Outdoor Power Equipment Market Webinar 2025: Cordless Growth, Pricing Pressures & Retail Shifts

Outdoor Power Shift Webinar: Analyst Insights on OPE Share, Pricing & Promotions

The outdoor power equipment (OPE) market is experiencing its biggest transformation in decades.

From the rapid rise of cordless tools to shifting consumer demographics and tariff-driven price pressures, the industry is entering a new era of innovation and competition.

In our OPE-focused insights webinar, our category analyst, Adrienne Spear, shared deep insight into outdoor power equipment market trends, market share shifts, and what’s ahead for 2025 and beyond.

Watch the webinar now or read the blog below for the highlights.

Check out our OPE market trends blog post for all the latest data in the market.

How much unit share does cordless OPE capture?

Cordless outdoor power equipment has officially surpassed gas and corded products combined, now making up more than 60% of units sold at major retailers.

Growth is strongest in handheld categories like trimmers and blowers, where customer adoption has accelerated due to convenience, quieter operation, and better performance.

What does the shift to cordless mean for OPE brands?

Battery ecosystems are now central to brand loyalty. Once a customer invests in a brand’s cordless platform, they tend to stick with that ecosystem, creating long-term share advantages.

This widespread shift to cordless OPE products signals a structural change in the outdoor power equipment market, and retailers need to stock the right cordless products and cordless brand ecosystems accordingly.

How are tariffs putting pressure on pricing in the outdoor power equipment market?

Tariffs are reshaping the OPE industry, driving higher input costs that manufacturers can’t fully absorb.

Brands like Troy-Bilt, DeWalt, and EGO have raised average prices significantly across categories. Here are some highlights of the price increases over the last 6 months:

- Troy-Bilt handhelds: +12%

- DeWalt handhelds: +10%

- Black+Decker handhelds: +9%

- EGO pressure washers: +12%

- Black+Decker pressure washers: +10%

Consumers are feeling the impact: OpenBrand survey data shows nearly 38% of OPE buyers delayed purchases, bought earlier, or shifted to American-made products due to tariffs in Q2 2025.

This economic pressure is redefining how brands and retailers balance pricing, promotions, and market share. Retailers should be thinking: American-made, compelling promotions, and an awareness that consumers are concerned about tariff-pricing.

How are OPE retailers shifting in 2025?

Competition across outdoor power equipment retailers is intensifying. Home Depot continues to lead in unit share, while Lowe’s holds the edge in dollar share. Yet mass merchants, specialty stores, and online platforms are making gains, with Walmart winning on affordability and private-label growth, Amazon leveraging convenience and premium assortments, and Ace Hardware and Tractor Supply Co. carving out space for themselves against these bigger players.

Let’s dive into all these trends in more detail.

Home Depot vs. Lowe’s: OPE Market Trends

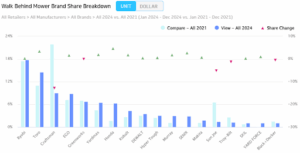

Home Depot relies heavily on Ryobi as its anchor brand, which accounts for more than half of its OPE unit share. Cordless dominates the mix with 64% of unit sales, while line trimmers deliver the highest volumes. Walk-behind mowers are the biggest dollar driver at 19%. This strategy positions Home Depot to lock in customers through Ryobi’s battery ecosystem and expand revenue through higher-ticket categories.

- Ryobi = 56%+ of OPE unit share

- Cordless = 64% of unit sales

- Line trimmers = highest unit mover

- Walk-behind mowers = 19% of OPE dollar share

Lowe’s, by contrast, takes a more diversified approach. Craftsman remains its leader, but EGO is the true growth engine, jumping to nearly 40% cordless unit share, up more than 5 points in a year. Zero-turn mowers (ZTRs) drive the largest share of dollars at 27%. Toro has also gained traction quickly, capturing about 24% of gas unit share since entering the retailer in 2024.

- Craftsman = lead brand

- EGO = 39%+ cordless unit share, growing fast

- ZTRs = 27% of OPE dollar share

- Toro = ~24% gas unit share since 2024

Customer spending patterns reinforce these differences. Shoppers spend more per product at Home Depot across most categories, except riding mowers, where Lowe’s leads.

Lowe’s also carries 43% more riders and ZTRs than Home Depot, a clear reflection of its more rural customer base. Meanwhile, Home Depot emphasizes cordless variety, balancing both DIY and pro-level offerings.

Openbrand’s Takeaway: Home Depot is maximizing cordless ecosystems and mid-ticket sales, while Lowe’s leans into premium gas and high-ticket riding equipment.

