Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity, portfolio shifts, and pricing captured throughout 2025 with comparisons drawn to 2024. The report features data and insights from OpenBrand’s Business Printers and Personal & SOHO Printers categories, which feature products sold through the US ecommerce and brick-and-mortar channels.

Read through all the 2025 insights below or email the report to read later.

You can also check out our 2025 Year-in-Review reports for other Print categories.

Impact Summary

- Launch activity reached its lowest level recorded in 2025

- Pricing increased amid tariff-related pressures

- Average promotions were relatively stable year-over-year

Our Methodology

Data included in this report is sourced from the OpenBrand Business Printers and Personal & SOHO Printers categories. Data in this analysis was captured between Q1 2024 (week of January 7) and Q4 2025 (week of December 14).

Printer Hardware Product Launch Activity in 2025

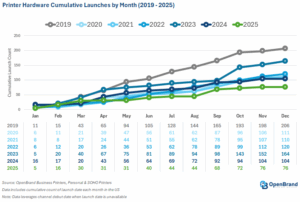

Printer hardware launch activity drastically slowed in 2025. With a total of 76 products introduced for open distribution channels, the year marked the quietest observed in recent memory. There were 27% fewer SKUs launched compared to 2024 when 104 models were released.

Despite the low number of products launched, brands brought notable products to market throughout the year. Brother officially entered the ink tank market, Canon updated its inkjet and laser-based lines, Epson refreshed its EcoTank portfolio, and HP introduced new AI-enabled inkjets and updated LaserJet models.

Brother executed one of the broadest portfolio expansions of the year, spanning A4 laser, inkjet, and ink tank categories. Most notably, Brother officially entered the US ink tank market for the first time with its INKvestment Tank series, signaling a global push to compete more directly against established ink tank players. Alongside this debut, Brother continued to expand its subscription-led strategy through “F” suffix SKUs bundling Refresh EZ Print or toner subscriptions, while also maintaining a strong club store presence with value-added derivatives. Collectively, these moves reflect Brother’s emphasis on portfolio breadth and ongoing focus on supplies attachment through services.

Canon implemented a mix of generational refreshes across its inkjet and laser lines. The company launched a new Color imageCLASS A4 SOHO lineup featuring a meaningful step-up in print speeds, while also quietly introducing “II” generation A4 small workteam devices as mid-lifecycle refreshes. Within its inkjet portfolio, Canon refreshed its consumer PIXMA lineup, updated its MegaTank small workteam series under clearer branding, and introduced the PIXMA TR160 mobile printer to address on-the-go business needs. Canon also strengthened its creative and professional offerings with new imagePROGRAF and PIXMA PRO photo printers. Overall, Canon’s 2025 activity reinforced a strategy centered on incremental improvement and portfolio continuity.

Epson reinforced its leadership in the ink tank category through a broad seventh-generation EcoTank refresh and continued channel expansion. New models such as the EcoTank ET-2980, EcoTank ET-3950, and EcoTank ET-4950 updated core configurations while raising Epson’s value proposition to “up to three years of ink in the box,” further widening its differentiation on included supplies.

HP advanced a services- and security-led hardware strategy across consumer, SOHO, and enterprise segments. The company expanded its AI positioning in inkjet with new Envy and OfficeJet Pro models featuring HP AI capabilities (including Perfectly Formatted Prints), while also quietly refreshing core OfficeJet Pro SKUs. HP increased its retail footprint through multiple merchant-exclusive derivatives and re-entered Sam’s Club in-store assortments, ending Epson’s extended exclusivity and restoring brand diversity in the channel. At the enterprise level, HP introduced the LaserJet Enterprise 8000 A3 series, emphasizing quantum-resistant security aligned with future US federal requirements.

Kyocera continued to methodically strengthen its A4 monochrome lineup with the launch of new ECOSYS MA and ECOSYS PA series models targeting SMB customers. The additions served as direct replacements for prior-generation devices while introducing compatibility with new toner and reinforcing Kyocera’s focus on energy efficiency, security, and compact design. These updates rounded out Kyocera’s ECOSYS A4 portfolio and underscored the OEM’s steady, refresh-driven approach to maintaining competitiveness in the A4 monochrome segment. It should be noted that these devices often sell across channels, with visibility at select resellers and available to Kyocera’s dealer partners.

