Tablets & Detachables: 2025 Year-In-Review

Our Tablets: 2025 Year-in-Review report recaps Tablet & Detachable launches, placements, pricing and advertising and promotional activity captured throughout 2025. The report features data and insights from OpenBrand’s Tablet & Detachables category, which feature products sold through the US ecommerce and brick-and-mortar channels.

Read through all the 2025 pricing and promotions insights below or email the report to read later.

You can also check out our 2025 Year-in-Review reports for other Consumer Electronics categories.

Tablets & Detachables Product Updates

In 2025, the tablet category sharpened into three clear battlegrounds: premium “laptop replacement” devices, midrange productivity slates, and ultra-affordable big-screen options. Across Apple, Samsung, Microsoft, Lenovo, Amazon, and Walmart’s onn, the year’s most meaningful shifts weren’t just about faster chips, they centered on AI-driven experiences, more PC-like workflows via keyboards and multitasking modes, and larger, higher-refresh displays becoming mainstream at lower prices.

- AI became the primary feature story, and also the biggest lineup divider.

- Apple pushed “built for Apple Intelligence” down to iPad Air (M3) while keeping the base iPad on A16 without Apple Intelligence support, making AI a clear upsell lever.

- Samsung did the same in Android-land by pushing AI features into both midrange FE and flagship S lines (Circle to Search, writing/drawing assists, etc.).

- “Laptop replacement” wasn’t just marketing. Brands shipped more “PC-like” workflows.

- Samsung upgraded DeX with Extended Mode (true dual-screen behavior across tablet + external monitor) and multi-workspace setups.

- Microsoft doubled down on the 2‑in‑1 identity with a new 12-inch Surface Pro and its redesigned keyboard/pen storage approach

- Big screens moved down-market; high refresh became common outside flagships. Samsung’s Tab S10 FE+ jumped to 13.1″ (90Hz), Lenovo brought 12.7″ 3K at 144Hz to both premium (Yoga Tab Plus) and midrange (Idea Tab Pro) pricing, and Apple kept 11/13-inch sizing as mainstream.

- Wi‑Fi 7 arrived as a flagship/tablet-halo checkbox. Apple brought Wi‑Fi 7 to iPad Pro via its new N1 networking chip; Samsung put Wi‑Fi 7 in Tab S11 Ultra; Lenovo put Wi‑Fi 7 in Yoga Tab Plus.

- The budget fight intensified via retail/channel brands, especially Walmart’s onn. onn pushed large-screen Android 14 tablets at ~$129–$179 price points (11″ and 12.1″) that undercut most “name brand” devices on screen size-per-dollar.

2025 Tablet Timeline: Key Launches & Strategic Moves

Jan (CES) — Lenovo

- Introduced Yoga Tab Plus (positioned as its first on-device AI tablet)

- Announced Idea Tab Pro pricing/availability

- Why it mattered competitively:

- Put “premium Android tablet” pressure on Samsung from below (flagship-ish screen/refresh + AI story at lower price points)

Mar — Apple

- Refreshed iPad Air to M3

- Introduced a new Magic Keyboard for Air

- Refreshed the base iPad to A16 with 128GB starting storage

- Why it mattered competitively:

- Apple re-anchored the lineup:

- Air becomes the mainstream “AI iPad”

- Base iPad becomes the value iPad—but explicitly not the AI iPad

- Apple re-anchored the lineup:

Apr — Samsung

- Launched Galaxy Tab S10 FE / FE+ (including the new 13.1″ FE+)

- Why it mattered competitively:

- Samsung defended the midrange with bigger screens + “AI out of the box”

- Directly aimed at iPad Air and Lenovo’s rising midrange

May — Microsoft

- Launched Surface Pro, 12-inch

- Copilot+ PC

- Snapdragon X Plus

- 45 TOPS NPU

- Why it mattered competitively:

- A clearer iPad Pro / Galaxy Tab Ultra challenger for buyers who want:

- Full Windows + tablet form factor

- A lower entry price than many premium tablet + keyboard bundles

- A clearer iPad Pro / Galaxy Tab Ultra challenger for buyers who want:

Aug — Amazon

- Reported plan for an Android-powered tablet (vs. Fire OS) “as soon as next year,” potentially around $400

- Also discussed Vega OS for lower-priced devices

- Why it mattered competitively:

- Amazon’s most meaningful tablet “move” in years:

- A credible attempt to move beyond content-first budget tablets

- Toward iPad/Samsung territory by addressing app compatibility pain

Sep — Samsung

- Launched Galaxy Tab S11 / S11 Ultra

- 14.6″ Ultra

- DeX Extended Mode

- Wi‑Fi 7 on Ultra

- Why it mattered competitively:

- Strengthened Samsung’s “Android laptop replacement” pitch

- Directly attacked iPad Pro’s productivity ceiling with improved external-display workflows

Oct — Apple

- Launched iPad Pro with M5

- AI performance leap

- Wi‑Fi 7

- Ultra-thin design

- Tandem OLED

- Why it mattered competitively:

- Protected the premium halo with:

- Maximum performance

- Display leadership

- A stronger AI acceleration story

- Kept iPad Pro positioned as the “no excuses” creative/pro device

- Protected the premium halo with:

Key Brands: 2025 Highlights and What Shifted

Apple: Key 2025 releases

- iPad Air (M3): positioned as “built for Apple Intelligence,” kept 11″/13″ sizes, and introduced a new Magic Keyboard designed for Air.