Walmart vs. Amazon: OPE Market Trends

The rivalry between Walmart and Amazon highlights two very different strategies in the outdoor power equipment market. Walmart prioritizes affordability and volume, while Amazon positions itself around convenience and choice, appealing to both budget-conscious and premium buyers.

Walmart OPE Trends in 2025

- Average spend is nearly 18% lower than Amazon’s, showing its value-driven strategy

- More than half of OPE unit sales are cordless, with almost half of SKUs priced under $100

- Hyper Tough, its private label, grew 7% year-over-year in unit share

- 67% of Hyper Tough buyers cite price as the top purchase driver

Amazon OPE Trends in 2025

- Cordless accounts for 65% of unit sales, with line trimmers leading both units and revenue

- Most units sold are under $100, but premium buyers find EGO and DeWalt in the mix

- Average OPE assortment is priced about 12% higher than Walmart’s, especially in chainsaws, snow throwers, and pressure washers

- Dual positioning allows Amazon to capture value buyers and high-end customers alike

OpenBrand’s Takeaways

- Walmart dominates the entry-level, traffic-driving segment through affordability and private-label strength

- Amazon balances mass-market accessibility with premium appeal, capturing unit share across the value spectrum

Ace Hardware vs. Tractor Supply Company: OPE Market Trends

Specialty retailers are carving out their own roles in the OPE market, targeting distinct customer bases with tailored strategies.

Ace Hardware OPE Trends

- Premium assortment anchored by STIHL and EGO

Chainsaws average over $1,000, reflecting STIHL’s professional-grade presence - Overall pricing is about 16% higher than Tractor Supply’s

- Targets higher-income suburban homeowners who prioritize brand reputation and durability

Tractor Supply OPE Trends

- Broad assortment that appeals to rural and farm-focused buyers

- Mix includes accessible cordless brands like Worx and Greenworks alongside premium riders and ZTRs

- Carries a more premium riding assortment than Ace, positioning itself as a destination for big-ticket equipment

Complements equipment sales with consumables under its “Life Out Here” lifestyle positioning

OpenBrand’s Takeaways

- Ace attracts suburban homeowners with a premium, pro-grade lineup

- Tractor Supply caters to rural customers with breadth in riders and consumables, strengthening its appeal to lifestyle-driven buyers

Together, Ace and Tractor Supply showcase how specialty retailers are thriving by targeting distinct customer segments. Ace appeals to suburban homeowners seeking premium, pro-grade solutions, while Tractor Supply attracts rural customers with breadth in riding equipment and a mix of consumables that complement equipment purchases.

Both strategies expand the competitive landscape beyond the big-box and online leaders, reinforcing the diversity of the outdoor power equipment market.

How are OPE buyers changing?

The OPE buyer base is shifting, with younger generations taking more unit share — but older buyers still dominate in volume. Here’s what our MindShare consumer durables survey data shows.

Generational Shifts

- Millennials & Gen Z: steadily increasing share of items sold

- Boomers & Matures: unit share is declining

- Younger priorities: cordless equipment, sustainability, online shopping convenience

Age Breakdown of Purchases (Q2 2025)

| Age Group | Share of Purchases | Notes |

| Under 25 | Smallest group | Most likely to prefer American-made, due to tariffs |

| 25–34 | Growing | Strong cordless adoption, eco-minded |

| 35–44 | Largest spending segment overall | Value and performance balance |

| 45–64 | Strong presence | Significant unit share of mainstream OPE demand |

| 65+ | Declining | Least likely to change behavior due to tariffs |

OpenBrand’s Takeaway

Younger buyers are shaping the future with cordless and sustainability preferences, while older buyers still account for the majority of purchases. Brands must balance digital-forward strategies for younger consumers with proven performance value for established customer segments.

Sustainability and Innovation Drive the Future of OPE

Regulatory pressure and consumer demand are pushing the industry toward sustainability. California’s statewide SORE emissions ban is just the start, with more restrictions expected across states and municipalities. Looking forward, the next wave of outdoor power equipment market trends will center on:

- Higher-capacity batteries and faster charging

- Robotics and AI innovation, particularly in mowing

- Smart technology integration with apps and connectivity

- Sustainability and recyclability as differentiators

These forces will determine which brands win long-term market share.

OPE Market Changes: Key Takeaways for 2025 and Beyond

Four themes will shape the outdoor power equipment market:

- Cordless dominance — handhelds lead growth, with consumers willing to pay more for performance improvements.

- Tariffs and pricing — costs are rising, forcing shifts in pricing and promotional strategies.

- Retail competition — Home Depot and Lowe’s still lead, but Walmart, Amazon, and specialty retailers are capturing more unit share.

