This OpenBrand year-in-review report recaps product launch activity, portfolio shifts, and pricing captured throughout 2024 with comparisons drawn to 2023. The report features data and insights from OpenBrand’s US MFP Copiers Reports, which include devices intended to sell through the dealer channel.

Read through all the 2024 pricing and promotions insights below or email the report to read later.

Methodology

The data used in this report is leveraged from the OpenBrand US MFP-Copiers Pricing & Promotions Report and the US Dealer Cost Report between the dates of Q1 2023 and Q4 2024. Data includes all products except production models that were captured in dealer price lists or contracts. The launch activity section, however, includes products that were announced but have not been captured in dealer price lists or contracts to-date. This section also features data from 2019 to 2024. This section also includes production models.

Impact Summary

- Launch activity reached 121 new products, declining 15% compared to 2023

- Portfolios continued to shift from A3 to A4

- Average public sector prices increased across several key segments

2024 Copier Product Launch Activity

Copier hardware launch activity was steady for most of the year, while demonstrating a significant uptick in September when Katun and Fujifilm Business Innovation announced major series launches. With a total of 121 products introduced for the dealer channel, this year’s launch activity had 15% fewer product launches than last year, becoming the second-slowest year in terms of launch activity since 2021.

The US copier market demonstrated a significant shift in 2024, with newcomers taking two of the top three spots for launch activity. With 28 new products announced, Fujifilm Business Innovation had the most launches in 2024. The move was marked by the OEM’s September announcement to partner with Marco Technologies, which became the first US dealer authorized to sell Apeos A3 and A4 MFPs. The partnership underscored Fujifilm’s strategy of westward expansion following the dissolution of the Fuji-Xerox partnership in 2021 and the OEM’s formal entry into European markets in April 2024.

Konica Minolta captured second place with 21 product launches in 2024, marking a noteworthy shift in pace after introducing just five products in 2023. The product introductions were made across two distinct launch announcements. These included the launch of eight A4 devices in March and the introduction of 13 A3 MFPs in July.

Katun rounded out the top three with a major announcement in September, when the brand unveiled its new Arivia lineup, effectively marking Katun’s entry into the US (and global) copier market. Although 11 A3 toner-based devices were initially introduced, OpenBrand uncovered four additional configurations within the series, which features color devices ranging from 25ppm to 65ppm and monochrome devices between 25ppm and 55ppm.

Portfolios

The copier market is undergoing a significant transformation, driven by evolving workplace trends, technological advancements, sustainability efforts, and budget constraints. As such, the market increasingly shifted to A4 devices, marking a pivot from A3’s dominant role.

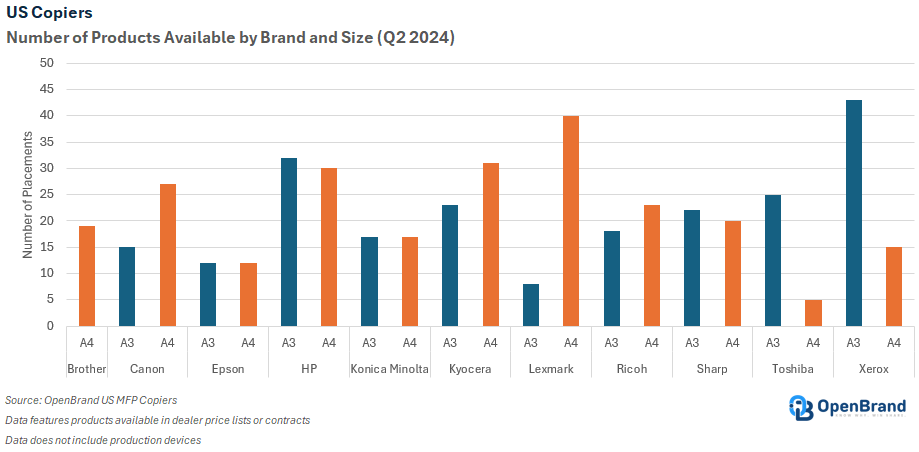

A4 devices demonstrated steady growth over the two years, with product counts increasing by 12% from 214 in 1H 2023 to 239 in 2H 2024. The second half of 2024 ended with 215 A3 products available to dealers. Although this number represents a 3% increase compared to 1H 2023, this count is still lower than the number of A4 models offered. This shift reflects the ongoing market attention toward compact, cost-effective solutions that align with the needs of hybrid and decentralized work environments.

