Refrigerators: 2024 Year-In-Review

The following report contains a 2024 year-end analysis for the Refrigerator category. The report covers placements, product debuts, promotions, pricing, and advertisements.

- 2024 Major Home Appliances Share of Placements by Category

- Refrigerators: 2024 Share of Retail Placements by Brand

- Refrigerators: 2024 Product Debuts

- Refrigerators: 2024 Promotions

- Refrigerators: 2024 Pricing

- Refrigerators: 2024 Advertising

- 2025 Outlook

Read through all the 2024 pricing and promotions insights below or email the report to read later.

2024 Major Home Appliances Share of Placements by Category

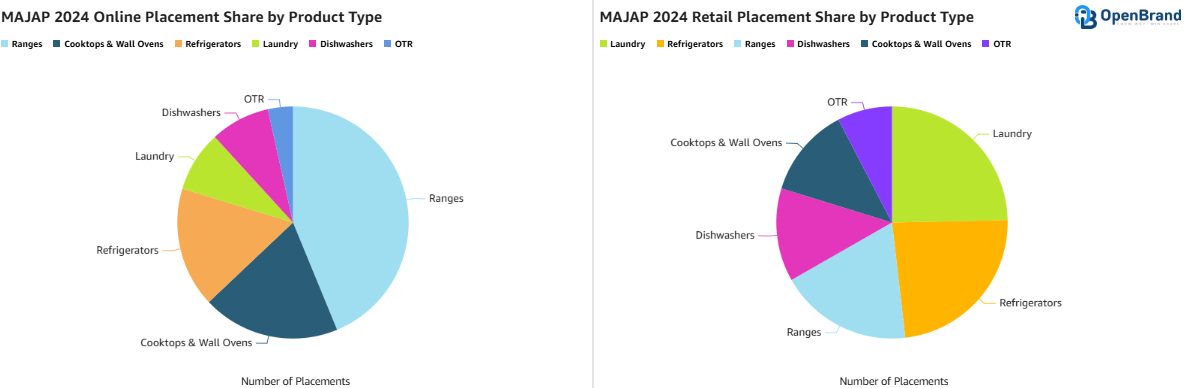

Across categories, Ranges continued to represent the majority of Home Appliances within the online channel (44%). The large presence of online offerings of ranges was driven by manufacturers such as Ilve, Viking, and AGA, as well as additional online exclusive premium manufacturers. Cooktops and Wall Ovens offered the second-largest online share of unique models (19%), followed by Refrigerators (17%), Laundry (8%), Dishwashers (8%), and Over the Range (OTR) Microwaves (4%).

Across categories, Ranges continued to represent the majority of Home Appliances within the online channel (44%). The large presence of online offerings of ranges was driven by manufacturers such as Ilve, Viking, and AGA, as well as additional online exclusive premium manufacturers. Cooktops and Wall Ovens offered the second-largest online share of unique models (19%), followed by Refrigerators (17%), Laundry (8%), Dishwashers (8%), and Over the Range (OTR) Microwaves (4%).

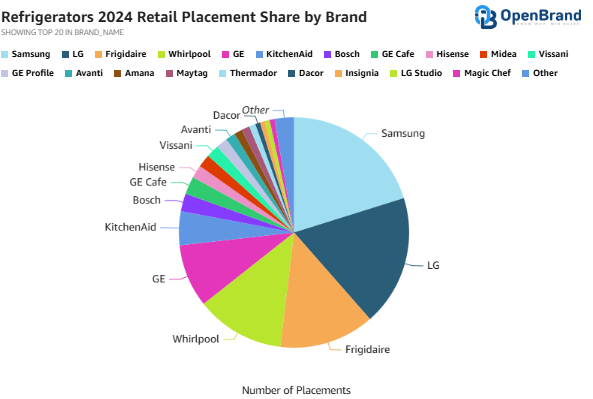

Refrigerators: 2024 Share of Retail Placements by Brand

In the retail channel, Samsung continued to hold the majority share for refrigerator placements (20%), despite experiencing a 3ppts decrease from 23% in 2023. LG offered the second-largest retail offering with an 18% share and experienced a 3ppts decrease in share from 21% in 2023. The remainder of the top five manufacturers leading in placement counts included Frigidaire (13% share), Whirlpool (12% share), and GE (9% share). The decrease in share for Samsung and LG was mainly driven by the increase in placements for Frigidaire (+2ppts YoY) and Whirlpool (+1ppt YoY).

