In today’s ever-changing business landscape, it is undeniable that data is a key driving force behind sustainable growth. And this is no exception for a consumer-based industry like durable goods.

Every customer consideration, engagement, and purchase delivers new Point of Sale (POS) data points, which subsequently creates the opportunity for better informed decision-making — all built around genuine consumer understanding.

Empowering consumer understanding through SKU data

One emerging area where POS data analytics can make a significant impact on business innovation and growth is in the durable goods industry. Historically, data in the durables and appliance industries has been hard to come by in an extensive or readily available system.

TraQline Hybrid POS™ (HPOS) entered the market to bridge that gap. HPOS is a next-generation SKU-level analytics platform, designed to give durables companies the POS data analytics they need to improve functions, optimize strategy, and elevate business growth.

Delivering product-level market share data across leading durables, outdoor power equipment, and appliance industry retailers — such as Best Buy, Lowe’s, and Home Depot — HPOS delivers unmatched data granularity on the best-selling SKUs across the outdoor power equipment and appliance industries. (Heads up: More industries coming very soon!)

Here are top four reasons businesses need competitive POS data analytics from Hybrid POS.

1. Hybrid POS Data Solves Retailer Participation Gaps

Traditional POS data providers rely on retailers voluntarily giving their POS data. While some retailers are willing to participate, participation gaps from retailers are common occurrences, leading to skewed data and an incomplete view of the market.

Alongside the difficulty of getting retailers to participate, gathering POS data from participating companies can still be challenging, as an aggregator must meet compliance and legal requirements.

Instead of relying on this inefficient and inaccurate system, Hybrid POS built a model that is completely free of retailer participation. Meaning that, unlike traditional POS data providers, the SKU data within our platform is not limited by retailers choosing to provide it. Subsequently, our SKU data is also without risk of being stripped away at the retailer’s discretion.

Visualizing POS Data

HPOS delivers our unmatched, retailer-agnostic POS data analytics through a visual and interactive analytics platform, making it accessible for your entire team, easy to filter and manipulate — and readily turned into actionable insights.

2. Hybrid POS Overcomes Traditional Reporting Limitations

Another pitfall of traditional POS data systems is the reliance on proprietary data to better understand the market and sales.

When a retailer opts into reporting for legacy POS data providers, they will control and own the data they provide. This can often lead to reporting limitations, as the retailer will set strict rules around data usage. These limitations can cause you to receive reports that are missing key models, key insights, and retailer-specific information.

Hybrid POS overcomes these traditional reporting limitations by using POS data from reliable sources that are independent of individual retailers. This data comes without limitations or restrictions, allowing for more through and comprehensive market, brand, and SKU analysis.

As an example, let’s look at how Hybrid POS overcomes a common restriction of retailer-supplier data: SKU share by retailer.

Delivering SKU share by individual retailer

Traditional HPOS data providers cannot report on individual retailer shares (e.g. Best Buy, Home Depot, Lowe’s), nor can they report on models (SKUs) that are sold at only one retailer (e.g. Best Buy-exclusive products such as Insignia). These other providers have a “rule of three” – meaning they need at least three retailers within a data set to publish it – and cannot report on anything lower.

Free of such regulations, Hybrid POS provides POS data analytics around not only what SKUs are sold across the market, but also at a specific retailer or for a specific brand.

In other words, Hybrid POS delivers market share for every SKU that is sold at the leading retailers – by retailer. Similarly, HPOS also provides data on brands, giving you actionable insights about derivative and private label models.

For example, with HPOS, you can find insights including but not limited to: 1) the percent of a product type sold by a specific retailer, 2) the amount of share won by a specific model, and most notably, 3) you can report the share of a specific model at one specific retailer, 4) SKU share by brand.

