Refrigerators: 2025 Year-In-Review

Our Refrigerators: 2025 Year-in-Review report recaps product launches, placements, pricing and advertising and promotional activity captured throughout 2025. The report features data and insights from OpenBrand’s Refrigerators category, which feature products sold through the US ecommerce and brick-and-mortar channels.

Read through all the 2025 pricing and promotions insights below or email the report to read later.

You can also check out our 2025 Year-in-Review reports for other Major Appliance categories.

Refrigerators: 2025 Product Updates

The major appliance market’s recovery from post-COVID supply chain challenges was suppressed in 2025 as the Trump administration announced tariffs at the beginning of the year. Despite macroeconomic uncertainty due to tariffs, falling consumer sentiment, and a slow housing market, the appliance market remained resilient in 2025 as major retailers consistently reported growth in appliance sales during quarterly financial earnings calls and manufacturers continued offering strong appliance promotions that aligned with prior years.

While the first half of the year was marked by price volatility, the second half of the year showed signs of price deceleration, with November marking a period of month-over-month price deflation in the appliance sector, according to OpenBrand’s Consumer Price Index. Coupled with price stabilization, new product debuts signaled a step towards normalization in the appliance industry leading into 2026. Whirlpool Corporation underwent a significant product portfolio refresh in 2025 with the company reporting that 30% of its North America product portfolio will be transitioned, as opposed to about 10% product renewal in a typical year. The company’s product revamp includes “the first full KitchenAid redesign in a decade”, which introduced the premium Black Ore and Juniper colorways.

These dynamics suggest that 2025 was defined less by contraction and more by recalibration. Pricing pressures eased, product innovation persisted, and promotional activity remained consistent. In 2025, the industry demonstrated an ability to navigate policy-driven uncertainty while laying the groundwork for more stable demand and competitive normalization heading into 2026.

2025 Refrigerators Market Share Overview

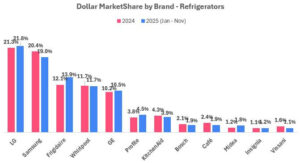

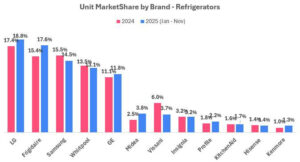

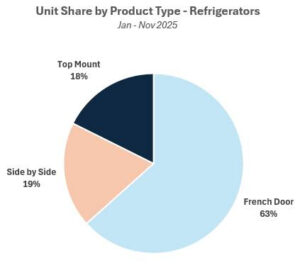

From January to November 2025, LG maintained leadership in the refrigerator market with about 19% unit share and 22% dollar share across major retailers. Frigidaire ranked second in unit share while Samsung ranked second in dollar share, reflecting Frigidaire’s value positioning and Samsung’s premium positioning. Lowe’s and Home Depot competed closely in the refrigerator market, with Lowe’s holding a slight lead over Home Depot in refrigerator unit share in 2025 (36% vs. 34%). French Door refrigerators remained the preferred configuration, composing 63% of unit sales.

Refrigerators: 2025 Pricing and Promotion Trends

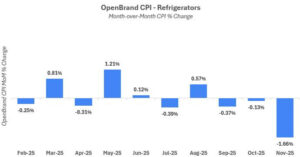

Refrigerator prices fluctuated throughout 2025 as manufacturers balanced tariff challenges with discounting strategy during key promotional periods. According to OpenBrand’s Consumer Price Index, refrigerator prices climbed month-over-month in March (+0.81% MoM), May (+1.21% MoM), and August (+0.57% MoM). Refrigerator prices experienced three consecutive months of price deflation starting in September and peaking in November (-1.66% MoM) as Black Friday promotions took effect. This pattern signals a trend towards price stability entering 2026.

Despite tariff fears, market leaders like LG, Samsung, Whirlpool, Frigidaire, and GE maintained significant discounts in 2025. These market leaders offered average discount rates above 28% for a French Door refrigerator. LG and Samsung extended these heavy promotions to their Side-by-Side portfolios, with both brands offering average discount rates above 26% on promoted models. Premium brands like GE Profile and KitchenAid promoted savings above 20% despite an average price nearing $3,000. At Lowe’s, Hisense refrigerators received heavy promotional discounts during Independence Day and Black Friday with advertised savings above 40%.

