The Outdoor Power Equipment market continues to evolve at a rapid pace, reshaping how consumers shop, which brands they trust, and what drives their purchase decisions.

From the strength of big-box retailers and dealer networks to the steady rise of online sales, the data reveals an increasingly competitive landscape where market leaders are widening their edge and challengers are finding new ways to compete.

Our public MarketSignal dashboard brings these shifts into focus, offering an interactive view of retailer performance, brand share, pricing trends, and consumer behavior.

In our breakdown below, learn why:

- Walmart is winning attention but losing the sale, signaling major conversion opportunites in pricing, assortment, and fulfillment.

- Ego is punching above its weight, delivering top-three share despite lagging in consumer awareness.

- Home Depot and Lowe’s are still the class of the OPE category, powered by Ryobi’s volume machine at Home Depot and Craftsman/Ego strength at Lowe’s.

- Women and Millennials are reshaping demand, driving interest in battery ecosystems, smart features, and more inclusive product positioning.

Explore these and the rest of our latest insights or dive into the dashboard to see how the market is moving.

SOURCE: All data insights in this article cover Q2 2025 within an OpenBrand aggregate category of several products including Mowers, Handhelds, Snow Throwers and Pressure Washers.

Who are the top Outdoor Power Equipment retailers by market share?

The top Outdoor Power Equipment retailers in 2025 remain Home Depot and Lowe’s, leading in both unit and dollar share – with Amazon and Walmart gaining ground.

Note: OpenBrand’s share split is based on our retailer panel, which currently consists of Home Depot, Lowe’s, Amazon, Walmart, and Best Buy. These retailers make up a majority of non-individual dealer sales in the OPE industry. More retailers are coming soon.

Outdoor Power Equipment Retailer Unit Share Winners

| Outdoor Power Equipment Retailer | Q2 2025 Unit Share |

| Home Depot | 38% |

| Lowe’s | 30% |

| Amazon | 16% |

| Walmart | 15% |

Outdoor Power Equipment Retailer Dollar Share Winners

| Outdoor Power Equipment Retailer | Q2 2025 Dollar Share |

| Home Depot | 41% |

| Home Depot | 39% |

| Amazon | 10% |

| Walmart | 9% |

OpenBrand’s OPE Retailer Trend Insights

Lowe’s and Home Depot compete for unit and dollar share in OPE; Home Depot’s Ryobi exclusivity heavily influences their place as unit share winner: While Home Depot reigns for most units sold, Lowe’s keeps pace in unit and dollars earned. Ryobi makes up 58% of units sold at Home Depot, with a majority of those units falling in the $499 and below range. Meanwhile, Craftsman and Ego make up 31% and 23% respectively at Lowe’s, accounting for nearly as many units sold at the retailer as Ryobi’s 56% at Home Depot. Correspondingly, Craftsman and Ego both skew into mid to high price brands in their sales at Lowe’s.

Amazon dollar share sees YOY stability after growth, lightly driven by Prime Day events in July and Oct. Amazon’s share YoY remains flat, however they saw a 4 percentage point growth in unit share from Q2 2024 to Q4 2024, likely indicating the success of their heavy promotional periods from Prime Day in Q3 to Prime Big Deal Days and Black Friday/Cyber Week in Q4.

| Amazon | Q2 24 | Q3 24 | Q4 24 | Q1 25 | Q2 25 |

| Dollar Share | 9.5% | 10.5% | 13.5% | 11% | 9.7% |

| Unit Share | 16.6% | 17.4% | 18.4% | 18.1% | 16.1% |

Outdoor Power Equipment Retailer Draw Rates

Our top market leaders also continue to lead in outlet draw rate, with:

- Home Depot drawing in 42% of all Outdoor Power Equipment purchasers

- Lowe’s drawing in 36%

- Walmart following as the third most considered outlet at 19%

OpenBrand’s OPE Retailer Trend Insights

Walmart beats Amazon in draw rate – but not in market share: Walmart attracts nearly one in five Outdoor Power Equipment shoppers, outperforming Amazon in initial consideration. Yet despite its strong draw rate, Amazon’s equal close rate of 68% gives it an edge in converting interest to actual sales, highlighting Walmart’s opportunity to strengthen conversion through assortment, pricing, or fulfillment advantages.

Home Depot closes the same percent of shoppers as Amazon: Home Depot continues to lead the category in reach, drawing 42% of Outdoor Power Equipment shoppers and closing 68%. Notably, Amazon matches this 68% close rate — despite drawing in just 14% of shoppers — signaling untapped potential. If Amazon can expand its shopper base, even modestly, its ability to convert at Home Depot–level efficiency could translate into meaningful share gains in the quarters ahead.

For more insights on draw and close rates – and to see who is stealing the shoppers lost by the leading retailer — check out our quarterly Outdoor Power Equipment MarketSignal dashboard.

Who leads the Outdoor Power Equipment market share by brand?

The top three Outdoor Power Equipment brands are Ryobi, Craftsman, and Ego.