- Sustainability and innovation — regulations, AI, and battery technology will shape the next decade.

Stay Ahead of Market Changes With OpenBrand’s OPE Intelligence

The outdoor power equipment market is evolving quickly, and brands that adapt to cordless growth, price pressures, new consumer behaviors, and sustainability trends will be best positioned for the future.

For a deeper dive into outdoor power equipment market trends and market share insights, watch the full webinar replay or connect with OpenBrand for a personalized demo.

Adrienne Spear

Adrienne Spear is a Senior Analyst with OpenBrand, having been with the company (formerly gap intelligence) since 2016. Previously, her focus was on the printer supplies market in the US. Adrienne has recently moved into the role of OpenBrand’s first analyst for the OPE categories, providing support for customers across the industry through custom projects, presentations, and analyses via the company’s Competitive Intelligence Services.

Electrification of OPE: How Battery-Powered Tools Are Reshaping Outdoor Power Equipment

The Quiet Revolution: Why Gas-Powered OPE is Losing Popularity

The outdoor power equipment (OPE) market is undergoing a fundamental transformation.

Historically reliant on small gas engines, the industry is now shifting toward battery-powered solutions, driven by breakthrough battery technologies, changing consumer preferences, and tightening noise and emissions regulations (such as California’s ban on gas-powered OPE).

From lawn mowers and chainsaws to line trimmers and leaf blowers, electrification is reshaping how both consumers and professionals power their landscaping and yard maintenance tasks.

In fact, as of 2024, cordless outdoor tools now command over 60% of OPE unit sales, dramatically reshaping the retail landscape.

Brands once synonymous with gasoline are scrambling to keep pace as battery-powered innovators take the lead.

But how did we get here? As OpenBrand’s OPE category expert, I took a look at the electrifying story behind this shift from a data-driven, analytical view to explore why the future of outdoor power equipment is quieter, cleaner, and cordless.

Read a summary of my findings below, and download my full analyst deep dive report now for all the insights and data.

Have a question for our analysts?

Get the market data needed to support your business goals, trend data to guide strategic decisions, and more.

Here’s what we’ll dive into in this post:

- From Gasoline to Batteries: What’s Powering the Change?

- Who’s Winning the Lawn Wars? Meet the New Leaders

- Battery Breakthroughs: Why Cordless Tools Compete and Win

- Are Consumers Paying More for Less Noise? Pricing Trends Explained

- Challenges Ahead: Will Tariffs Slow the Electrification Wave?

- Your Customers’ Future is Cordless—Here’s How to Prepare

From Gasoline to Batteries: What’s Powering the Change?

The shift toward cordless/battery-operated models has been observed across all OPE categories tracked across Best Buy, Lowe’s, Home Depot, and Walmart in recent years.

The shift from gasoline to battery-powered outdoor power equipment (OPE) has been accelerated by a range of environmental, regulatory, and practical factors. Regulatory mandates, notably California’s 2024 ban on the sale of new small off-road gas engines (SORE), have accelerated industry-wide shifts toward electrification. Environmental concerns and noise ordinances are also motivating consumers and municipalities to seek quieter, cleaner alternatives to gas-powered tools.

Additionally, advancements in battery technology have significantly boosted performance, runtime, and user convenience, creating a strong market preference for cordless solutions.

Who’s Winning the Lawn Wars?: Meet the Current OPE Leaders

OpenBrand’s MarketShare data from 2021 to 2024 underscores a clear and sustained shift toward cordless OPE models across all major categories.

Ryobi consistently strengthened its position as the leading brand in mowers, handhelds, and snow removal, largely driven by its cordless portfolio, achieving over 15% total mower retail unit share in 2024 and dominating cordless walk-behind mowers with approximately 37% share.

Traditional gas-powered brands like Craftsman and Husqvarna saw significant declines in unit share, with Craftsman’s mower share notably falling from 19% in 2021 to 8% in 2024, reflecting broader market momentum away from gas.

Emerging players such as EGO, Cub Cadet, and Greenworks also captured share gains, signaling increased competition and consumer preference for battery-powered alternatives.

For market share leader breakdown by category, get the full report.

Battery Breakthroughs: Why Cordless Tools Compete and Win

Recent advancements in battery technology have dramatically increased performance, runtimes, and convenience, making cordless OPE highly competitive with traditional gas-powered tools. Modern battery platforms like Greenworks 60V, EGO 56V, and Ryobi 40V offer consumers fast-charging, high-power solutions and interchangeable battery systems that encourage loyalty and cross-category purchases.

Are Consumers Paying More for Less Noise?: Pricing & Promotional Trends

Cordless products were generally priced lower than gas products, but the price gap narrowed over time as premium cordless models gained popularity.