*Average price and discount rate excludes ultra premium refrigerators with a pre-discount price above $5,000

Craft Ice Segment Grows

LG introduced its first craft ice refrigerator in 2019 and this features popularity grew as the brand released new models that integrated this technology. In Q2 2025, LG debuted several new craft ice refrigerators, including a 3-Door French Door Refrigerator with an InstaView Window (LF25S6560S) and a Lowe’s Exclusive Side-by-Side Refrigerator (LL27T3530S). In the second half of 2025, Samsung released a Home Depot-Exclusive Samsung 4-Door French Door Refrigerator with Sphere Ice (RF70F29MER), supporting the growth of the craft ice refrigerator segment.

LG continued innovating in the craft ice space with the release of its first mini craft ice refrigerator (LF29S9730S) in September 2025. Rather than producing the craft ice in the freezer compartment, LG’s mini craft ice dispenses through the external water and ice dispenser. LG extended its mini craft ice refrigerator portfolio with the debut of a 4-Door French Door Refrigerator with a Instaview Window (LF29S9775S) in October 2025. With the introduction of mini craft ice technology, LG demonstrated its focus on innovation in the appliance space.

KitchenAid’s Redesign

In 2025, Whirlpool underwent a significant refresh of its appliance lineup, resulting in the transition of 30% of its North America portfolio, as opposed to 10% in a typical year. With Whirlpool’s refresh, the KitchenAid brand received its “first full redesign in a decade” as the brand debuted a new suite of large kitchen appliances with customizable hardware. Along with a standard Stainless Steel colorway, KitchenAid released two new premium colorways: Black Ore and Juniper. The brand heavily marketed its new lineup with an exhibit at KBIS 2025 and its “Make More Than Meals” advertising campaign that kicked off in October 2025.

KitchenAid released several refrigerator lines in the Black Ore and Juniper colorways, including a Counter-Depth 3-Door French Door line with an interior water dispenser (KRFC236 Series), a 3-Door French Door line with an exterior water dispenser (KRFF436 Series), a 4-Door French Door line (KRMF436 Series), and a Counter-Depth Side-by-Side line (KRSC536 Series). These new KitchenAid models are widely available at all three major retailers.

Refrigerator Market: 2026 Outlook

The 2025 refrigerator market asserted LG’s market leadership as the brand achieved the top rank in both unit and dollar sales. LG’s craft ice innovation and KitchenAid’s redesign in 2025 demonstrated the importance of both technology and aesthetics for refrigerator shoppers. In 2026, LG will continue to be an influential brand as it grows the craft ice segment and challenges premium design-focused brands with the introduction of a new LG Signature lineup that is expected to debut at CES 2026. While Asian manufacturers may experience some pricing and cost challenges with the possibility of unexpected tariff or other macroeconomic challenges, brands will likely continue offering strong discounts, especially during key promotional periods like Independence Day and Black Friday.

Get more information

Visit our Major Appliance industry page to learn more about the data we deliver for the Refrigerators market – or reach out to our analyst below to ask questions about this report or get specific insights you need.

About the Author

Bryce Tecson

Bryce Tecson is a home appliance analyst at OpenBrand with professional data analytics experience dating back to 2017. His work empowers brands to make data-driven decisions by leveraging several sources of data, including survey, pricing and promotion, and market share data. Bryce specializes in the Laundry, Refrigerators, and Ranges categories.

Ranges: 2025 Year-In-Review

Our Ranges: 2025 Year-in-Review report recaps product launches, placements, pricing and advertising and promotional activity captured throughout 2025. The report features data and insights from OpenBrand’s Ranges category, which feature products sold through the US ecommerce and brick-and-mortar channels.

Read through all the 2025 pricing and promotions insights below or email the report to read later.

You can also check out our 2025 Year-in-Review reports for other Major Appliance categories.

Ranges: 2025 Product Updates

The recovery of the major appliance market from post-COVID supply chain challenges was suppressed in 2025 as the Trump administration announced tariffs at the beginning of the year. Despite macroeconomic uncertainty due to tariffs, falling consumer sentiment, and a slow housing market, the appliance market remained resilient in 2025 as major retailers consistently reported growth in appliance sales during quarterly financial earnings calls and manufacturers continued offering strong appliance promotions that aligned with prior years.

