The 2024 TV market witnessed dynamic shifts driven by innovative product launches, strategic advertising, and intensified competition across key brands and retailers. From Samsung’s expanded OLED and Micro LED portfolios to disruptive entries by Sansui and Panasonic, brands demonstrated a strong commitment to meeting diverse consumer demands. Meanwhile, seasonal sale events and quarterly advertising trends highlighted fluctuating strategies aimed at maximizing visibility and engagement.

Read through all the 2024 pricing and promotions insights below or email the report to read later.

Methodology

Data included in this report is sourced from the OpenBrand Televisions categories. Data in this analysis (except for advertising data) was captured between Q1 2023 (week of January 1) and Q4 2024 (week of December 8). Advertising data runs through December 31, 2024. Retail advertisements include Banner Ads and Retail Circulars captured at retailers and their dot com counterparts (i.e. Staples and Staples.com). The merchants were updated to only the brick-and-mortar name regardless of channel for simplicity (i.e. any Staples.com ads were updated to Staples). Additionally, the following advertising section features SKU-specific ads.

Product Launches

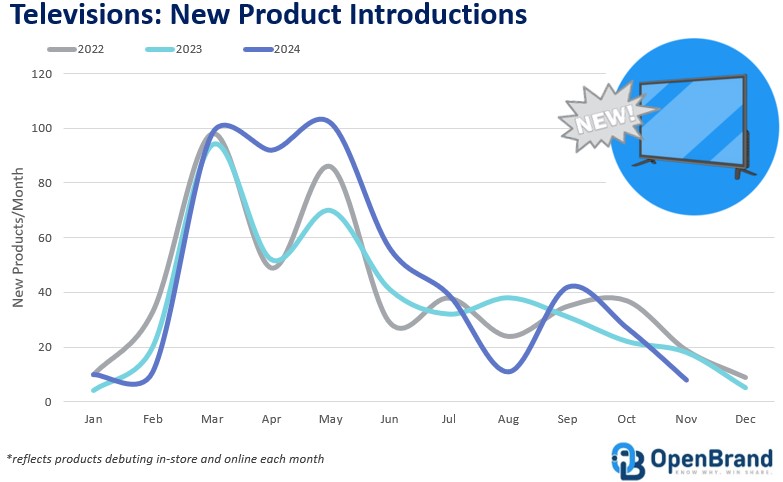

2024 brought robust product introductions from brands across the TV market. By December, TV launches were up 16% YTD despite the fall season bringing a slowdown.

Samsung was responsible for 29% of the new debuts in 2024, 3 points ahead of its share one year ago, while LG was responsible for 15% of the new debuts in 2024, exactly the same as its share from the prior year. Hisense and TCL have similar 11% shares of 2024’s new debuts, a YoY uptick of two points for Hisense and a downturn of three points for TCL.

Samsung

Samsung unveiled its 2024 OLED and Neo QLED TV lines early in the year. Its OLED split between three series, and its QLEDs split into six separate series. The OLEDs feature glare free viewing and QLEDs boast AI enhancements.

The brand expanded its OLED TV portfolio with new launches later in the year by announcing the OLED S85D series and additional sizes for the S90D. The S85D joins as entry-level options in 55”, 65”, and 77” options. New 42” and 48” sizes for the S90D extend both the entry point and high end of series, and both expansionary lines cater toward gaming use cases.

In the back half of 2024, Samsung expanded its Micro LED TV portfolio. Samsung’s Micro LED TV lineup includes new 89”, 101”, and 114” sizes priced at $109,999, $129,999, and $149,999, respectively and hit the market in September 2024. Distribution of Samsung’s prior Miro LED TV was limited to BestBuy.com and ABT.com, and the new entries compete against high-end luxury TVs by appealing to tech-enthusiasts.

LG

LG revealed its 2024 QNED TV lineups at CES 2024, including QNED99, QNED90, QNED85, and QNED80. An ultra-large 98”QNED joined the product mix to expand LG’s premium stance. Features of the 2024 generation are led by new AI-equipped processors: α9 8K and α8 4K. LG also revealed 2024 OLED TV lineups including the M4, G4, C4, and B4. These feature new AI-equipped processors, the α11 and α9 4K. The OLED lineup is sized 42” up to 97” and led by VRR up to 144Hz and Dynamic Tone Mapping Pro.

Hisense

Hisense started the year by debuting robust 2024 ULED and ULED X TV lineups, including 98” and 110” ULED X TV to serve as flagship models. The ULED Mini LED TVs include U8, U7, and U6 series, with headlining features like increased brightness, better contrast, and new AI processors. The lineup features an emphasis on ultra-large sizes.