Between 2021 and 2024, average prices for cordless chainsaws, hedge trimmers, and leaf blowers increased to align more closely with gas models. This alignment reflects consumers’ willingness to invest more upfront for the added benefits of reduced noise, simpler maintenance, and environmental advantages.

Promotional activity captured across major retailers in March 2025 reflects a highly competitive market environment as the industry prepares for the spring shopping season.

The Home Depot, Ace Hardware, and Lowe’s are aggressively promoting battery-powered OPE products, focusing on price discounts, bundled tool and battery kits, and loyalty program offers.

For promotional breakdown by retailer, get the full report.

Challenges Ahead: Will Tariffs Slow the Electrification Wave?

The introduction of U.S. tariffs in 2025, targeting lithium-ion batteries, electric motors, and steel components, presents significant challenges for cordless equipment manufacturers.

Brands heavily reliant on Asian manufacturing (e.g. EGO, Ryobi, Greenworks, Toro, and DeWalt) are particularly vulnerable to cost pressures. These tariffs, ranging from 20% to 25%, could increase production costs and potentially slow consumer adoption in price-sensitive categories, posing strategic challenges for brands and retailers.

However, despite these disruptions, the overall momentum toward electrification is expected to continue.

Your Customers’ Future is Cordless: Here’s How to Prepare

Brands and retailers should proactively adapt to this cordless future by expanding their battery-powered assortments and investing in system-based platforms.

Some manufacturers have already responded aggressively to market shifts. In 2023, Honda announced it would cease production of gas-powered lawn mowers, underscoring the industry’s pivot toward battery-powered equipment.⁶ Leading brands like EGO, Ryobi, Greenworks, Toro, Craftsman, and Milwaukee continue to expand their cordless offerings, improve battery performance, and promote ecosystem-based platforms.

Looking forward, analysts project a compound annual growth rate (CAGR) of 6.5% to 8% for battery-powered OPE through 2030.⁵ Battery products are expected to dominate the residential market within five to ten years, with commercial applications following soon after. Future innovation will likely focus on modular battery systems, improved diagnostics, and smart features.

Brands should continue to shift focus to emphasizing bundled promotions and loyalty-driven discounts that can attract consumers looking for value and ease of use.

Finally, continuing to monitor and understand evolving market trends, regulatory shifts, and consumer preferences will be crucial to capitalizing effectively on this market transformation and maintaining a competitive advantage. If you’d like to see how OpenBrand can help your business get ahead of future shifts, reach out at openbrand.com/contact.

Get Our Free Analyst “Electrification of OPE” Report

For more insights into the electrification of outdoor power equipment download our full analyst report today. The extended report includes:

- Detailed market share breakdowns, by category

- Geographic adoption patterns

- Retailer promotional strategies

- The full analysis of how new tariffs could impact top industry brands

Discover exactly what’s powering the shift, and how you can stay ahead in a rapidly evolving market. Have a question you’d like to ask me about this review or other industry data? Ask it here!

Access the report now

About the Analyst

Adrienne Spear

Adrienne Spear is a Senior Analyst with OpenBrand, having been with the company (formerly gap intelligence) since 2016. Previously, her focus was on the printer supplies market in the US. Adrienne has recently moved into the role of OpenBrand’s first analyst for the OPE categories, providing support for customers across the industry through custom projects, presentations, and analyses via the company’s Competitive Intelligence Services.

Printer Supplies: 2024 Year-In-Review

This OpenBrand report provides an overview of the most impactful printer supplies news in 2024, highlighting launches, subscriptions, pricing activity, and key business moves from major industry players. The report features data and insights from OpenBrand’s Ink Supplies and Laser Printer Supplies categories, which include products sold through the US ecommerce and brick-and-mortar channels.

- Product Launch Activity

- Subscription News

- Pricing Activity

- Acquisitions, Mergers, and Joint Ventures

- OEM Business News

- 2025 Printer Supplies Outlook

Read through all the 2024 pricing and promotions insights below or email the report to read later.

2024 brought a continuation of post-COVID market normalization observed in 2023, with increasing focus on hybrid office solutions and fewer consumer-focused launches. Fewer new supplies were introduced compared to the prior year as manufacturers trimmed down inventories and streamlined distribution.

Strategic expansion in growth areas such as tank/CISS and subscription services was evident for OEMs including HP, Canon, Epson, and Brother.

Meanwhile, laser-based manufacturers including Lexmark, Xerox, Ricoh, and Toshiba sought growth through acquisitions and mergers.