Refrigerators: 2024 Product Debuts

In 2024, OpenBrand captured 718 refrigerator product debuts, over double the collective count of debuts in 2023 and 2022. This is the largest number of product debuts captured for the category in over five years. Fifty-nine manufacturers offered new models, with the top five largest contributing manufacturers including Sub-Zero (81), Hallman (79), Viking (46), Smeg (35), and Forno (32). The month of March offered the highest amount of product debuts (172).

Out of the 718 product debuts captured in 2024, only 36 gained an in-store placement. Samsung offered 29 product debuts in 2024, with 11 models gaining an in-store placement. These debuts included the 22.5’, 23’, 28.6’, and 29.0’ BESPOKE French Door models. LG followed with nine of its 23 product debuts in 2024 gaining in-store placements. Most of LG’s in-store debuts were a mix of Top Mount, French Door, and Side by Side models, with three large-capacity French Door models, including the 30.7′ InstaView Stainless French Door (LF31S6360S).

Notable 2024 Refrigerator series launches included:

- Samsung Bespoke Series – Featuring the AI Family Hub in the 4-Door Flex models

- Bosch 100 Series – Aimed at delivering premium features with accessibility

- LG MAX™ Series – A 4-Door standard-depth line offering enhanced flexibility and style

- LG Counter-Depth MAXRefrigerator with Zero Clearance

Refrigerators: 2024 Promotions

The average discount percentage in 2024 was consistent with the previous year at 13%, but demonstrated 6ppts increase compared to 2022 (7%). The average promotion value increased to $338 from $331 in 2023 to $172 in 2022.

Hisense led key manufacturers in the overall average discount percentage in 2024 (27%), as well as experienced the largest increase YoY (+7pps). Frigidaire offered the second-largest average discount percentage of 2024 with 24%, followed by Samsung (21%), LG (13%), GE (13%), and GE Profile (13%). LG (-3ppts), Amana (-2ppts), Bosch (-1ppt), and Electrolux (-2ppts) all experienced a decrease in average discount percentage during 2024.

In 2024, Lowe’s consistently offered the highest discounts, peaking at 28% in February and maintaining a strong promotional focus throughout the year, with dips in July and August before recovering to around 26% in December. Best Buy and regional merchants closely followed, with their discounts oscillating between 24% and 26% for most of the year, showing a strong competitive push. Home Depot, however, maintained a more conservative discount strategy, hovering between 19% and 22%, with a slight increase to 22% in April before stabilizing again. These trends highlight Lowe’s dominance in promotional activity while showcasing a steady but less aggressive approach from Home Depot.

In 2024, promotional discounts for refrigerators during key sales periods showcased an overall increase compared to previous years. Presidents Day saw a significant jump to 21%, up from 18% in 2023 and 12% in 2022, marking one of the largest growth periods. Memorial Day and Independence Day also reached 22%, slightly increasing from 21% in 2023 and noticeably higher than 14% and 15% in 2022, respectively. Labor Day discounts dipped slightly to 20%, compared to 21% in 2023, but remained above the 16% in 2022. Black Friday discounts held steady at 21%, consistent with 2023 and up from 18% in 2022.

Refrigerators: 2024 Pricing

In 2024, the average net price for Refrigerators decreased by $13 to $1,057 compared to $1,070 in 2023. The average shelf price remained relatively consistent, slightly increasing to $1,469 from $1,453 in 2023.

Among key brands in 2024, KitchenAid consistently held the highest net price in 2024, ranging from $1,706 to $2,071, with a notable peak in August before stabilizing near $1,857 by December. LG remained competitive in the mid-tier range, fluctuating between $1,220 and $1,343, with prices stabilizing after a slight dip mid-year. Samsung’s pricing stayed steady in the $1,000-$1,100 range, indicating minimal yearly volatility.

Whirlpool and GE operated at the lower end of the spectrum, with Whirlpool’s prices dropping from $921 in January to $790 by December and GE showing a consistent downward trend, ending the year at $599. Frigidaire maintained its position as the most affordable option, with prices hovering around $770-$880 for most of the year.