Later in the year, Hisense introduced new premium TVs including the CanvasTV and U9N Mini-LED QLED Google TVs. The 55” and 65” CanvasTVs are designed for artwork, feature matte finish, and hit the market priced at $999 and $1,299, undercutting Samsung’s The Frame series. Meanwhile, the U9N series comes in 75” and 85” with price tags of $2,999 and $3,999, positioned for tech-enthusiasts

TCL

The first 2024 TV lineup announced by TCL includes QD Mini LED, Q Class, and S Class. The brand’s 115” QM891G was billed as the “world’s largest Mini LED TV,” and AIPQ processors are found across the new line, yielding increased brightness and enhanced color as central benefits.

Mid-year, TCL introduced a new series, the NXTFRAME TV, which are its art-focused frame-style models. They are the first product created in partnership with Danish AV brand Bang & Olufsen, and TCL meets Samsung and Hisense as direct competitors in frame-style segment.

In the fall, TCL also showcased QD-Mini LED TV lineups for global audiences at IFA 2024. TCL’s X11H QD-Mini LED TVs are the current pinnacle of its large-size product portfolio at, and along with the C765 series, they gained a European release after debuting previously in China. Both QD-Mini LED TV series’ are led by a wealth of local dimming zones and impressive peak brightness, giving a previous of the brand’s priorities for its next generation.

Sony

In the springtime, Sony introduced its new TV lineups for 2024. The brand’s big move was to simplify its BRAVIA branding and TV portfolio naming structure. Sony 2024 TV lineup spans across four product families, yielding 16 different models. BRAVIA 9 and BRAVIA 7 are Mini LED, BRAVIA 8 is OLED, and BRAVIA 3 is LED. The new generation emphasizes brightness, dimming zone control, and power savings.

Vizio

Vizio was another brand with new TV models for the spring as it updated its 4K, Full HD, and HD TV Lineups for 2024. The brand’s 4K series starts at 43” and includes its first 86” model, priced at $999. The full refreshed lineup continues Vizio’s sub-$1,000 alignment as a value brand.

Skyworth

Skyworth also joined the focus on art-inspired TVs by announcing a duo of C1 Canvas Art TVs at CEDIA Expo 2024. The lineup competes online with a growing array of other art-focused TVs that follow Samsung’s The Frame in the market. The TVs have an ultra-thin design with customizable frame and matte screen, plus an Art Time mode that offers 150+ artworks and Dolby Vision.

Sansui

Sansui launched a disruptive OLED TV with aggressive pricing and advanced features in the second half of 2024 as a net new entry into the market segment. Sansui’s 55″ OLED TV is priced at $799, significantly undercutting rivals like LG and Samsung. The strategy makes high-end OLED technology accessible to more budget-conscious consumers. It is designed to disrupt the OLED market, possibly pressuring rivals to adjust their pricing strategies, but Sansui’s lower brand recognition will be a hurdle to overcome. Its OLED TV includes an AI-powered karaoke feature that removes vocals from YouTube videos in real-time.

Panasonic

Another disruptive move was Panasonic returning to the US TV market, which it announced at IFA 2024. Panasonic returned to the US market after a 10-year absence with OLED and Mini LED Fire TVs. The brand aims to meet demand for high-quality picture TVs and reestablish itself via Amazon and Costco channels. The flagship Z95A OLED features premium audio from Technics and Micro Lens Array technology.

Amazon and Roku

Both Amazon and Roku worked this year to elevate their TV portfolios after their relatively recent entrance into the market as actual hardware brands in recent years. Amazon launched a Fire TV Omni Mini-LED Series as its most advanced TVs, starting at $819.99, marking its first use of Mini LED technology. The TVs have AI-driven picture optimizations, and gaming support, plus motion-responsive art displays that provide fun ambient experiences. They are feature-rich, budget-friendly options for gamers, smart home users, and everyday viewers.

Roku meanwhile unveiled its Pro series TVs in 55”, 65”, and 75” sizes. The Pro series is positioned as a step-up to Roku’s Select and Plus, offering AI tech and elevated style to buyers, while widening its product portfolio.