Product Launch Activity

Brother

Brother notably focused on laser/LED-based supplies launches in 2024, with no new ink cartridge introductions during the year. Following their January 3 introduction alongside seven A4 B&W devices, Brother’s TN830 series supplies gained multiple new online placements. The supplies debuted in the brick-and-mortar channel at Staples during the same month. The launch was the latest in a string of updates to Brother’s laser/LED lineup that began in October 2023. Since that time, Brother introduced three open channel supplies series and nearly three dozen new printer models, marking the largest lineup refresh for the OEM in the last decade.

Canon

Canon U.S.A. introduced its latest A4 B&W imageCLASS models in September, launching four new printers targeting the small office and home office (SOHO) segment. Alongside these new devices, Canon unveiled its 072 mono toner cartridge series, which serves as the generational replacement for the 051 series that debuted in 2018. The new supplies provide improved printing costs, with both standard and high-capacity cartridges offering reductions in cost-per-page (CPP) versus their predecessors.

In September, Canon U.S.A. launched three new PIXMA all-in-one printers along with the new PGI-230/CLI-231 six-color ink series. The new inks support the PIXMA TS8820 A4 AiO, while the two other models, the PIXMA G3290 and PIXMA G4280 MegaTank AiOs, are compatible with the existing GI-21 ink bottles. The launch updated Canon’s home printing portfolio and followed a similar launch in Japan in August.

Epson

In November, Epson introduced the Expression Photo XP-8800 A4 inkjet AiO, the newest member of its Expression Photo lineup, alongside the 340 Claria Photo HD Ink series. The launch brought the replacement of the 2.5-year-old Expression Photo XP-8700 and its compatible 312 Claria Photo HD Inks, which debuted in 2017. The 340 ink supplies gained initial reseller availability at Amazon shortly after launching.

HP

On March 7, HP announced the launch of its newest Color LaserJet Pro 3000 series, which features new 218 series TerraJet supplies. HP markets that its TerraJet toner line features up to 27% reduced energy consumption and up to 28% reduced plastic usage, while also using as much as 71% less plastic in packaging than traditional toner cartridges. The Color LaserJet Pro 3000 series supplies (218A/218X toners) also feature 11% more vivid colors and 18% faster printing speeds compared to their predecessors.

HP announced the launch of its All-In Plan in February, offering customers an all-inclusive printer and ink supplies subscription for a monthly fee. The All-In Plan combines HP’s flagship Instant Ink service with printer hardware and 24/7 support, allowing customers to “never own a printer again.” The service includes plans starting at $6.99 per month and going up to $35.99 per month. The launch of the All-In Plan was expected, as HP’s Tuan Tran stated that the service would debut in Q1 2024 during the company’s 2023 Securities Analyst Meeting held in October 2023.

HP’s 68 series ink supplies and compatible Envy printer models became available from the vendor’s US webstore in Q3, aligning with OpenBrand’s previous reporting that the lineup was expected to be released on September 16. The 68 series inks, along with the Envy 6555e and Envy 6155e all-in-one printers, also became available to ship from major online retailers, including Amazon, BestBuy.com, OfficeDepot.com, Staples.com, and Walmart.com. HP formally announced the new lineup at its Imagine 2024 event on September 24, 2024.

Lexmark

Lexmark formally announced its refreshed 9-Series and 8-Series lineup in Q2, introducing all new mono and color laser supplies that support the vendor’s internally developed A3 and A4 models. Lexmark stated that nine open channel models would become available in June, with additional models slated for release in Q1 2025, although the other models have already emerged at the vendor’s US website. The entire lineup is supported by the same 26 supplies SKUs, bringing significant consolidation to Lexmark’s supplies portfolio while simplifying serviceability.

Xerox

In July, Xerox announced via LinkedIn the launch of its C325/DNI A4 small workteam color MFP, releasing all new color toners for the device and its forthcoming SFP sibling, the C320/DNI. The supplies include both Use & Return and Return Optional toner cartridges that were first spotted in the two-tier distribution channel and emerged shortly after at Xerox’s direct US website. The supplies have since gained distribution in the online reseller channel.

Subscription News

Brother

Brother implemented significant changes to its page-based Refresh EZ Print Subscription service in Q3. The vendor expanded the Refresh EZ service to include new bonus features within its higher volume tiers, rebranding them as “Best for Business” plans. In addition, Brother reduced its Basic 20-page mono toner plan from $0.89 a month to free, incentivizing low print volume customers to try the service with no long-term commitment. The vendor has also readjusted the page limits and pricing structure for several of its plans, raising CPPs for lower volume tiers for both ink and color laser customers. These significant enhancements to the Refresh service demonstrate the importance of the subscription service as part of Brother’s growth strategy.