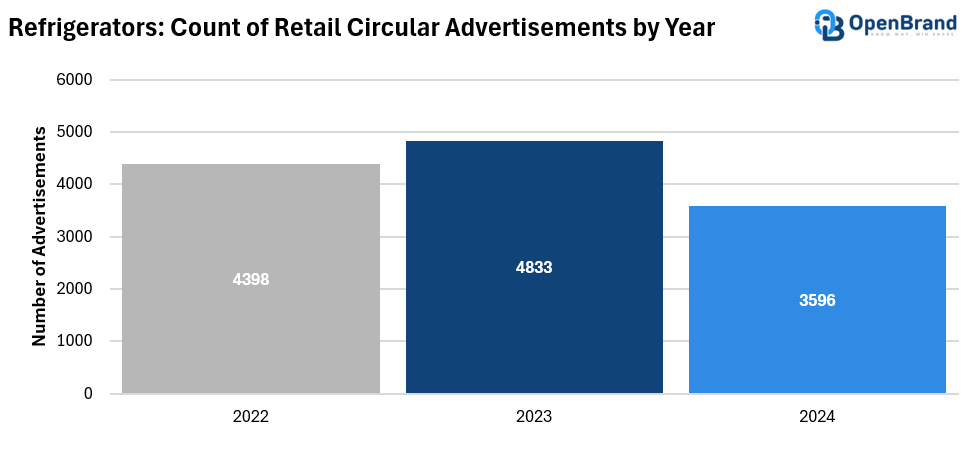

Refrigerators: 2024 Advertising

In 2024, refrigerator retail circular advertising experienced a 25% YoY decrease to 3,596 total advertisements and an 18% decrease compared to 2022. Samsung continued to lead manufacturers with the largest amount of advertisements (23% share), followed by LG (19% share), Frigidaire (13% share), Whirlpool (7% share), and GE (6% share). Instant savings remained the dominant promotion type for refrigerators, comprising 31% of all retail advertisements.

Market Outlook for 2025 and 2026

Looking ahead to 2025, the refrigerator category is expected to see continued growth in product diversity, with manufacturers broadening their offerings to cater to a wider range of consumer preferences.

Online-exclusive models and AI-driven smart features will likely gain further traction as demand for connected home appliances continues to rise.

Competitive pricing strategies and aggressive promotions during major sales events will remain key drivers of market activity.

However, tariffs will impact pricing into 2026, driving up costs and dampening consumer interest in refrigerator purchases and upgrades.

As brands navigate these challenges alongside evolving consumer priorities, the balance between innovation, affordability, and functionality will be critical in shaping the market trajectory.

Get more information

About the Author

Eleni Fialo

Eleni Fialo is a market analyst with a focus on the cooking and refrigeration industries. Her research examines emerging trends and innovations driving change in these sectors.

Ranges: 2024 Year-In-Review

Our Ranges year-in-review report recaps placements, product debuts, promotions, pricing, and advertisements captured throughout 2024 with comparisons drawn to 2023. The report features data and insights from OpenBrand’s Business Ranges categories, which feature ranges sold through the US ecommerce and brick-and-mortar channels.

- Impact Summary

- Share of Placement

- Product Debuts

- Promotions

- Pricing

- Advertising & Promotions

- Outlook

Read through all the 2024 pricing and promotions insights below or email the report to read later.

Methodology

Data included in this report is sourced from the OpenBrand Business Range categories. Data in this analysis (except for advertising data) was captured between Q1 2023 (week of January 1) and Q4 2024 (week of December 8). Advertising data runs through December 31, 2024. Retail advertisements include Banner Ads and Retail Circulars captured at retailers and their dot com counterparts (i.e. Staples and Staples.com). The merchants were updated to only the brick-and-mortar name regardless of channel for simplicity (i.e. any Staples.com ads were updated to Staples). Additionally, the following advertising section features SKU-specific ads.

Impact Summary

The 2024 Year-in-Review for Ranges outlines significant market trends, highlighting their continued prominence in the major home appliance sector. The analysis includes insights on placements, product debuts, promotions, pricing, and advertising, offering a comprehensive view of the category’s performance over the past year.

