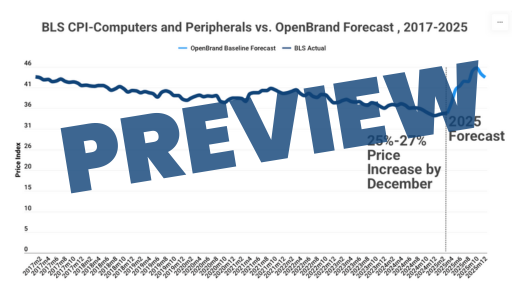

Pricing / CPI Forecasting

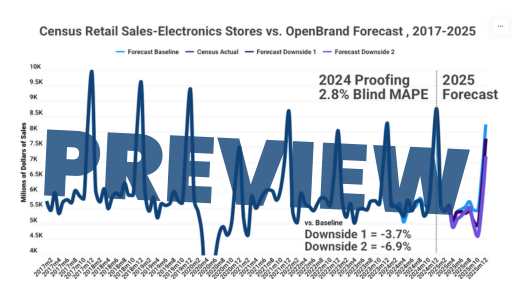

Retail Channel Sales Forecasting

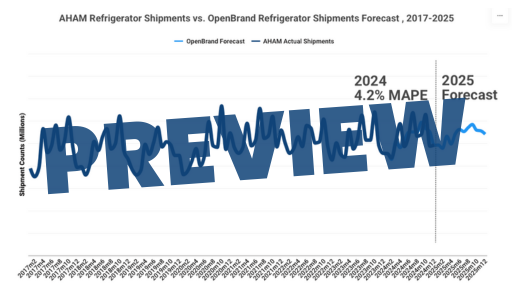

Shipments Forecasting

BYO Data Forecasting

Empowering stronger demand planningthrough accurate economic forecasts

Plan strategically, assess market risks, and optimize pricing, sales, and supply chain decisions with ease through highly accurate, scenario-based models. With forecasting available across pricing, retail channel sales, and shipments, companies gain a comprehensive, flexible view of market dynamics to drive smarter, faster business decisions.

INTELLIGENT & HIGHLY-ACCURATE

Our Economic Forecast Model

How our model delivers more accurate results

OpenBrand employs a neural net-based forecasting model, which operates more like a human brain, learning from historical patterns and correcting for past forecasting errors.

OpenBrand Forecasting Model Advantages

Faster processing, with solutions generated in seconds, rather than hours or days

Higher accuracy than traditional linear models

Scalability, adapting quickly across products, industries, and economic scenarios

Accuracy drives wise investments and policy decisions for our clients

OpenBrand uses Mean Absolute Percentage Error (MAPE) as the standard for measuring forecast accuracy. Lower MAPE values reflect higher forecasting precision, with most forecasts achieving MAPE below 2%.

Our forecasts consistently average just a few percentage points off actual results, giving clients greater confidence in the projections shown.

Three forecast scenario presentations

Plan confidently across a range of macroeconomic possibilities

Each scenario is built using our same neural network model, but tuned with different macroeconomic inputs — allowing you to compare outcomes, pressure-test strategies, and plan with greater resilience.

Baseline

Our best estimate based on current economic signals — the most likely path forward, assuming moderate policy outcomes, continued inflation easing, and stable employment trends.

Pessimistic

More cautious scenario, built for turbulence — including slower trade resolutions, rising deportation activity, higher treasury yields, and inflation reacceleration. Statistically, there’s an 80% chance the real-world outcome will be better.

Optimistic

Forward-leaning scenario, which assumes stronger economic performance — including successful trade deals, faster inflation control, and continued employment strength.

Our forecasting adapts to market shifts

Our economic forecasts adapt in real-time to economic changes, including inflation movements, trade environment shifts, and consumer sentiment variations.

Forecasts are recalibrated monthly and special updates are made in response to significant macroeconomic shifts.

Request a Forecast Preview

See What’s Next.Move First.

Our powerful forecasting suite delivers high-accuracy predictions across pricing, retail channel sales, and shipments — all backed by economic scenario modeling and real-time market responsiveness. We’re redefining how brands and retailers anticipate change, manage uncertainty, and seize new opportunities.

Request a meeting with our Chief Economist to take a look at our forecasting capabilities

INTELLIGENT & HIGHLY-ACCURATE

Forecasting Solutions

Pricing/CPI Forecasts

Market shifts have a direct impact to pricing patterns

Gain a real-time edge in managing pricing strategy, inflation exposure, and vendor negotiations.