HP

In July, OpenBrand confirmed HP’s plans to discontinue Instant Ink for Toner, which was due to stop allowing new customers from enrolling in the service at some point in late 2024. The phase-out followed the discontinuation of HP+ LaserJet printers beginning in late 2023 and into 2024. HP stated in part, “HP regularly reviews its portfolio and makes adjustments to adapt to changing customer needs. Customer experience is our top priority, and we will continue to address the requirements of customers printing on Laser products with quality products and services.”

Lexmark

In Q1, Lexmark confirmed the discontinuation of the Printer + Toner option within its OnePrint subscription service. All mentions of the printer option were removed from Lexmark’s North American and European websites, indicating that the service was no longer available to new customers. OpenBrand reached out to Lexmark to confirm the discontinuation. Lexmark introduced the Printer + Toner expansion to its OnePrint service in early 2023.

Pricing Activity

Brother

Brother raised pricing on the bulk of its open channel printer supplies portfolio. OpenBrand recorded price increases at Brother’s direct US website in May, with individual increases on laser supplies ranging from 5% to 7%. In total, Brother raised prices on 131 SKUs by an average of 5%, impacting roughly 84% of the vendor’s actively selling laser supplies portfolio. Brother also raised pricing on 127 ink SKUs by an average of 6%, impacting roughly 78% of the vendor’s assortment.

Canon

Canon U.S.A. raised prices on printer supplies tracked by OpenBrand in March, with increases ranging from 5% to 20% on 27 ink SKUs. The price increases were identified at Canon’s direct US website and impacted both ink and laser supplies. This was the third price increase implemented by Canon on ink supplies since 2022, representing accelerated pricing action from the OEM.

Epson

In August, OpenBrand data specialists identified increased prices on Epson’s portfolio of wide format ink supplies. The inks, which support a wide range of photo and graphics SureColor and Stylus series models, saw an average 6% increase across roughly 150 SKUs tracked by OpenBrand (although additional graphics inks outside of OpenBrand’s coverage were also impacted). The changes occurred roughly two years after Epson last raised prices on its wide format ink portfolio and approximately four months after a major supplier, Sun Chemical, raised wholesale prices on pigments and pigment dispersions.

In September, OpenBrand data specialists identified widespread price increases across Epson’s consumer ink supplies portfolio. Price hikes were observed on a wide range of Epson ink SKUs, affecting both standard and high-capacity cartridges, as well as ink bottles. The price increases ranged from 3% to 17%, with the most significant adjustments affecting ink bottles and multipack products. In total, over 90 SKUs were impacted by this upward pricing adjustment.

HP

HP raised prices on its Instant Ink subscription service on January 23, impacting roughly 12 million customers globally. OpenBrand reported on the forthcoming changes in December 2023 following the emergence of forum posts from customers who were notified of the price increases in Germany, the UK, and Australia. Monthly ink plans in the US increased by as much as 50.5% with the Light 10-page plan. The pricing change followed less than three months after HP issued widespread price increases on its transactionally sold ink and toner cartridges on November 1, 2023.

Exactly one year later, on November 1, 2024, HP again issued widespread price increases to both its ink and laser supplies portfolios, impacting roughly 94% of its actively selling open channel SKUs. Price increases ranged from 2% to 6%, averaging 4% across 612 supplies SKUs. Well over half (57%) of the SKUs impacted were laser supplies, while the remaining SKUs (43%) with raised prices were ink supplies.

Lexmark

Lexmark raised prices on 438 laser supplies in Q2 2024, marking the third upward price adjustment from the vendor on supplies in roughly a year and a half. Prices increased by an average of 8% across most SKUs, although select supplies increased by as much as 22% to 57%. This follows previous increases in November and April 2023, underscoring the continued pricing pressures Lexmark faces amid industry challenges and supply chain issues.

Xerox

Xerox issued price increases in February on laser supplies SKUs that support first-generation A4 VersaLink printers and MFPs launched in 2017. The price adjustments were identified via Xerox’s direct US website and impact 59 SKUs with an average 5% increase. The targeted price increases coincided with the completion of Xerox’s VersaLink refresh, which began in 2023 and finished with the announcement of the VersaLink B620/DN A4 B&W workgroup printer on February 1.

Acquisitions, Mergers, and Joint Ventures

Brother

Brother Industries, Ltd. (Brother) bowed out of plans to acquire Roland DG Corporation (Roland DG) for a reported ¥64 billion ($428.9 million) after refusing to compete with a tender offer made by XYZ K.K (XYZ). Brother offered ¥5,200 per share ($34.84), while XYZ ultimately won the bid with its offer of ¥5,370 per share. Roland DG is a major provider of digital printing solutions, and Brother’s acquisition of the company could have bolstered the OEM’s efforts to diversify and grow its print portfolio.