- Ranges dominated online offerings (44%) but lost the top spot to laundry in brick-and-mortar placements.

- 1,858 new ranges were introduced, driven by premium manufacturers like Ilve and Viking. March was the peak launch month.

- Discounts averaged 9%, led by Hisense (31%) and Frigidaire (22%).

- KitchenAid led premium pricing, while GE and Frigidaire remained budget-friendly.

- Expect innovation balanced with affordability amidst economic challenges.

Share of Placement

2024 Major Home Appliances Share of Placements by Category

Across categories, Ranges continued to represent the majority of Home Appliances within the online channel (44%). The large presence of online offerings of ranges was driven by manufacturers such as Ilve, Viking, and AGA, as well as additional online exclusive premium manufacturers. Cooktops and Wall Ovens offered the second-largest online share of unique models (19%), followed by Refrigerators (17%), Laundry (8%), Dishwashers (8%), and Over the Range (OTR) Microwaves (4%).

Within the brick-and-mortar channel, Ranges lost its dominant presence to Laundry, which held a 25% share of all retail placements. Refrigerators comprised the second-largest offering with a 23% share, followed by Ranges (19%), Dishwashers (13%), Cooktops and Wall Ovens (13%), and Over the Range Microwaves (8%).

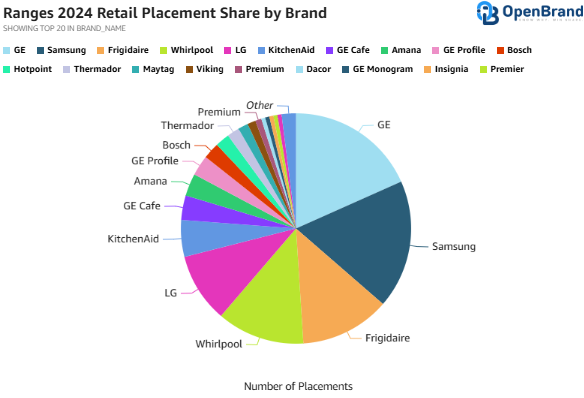

Ranges: 2024 Share of Retail Placements by Brand

In the retail channel, GE continued to hold the majority of in-store placements (18%), increasing by 1ppt compared to 2023 (17%). All remaining top five manufacturers for placement share remained consistent with slight increases and decreases by manufacturer, including Samsung (18% share, +2ppts YoY), Frigidaire (13% share, -1ppt YoY), Whirlpool (12% share, flat YoY), and LG (10% share, flat YoY).

Product Debuts

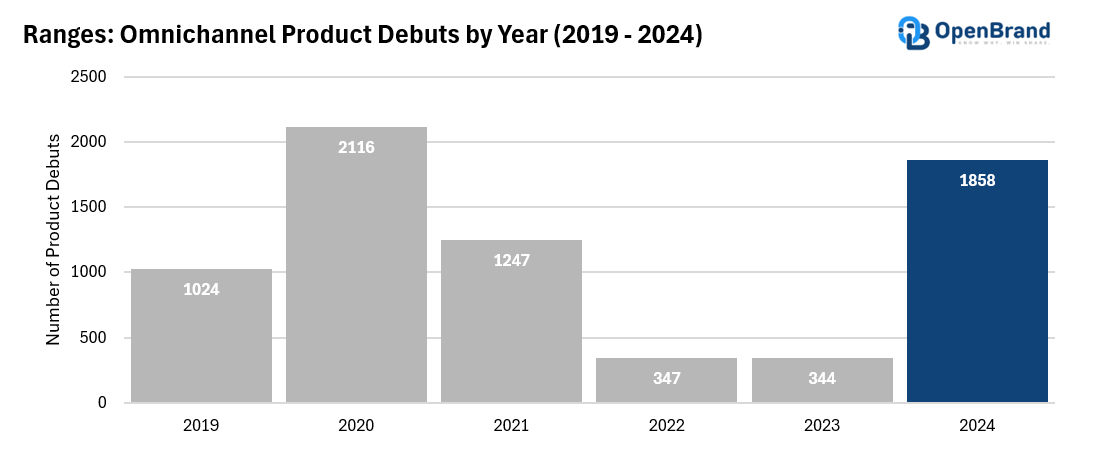

In 2024, OpenBrand recorded 1,858 range product debuts across the omnichannel, making it the second-largest year for debuts after 2020, which saw 2,116 introductions. This marks a significant rebound from the lower numbers in the previous two years. The surge in 2024 was driven by premium manufacturers such as Ilve, Hallman, ZLINE, and Kucht, each contributing over 200 new models. AGA and Viking also played a key role, introducing 159 and 157 models, respectively.

