The Category Moves That Mattered and the Data Behind Them

Most Black Friday and Cyber Monday reporting focuses on headlines and MSRP discounts. OpenBrand goes deeper, delivering real-time pricing and promotion intelligence across dozens of categories – from appliances to TVs, tablets and wearables to name a few.

As the 2025 holiday season winds down, we’ve compiled the standout themes from Black Friday and Cyber Monday, backed by OpenBrand’s data, analysts, and in-store audits.

The 2025 holiday kick-off delivered strong engagement across both Black Friday and Cyber Monday but performance diverged sharply by category, channel, and spend tier.

Here are the top three takeaways shaping the retail landscape:

- Black Friday drove in-store conversions and big-ticket wins across Appliances, Floor Care, Wearables and large TVs. Doorbusters and real-time signage execution separated top-performing retailers from the rest.

- Cyber Monday shifted toward self-upgrading and digital deal-hunting, winning with strength in Tablets, Smartphones and Desktops, especially in price bands under $500.

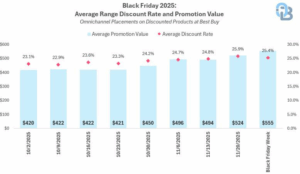

- Pricing precision and promo execution were critical. Retailers who nailed both – Lowe’s in Appliances and Best Buy in CE outperformed the competition relying on static signage or shallow discounts strategies.

Check out our 2025 Holiday Shopping Tracker and continue reading to see some of the category specifics showing up for Black Friday and Cyber Monday.

BLACK FRIDAY INSIGHTS 2025

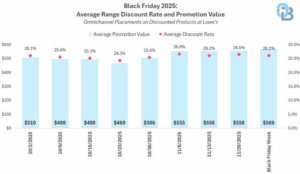

Appliances Made a Major Statement: Lowe’s Led on Price

Lowe’s had the deepest discount rates across major appliance categories during the week of Black Friday outperforming both Home Depot and Best Buy.

- Refrigerators: 28.1% at Lowe’s vs. 24.9% at Home Depot and 26.8% at Best Buy

- Washers/Dryers: 27.8% at Lowe’s vs. 25.9% at Home Depot and 25.0% at Best Buy

- Ranges: 26.2% at Lowe’s vs. 25.1% at Home Depot and 25.4% at Best Buy

These rates, combined with strong entrance placements and Black Friday doorbusters, positioned Lowe’s as the most aggressive among the big three.

Home Depot and Best Buy: Dropping the Ball on In-Store Execution?

Home Depot offered strong deals but suffered from signage mismatches, where printed in-store tags were higher than digital shelf tags across a variety of categories; ranges, laundry and refrigerators which was one of the most significant.

And while Best Buy improved YoY regarding discount depth, it also fell short in signage execution and top-end SKU coverage.

Appliance conversion remains heavily store-driven during Black Friday, but success increasingly depends on the full customer experience — including signage accuracy and in-store execution. While sharp pricing gets shoppers in the door, even small execution missteps can derail the sale.

At Home Depot, we heard from staff that signage updates were delayed or skipped entirely, while at Lowe’s we observed Black Friday tags placed on the wrong range models. These breakdowns highlight a bigger truth: human error can undermine even the best promotions.

For retailers and brands alike, ensuring price accuracy — both online and in-store is now a baseline requirement for winning in big-ticket durables.

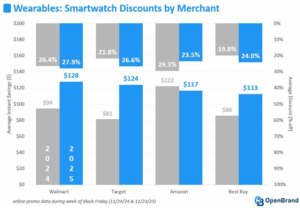

Wearables Were the MVP: Led by Garmin and Walmart.com

Black Friday was a breakout moment for wearables, especially smartwatches.

Walmart.com emerged as the category’s top discounter, led by a massive surge in Garmin deals.

Garmin nearly doubled its promo count YoY, taking the top spot in deal volume across all brands. Walmart.com offered the highest average instant savings ($128) and the deepest average discount rate (27.9%), powered largely by Garmin’s “7X” series. Garmin’s average promo savings hit $157-off, outpacing Apple and Samsung.

The $200–299 price band grew the fastest YoY, with OpenBrand tracking 299 smartwatch deals in this range.

Floor Care Surged on Black Friday: Especially Premium & Cordless Models

Consumers showed up ready to spend in this category. Floor care brands like Shark, Dyson, and Tineco captured outsized attention on Black Friday.

The $200–$299 band dominated in total promo count across robot vacuums and cordless stick vacs.

Retailers leaned into promo volume over deep discounting while average % off was steady YoY, there was a significant increase in SKUs on promotion, especially at Walmart and Amazon.

Premium cordless vacs outpaced legacy uprights, a shift OpenBrand attributes to growing consumer preference for flexibility and ease-of-use.