Epson

Seiko Epson Corporation (Epson) announced the acquisition of Fiery, LLC, a US-based provider of digital front-end (DFE) software and printing solutions, from private equity firm Siris in a transaction valued at $591.4 million. This acquisition will expand Epson’s presence in the digital printing market by integrating Fiery’s advanced technology, which serves industrial and graphic arts sectors with high-performance DFE servers and workflow solutions. The deal was expected to close by the end of 2024, pending regulatory approvals.

Fujifilm

Fujifilm Business Innovation Corp. and Konica Minolta, Inc. announced a delay in the launch of their planned joint venture due to ongoing international competition law reviews and approval processes. The companies originally signed a Joint Venture Agreement on July 8, 2024, with a target launch date of September 30, 2024, aimed at optimizing the procurement of raw materials and components. A revised establishment date will be shared once finalized.

HP

On September 25, 2024, HP announced the acquisition of Vyopta, a Texas-based provider of collaboration management solutions for unified communications (UC) networks. Vyopta’s expertise will enhance HP’s Workforce Experience Platform, launched earlier this year, by adding advanced analytics and monitoring capabilities. The platform is designed to improve employee experiences and simplify IT management by giving customers centralized control over their digital ecosystems. According to HP, this acquisition will help create a more comprehensive workplace view and set the company apart from competitors.

Lexmark/Xerox

On December 23, Xerox announced plans to acquire Lexmark, making waves during a holiday week that is typically quiet for the US print industry. Rumors circulated in Q3 that Lexmark’s owners—the Chinese consortium led by Ninestar and PAG Asia Capital—were evaluating a potential divestiture. Xerox will reportedly finance the $1.5 billion acquisition with a combination of cash and debt refinancing as it looks to strengthen its core printing business following multiple challenging quarters post-pandemic. The deal will bring Lexmark back under US ownership after its 2016 sale to the Chinese consortium.

Xerox

On October 17, 2024, Xerox announced the acquisition of ITsavvy, an Illinois-based IT services provider, for $400 million. This acquisition was part of Xerox’s broader Reinvention strategy aimed at diversifying its business by expanding into IT services. ITsavvy’s expertise in IT infrastructure, cloud migration, and managed services will bolster Xerox’s presence in the US, UK, and Canada. The acquisition is expected to be immediately accretive to earnings, reinforcing Xerox’s efforts to transform workplace solutions through innovative IT offerings.

OEM Business News

Canon

Canon U.S.A. announced the appointment of Isao “Sammy” Kobayashi as President and CEO, effective January 1, 2024. Kobayashi has been with the Canon organization since 1990, beginning his career in the photocopier sales division. More recently, Kobayashi served as the President and CEO of Canon Canada Inc. for the last year and previously held the position of Senior VP and GM of Canon U.S.A. Kobayashi will also continue to serve as an Executive Officer for Canon Inc. This transition marks his succession Kazuto “Kevin” Ogawa, who has returned to Japan for an undisclosed new assignment.

Epson

Epson remains embroiled in a legal battle with its former dealer partner, Epic Office Solutions.

Just days after its first lawsuit was dismissed on improper venue grounds, Epic Office Solutions filed a new lawsuit against Epson America in the US District Court for the Central District of California. The case, which was initially filed in New York in December 2023, originated from Epic’s claims that Epson misrepresented the yields of its ink cartridges and the potential margins available to the dealer, allegedly resulting in financial losses to Epic.

The new lawsuit is similar to the previous New York filing, although Epic has included a new section claiming that Epson added more than the stated ink volumes to cartridges “in a clear attempt by Epson to compensate for its knowledge that its machines, including all of the machines at issue in this action, did not perform as Epson represented.” Epic is asking for $20 million in damages relating to its claims.

HP

HP held its Amplify Partner Conference 2024 (APC 2024) at the Venetian in Las Vegas, Nevada, from Tuesday, March 5, to Thursday, March 7. Centered on the theme, “Future Ready – United We Win,” HP’s event served as host to over 1,500 commercial, alliance, and distribution partners representing 95 countries. HP was heavily focused on generative artificial intelligence (AI) and hybrid systems, as well as how these two technologies will power the future of work. Through HP’s AI and hybrid work initiatives and the support of its channel partners, the company intends to drive long-term sustainable partner growth.