Many of these manufacturers emphasized variety by offering the same models in multiple color options, significantly boosting the debut count. Like 2020, these premium brands led the charge, focusing on refreshing their existing assortments. March 2024 stood out as the peak month, with 653 new models introduced.

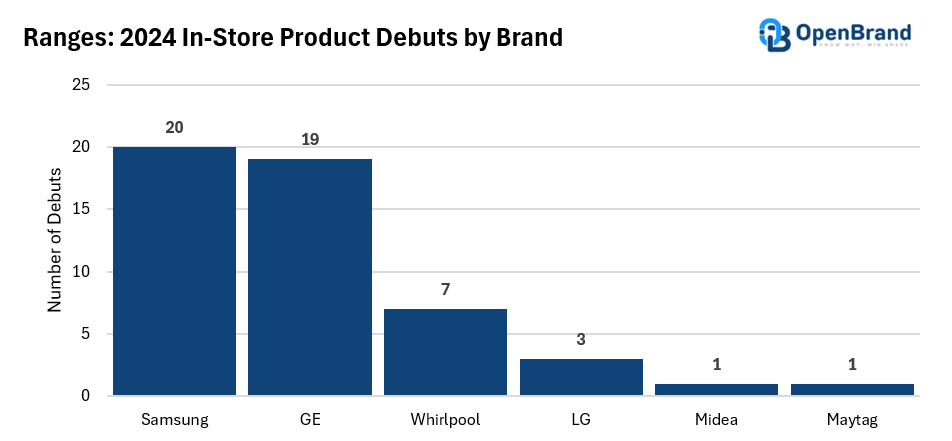

Out of the 1,858 debuts in 2024, only 51 gained in-store placements. Samsung led in in-store debuts, representing with 20 in-store placements out of the 70 total across brands. All of Samsung’s in-store debuts were for its refreshed BESPOKE Series, which included the 6.3′ BESPOKE AI Stainless Induction (NSI6DG9900SR). GE followed closely behind Samsung with 19 in-store debuts, driven by the expansion of its 400, 500, and 600 Series models during the first half of the year.

Additional notable product debuts included:

- Samsung BESPOKE Ranges – Including the first induction models introduced to the series

- Midea Freestanding Range Series – Marking Midea’s debut in the freestanding range market, with models featuring large oven capacities and steam cleaning functionality

- Frigidaire Professional Series – Equipped with Air Fry, True Convection, and sleek stainless-steel designs

- Whirlpool Smart Range Series – Focused on connectivity with features like remote control and scan-to-cook technology

