The Quiet Revolution: Why Gas-Powered OPE is Losing Popularity

The outdoor power equipment (OPE) market is undergoing a fundamental transformation.

Historically reliant on small gas engines, the industry is now shifting toward battery-powered solutions, driven by breakthrough battery technologies, changing consumer preferences, and tightening noise and emissions regulations (such as California’s ban on gas-powered OPE).

From lawn mowers and chainsaws to line trimmers and leaf blowers, electrification is reshaping how both consumers and professionals power their landscaping and yard maintenance tasks.

In fact, as of 2024, cordless outdoor tools now command over 60% of OPE unit sales, dramatically reshaping the retail landscape.

Brands once synonymous with gasoline are scrambling to keep pace as battery-powered innovators take the lead.

But how did we get here? As OpenBrand’s OPE category expert, I took a look at the electrifying story behind this shift from a data-driven, analytical view to explore why the future of outdoor power equipment is quieter, cleaner, and cordless.

Read a summary of my findings below, and download my full analyst deep dive report now for all the insights and data.

Have a question for our analysts?

Get the market data needed to support your business goals, trend data to guide strategic decisions, and more.

Here’s what we’ll dive into in this post:

- From Gasoline to Batteries: What’s Powering the Change?

- Who’s Winning the Lawn Wars? Meet the New Leaders

- Battery Breakthroughs: Why Cordless Tools Compete and Win

- Are Consumers Paying More for Less Noise? Pricing Trends Explained

- Challenges Ahead: Will Tariffs Slow the Electrification Wave?

- Your Customers’ Future is Cordless—Here’s How to Prepare

From Gasoline to Batteries: What’s Powering the Change?

The shift toward cordless/battery-operated models has been observed across all OPE categories tracked across Best Buy, Lowe’s, Home Depot, and Walmart in recent years.

The shift from gasoline to battery-powered outdoor power equipment (OPE) has been accelerated by a range of environmental, regulatory, and practical factors. Regulatory mandates, notably California’s 2024 ban on the sale of new small off-road gas engines (SORE), have accelerated industry-wide shifts toward electrification. Environmental concerns and noise ordinances are also motivating consumers and municipalities to seek quieter, cleaner alternatives to gas-powered tools.

Additionally, advancements in battery technology have significantly boosted performance, runtime, and user convenience, creating a strong market preference for cordless solutions.

Who’s Winning the Lawn Wars?: Meet the Current OPE Leaders

OpenBrand’s MarketShare data from 2021 to 2024 underscores a clear and sustained shift toward cordless OPE models across all major categories.

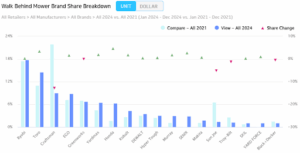

Ryobi consistently strengthened its position as the leading brand in mowers, handhelds, and snow removal, largely driven by its cordless portfolio, achieving over 15% total mower retail unit share in 2024 and dominating cordless walk-behind mowers with approximately 37% share.

Traditional gas-powered brands like Craftsman and Husqvarna saw significant declines in unit share, with Craftsman’s mower share notably falling from 19% in 2021 to 8% in 2024, reflecting broader market momentum away from gas.

Emerging players such as EGO, Cub Cadet, and Greenworks also captured share gains, signaling increased competition and consumer preference for battery-powered alternatives.

For market share leader breakdown by category, get the full report.

Battery Breakthroughs: Why Cordless Tools Compete and Win

Recent advancements in battery technology have dramatically increased performance, runtimes, and convenience, making cordless OPE highly competitive with traditional gas-powered tools. Modern battery platforms like Greenworks 60V, EGO 56V, and Ryobi 40V offer consumers fast-charging, high-power solutions and interchangeable battery systems that encourage loyalty and cross-category purchases.

Are Consumers Paying More for Less Noise?: Pricing & Promotional Trends

Cordless products were generally priced lower than gas products, but the price gap narrowed over time as premium cordless models gained popularity.

Between 2021 and 2024, average prices for cordless chainsaws, hedge trimmers, and leaf blowers increased to align more closely with gas models. This alignment reflects consumers’ willingness to invest more upfront for the added benefits of reduced noise, simpler maintenance, and environmental advantages.

Promotional activity captured across major retailers in March 2025 reflects a highly competitive market environment as the industry prepares for the spring shopping season.

The Home Depot, Ace Hardware, and Lowe’s are aggressively promoting battery-powered OPE products, focusing on price discounts, bundled tool and battery kits, and loyalty program offers.

For promotional breakdown by retailer, get the full report.

Challenges Ahead: Will Tariffs Slow the Electrification Wave?

The introduction of U.S. tariffs in 2025, targeting lithium-ion batteries, electric motors, and steel components, presents significant challenges for cordless equipment manufacturers.

Brands heavily reliant on Asian manufacturing (e.g. EGO, Ryobi, Greenworks, Toro, and DeWalt) are particularly vulnerable to cost pressures. These tariffs, ranging from 20% to 25%, could increase production costs and potentially slow consumer adoption in price-sensitive categories, posing strategic challenges for brands and retailers.

However, despite these disruptions, the overall momentum toward electrification is expected to continue.

Your Customers’ Future is Cordless: Here’s How to Prepare

Brands and retailers should proactively adapt to this cordless future by expanding their battery-powered assortments and investing in system-based platforms.

Some manufacturers have already responded aggressively to market shifts. In 2023, Honda announced it would cease production of gas-powered lawn mowers, underscoring the industry’s pivot toward battery-powered equipment.⁶ Leading brands like EGO, Ryobi, Greenworks, Toro, Craftsman, and Milwaukee continue to expand their cordless offerings, improve battery performance, and promote ecosystem-based platforms.

Looking forward, analysts project a compound annual growth rate (CAGR) of 6.5% to 8% for battery-powered OPE through 2030.⁵ Battery products are expected to dominate the residential market within five to ten years, with commercial applications following soon after. Future innovation will likely focus on modular battery systems, improved diagnostics, and smart features.

Brands should continue to shift focus to emphasizing bundled promotions and loyalty-driven discounts that can attract consumers looking for value and ease of use.

Finally, continuing to monitor and understand evolving market trends, regulatory shifts, and consumer preferences will be crucial to capitalizing effectively on this market transformation and maintaining a competitive advantage. If you’d like to see how OpenBrand can help your business get ahead of future shifts, reach out at openbrand.com/contact.

Get Our Free Analyst “Electrification of OPE” Report

For more insights into the electrification of outdoor power equipment download our full analyst report today. The extended report includes:

- Detailed market share breakdowns, by category

- Geographic adoption patterns

- Retailer promotional strategies

- The full analysis of how new tariffs could impact top industry brands

Discover exactly what’s powering the shift, and how you can stay ahead in a rapidly evolving market. Have a question you’d like to ask me about this review or other industry data? Ask it here!

Access the report now

About the Analyst

Adrienne Spear

Adrienne Spear is a Senior Analyst with OpenBrand, having been with the company (formerly gap intelligence) since 2016. Previously, her focus was on the printer supplies market in the US. Adrienne has recently moved into the role of OpenBrand’s first analyst for the OPE categories, providing support for customers across the industry through custom projects, presentations, and analyses via the company’s Competitive Intelligence Services.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Price Forecasts for Durables in 2026: Consumer Electronics, Appliances & Home Improvement

Modest inflation will drive incremental durables market growth in the year ahead As short-term…

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…