HP announced the development of its SecuReuse program, designed to support the use of remanufactured ink and toner cartridges in its printers. Announced on May 15, 2024, at the ETIRA Conference in Brussels, Belgium, HP frames the program as an initiative to address sustainability concerns and promote the circular economy by allowing remanufacturers to reset genuine HP chips for use in remanufactured cartridges. Some industry professionals, however, view the program as a way for HP to potentially stifle aftermarket competition, as HP will charge remanufacturers to reset its chips for reuse. The program is expected to be fully rolled out in late 2025 or early 2026.

HP hosted its Amplify Retail Forum on June 4-5, 2024, in Barcelona. Themed “Future Ready – United We Win,” the event focused on the convergence of hybrid systems and generative AI to shape the future of work and play. Over 500 retail partners were reportedly in attendance, and the event featured executive keynotes from HP leadership and key alliance partners. HP introduced new retail partner benefits at the event.

HP hosted its HP Imagine 2024 event on Tuesday, September 24, 2024, at its headquarters in Palo Alto, California. The event centered on how HP plans to support the “Future of Work” as it aims to leverage AI technologies across its product lines. This included significant emphasis on AI-powered PCs and more information about HP Print AI, highlighting the company’s intention to integrate artificial intelligence (AI) into both its Personal Systems and Print business segments.

Lexmark

On March 11, Ninestar Co., Ltd. announced the decision to sell and subsequently lease back properties of its subsidiary, Lexmark, including the headquarters in Lexington, Kentucky, for $126.95 million with a monthly leaseback rate of $1.14 million. The annual rent growth rate upon renewal will be 3%. Lexmark stated that the decision to sell the properties was that of its own board of directors, not Ninestar, and that Lexmark would retain all proceeds from the sale.

Lexmark received favorable news from the U.S. Customs and Border Protection (CBP) agency, which changed the country of origin for Lexmark’s MS/MX and CS/CX printers and MFPs from China to Mexico. This change followed Lexmark’s revision of its production processes in its Juarez, Mexico facility. Under the United States-Mexico-Canada Agreement (USMCA), goods from Mexico can be imported duty-free, whereas laser printers from China face tariffs up to 25% due to Section 301 of the Trade Act of 1974.

Xerox

On March 12, Xerox Holdings Corporation (Xerox) announced the sale of its direct business in Argentina and Chile to Grupo Datco, a technologies and fiber optic network service provider in Latin America. The sale made Datco Group the exclusive partner for Xerox in Argentina and Chile, representing Xerox’s plans to transition some of its operations to a partner-led model.

On April 2, Xerox announced that Productive Business Solutions Limited (PBS) Group would take ownership of the OEM’s operations in Peru and Ecuador. PBS Group is a long-standing partner of Xerox throughout Central America, South America, and the Caribbean. The transaction closed in Q3 2024. The financial terms of the transaction were not disclosed.

On October 1, 2024, European paper distributor Antalis signed an agreement to acquire Xerox’s EMEA paper business, expanding its position in paper distribution across Europe, Africa, and India.

The acquisition granted Antalis exclusive rights to market and distribute Xerox-branded paper and digital printing media in over 40 countries, including Eastern Europe, the Balkans, the Middle East, India, and Africa. For Xerox, the divestment aligns with its focus on delivering innovative services and solutions within its core businesses.

2025 Outlook

As demand for at-home printing equipment wanes and overall print volumes continue to gradually decline, manufacturers will continue to pursue new growth opportunities while simultaneously working to preserve supplies profitability.

As a result, 2025 is expected to bring fewer supplies launches for consumer segments, with more brands turning to compatibility expansion of existing supplies rather than investing in the development of new technology for low-end lines.

Instead, expect to see increased emphasis on home printing subscriptions, with OEMs investing more to market these services to secure ongoing revenue streams. Tank/CISS models will continue to grow in overall market share as consumers increasingly favor printers with higher long-term value and smaller carbon footprints.

Within business segments, A4 color laser could see a boost from more return-to-office (RTO) mandates. Higher costs of production and the threat of tariffs on US imports may lead to additional supplies price increases, which accelerated post-pandemic and continued through 2024.

Sustainability is expected to become an increasingly important focus for manufacturers as environmental policies to combat climate change expand globally. Collection, recycling, and remanufacturing of used cartridges will gain momentum as OEMs work to meet emissions and circular economy goals.

Get more information

About the Author

Adrienne Spear

Adrienne Spear is a Senior Analyst with OpenBrand, having been with the company (formerly gap intelligence) since 2016. Previously, her focus was on the printer supplies market in the US. Adrienne has recently moved into the role of OpenBrand’s first analyst for the OPE categories, providing support for customers across the industry through custom projects, presentations, and analyses via the company’s Competitive Intelligence Services.