Impactful Occurrences in 2024’s TV Market

Big Screen TV Market Got Bigger in 2024

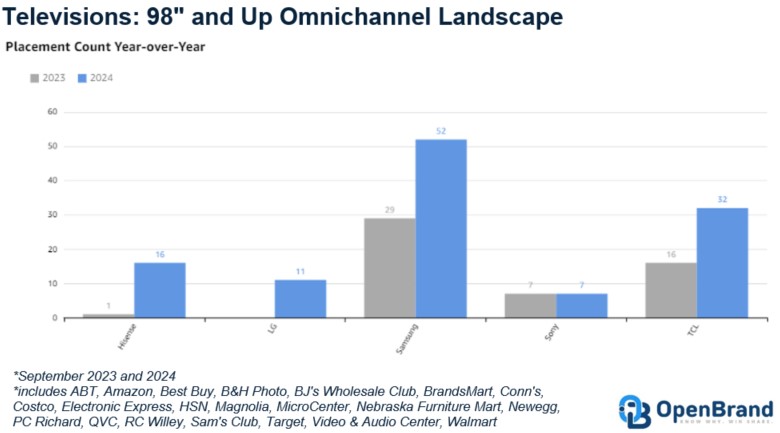

The 98” and up segment of the TV market more than doubled in size YoY (from 53 to 118 SKUs), reflecting growing awareness, budding brand involvement, and falling prices within the ultra-sized arena.

While LG entered the segment to give heightened brand diversity, Samsung remained the dominant player in 98” and up with its placements increasing from 29 in 2023 to 52 in 2024, marking a 79% growth YoY as its Micro LEDs set the upper threshold of the sector. TCL experienced a significant rise, doubling its placements from 16 in 2023 to 32 in 2024, and remains an aggressive competitor with some of the segment’s top discounts, currently averaging a 37% off discount rate, just one point under Hisense. Hisense saw the most significant growth YoY, skyrocketing from just one placement in 2023 to 16 in 2024, reflecting broader ULED and QLED lineups in the market as brand renown continues to grow. Sony remained consistent, with no change in its placement count, holding steady at seven placements in both 2023 and 2024, illustrating its well curated product portfolio.

Roku Grew its Market Exposure in 2024

After first debuting in the TV market during March 2023 as an exclusive brand for Best Buy, Roku spent 2024 visibly expanding the availability of its models. Roku TVs expanded onto Walmart.com, which opened up a huge new opportunity for Roku to connect with buyers as the brand’s third new merchant account. This came after breaking beyond its Best Buy exclusivity and joining Amazon.com and Costco.com. By mid-year, Roku then carved out space inside Target stores, giving the brand its first establishment inside the national mass merchant. Later in the year, Roku gained Nebraska Furniture Mart as a net new online account with models ranging from 32” up to 55” that diversified the merchant’s sub-$800 TV assortment. The new account opened up additional opportunities for sales for the later portion of 2024.

Walmart Completed $2.3 Billion Vizio Acquisition

The deal, which was announced in February of this year, bolsters Walmart Connect, Walmart’s retail media business, by incorporating Vizio’s lucrative advertising and data platform, Platform Plus, which generates all of Vizio’s gross profit. This integration is expected to enhance Walmart’s ability to target ads across platforms like Disney+ and Hulu, and potentially expand advertising on Vizio TVs through the brand’s SmartCast OS, which has over 18 million active accounts. Walmart sees the acquisition as a key step in scaling its advertising capabilities while maintaining Vizio’s focus on affordable, innovative home entertainment products. Walmart’s strengthened position in the ad-supported TV market, allows it to compete more effectively with players like Roku, Amazon Fire TV, and other emerging platforms.

Timeline of Seasonal Sale Events

Seasonal sale events in 2024 showcased a dynamic landscape of shifting strategies, competitive advertising, and evolving discount trends. While advertising volume fluctuated, with declines for the Super Bowl but growth on Black Friday, discount levels consistently edged higher year-over-year, reflecting intensified efforts to attract deal-savvy shoppers. Samsung, TCL, Hisense, and other major players led the charge in offering deeper discounts and dominating ad placements, underscoring a competitive push to stand out in an increasingly crowded marketplace.

Super Bowl

Advertising volume leading into Super Bowl 2024 declines 9% YoY

Best Buy remains top retailer for Super Bowl deals, solidified by ad count increase of 2% YoY

Samsung leads a collection of 10 participating brands for 2nd consecutive year

Discounts during period averaged 23%, 3 points ahead of last year, & ranged up to a higher 70%-off

July Prime Day

Overall average Prime Day 2024 discount across brands was 29% off; +1 point YoY

Amazon led deal count with 16 TVs, Hisense led discounts w/ 40% off

Amazon’s Prime Day 2024 spurs competing sale events from major online merchants intent to capitalize on increased deal awareness during the week

October Prime Big Deal Days

Overall average discount across brands was 26% off, 4 points up YoY

TCL leads deal count, Vizio and Samsung lead event discounting

Amazon’s Prime Big Deal Days 2024 spurs competing sale events from major online merchants intent to capitalize on increased deal awareness during the week

