Modest inflation will drive incremental durables market growth in the year ahead

As short-term tariff swings ease and economic policy uncertainty fades, we anticipate 2026 will mark a period of stabilization, including within the durables sector. Though we expect stabilization, it’s important to acknowledge that short-term political volatility will likely continue as a strategic tool of the current administration. The durables industry has proven to be durable (pun intended), and we expect that durability to persist through it.

The limited expansion in market size we expect this year is likely to be driven primarily by incremental price increases following recent Fed rate cuts. We project durables market growth to reach its high point in July, coinciding with the largest price adjustment, before slowing through the rest of the year.

One of the large wildcards this year will be the tone set by the Federal Reserve Chair nominee Kevin Warsh. We expect Warsh to push for a lower interest rate environment, and there is a reasonable possibility of a moderate upside deviation to our forecasts below.

Read on for OpenBrand’s price and growth expectations across consumer electronics, appliances, and home improvement in the year ahead.

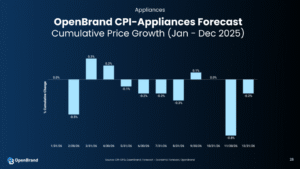

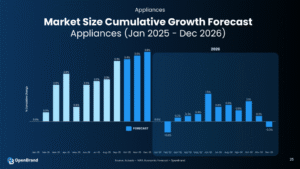

Appliances: Market Size Growth Hindered by Price Deceleration

Prior to the new tariffs that were implemented in 2025, appliances (see appliance product list) had been on a downward price trajectory for a number of years. While short-term tariff-related price increases led to growth in the cumulative size of the appliance market last year, we anticipate that prices will decelerate again in the months ahead.

The deflationary environment for appliances will outpace our forecast for a slight pickup in unit sales this year, resulting in modest to negative market size growth. In other words, we expect that more appliances will be sold in 2026, but at lower, or slower, growing prices. OpenBrand daily pricing data and durables tracking survey shows that consumers are still buying appliances, but they are delaying upgrades when possible and trading down on features rather than exiting the category. That means that incremental, mid-tier upgrades are under the most pressure.

Regardless of the economic cycle, appliances are a replacement-driven category which makes it more resilient. In 2026, the most successful businesses will likely be the ones that implement pricing discipline and clear value positioning.

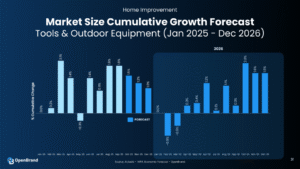

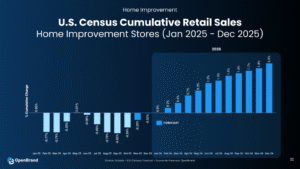

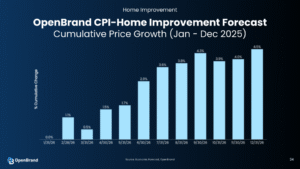

Home Improvement: Rate Cuts Will Support DIY, Construction Rebound

The home improvement category (see HI product list) depends largely on the health of the housing market, which we expect will begin to show signs of a turnaround in 2026. That recovery is largely tied to the Fed’s recent rate cuts, which will also drive down borrowing costs. We expect existing home sales to recover in the second quarter, boosting demand for DIY-related categories like tile, roofing, and paint. New home sales should gain momentum in the fourth quarter, which is likely to support increased demand for higher-end, professional-grade tools tied to new construction and home upgrades.

While growth in retail sales at home improvement stores was negative for nearly all of 2025, we expect a recovery this year, particularly in the second half. The return to growth doesn’t necessarily indicate a boom for home improvement retailers, but it does reflect a normalization after a slow year.

As is the case for appliances, a share of the increase in the growth of the home improvement market will come from price increases. We anticipate that prices will show modest growth in the first quarter, before picking up more significantly in April and beyond.

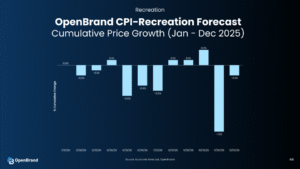

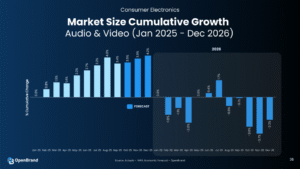

Consumer Electronics: Expect Muted 2026 Growth

In 2025, we saw stronger-than-expected growth in consumer electronics categories (see CE product list) like audio and video. That was largely because consumers pulled their spending forward in anticipation of tariff-related price increases and economic uncertainty.

As a result, our outlook for consumer electronics growth is more muted for the year ahead. We expect flat to slightly negative growth in consumer electronics, not because demand disappeared, but because much of it happened earlier than anticipated.

Getting the attention of the consumer will be more difficult in the year ahead; the retailers and manufacturers that come out on top will be the ones that focus on feature-laden products—like bluelight-blocking technology for screens—that were buzzy at CES in January.

Cumulative prices are expected to contract across consumer electronics this year, with the most pronounced drop toward the end of the year. That’s good news for consumers, who will be able to get great deals on new gadgets, and difficult for brands, who will now compete in an even more price-competitive market.