In Q4 2024, brands displayed distinct strategies in balancing their A3 and A4 portfolios. Lexmark and Kyocera leaned heavily toward A4 devices, with 40 and 31 A4 models, respectively. Brother focused entirely on A4 with 19 models, reinforcing its commitment to the SMB and SOHO segments (as well as its lack of A3 technology or partnerships). Canon also leaned more toward A4, offering 27 A4 models compared to 15 A3 devices. Conversely, Xerox and Toshiba prioritized A3 devices, with 43 and 25 models, respectively. HP maintained a balanced portfolio with 32 A3 and 30 A4 models, while Sharp and Ricoh showed similar dual-focus strategies to address diverse market needs.

Copier Market Pricing

Between Q1 2023 and Q4 2024, A3 color segment public sector prices saw significant growth across all tiers, reflecting the market’s upward shift toward higher-value devices and downward shift into A4.

Segment 1 Color rose by 42%, from $3,200 to $4,545 while Segment 2 Color experienced a 44% increase to $5,604.

Segment 3 Color grew by 41%, from $5,029 to $7,115 while Segment 4a Color rose by 28%, from $6,372 to $8,133.

Segment 4b Color increased by 41%, from $7,725 to $10,872, and Segment 5 Color saw a 21% rise from $11,403 to $13,844.

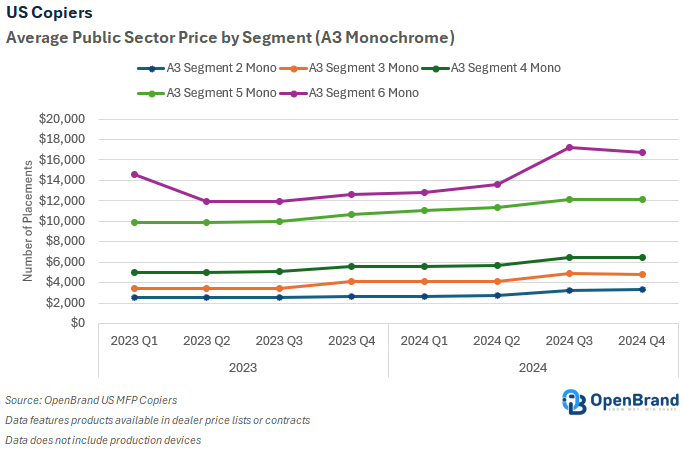

During the period, A3 mono segment prices experienced significant increases across all tiers. Segment 2 Mono saw a 32% rise, from $2,519 to $3,334, and Segment 3 Mono grew by 41% from $3,415 to $4,818. Segment 4 Mono rose by 28% from $5,028 to $6,423 while Segment 5 Mono experienced a 22% increase from $9,899 to $12,122. Finally, Segment 6 Mono saw the most significant rise at 14%, increasing from $14,608 to $16,691.

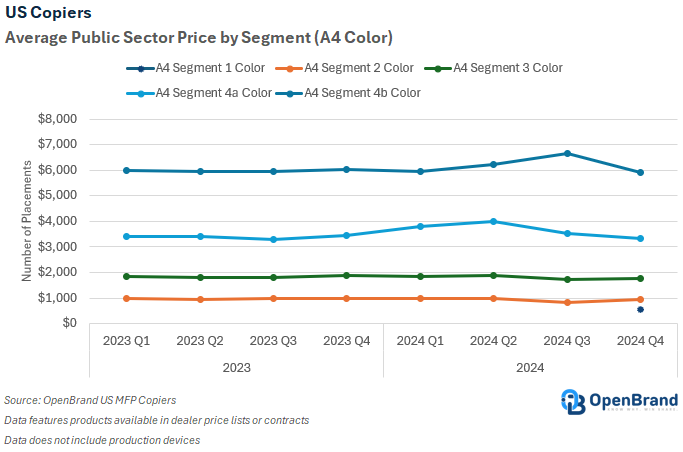

A4 color segment prices exhibited mixed trends, with some tiers experiencing growth and others showing declines. Segment 2 Color saw a slight decline of 4% from $993 to $958. Segment 3 Color remained relatively stable, with a modest decline of 3% from $1,834 to $1,774. Segment 4a Color experienced a decrease of 2%, from $3,406 to $3,346 while, in contrast, Segment 4b Color pricing grew 6% from $5,970 to $5,911.

