Insights from OpenBrand’s January 2026 webinar

As we enter the new year, OpenBrand is reflecting on 2025 and unpacking which consumer durables trends may stick around this year versus those that were just buzz.

During our January webinar, OpenBrand CEO Greg Munves and Chief Economist Ralph McLaughlin analyzed last year’s macroeconomic conditions, durables market performance, and the ways in which consumer sentiment doesn’t always reflect behavior. They also shared OpenBrand’s forecasts for pricing, retail sales, housing, and more in the months ahead.

Watch the webinar in full above, or read on for a recap of what last year taught us about the state of consumer durables and what’s ahead in 2026.

Macroeconomic Conditions in 2025: Tariffs, GDP, and Inflation

New tariffs implemented by President Donald Trump in early 2025 dominated news headlines and drove uncertainty and fear for economists and retailers alike. Some forecasters expected a near-term recession as well as runaway inflation.

The good news is that the catastrophic predictions largely didn’t materialize. The United States didn’t fall into a recession, and instead experienced only a minor slowdown in GDP growth. Meanwhile, inflation didn’t reaccelerate to concerning levels, and the Fed delivered three rate cuts.

In April of last year, we predicted slower economic growth, though not a contraction, and a modest increase in inflation. We also expected consumers to make some spending adjustments but not make drastic changes to their behavior. Those outcomes proved to be in line with what the data from 2025 now reflects, particularly when it comes to consumer behavior.

Consumer Emotions Don’t Always Match Spending Patterns

The way consumers say they feel about economic conditions often doesn’t line up with how they behave in practice, particularly when there’s a change in political leadership or economic policy.

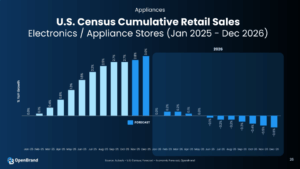

That dynamic unfolded last year, when consumer sentiment surveys dropped to some of their lowest readings on record following President Trump’s inauguration and the implementation of new global tariffs. Despite the negative outlook, there wasn’t an associated drop in retail sales.

OpenBrand’s MindShare consumer survey, which accounts for both sentiment and behavior, shows that tariffs were only a modest purchase filter in 2025. As the year progressed, more consumers delayed purchases due to higher prices but it was modest and gradual. In March 2025 over half of consumers said that tariffs didn’t impact their purchase decisions; that figure fell by only five percentage points by November.

The modest price pressure that resulted from tariffs ultimately shifted value within categories, not demand out of them. That’s because when tariffs matter to consumers, they are more likely to trade down on quality and not exit the market entirely. In 2025, 62% of the consumers who delayed purchases traded down. This helps explain why demand remained intact but why brands felt pressure on mix, margin, and price realization.

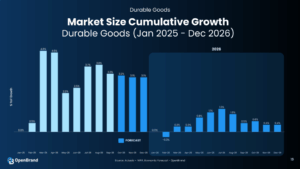

U.S. Tariffs and Housing Drove Durables Spending Patterns Last Year

Two major factors impacted the market for durable goods and home improvement in 2025: tariffs and the housing market.

While prices for appliances picked up mid-year, they’ve since been on a downward trajectory. That suggests that tariffs caused turbulence in the immediate term but that prices likely won’t remain elevated. One reason is that major appliance brands like Whirlpool manufacture a majority of products in the US, making them immune to duties. Additionally, tariffs on foreign-made appliances are charged on the wholesale price. Unless the margins for a particular product are razor-thin, the percentage increase for the consumer ends up being smaller than expected.

Meanwhile, the housing market experienced its slowest period since the Great Recession, with buyers holding back on both new and existing homes. As a result, consumers became more selective, gravitating toward lowest-priced options that met their immediate needs or premium products that clearly justified the cost, while largely ignoring mid-range choices—a trend known as “value discipline.” This same behavior showed up in DIY projects, where customers chose the cheapest options for smaller jobs but were willing to pay more for products that were critical to performance.

Looking Ahead: Macroeconomic Stabilization and Housing Market Rebound

With short-term tariff volatility and economic policy uncertainty seemingly behind us, we expect 2026 to be a year of stabilization, particularly for the durables market.

Much of the modest growth in market size that we expect this year will come from incremental price increases resulting from Fed rate cuts. We forecast durables market size growth to peak in July, around the time of the largest price increase, and then decelerate for the remainder of the year.

Recent rate cuts by the Federal Reserve are expected to bring mortgage rates down and stimulate the housing market, while a steady labor market will help support a resilient consumer. Both of those dynamics are important for durable goods like appliances and electronics, which depend on demand for new and existing homes, as well as healthy shopping patterns. The state of the durables market, in other words, appears durable for the foreseeable future.

We anticipate that existing home sales will rebound in the second quarter, fueling demand for appliances and items like tile, roofing, and paint for DIY projects. Sales of new homes will pick up in the fourth quarter, after owners of existing homes sell and look to upgrade. That will then drive demand for more premium, professional tools and appliances that are associated with construction and trading-up.

Key Takeaways: What The Data Says About The Year Ahead

We expect a more constructive outlook for consumer durables in 2026, with stabilization replacing volatility and demand coming largely from a healthier housing market.

- The tariff shock is fading, and conditions are stabilizing. After a period of disruption, consumer durables categories are adjusting to the post-tariff cost environment.

- The housing market rebound will be a critical demand catalyst. As home sales and construction activity recover, demand for big-ticket durables—appliances, furniture, and home-related goods—is poised to accelerate.

- Sentiment can be misleading. Consumer confidence surveys often reflect economic anxiety, but spending behavior tells a different story. Income growth, employment levels, and balance sheets are more closely correlated with durables demand than headline sentiment measures.

- Focus on fundamentals, not headlines. As 2026 approaches, the outlook for consumer durables is increasingly driven by tangible indicators—housing turnover, replacement cycles, and employment—rather than short-term noise. For industry leaders and investors alike, the data points to cautious optimism, not retrenchment.

About OpenBrand’s CPI: OpenBrand delivers a Durables-grade Consumer Price Index that provides a more nuanced look at price inflation specific to the market.

About OpenBrand’s Economic Forecasting: From scenario-based forecasting products to custom projections, out economic forecasts equip retail companies with the ability to know and respond to what’s happening before it happens.

Contact Us

Contact us to see how OpenBrand can help you make stronger business decisions around inflation, retail sales, and other macroeconomic factors.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Price Forecasts for Durables in 2026: Consumer Electronics, Appliances & Home Improvement

Modest inflation will drive incremental durables market growth in the year ahead As short-term…

Consumer Price Index: Durable and Personal Goods | December 2025

This is the January 2025 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Lowe’s Earnings: Market Share Breakdown | Q3 2025

Inside the Q3 2025 Lowe’s Earnings Call Lowe’s earnings for Q3 2025 reflect positive growth YoY,…