While the first half of the year was marked by price volatility, the second half of the year showed signs of price deceleration, with November marking a period of month-over-month price deflation in the appliance sector, according to OpenBrand’s Consumer Price Index. Coupled with price stabilization, new product debuts signaled a step towards normalization in the appliance industry leading into 2026. Whirlpool Corporation underwent a significant product portfolio refresh in 2025 with the company reporting that 30% of its North America product portfolio will be transitioned, as opposed to about 10% product renewal in a typical year. The company’s product revamp includes “the first full KitchenAid redesign in a decade”, which introduced the premium Black Ore and Juniper colorways.

These dynamics suggest that 2025 was defined less by contraction and more by recalibration. Pricing pressures eased, product innovation persisted, and promotional activity remained consistent. In 2025, the industry demonstrated an ability to navigate policy-driven uncertainty while laying the groundwork for more stable demand and competitive normalization heading into 2026.

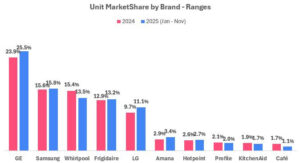

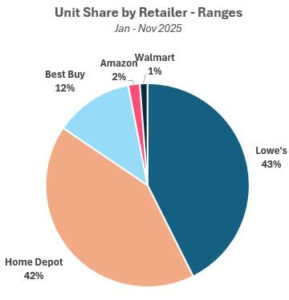

2025 MarketShare Overview: Ranges

From January to November 2025, GE increased its lead in the range market after growing unit share by 1.6ppts and dollar share by 2.3ppts compared to 2024. Samsung ranked second in the range market with about 16% unit share at major retailers. While LG trended up in 2025 (+1.4ppts compared to 2024), Whirlpool’s unit share declined by 1.9ppts. Lowe’s captured the highest unit share among major retailers in 2025 (43%) following Home Depot’s retail market leadership in 2024.

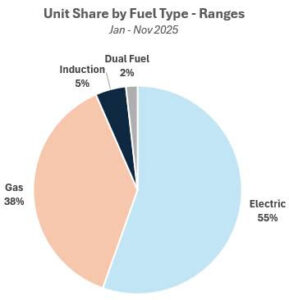

Electric ranges remained the fuel type of choice for range shoppers in 2025. Electric ranges composed 55% of unit sales at major retailers, which matched the market share of electric ranges in 2024. Gas ranges represented 38% of unit sales, which also aligned with 2024’s share. Induction and dual fuel ranges remained a small portion of range sales in 2025.

Ranges: 2025 Pricing and Promotion Trends

Range prices experienced steady inflation throughout the year starting in May, which saw prices grow by 0.83% month-over-month, according to OpenBrand’s Consumer Price Index. After six consecutive months of price growth, range prices experienced a 3.12% decline from October to November 2025 as retailers applied Black Friday promotions. This pattern is consistent with other major appliance categories as brands balanced promotional strategies with tariff challenges.

Top range brands continued offering aggressive discounts despite tariff challenges in 2025. LG, Samsung, and Frigidaire promoted an average savings around 30% off on discounted ranges throughout the year, with LG increasing its average discount rate from 23.5% in 2024 to 29.2% in 2025. While GE’s discount rate fell short of these top brands, GE’s sub-$1,000 average price and increased average discount rate (20.6% in 2024 to 24.3% in 2025) assisted in the brand’s market leadership.

Frigidaire Gallery’s Stone-Baked Pizza Innovation

In July 2025, Frigidaire released a new Frigidaire Gallery slide-in range, available in Electric (GCFE3070BF), Gas (GCFG3070BF), and Induction (GCFI3070BF), that features a new Stone-Baked Pizza oven cooking setting. This new innovation quickly cooks restaurant-quality pizza by attaching the Frigidaire Stone-Baked Pizza Shield and Stone to the top of the oven and raising the temperature to 750⁰F. Frigidaire marketed this new range as “the only oven that reaches 750⁰F” in both the product details page and in-store displays. Home Depot added the electric model to its Black Friday circular with the description identifying this model as the “only range that delivers restaurant-quality pizza in as little as 2 minutes.” The brand’s marketing messages demonstrate the significance of this new Stone-Baked Pizza feature as Frigidaire conveys the unique differentiation of its new range line.