OpenBrand’s pricing/Consumer Price Index (CPI) forecast solution is an independent prediction of the BLS consumer price index.

Through an exceptionally accurate projection of future category-level price trends, we help retailers and brands:

Stay ahead of inflation, seasonality & market shifts

Understand the impact of real-world economic conditions

Plan smarter promotional strategies and pricing tiers

Adjust pricing in response to inflation, sourcing, or tariff changes

Support B2B contract negotiations with objective forward-looking data

Validate or challenge internal price assumptions

With low error rates and scenario flexibility, our pricing forecasts help you stay ahead of market shifts — not react to them.

Our CPI forecast is available across various durable goods and personal care categories, with coverage at both the group and sub-group levels (e.g., major appliances, small appliances. etc.) Custom options using your own data are also available. See the full list of groups and sub-groups available.

Retail Channel Sales Forecasts

When market conditions shift, so does consumer demand

Our retail channel sales forecasts help you plan revenue, allocate resources, and assess risk across channels — all backed by proven accuracy and scenario-based optionality.

OpenBrand’s retail channel forecast looks at future sales across major retail sectors — from appliance and electronics stores to warehouse clubs, hardware chains, and eCommerce.

Gain a clear picture of where sales are headed.

Size up market opportunities in specific retail segments

Plan and prioritize channel strategies

Forecast demand under upside / downside economic scenarios

Benchmark sales expectations with independent third-party data

Align marketing and merchandising with projected sales cycles

Our retail sales forecast is built on NAICS and sub-NAICS structures, and updated monthly over a 36-month horizon. It is available across sectors, including appliances, automotive, furniture, electronics, and more. Custom options using your own data are also available. See the full list of groups and sub-groups available.

Shipments Forecasts

The market is volatile and operational challenges are ongoing...

Stay agile with OpenBrand’s shipment forecast solution, which gives brands and retailers a view into how product shipments are trending over the next 12-36 months.

With broader awareness into future-looking order fulfillment numbers, you can better:

Plan production and inventory around expected shipment demand

Align financial investment and budget to industry/category growth or decline

Balance retail delivery volumes

Model supply chain strategies against baseline, optimistic, or pessimistic conditions

Help buyers align inventory levels with supply trends

OpenBrand’s shipment forecast solution delivers projections for industry organization shipment data from organizations, including AHAM, OPEI, and more. Custom options using your own data are also available. See the full list of categories available.

BYO Forecasting

Client Data Integration

Tailored forecasts for your shipment or sales data

Our forecasting model quickly ingests historical data to generate tailored and client-specific shipment and retail sales forecasts, enhancing precision and strategic alignment.

If you have the data, we can forecast it.

Redefining Data in Durables

OpenBrand is the key to clarity. We are shaping the future of the consumer durables industry, combining advanced AI technology and unique data with our rich history as the leading data provider for the durable goods market.

Our ongoing commitment to leverage the latest AI technology – to deliver the most comprehensive market data available – empowers brands and retailers with actionable insights that drive innovation, sharpen their competitive edge, and enable them to anticipate market shifts.

Beyond Economic Forecasting

Total Market Intelligence From OpenBrand

Layer in OpenBrand’s CPI, Market Measurement, and Competitive Intelligence solutions to track performance across brands, channels, and SKUs — and combine it with analyst expertise to understand not just where you stand, but why.

OpenBrand CPI-DPG

Navigate tariff impacts and inflation, with the OpenBrand CPI for Durables and Personal Goods, available monthly

Market Measurement

Monitor market share shifts and understand consumer perception — the complete market picture you need to grow share

Competitive Intelligence

Accurately monitor product, pricing, promotions, inventory, and media presence in real-time — to easily identify opportunities to win

Custom Research

Leverage custom insights and top-tier data support from our expert category analysts — your eyes and ears in the market

Trusted by global brands, retailers, distributors, and suppliers

EXPLORE OUR DATA

Public Quarterly Market Dashboards

OpenBrand’s data is available to the public through MarketSignal, our quarterly overview dashboards, delivering market share, pricing, promotions, and purchase insights.

Read our latest blogs and insights

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Price Forecasts for Durables in 2026: Consumer Electronics, Appliances & Home Improvement

Modest inflation will drive incremental durables market growth in the year ahead As short-term…

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…

Ready to get a pulse on the market?

Get access to OpenBrand’s Market Measurement solution