Promotions

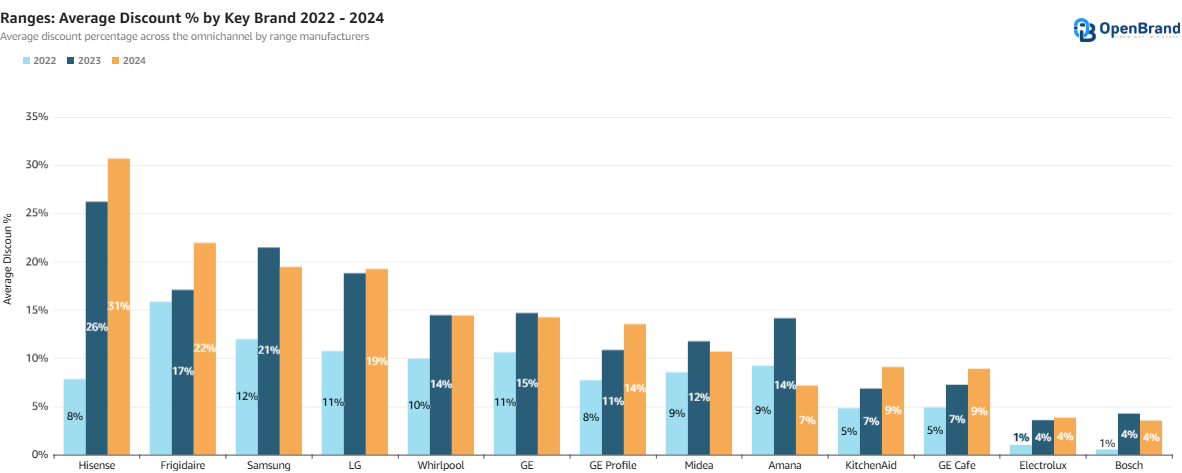

The average discount percentage in 2024 increased slightly YoY to 9%, demonstrating a 4ppts increase compared to 2022 (5%). The average promotion value increased to $343 from $275 in 2023 and from $151 in 2022.

In 2024, Hisense remained the leader in average discount percentage for ranges, offering 31% off, up from 26% in 2023. Frigidaire followed with a 22% discount, a notable increase from 17% in 2023. Hisense and Frigidaire were tied for the largest YoY increase (+5pps). Samsung maintained a strong position at 21%, up slightly from 20% the previous year. In contrast, LG experienced a decline, dropping from 22% in 2023 to 19% in 2024.

Other brands, including Whirlpool and GE, remained relatively stable, with slight variations around the 14%-15% range. Midea also saw consistent performance, holding at 12%, while Amana's discounts grew significantly from 9% to 14%. Notably, premium brands like KitchenAid, GE Café, Electrolux, and Bosch offered minimal discounts, hovering between 4%-9%.

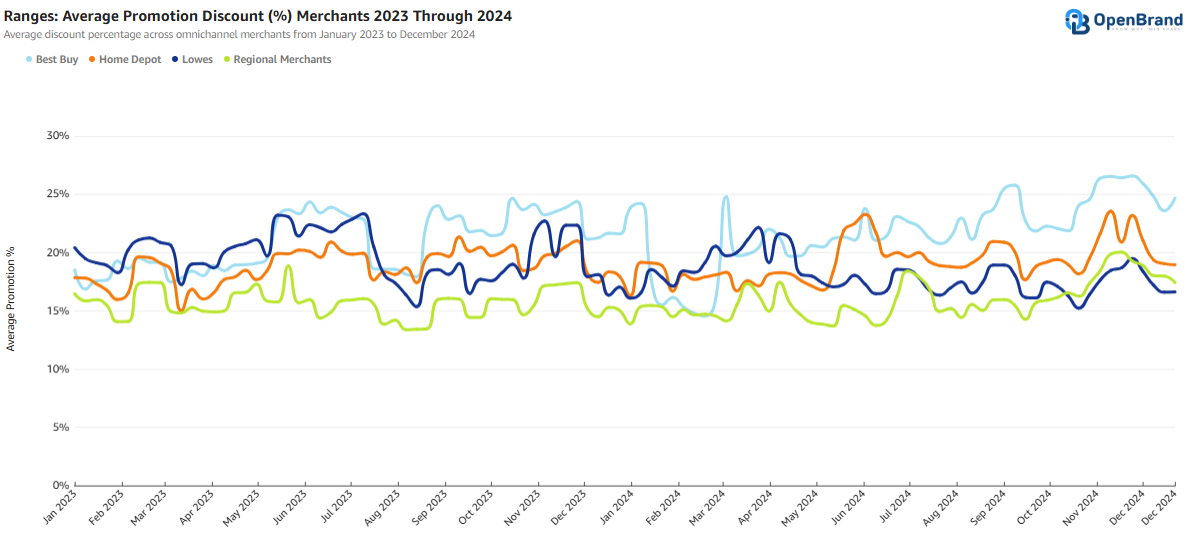

In 2024, Best Buy led with the largest promotional discounts, peaking at 27% in November and maintaining consistently high discounts above 24% throughout much of the year. Home Depot followed, peaking at 23% in November, with discounts generally ranging between 18% and 22%. Lowe’s peaked at 22% in March 2024, with discounts typically fluctuating between 16% and 22% throughout the year.

Regional merchants offered the lowest average discounts, peaking at 20% in December and remaining between 14% and 18% throughout the year. Best Buy’s aggressive discounting dominated key promotional periods, especially in November, while Home Depot maintained consistent activity with a notable increase in May. Lowe’s demonstrated strong performance early in the year, with its March peak, while regional merchants showed steadier, more conservative trends.