CYBER MONDAY INSIGHTS 2025

Appliance Momentum Cooled: Focus Shifted to Replenishment

Cyber Monday did not replicate Black Friday’s success in large appliances.

OpenBrand’s reporting confirms Black Friday as the primary conversion moment for big-ticket appliances, while Cyber Monday shifted toward small appliances, replenishment, and CE upgrades.

Conversion for large appliances declined post-weekend as shoppers pulled back on high-ticket purchases and redirected spend toward online-first tech categories.

Appliance performance on Cyber Monday was fragmented, with no clear merchant leader emerging.

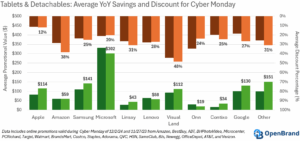

Tablets Delivered Volume: But Not Deeper Discounts

Tablets performed well on Cyber Monday, driven by higher ASPs rather than deeper markdowns.

- Average discount rates held flat YoY at 22%, while average promo value rose to $128 (+10% YoY).

- Best Buy and Amazon led with targeted, model-specific deals.

- Walmart pulled back on depth, offering just $67 average savings (–7% YoY), driven by Fire and Onn assortment.

Promotional focus skewed toward replenishment and lower-to-mid tier SKUs, rather than aggressive premium discounting.

Desktops Gained Share: Mid-Tier Promotions Worked

Desktops gained traction on Cyber Monday through deeper discounts, particularly at Best Buy and Costco.

Lenovo emerged as a key share gainer by concentrating promotions on AIOs and mini desktops in the mid-price tier—balancing value without over-discounting flagship configurations.

Smartphones Became a Self-Upgrade Event

Cyber Monday smartphone demand skewed heavily toward self-purchasing rather than gifting.

- 54% of buyers shopped for themselves, not others.

- 27% spent over $500, showing premium SKUs still converted when paired with compelling offers.

This reinforced Cyber Monday’s role as a personal upgrade moment, rather than a traditional gifting peak.

Small Appliances Traded Down

Small appliance buyers shifted downmarket, with spend clustering in the $50–$150 range.

This trade-down behavior aligned with Cyber Monday’s broader theme: efficient, online-driven purchases rather than aspirational big-ticket spending.

Cyber Monday Bottom Line

Cyber Monday performed best in categories with high online elasticity and low in-store dependency — notably tablets, desktops, and smartphones.

While volume was strong, success hinged on precision promotions and SKU-level targeting, rather than broad-based discount depth.

What Retailers Should Avoid in 2026

- Price-only plays won’t win in CE if the discount rate does not move. Consumers increasingly notice percent savings, not just total dollars.

- Outdated in-store signage hurt multiple retailers, OpenBrand audits caught several examples at both Home Depot and Lowe’s.

- Undifferentiated SKU strategies underperformed. In CE and appliances alike, older models with generic price cuts lost ground to exclusives or hero SKUs promoted through endcap visibility.

Don’t see holiday highlights for your category? Connect with our category experts to request data for a specific brand, category, retailer, and more.

Where Openbrand’s Insights Come From

OpenBrand tracked every key moment across the promotion period, surfacing not just what was promoted, but what actually moved, who gained share, and where execution broke down.

Our category experts utilize pricing and promotion data directly sourced from OpenBrand’s Competitive Intelligence platform which captures daily online pricing and weekly in-store pricing for top retailers. Average discount rates and promotion values aggregate omnichannel pricing records on promoted products (i.e., all products that received a discount) throughout the Black Friday promotional period. In addition to leveraging the OpenBrand Competitive Intelligence Platform, analysts performed in store shops to verify shelf pricing during key events.

OpenBrand also implemented a Holiday Shopping MindShare Tracker (Nov. 19 – Dec. 4) focused on understanding discount and spend expectations, retailers consumers planned to shop versus actually shopped, categories shopped and purchased and much more, across Black Friday and Cyber Monday.

Track Key Events With OpenBrand

It’s Not Just Tracking Deals – It’s Telling You What Moved

Most Black Friday coverage focuses on headlines like “Apple dropped $100 off iPads.” But OpenBrand’s platform goes deeper:

- Tracks exact discount depth, not MSRP-based fluff

- Differentiates between volume vs. value share

- Flags execution risks in real time (e.g., mismatched signage, promo inconsistencies)

- Maps trends by brand, retailer, subcategory, and price band

That’s how we can confidently say Garmin gained share, Cyber Monday didn’t deepen discounts, and retailers over-indexed on $200–$299 SKUs across multiple categories.

Connect with our team today to see how we can help you track the next key promotional period.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…

Refrigerators: 2025 Year-In-Review

Our Refrigerators: 2025 Year-in-Review report recaps product launches, placements, pricing and…