Black Friday

Black Friday 2024 TV advertising up 8% YoY for event (280 vs. 260 ads)

Overall average instant savings discount level of 28% off is one point deeper than last year’s 27% off average

Samsung remains most active Black Friday TV advertiser for fifth consecutive year

BJ’s Wholesale Club has the most active Black Friday TV ads for second consecutive year

Cyber Week

61% of all TVs were on sale during Cyber Week 2024, 15 points lower saturation vs. 2023

Overall average discount level of 28%, in line with last year

Sharp, Hisense, and TCL top average savings landscape with 31% to 35% off

Quarterly Advertising Activities

Quarterly advertising volume in 2024 brought fluctuating totals, but persistent leadership by top brands and retailers. While overall advertising volumes faced year-over-year declines in Q1 and Q2, a rebound emerged in Q3. Peaks in advertising activity aligned with major seasonal events, including the Super Bowl, the lead-up to summer, and an early Black Friday push, reflecting strategic timing to maximize consumer engagement.

Q1 2024 advertising total down 9% YoY, down 25% QoQ

- Samsung and LG maintain leadership of advertising; pair responsible for 66% of all Q1 2024 ads

- Peak advertising activity comes during lead up into Super Bowl, the again for March Madness

- Best Buy is dominant Q1 2024 advertiser w/ 66% share, unchanged YoY, up 15 points QoQ

Q2 2024 advertising total down 17% YoY, down 2% QoQ

- Samsung and LG maintain leadership of advertising; pair responsible for 59% of all Q2 2024 ads

- Advertising activity peaks early in Q2 2024, then momentum builds into summertime

- Best Buy is dominant Q2 2024 advertiser with 74% share, up 8 points YoY and QoQ

Q3 2024 advertising total down 2% YoY, up 19% QoQ

- Samsung and LG maintain respective 1 and 2 rankings QoQ & YoY; pair responsible for 57% of all Q3 2024 ads

- Samsung commands lead in early Q3, LG and TCL ramp up efforts to close the quarter

- Best Buy is dominant Q3 2024 advertiser w/ 65% share, down 3 points YoY, down 9 points QoQ

Outlook for 2025

The TV market in 2025 is poised for further evolution as brands continue to push technological boundaries and adapt to shifting consumer preferences. Expect advancements in OLED, QLED, and Micro LED technologies, with increased accessibility through competitive pricing and expanded product lineups. The ultra-large screen segment will likely see continued growth as brands like Samsung, LG, Hisense, and TCL fortify their premium offerings. Advertising strategies may become more data-driven and tailored, with retailers and brands leveraging their platforms to target niche audiences effectively. Upcoming moves from emerging players and ongoing innovation in art-inspired and gaming-centric TVs will keep competition fierce, while sustainability and energy efficiency could emerge as key themes shaping product development and consumer priorities.

Promotional activity is expected to intensify into 2026

As competition across the television market continues to grow, manufacturers and retailers are likely to deploy more aggressive discounting strategies and enhanced value propositions to capture consumer attention. This heightened promotional activity could lead to a reduction in average prices as players compete for market share.

TV Market Pricing Trends Carry Uncertainty

However, pricing trends remain uncertain due to external economic factors. While competition may drive prices down, the potential for tariffs or changes in trade policies could exert upward pressure on costs, particularly for imported products. These conflicting forces highlight the importance of strategic pricing management to balance competitiveness with profitability. These shifts could also affect product launch activity.

Manufacturers and their channel partners should remain agile in navigating this dual dynamic. Investing in data-driven promotional strategies and leveraging omnichannel visibility will be key to staying competitive while managing cost pressures effectively. As the market evolves, pricing and promotional strategies, as well as product value propositions, will play a pivotal role in shaping outcomes for both manufacturers and consumers.

Get more TV market data

OpenBrand is the leading provider of market data for the TV industry. For more insights, download the full report and contact our team today.

About the Author

Scott Peterson

Scott is a senior analyst here at OpenBrand. Since 2010, Scott has supported the strategic efforts of the world's top brands, and is recognized for his thought leadership in the industry. Over the years, his insights have been showcased online, in print, and on television, lending authority and expertise to countless productions. Holding previous management positions at both national and specialty retailers forged Scott's deep understanding of the channel and end-user perspectives.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Price Forecasts for Durables in 2026: Consumer Electronics, Appliances & Home Improvement

Modest inflation will drive incremental durables market growth in the year ahead As short-term…

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…