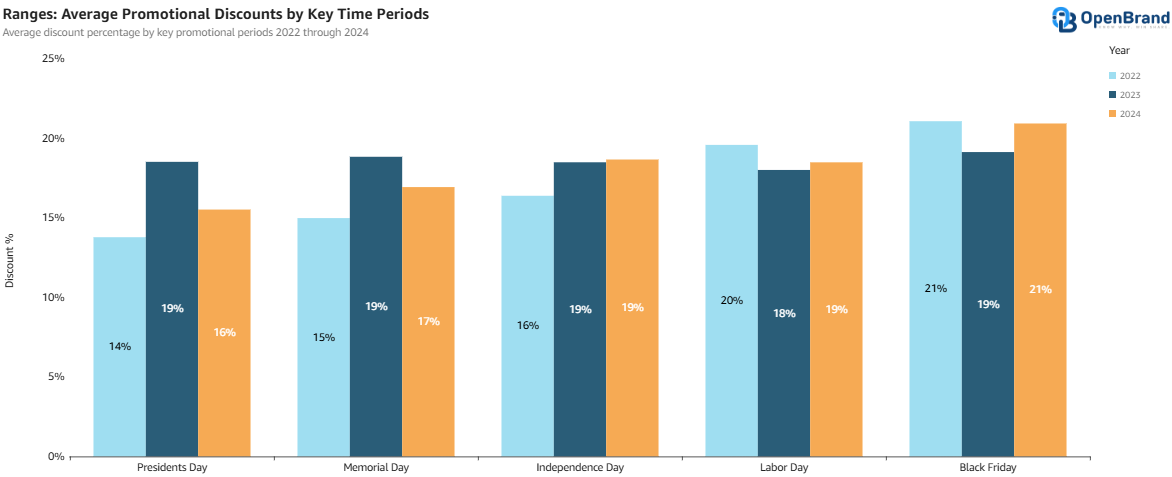

In 2024, promotional discounts for ranges during key sales periods showed varied trends compared to prior years. Presidents’ Day saw a notable decline in average discounts, dropping to 16% from 19% in 2023 but remaining higher than 14% in 2022.

Memorial Day also experienced a decrease, with discounts averaging 17%, down from 19% in 2023 and 15% in 2022. Independence Day held steady at 19%, consistent with 2023 and up from 16% in 2022. Labor Day discounts increased slightly to 19%, compared to 18% in 2023 but remained below the 20% in 2022. Black Friday tied with its 2022 peak at 21%, recovering from 19% in 2023.