Prior to Xerox’s acquisition of Lexmark, the OEM formally concluded the phased rollout of its 9-series A3 portfolio. The final models completed the company’s planned Q1 release cadence and reinforced Lexmark’s efforts to grow share in A3 color and monochrome MFP segments with its internally developed platform.

Xerox finalized the long-anticipated launch of the C320/DNI by adding official pricing to its US website, closing a visibility gap that had persisted since the model first appeared at resellers. While modest in scope, the update rounded out Xerox’s A4 color offering.

Printer Hardware: 2025 Pricing Insights

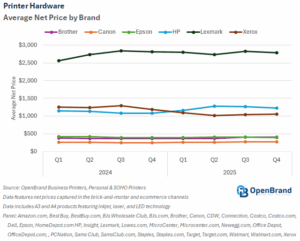

Across the market, average net prices increased modestly year-over-year, with notable divergence by brand and segment. Overall, average net prices rose 4%, increasing from $898 in 2024 to $935 in 2025, reflecting tariff-related price increases and some shifts in product mix.

HP recorded the largest year-over-year increase, with average net prices rising 10% from $1,117 to $1,233. Brother and Canon each posted 4% growth in average net prices, with Brother moving from $373 to $389 and Canon increasing from $259 to $270. Lexmark saw a smaller 2% increase, rising from $2,734 to $2,784, indicating relative pricing stability. In contrast, Epson and Xerox experienced declines, with Epson slipping just 1% from $411 to $407 and Xerox declining 15% from $1,244 to $1,054.

Printer Hardware: 2025 Promotions Insights

Promotional activity remained largely stable year-over-year, with only modest shifts in timing and intensity. The average promotional value held flat at $79 in both 2024 and 2025, despite some quarterly variability, indicating that manufacturers largely maintained headline discount levels rather than escalating incentives. While the average promotional percentage discount off shelf price also remained unchanged at 27%, the mix shifted slightly, with higher discount intensity appearing later in the year.

In 2025, promotions softened in the first half before strengthening in Q4, when average promotion value rose to $86 and the average percent discount reached 29%. Overall, the data suggests that vendors relied on targeted, seasonal promotions rather than broad discounting, using promotions tactically to support peak demand periods while preserving pricing discipline across the year.

Printer Hardware: 2026 Market Outlook

Looking ahead to 2026, the US printer hardware market is expected to adjust following a relatively slow product launch environment in 2025. Activity is likely to pick up as OEMs bring refreshed portfolios to market with an expected emphasis on share gains and competitive differentiation. Ink tank technology is expected to remain a key focus, as manufacturers continue to compete on long-term cost-of-ownership messaging and bundled value rather than upfront price alone.

Pricing dynamics entering 2026 remain mixed. While pricing has been under pressure due to tariffs and elevated costs, the potential easing of tariff-related challenges could reduce some of that pressure over time, although both the timing and magnitude remain uncertain. As a result, OEMs are likely to maintain selective pricing actions, balancing cost recovery with the need to remain competitive, especially in price-sensitive segments. At the same time, manufacturers are expected to continue prioritizing supply chain resilience and disciplined portfolio management to navigate ongoing uncertainty.

Overall, 2026 is shaping up to be a year of re-acceleration rather than disruption, with manufacturers focusing on refreshed lineups, targeted innovation, and controlled pricing and promotional strategies to drive incremental growth in the competitive US printer market.

Get more information

Visit our Print industry page to learn more about the data we deliver for the Ink Supplies market – or reach out to our analyst below to ask questions about this report or get specific insights you need.

About the Analyst

Valerie Alde-Hayman

Val is a Senior Analyst at OpenBrand. With over 12 years of experience, she has established a reputation for delivering insightful analysis and thought leadership, while helping organizations navigate the complexities of the print market. With a deep understanding of industry trends and technological advancements, Valerie has contributed significantly to the field, sharing expertise through numerous publications, presentations, and consultations.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…

Refrigerators: 2025 Year-In-Review

Our Refrigerators: 2025 Year-in-Review report recaps product launches, placements, pricing and…

Notebooks: 2025 Year-In-Review

Our Notebooks: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…