Key Takeaways: What Our 2026 Durables Outlook Means For Your Business

Despite softening last year, the durables market has held up through the worst housing market in 15 years and big swings in consumer sentiment. Looking ahead, we’re anticipating a year of normalization, with market growth influenced largely by price changes and the tone set by the incoming Fed chair. Whether you’re a retailer or a manufacturer, here are three things to consider as you plan for the months to come:

- Consumers are adjusting, not disappearing. We’re seeing trade‑down at entry prices and resilience at the premium tier. In other words, consumers are opting for products that either minimize spend or deliver obvious value, with fewer decisions centered on mid-priced items.

- Housing matters for appliances and home improvement. As the housing market normalizes and eventually improves, that’s a structural tailwind for durables, even if the mix by category and price tier continues to shift.

- Competition is growing more intense for consumer electronics. That underscores the need for innovators to invest in new features that are going to get buyers’ attention. Manufacturers need to be thinking about competing not just on prices, but also product characteristics.

State of Durables Webinar

I spoke on this 2026 forecast data, as well as a look back at 2025, in OpenBrand’s recent State of Durables webinar. Check it out below.

Contact Us

Interested in getting more granular 2026 price forecasts for appliances, consumer electronics, and home improvement? OpenBrand has monthly scenario-based forecasting for durables by category and sub-group. Contact us below to learn more or request a forecast preview.

About OpenBrand CPI & Economic Forecasting Solutions

About OpenBrand’s CPI: OpenBrand delivers a Durables-grade Consumer Price Index that provides a more nuanced look at price inflation specific to the market.

About OpenBrand’s Economic Forecasting: From scenario-based forecasting products to custom projections, out economic forecasts equip retail companies with the ability to know and respond to what’s happening before it happens.

OpenBrand CPI – Durable and Personal Goods

Groups and Products

Appliance Group

Air Conditioners

Air Purifiers

Beverage Coolers

Blenders

Coffee Makers

Cooktops & Wall Ovens

Countertop Cooking

Countertop Microwaves

Dehumidifiers

Dishwashers

Dryers

Freezers

Icemakers

Laundry

Ranges

Refrigerators

Vacuums

Washers

OTR (Over-the Range Microwaves)

Communications Group

Business Printers

Desktops

Headsets

HED

Ink

Large Printers

MFP Copiers

Monitors

Notebooks

Personal & SOHO Printers

Projectors

Smartphones

Tablets & Detachables

Toner

Wearables

Wireless Routers

Recreation Group

Bluetooth Speakers

Bluray

Digital Camcorders

Digital Cameras

Headphones

Media Players

Photo Paper

Sewing Machines

Sound Bars

Speaker Systems

TVs

VAW Speakers

Home Improvement Group

Bathroom Faucets

Bathroom Sinks

Bathroom Vanity

Bathtubs

Cutting Machines

Carpets

Door Locks

Exterior Paints

Exterior Stains

Floor Tiles

Garden Hoses

Generators

Grass Seed

Handhelds

Hand Tools

Hardwood Flooring

Interior Paints

Interior Stains

Kitchen Cabinets

Kitchen Cleanup

Kitchen Faucets

Lawn Fertilizer

Lawn Products

Log Splitters

Mowers

Outdoor Cooking

Outdoor Cooking Accessories

Paint Supplies

Pesticides

Shower Stall and Enclosures

Power Tools

Power Tools Accessories

Pressure Washer

Replacement Batteries

Shower Doors

Shower Heads

Smart Doorbells

Smart Locks

Smart Cameras

Smart Thermostats

Snow Throwers

Spray Paint

Toilets

Vinyl Flooring

Water Filtration

Weed Killer

Personal Care Group

Anti-Smoking Products

Adult Incontinence

Baby Products

Bath Products

Contraceptives

Cosmetics (Eye, Facial, Nail)

Deodorants

Diabetic Products

Digestive (Lower GI, Upper GI, Hemorrhoidal)

Ear Care Products

Eye Care Products

Feminine Needs (Sanitary Napkins/Tampons & Women’s Care)

First Aid Accessories & Treatments

Foot Care Products

Fragrance

Hair Care (Coloring, Growth, Shampoo, Conditioner, Styling)

Hair Dryers

Home Health Care

Lip Preparations

Oral Care (Breath Fresheners, Accessories, Dentures, Mouthwash, Oral Hygiene, Toothpaste)

Pain (Analgesic, External & Internal)

Sexual Wellness

Shave (Non-Razor Blades, Creams, Razors)

Skin Care (Acne, Facial, Hand & Body)

Sleeping Remedies

Soap

Sun Care

Upper Respiratory (Cold/Allergy/Sinus Liquids & Tablets, Cough Drops/Lozenges, External, Nasal Products)

Vitamins, Minerals & Supplements

Wt Ctl/Nutrition (Tablets & Liquid, Powder Wipes, Towelettes)

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

The State of Consumer Durables: Lessons from 2025 and What’s Ahead

Insights from OpenBrand’s January 2026 webinar As we enter the new year, OpenBrand is reflecting on…

Consumer Price Index: Durable and Personal Goods | December 2025

This is the January 2025 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Lowe’s Earnings: Market Share Breakdown | Q3 2025

Inside the Q3 2025 Lowe’s Earnings Call Lowe’s earnings for Q3 2025 reflect positive growth YoY,…