Outdoor Power Equipment Brand Unit Share Winners

| Outdoor Power Equipment Brand | Q2 2025 Unit Share |

| Ryobi | 22% |

| Craftsman | 10% |

| EGO | 9% |

Outdoor Power Equipment Brand Dollar Share Winners

| Outdoor Power Equipment Brand | Q2 2025 Dollar Share |

| Ryobi | 13% |

| EGO | 11% |

| Craftsman | 9% |

For more brand share insights, including share trend over time, access our public OPE dashboard now.

OpenBrand’s OPE Market Trend Insights

Ryobi dominates in unit share, but sells at a lower price point: With over 10 ppt more in unit share than the second and third leading OPE brand, Ryobi wins these sales with a lower price point, with 60% of sales coming in at the lowest price band ($499 and below). Notably, Ryobi did see a 3 ppt growth from Q1 to Q2.

Ryobi leads the market, despite being exclusive to Home Depot: Ryobi continues to hold the top spot as Outdoor Power Equipment brand winner, capturing 21% of unit share and 13% of dollar share — all through a single retail partner, Home Depot. Its dominance underscores the strength of Home Depot’s channel reach and Ryobi’s appeal among value-driven shoppers. Even without a multi-retailer presence, Ryobi’s combination of accessibility, breadth of lineup, and competitive pricing keeps it well ahead of broader-distributed rivals like Ego and Craftsman.

Brand Consideration Rates

When purchasing Outdoor Power Equipment, consumers consider the following three brands most often:

| OPE Brand | Brand Consideration Rate |

| Ryobi | 14% |

| Craftsman | 11% |

| Black & Decker | 8% |

| Toro | 8% |

| Stihl | 8% |

| DEWALT | 8% |

OpenBrand’s OPE Market Trend Insights

Ego ranks high in share but lags in consumer consideration: Despite holding a spot in the top three Outdoor Power Equipment brands for unit and dollar share, Ego doesn’t appear among the six most-considered brands, signaling low top-of-funnel visibility. This gap suggests that while Ego performs strongly once shoppers reach the purchase stage, likely driven by premium positioning and retailer partnerships, its overall awareness and early-stage influence trail behind competitors like Ryobi, Craftsman, and DEWALT. For Ego, growing mindshare could be key to sustaining its market momentum.

Ego captures Ryobi’s lost shoppers despite low consideration: Even though Ego isn’t among the top six most-considered Outdoor Power Equipment brands, it still captures 9% of Ryobi’s lost shoppers, a notable win given Ryobi’s 25% walk rate. The trend highlights Ego’s strength in converting late-stage buyers, often those trading up for higher performance or premium features, despite weaker early-stage awareness. Increasing visibility earlier in the purchase journey could help Ego translate this conversion efficiency into broader share growth.

Explore the drivers and promotions data that may impact low conversion rates in our quarterly Outdoor Power Equipment MarketSignal dashboard.

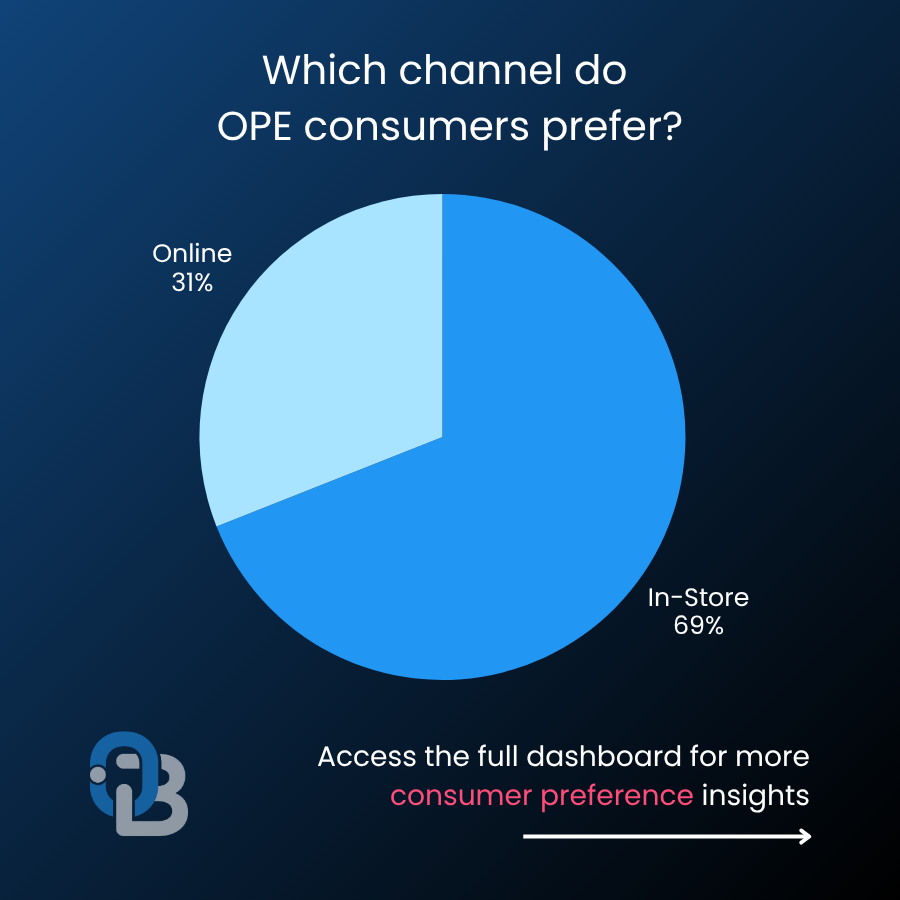

How are online and in-store sales trending for the Outdoor Power Equipment market?