Pricing

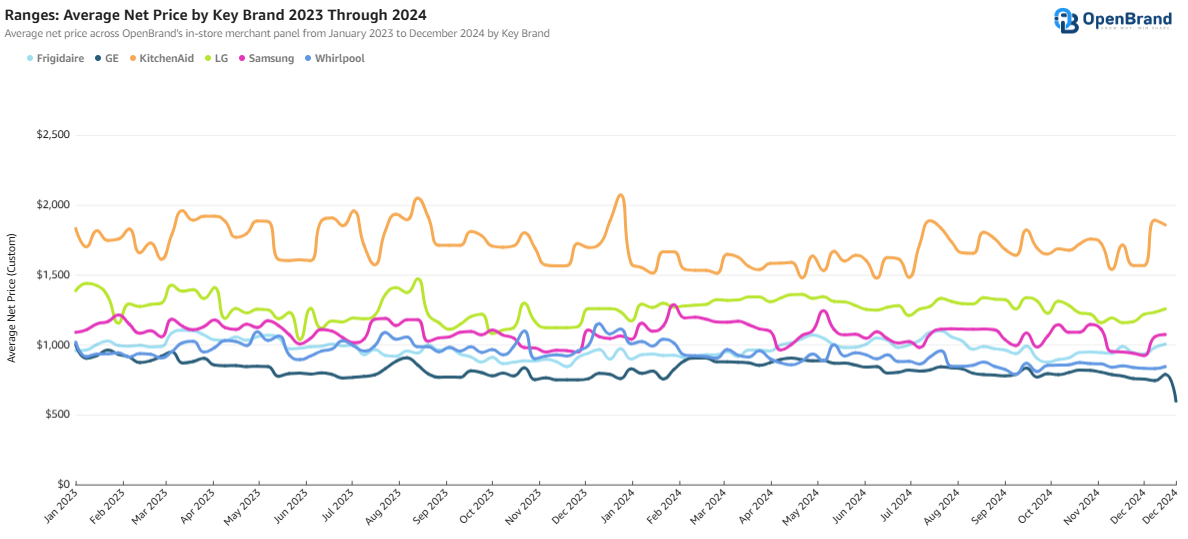

In 2024, KitchenAid maintained the highest average net price among key range brands, consistently hovering between $1,800 and $2,071 and peaking in August before stabilizing at $1,857 by December. LG operated in the mid-tier price range, with averages fluctuating between $1,167 and $1,343, showing modest price stability throughout the year and ending at $1,257. Samsung’s average net price remained steady in the $1,000 to $1,100 range, reflecting minimal volatility.

Whirlpool and GE targeted more budget-conscious consumers, with Whirlpool’s prices dropping steadily from $921 in January to $790 by December, while GE showed a consistent downward trend, ending at $599, the lowest among all brands. Frigidaire maintained its position as the most affordable option, with average net prices ranging from $770 to $890, gradually decreasing throughout the year.

Advertising & Promotions

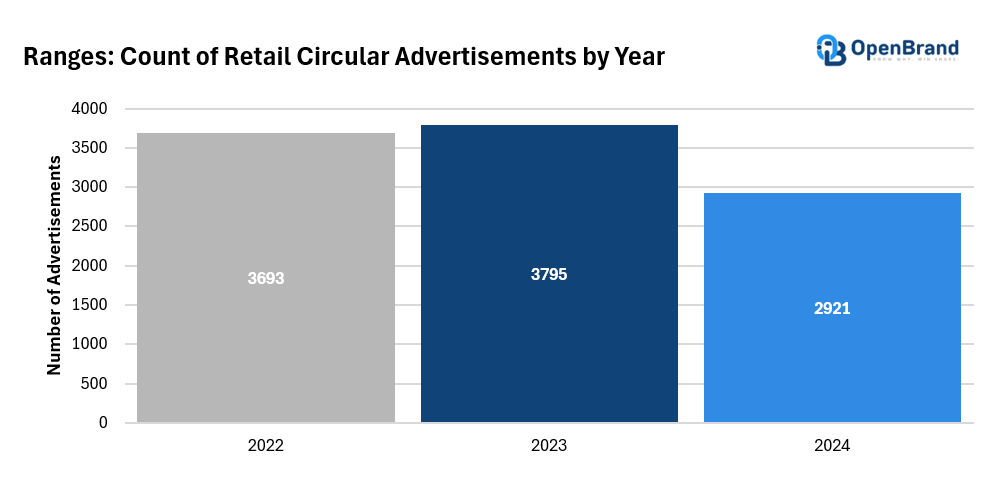

In 2024, range retail circular advertising experienced a 23% YoY decrease to 2,921 total advertisements and a 21% decrease compared to 2022. Samsung continued to lead manufacturers with the largest amount of advertisements (19% share), followed by Frigidaire (14% share), LG (13% share), Whirlpool (11% share), and GE (9% share).

Bundles remained the dominant promotion type for ranges, comprising 42% of all retail advertisements.

Outlook

Looking ahead to 2025, the range category is expected to balance innovation, affordability, and competitive pricing amidst potential economic challenges. Premium brands like KitchenAid and Samsung will likely continue focusing on high-end offerings with advanced features, while budget-friendly options from Whirlpool, Frigidaire, and GE aim to capture cost-conscious consumers through lower net prices and consistent promotions.

However, potential tariffs on imported components or finished goods could drive up prices, impacting affordability and possibly slowing consumer purchases and upgrades. Manufacturers and retailers will need to adapt by refining promotional strategies and focusing on product differentiation to maintain market competitiveness.

Get more information

About the Author

Eleni Fialo

Eleni Fialo is a market analyst with a focus on the cooking and refrigeration industries. Her research examines emerging trends and innovations driving change in these sectors.