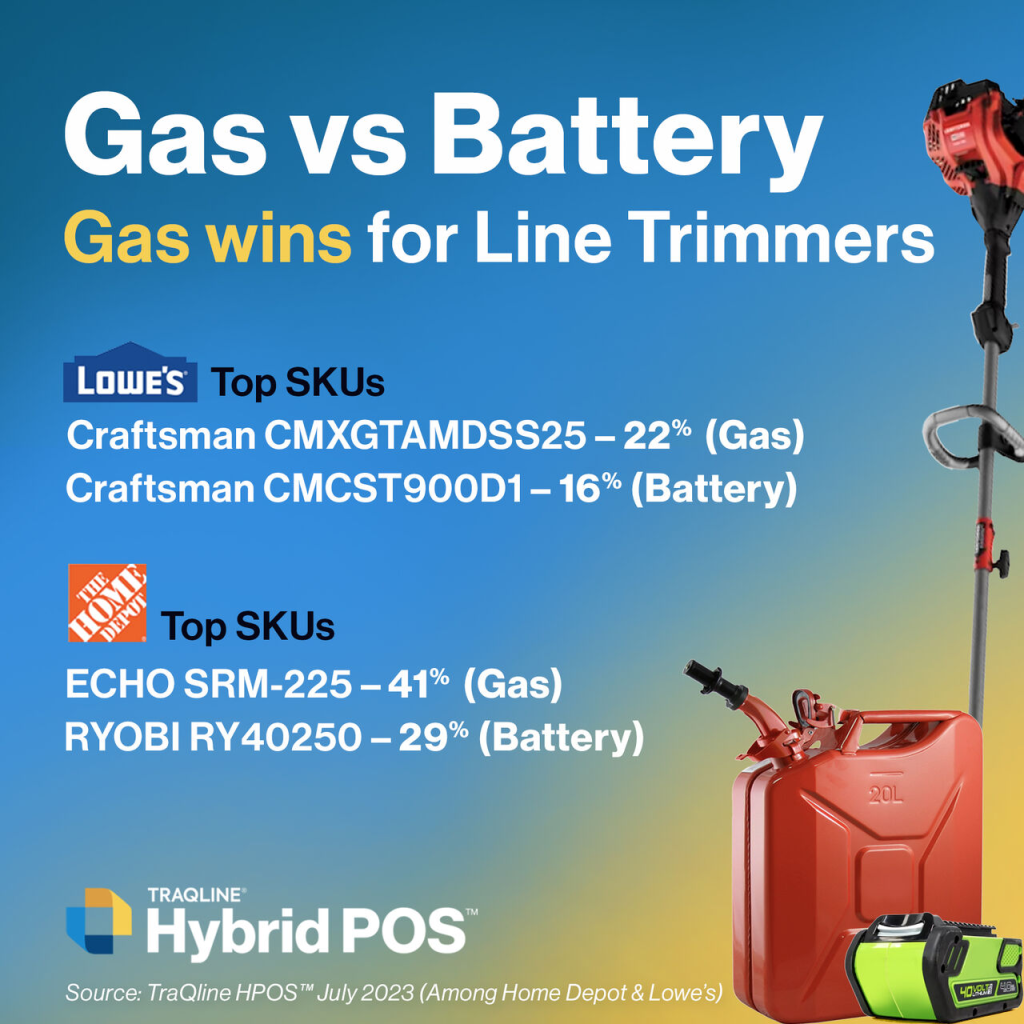

Recent POS data for OPE & appliance industry

To highlight the scope of data available through Hybrid POS, let’s take a look at four recent insights from the tool.

1. Retailer share by product

In both dollar and unit share, Lowe’s earned 41% of sales for all front load washers in July 2023.

2. SKU product share

Ryobi’s #P2109BTL leaf blower was the leading model in July 2023, with 9% unit share across the three leading retailers. (Shown above, image one.)

3. SKU share by retailer

In July 2023, Craftsman’s #CMXGTAMDSS25 won 22% market share at Lowe’s — coming in as the leading gas-powered line trimmer. (Shown above, image two.)

4. SKU share by brand (+ pricing tier)

In July 2023, Samsung sold 34% of all 3-door French door refrigerators within the $1,900 or less dollar range. (Shown above, image three.)

3. Consistent Monthly Brand & Retailer Data

Due to the aforementioned reliance on retailer participation, traditional data providers always risk a retailer deciding to discontinue participation in the program.

Hybrid POS is able to deliver a consistent and retailer view of retailer and brand insights – allowing you to plan, measure, and analyze with peace of mind that the data will reflect the market without disruption from one period to the next.

To put this into perspective, let’s say your legacy POS data provider delivers data for the top four retailers in your industry. Unexpectedly, one retailers restricts access to their POS data. This would immediately impact the data available to you, as well as your analysis of the market, changing what percent of coverage you can compare and measure against.

4. HPOS Data Eliminates Transmission Errors

When you use a traditional POS system for data collection, POS data has to flow through retailers, aggregators, and customers. This unfortunately leaves open the opportunity for transmission errors to occur, due to issues with connection, timing, noise, and staffing, among others.

Errors can include anything from connections timing out, to signal distortion, burst errors, connection refusals, and many more. This can ultimately create incomplete and/or inaccurate data.

Since HPOS relies on raw data that does not pass through multiple connections, the end output delivers consistently and accurately – furthering the reliability businesses expect from our comprehensive market POS data analytics.

Empower Your Business With TraQline HPOS Data

At TraQline, we know how important accurate and accessible data is for our clients. Overcoming the limitations of traditional data providers allows us to power your business through more comprehensive, accurate, and reliable market data.

Get the POS data analytics you need to confidently keep an eye on current market trends — and elevate your business growth. Whether you want to eliminate participation gaps, utilize a more user-friendly POS system, gain deeper insights about your sales, or cut down on transmission errors, HPOS is the system for you.

Learn more about TraQline HPOS today. If you have any questions or want to start using HPOS data at your business, please contact us below.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…

Refrigerators: 2025 Year-In-Review

Our Refrigerators: 2025 Year-in-Review report recaps product launches, placements, pricing and…