KitchenAid’s Redesign

In 2025, Whirlpool underwent a significant refresh of its appliance lineup, resulting in the transition of 30% of its North America portfolio, as opposed to 10% in a typical year. With Whirlpool’s refresh, the KitchenAid brand received its “first full redesign in a decade” as the brand debuted a new suite of large kitchen appliances with customizable hardware. Along with a standard Stainless Steel colorway, KitchenAid released two new premium colorways: Black Ore and Juniper. The brand heavily marketed its new lineup with an exhibit at KBIS 2025 and its “Make More Than Meals” advertising campaign that kicked off in October 2025.

KitchenAid released several slide-in range lines in the Black Ore and Juniper colorways, with varying tiers of features. The base-level 330 Series ranges offer standard functionality with several convection cooking modes like no preheat air fry, slow cook, and fresh pizza mode. The upgraded 530 Series features two Even-Heat Hyper Elements that accommodate 6-inch and 9-inch cookware for the electric ranges and a 2-in-1 stacked central burner that can transition from an oval burner to circular burner for the gas ranges. Lowe’s also released an exclusive 430 Series that represents a mid-tier option that lacks these customizable cooking elements but includes additional cooking options like air sous vide and steam cooking. While the 430 Series is exclusive to Lowe’s, the KitchenAid 330 Series and 530 Series models are widely available at all three major retailers.

Ranges: 2026 Outlook

In 2025, GE grew its lead in the range market despite challenges from Frigidaire’s new pizza cooking innovation and KitchenAid’s range refresh. In 2026, premium range brands may reemphasize design and customizability in response to KitchenAid’s redesign, potentially beginning with LG Signature’s new range that is expected to debut at CES 2026. While range prices grew consistently throughout 2025, prices will likely normalize in 2026 as manufacturers adjust to tariffs that were announced in 2025. Top range brands will likely continue promoting discounts around 30%, especially during key promotional periods.

Get more information

Visit our Major Appliance industry page to learn more about the data we deliver for the Ranges market – or reach out to our analyst below to ask questions about this report or get specific insights you need.

About the Author

Bryce Tecson

Bryce Tecson is a home appliance analyst at OpenBrand with professional data analytics experience dating back to 2017. His work empowers brands to make data-driven decisions by leveraging several sources of data, including survey, pricing and promotion, and market share data. Bryce specializes in the Laundry, Refrigerators, and Ranges categories.

Laundry: 2025 Year-In-Review

Our Laundry: 2025 Year-in-Review report recaps washer and dryer product launches, placements, pricing and advertising and promotional activity captured throughout 2025. The report features data and insights from OpenBrand’s Floor Care category, which feature products sold through the US ecommerce and brick-and-mortar channels.

Read through all the 2025 pricing and promotions insights below or email the report to read later.

You can also check out our 2025 Year-in-Review reports for other Major Appliance categories.

Laundry Market: 2025 Product Updates

The recovery of the major appliance market from post-COVID supply chain challenges was suppressed in 2025 as the Trump administration announced tariffs at the beginning of the year. Despite macroeconomic uncertainty due to tariffs, falling consumer sentiment, and a slow housing market, the appliance market remained resilient in 2025 as major retailers consistently reported growth in appliance sales during quarterly financial earnings calls and manufacturers continued offering strong appliance promotions that aligned with prior years.

While the first half of the year was marked by price volatility, the second half of the year showed signs of price deceleration, with November marking a period of month-over-month price deflation in the appliance sector, according to OpenBrand’s Consumer Price Index. Coupled with price stabilization, new product debuts signaled a step towards normalization in the appliance industry leading into 2026. Whirlpool Corporation underwent a significant product portfolio refresh in 2025 with the company reporting that 30% of its North America product portfolio will be transitioned, as opposed to about 10% product renewal in a typical year. The company’s product revamp includes “the first full KitchenAid redesign in a decade”, which introduced the premium Black Ore and Juniper colorways.

These dynamics suggest that 2025 was defined less by contraction and more by recalibration. Pricing pressures eased, product innovation persisted, and promotional activity remained consistent. In 2025, the industry demonstrated an ability to navigate policy-driven uncertainty while laying the groundwork for more stable demand and competitive normalization heading into 2026.