In Q2 2025, brick-and-mortar stores continued to dominate OPE sales, though online purchases have carved out nearly a third of the market:

- In-store: 69% of purchases

- Online: 31% of purchases

OpenBrand’s OPE Channel Trend Insights

Online Can’t Be Ignored: In-store remains the dominant channel for Outdoor Power Equipment sales, capturing 69% of purchases. However, the 31% of sales happening online signals a major behavioral shift. Amazon’s growing influence in this space is driving much of that movement, reshaping expectations for pricing visibility, delivery speed, and post-purchase support. Brands that align their omnichannel strategy — maintaining consistent pricing, strong digital merchandising, and seamless BOPIS integration — are best positioned to capture the next wave of online-driven growth.

Outdoor Power Equipment Consumer Demographics

OpenBrand’s long-standing consumer tracking survey delivers census-balanced market insights that highlight the typical Outdoor Power Equipment buyer.

As of Q2 2025, Outdoor Power Equipment consumers showed the following traits:

- 76% of purchasers are homeowners, 21% rent

- 56% of purchasers are married

- 69% of purchases were made with males only in the buying process; 31% were made with female only

- 30% of purchases were made by Millennials, coming in just above Gen X buyers (29%)

OpenBrand’s OPE Consumer Trend Insights

OPE buying remains male-dominated, but opportunity exists: Nearly seven in ten OPE purchases involve men as the sole decision-makers. However, a significant 31% are driven by women. As female homeownership and DIY participation grow, expanding product messaging and retail experiences to resonate beyond traditional male audiences could unlock incremental growth.

Homeowners remain the engine of OPE sales: With 76% of purchasers owning their homes, OPE demand continues to be rooted in property maintenance and improvement, signaling that replacement and seasonal upkeep remain key purchase triggers. As rental rates rise nationally, the category’s dependence on homeownership underscores the importance of targeting stable, higher-income households.

OPE Purchase Drivers

Why do consumers select a specific retailer for purchase? The most mentioned reasons for purchasing Outdoor Power Equipment at a specific retailer were:

Why consumers select a specific retailer

- Competitive price — 52%

- Good selection of products — 31%

- Convenient location — 25%

- Previous experience with store — 21%

OpenBrand’s Trend Insights

Value wins in Outdoor Power Equipment retail: More than half of OPE shoppers (52%) cite competitive pricing as their top reason for choosing a retailer, reinforcing the importance of affordability in this category. This price-first mindset aligns with Ryobi’s leadership at Home Depot, where the brand’s dominance in sub-$499 products fuels both shopper traffic and unit share. In a market where cost-conscious homeowners dominate, accessible pricing remains a decisive edge.

OPE Industry Outlook and Emerging Trends

What’s next for the US Outdoor Power Equipment market in 2025?

Looking beyond Q1 2025, several factors are shaping the Outdoor Power Equipment market:

- Sustainability and compliance reshape product strategy: The future means cleaner OPE. Battery-powered equipment continues to gain ground as states tighten emissions rules and phase out gas engines. Brands with mature battery ecosystems are best positioned to meet new standards and capture eco-conscious demand.

- Robotics and automation move from novelty to necessity: Advancements in robotic mowers and connected “smart” tools are redefining the category. As labor costs rise, both homeowners and pros are turning to automation for efficiency and convenience. We can expect to see more higher-capacity battery packs, faster charging, with an emphasis on durability and premium features like bluetooth and smart app compatibility.

- Omnichannel execution grows in importance: In-store still dominates, but online sales continue to climb, with Amazon’s equal close rate to Home Depot shows its potential to gain share. Consistent pricing, strong digital merchandising, and BOPIS integration will separate winners from followers.

- Margin pressure accelerates brand consolidation: Electrification, software integration, and compliance costs are raising barriers to entry. Expect more focus on platform ecosystems, fewer redundant SKUs, and tighter alignment between brands and retail partners to protect profitability.

Get more insight into Outdoor Power Equipment market trends

The market insights don’t stop here.

For more retail sales data, market share, and insights on the Outdoor Power Equipment industry, access the Outdoor Power Equipment MarketSignal dashboard now.

To see insights for other industries or find out how we can help power growth for your business, contact us today.

Ashley Jefferson

Ashley is the Demand Generation Manager at OpenBrand. She's a seasoned marketing professional with over 9 years of experience creating content and driving results for B2B SaaS companies.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…

Refrigerators: 2025 Year-In-Review

Our Refrigerators: 2025 Year-in-Review report recaps product launches, placements, pricing and…

Notebooks: 2025 Year-In-Review

Our Notebooks: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…