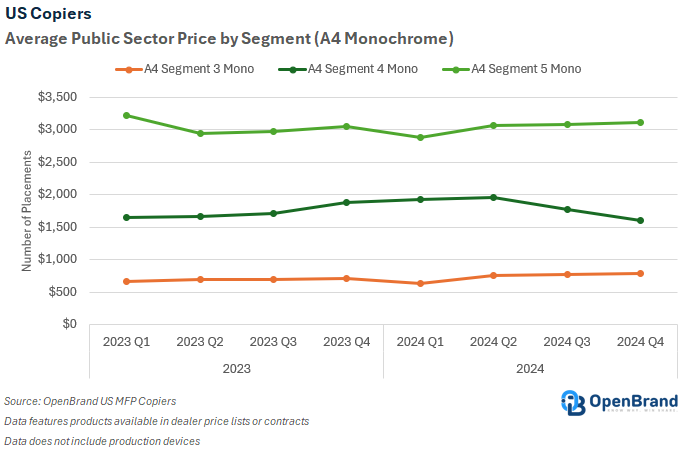

Average A4 mono segment prices also exhibited varied trends across tiers. Segment 3 Mono showed a modest increase of 19% from $660 to $784 while Segment 4 Mono, however, experienced a 3% decline from $1,644 to $1,599. Segment 5 Mono demonstrated 3% growth, increasing from $3,212 to $3,116.

Copier Market Outlook Going into 2026

The copier market is poised for transformative changes in 2025 as manufacturers respond to shifting customer demands, mergers and acquisitions, and global economic pressures. Product launch activity is anticipated to remain steady, likely focusing on alignment with evolving workplace dynamics that prioritize decentralized and cost-effective equipment that will further the shift from A3 to A4.

Pricing trends will be influenced by multiple factors. While competition could drive down costs in some segments, external pressures such as tariffs on raw materials and components may result in price increases, particularly for high-end devices.

Corporate realignments and partnerships are set to reshape the competitive landscape. Xerox’s planned acquisition of Lexmark, expected to close in the second half of 2025, will lead to a significant restructuring of both companies’ portfolios and market strategies. This merger positions Xerox to expand its presence in the A4 segment, leveraging Lexmark’s established reputation in SMB and enterprise markets. Ricoh and Toshiba’s integration of R&D efforts will likely result in innovative products and enhanced workflow solutions, while the Fujifilm-Konica Minolta joint venture seeks to optimize procurement strategies and reduce operational costs.

Additionally, the industry will continue to keep a close eye on efforts from Fujifilm and Katun. Fujifilm’s continued expansion into Western markets could intensify competition, although the brand may still be challenged to build out its channel network. Additionally, Katun’s entry into the global market introduces new competition, as the company seeks to establish itself in the crowded and mature market.

Overall, 2025 will be a year of significant change, marked by competitive pressures, portfolio realignments, and strategic corporate moves. Manufacturers that effectively navigate pricing complexities, leverage new partnerships, strengthen existing partnerships, and capitalize on emerging opportunities will be well-positioned for success in this evolving market.

Get more information

About the Author

Valerie Alde-Hayman

Val is a Senior Analyst at OpenBrand. With over 12 years of experience, she has established a reputation for delivering insightful analysis and thought leadership, while helping organizations navigate the complexities of the print market. With a deep understanding of industry trends and technological advancements, Valerie has contributed significantly to the field, sharing expertise through numerous publications, presentations, and consultations.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…

Refrigerators: 2025 Year-In-Review

Our Refrigerators: 2025 Year-in-Review report recaps product launches, placements, pricing and…