2025 MarketShare Overview: Washers and Dryers

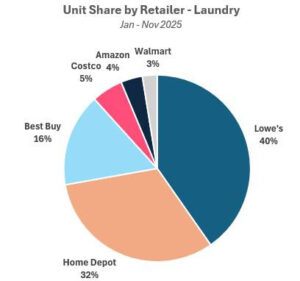

From January to November 2025, LG maintained leadership in the laundry market with about 24% unit share and 28% dollar share across major retailers. While LG’s share remained consistent with its 2024 share, Samsung experienced about a 2ppt year-over-year unit share increase while Whirlpool lost about 1ppt of unit share. Similar to 2024, Lowe’s captured 40% of the laundry unit share in 2025 while Home Depot followed with 32% unit share.

Laundry shoppers continued to favor top load washers over front load washers in 2025. Top load washers represented 66% of the washer units sold at major retailers, followed by front load washers at 28%. Similarly, electric dryers remained the preferred dryer type in 2025 with 80% unit share in the dryer market. This matches the electric dryer’s unit share in 2024.

Laundry: 2025 Pricing and Promotion Trends

Laundry prices fluctuated throughout 2025 as manufacturers reacted to new tariff announcements while offering appealing discounts during key promotional periods. According to OpenBrand’s Consumer Price Index, laundry prices spiked in March and May 2025 with price increases of 1.9% and 1.2% compared to the previous month. Laundry prices remained relatively stable throughout the Summer; however, prices began to trend down starting in September as manufacturers adjusted to tariff policies. Prices experienced the largest drop from October to November as Black Friday promotions took effect.

Despite tariff fears, key brands continued offering a sub-$1,000 average price for a washer or dryer in 2025. Top laundry brands also sustained significant discounts on promoted washers and dryers, illustrated by LG’s 27.3% average discount rate. Other top brands like Samsung and GE similarly offered an average discount rate above 25% while Whirlpool, a primarily domestic manufacturer, trailed these top brands with a 21.2% average discount rate (-2.0ppts compared to 2024’s average discount rate). Best Buy’s house brand Insignia led the value market in average price ($491) and average discount rate (27.1%) compared to other budget brands.

Pet Pro Laundry Options Trending Up

At KBIS 2025, Whirlpool introduced Maytag’s new Pet Pro Option that leverages extra water settings, built-in filters, and steam technology to optimize pet hair removal from laundry loads. The brand exhibited its new front load line (MFW7020 Series) during the conference and expanded the distribution of the White, Midnight Steel, and Volcano Black models to all three major retailers throughout the first half of 2025. In the second half of 2025, Maytag released two top load laundry lines with the Pet Pro Option integration. The brand first released the premium top load line (MTW7200 Series) that is available in White, Midnight Steel, and Classic Silver. Maytag followed with a more basic top load line (MTW5600 Series) that trades a lower price point for fewer color options (White, Volcano Black) and lower capacity (4.8’ vs. 5.3’).

In Q3 2025, LG responded to Maytag’s pet care launches with the debut of a new front load line (WM5800 Series) that included a Pet Care cycle. While Maytag primarily focused on promoting its Pet Pro features on its new laundry line, the new LG front load line emphasizes other features like AI Sensing in its product details page. This suggests that Maytag’s 2025 laundry debuts will likely focus on dominating the pet care shopper while other brands will take a more holistic approach to reach a wider audience.

Laundry Market: 2026 Outlook

The 2026 laundry market will likely continue seeing LG and Samsung’s brand leadership and Lowe’s retail leadership. Whirlpool underwent a significant product portfolio revamp across all its appliance categories in 2025, suggesting that debuts may be limited in the second half of 2026 across its key brands. However, the company signaled optimism for a price and cost advantage over Asian manufacturers as tariffs take full effect. Whirlpool may opt for increasing discounts on 2025 releases to apply pressure to brands like LG and Samsung. While these brands may experience some pricing and cost challenges, it is likely that these brands maintain an average discount rate above 25%, especially during key promotional periods like Independence Day and Black Friday.

Get more information

Visit our Major Appliance industry page to learn more about the data we deliver for the Landry market – or reach out to our analyst below to ask questions about this report or get specific insights you need.

About the Author

Bryce Tecson

Bryce Tecson is a home appliance analyst at OpenBrand with professional data analytics experience dating back to 2017. His work empowers brands to make data-driven decisions by leveraging several sources of data, including survey, pricing and promotion, and market share data. Bryce specializes in the Laundry, Refrigerators, and Ranges categories.