net prices in the small appliance category are historically lower than other retailers, with an average of $52 less than other retailers. This is driven by strong discounts for the category, as seen during Prime Day events.

7. While the majority of consumer durables are still purchased by Millennials, Gen X, and Baby Boomers, purchases by Gen Z are on the rise.

8. While most rewards programs remained flat year-over-year, MyLowe’s Rewards ramped up in 2024.

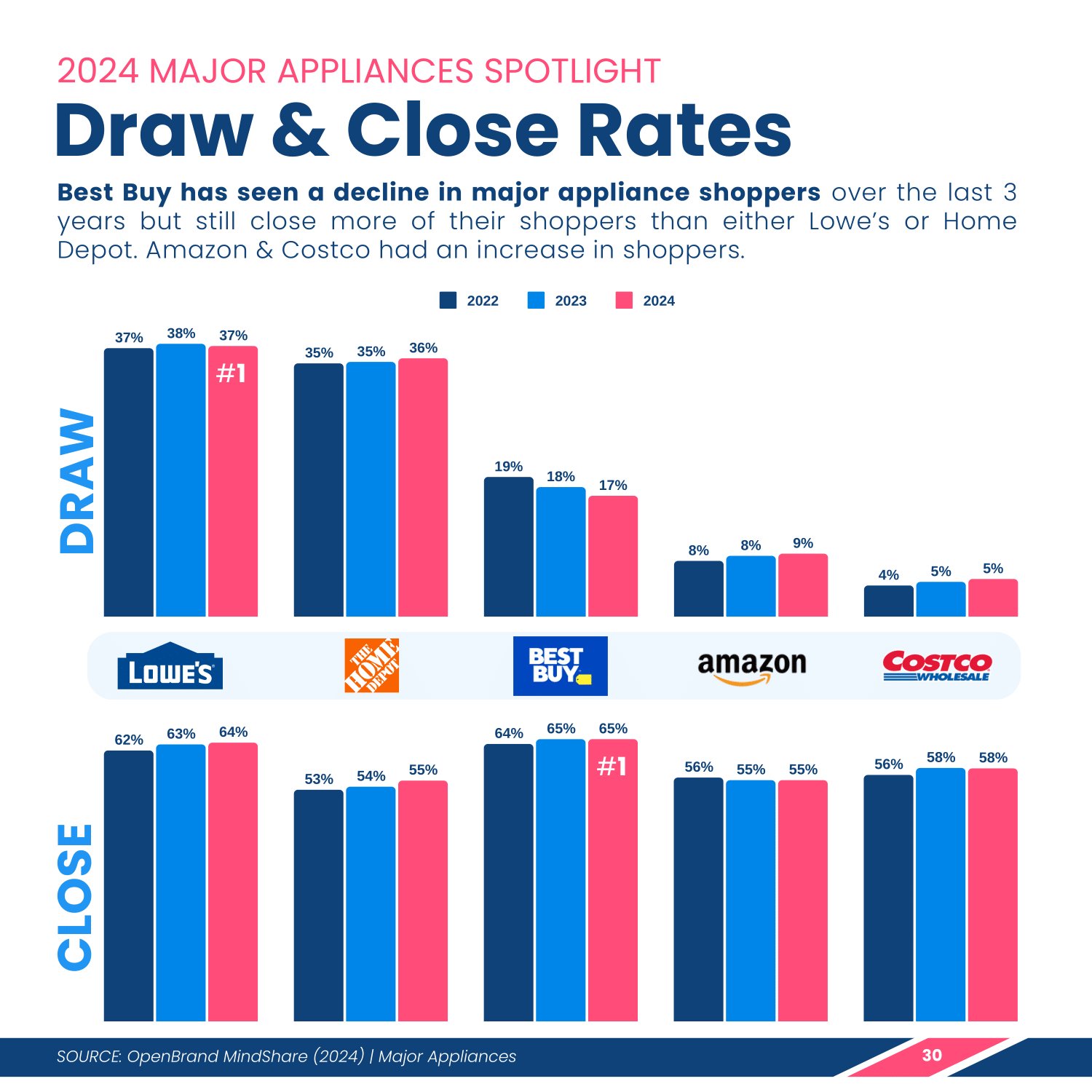

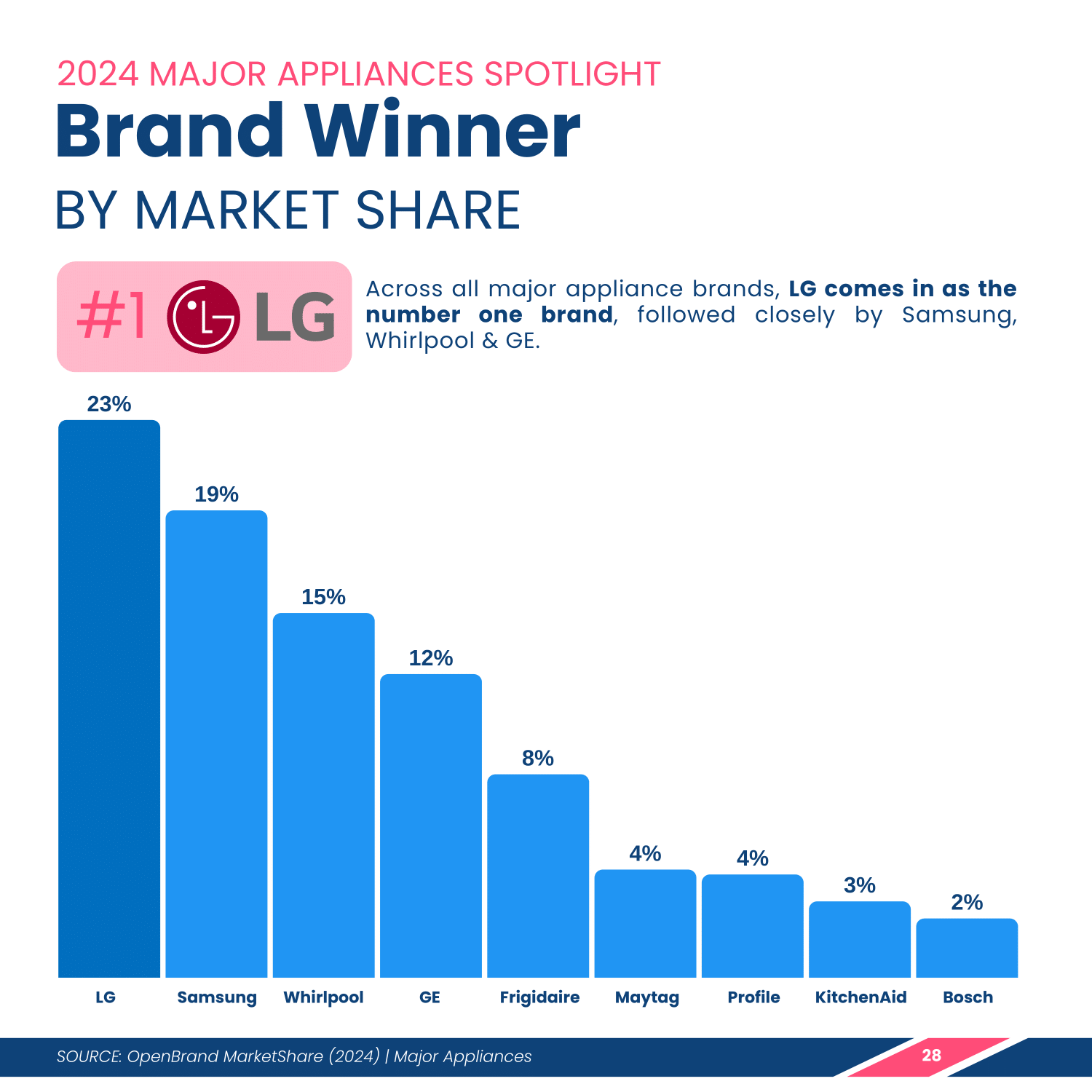

9. LG and Lowe’s won as top brand and retailer for major appliances, bringing in the most consumer dollars in 2024. Out of all the top retailers, Lowe’s draws in the most major appliance consumers — however, despite a decline in draw, Best Buy closes the most shoppers.

10. Ranges represent the majority of online major appliance placements at 44% share, with Home Depot outlet leading in placement count at 1855.

Download the Full Report

Monitor Your Market With OpenBrand

OpenBrand offers market measurement and competitive intelligence intelligence solutions that give consumer durables brands and retailers the data they need to fill in gaps in their market understanding, build stronger business strategy, and win share. These data solutions deliver everything from where competitors are gaining market share, to product line opportunities, consumer purchase behaviors, and so much more.

To see the data available for your brand, contact us today.

Related blogs

Prime Day 2025 for Durables: Shopper Intent, Promotions & Where to Focus

Prime Day 2025 broke the mold. For the first time, Prime Day ran four full days, spanning July 8–11, twice the usual length, and emerged as Amazon’s…

Related blogs

Consumer Price Index: Durable and Personal Goods | November 2025

This is the December 2025 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Home Depot Market Share Breakdown: Q3 2025 Earnings Call Analysis

Inside the Home Depot Q3 2025 Earnings Call Home Depot’s Q3 2025 earnings call confirmed solid…

The Power Tools Market is Changing: Here’s How | Q2 2025 Share & Rankings

The Power Tools market is moving faster than ever, shaping how consumers shop, which brands command…

Consumer Price Index: Durable and Personal Goods | October 2025

This is the November 2025 release of the OpenBrand Consumer Price Index (CPI) – Durable and…