- Base iPad (11th gen, A16): upgraded to A16 and 128GB starting storage at $349, shipping March 12, but explicitly remains the only “new iPad” without Apple Intelligence.

- iPad Pro (M5): leaned hard into AI performance claims, N1 Wi‑Fi 7, C1X modem on cellular models, and an Ultra Retina XDR “tandem OLED” display in an ultra-thin chassis.

Competitive impact (2025)

- Apple’s lineup became more intentionally tiered by AI readiness: if a shopper wants “the AI iPad,” Apple steers them to iPad Air/Pro; the base iPad stays the price anchor and volume play.

- The M5 Pro keeps Apple’s premium position strong against Samsung’s Ultra tablets and 2‑in‑1 PCs by pairing display leadership + on-device performance narrative.

Samsung: Key 2025 releases

- Galaxy Tab S10 FE / FE+ (April): FE+ moved to 13.1″, 90Hz, up to 800 nits HBM, Exynos 1580, IP68, and a big bundle of “Intelligent Features” (Circle to Search, Samsung Notes math/handwriting tools, AI Key on the Book Cover Keyboard, etc.).

- Galaxy Tab S11 / S11 Ultra (September):

- DeX Extended Mode (dual-screen workflow across tablet + external monitor) + multiple workspaces

Redesigned S Pen - 14.6″ Tab S11 Ultra with 120Hz AMOLED and Wi‑Fi 7

- DeX Extended Mode (dual-screen workflow across tablet + external monitor) + multiple workspaces

Competitive impact (2025)

- Samsung’s FE+ sizing is a direct response to Apple’s 13-inch iPad Air: “big-screen productivity” is no longer premium-only.

- The Tab S11 Ultra is Samsung’s clearest iPad Pro challenger on workflow, not just hardware, DeX improvements are meant to answer the “iPadOS ceiling” critique with a more desktop-like environment.

Microsoft (Surface Pro line): Key 2025 release

- Surface Pro, 12-inch (May): Microsoft positioned it as the “thinnest and lightest Copilot+ PC,” powered by Snapdragon X Plus with a 45 TOPS NPU, starting at $799 and available May 20; detachable keyboard and pen storage/charging were emphasized as core to the form factor.

Competitive impact (2025)

- Surface Pro’s advantage vs. iPad/Galaxy Tab remains the same, but got sharper in 2025: it’s the most credible “tablet that is also a real PC” option, which matters for office-heavy, legacy-app, and enterprise workflows.

- The 12-inch size and lower entry price make it a more direct alternative to iPad Pro 11-inch buyers who were already paying “laptop money” once accessories were added.

Lenovo: Key 2025 releases

- Yoga Tab Plus (announced Jan; available starting Jan 2025): Lenovo framed this as its first on-device AI tablet, with Snapdragon 8 Gen 3 + 20 TOPS NPU, built-in LLMs + Lenovo AI Now, 12.7″ 3K anti-reflection display, 144Hz, Wi‑Fi 7, and a stated starting price of $699.99.

- Idea Tab Pro (available starting April 2025): positioned for students with Circle to Search and Gemini, also 12.7″ 3K 144Hz, and starting at $349.99.

Competitive impact (2025)

- Lenovo attacked both Samsung and Apple from the middle: offering “flagship-feeling” screen specs (12.7″, 3K, 144Hz) at prices that sit closer to base iPad / FE territory than iPad Pro / Tab Ultra territory.

- The Yoga Tab Plus was also seen as a serious premium Android alternative (including comparisons to Samsung’s Ultra tier).

Amazon: What changed in 2025

- The biggest tablet “development” was strategic, not a marquee Fire hardware refresh: It was reported Amazon is planning a higher-end Android-powered tablet (vs its forked Android / Fire OS approach) potentially around $400, aiming to address longstanding Fire OS complaints and app ecosystem limits; it was also reported Amazon could ship some lower-priced tablets with Vega OS before eventually moving the slate toward Android.

- Amazon also ended Android support for its Appstore on third-party Android devices (while keeping it on Fire tablets/TV), which underscores how the company is rethinking its software distribution footprint.

Competitive impact (2025)

- If Amazon follows through, it sets up a 2026 fight where Amazon can credibly target base iPad / midrange Android shoppers with “real Android compatibility,” not just “cheap tablet for Prime content.”

onn: What mattered in 2025

- onn. continued to pressure the low end with mainstream-feature Android tablets at extreme prices, including:

- onn. 11″ Tablet Pro (2024 model) running Android 14 with 1840×1280 display, 4GB RAM, 64GB storage (expandable), and pricing commonly seen around $129 on Walmart listings.

onn. 12.1″ Tablet Pro (2024 model) running Android 14 with 2560×1600 display, 6GB RAM, 128GB storage (expandable), and pricing commonly seen around $179 on Walmart listings.

Competitive impact (2025)

- onn. is one of the clearest reasons “big screen for cheap” became a table-stakes expectation in the budget aisle, creating pressure on Amazon Fire (which still carries Fire OS tradeoffs) and on entry Samsung devices.

How 2025 Tablet Models Reshaped Head-to-Head Competition

1) Premium “laptop replacement” showdown

iPad Pro (M5) vs Galaxy Tab S11 Ultra vs Surface Pro 12-inch vs Lenovo Yoga Tab Plus

- Apple iPad Pro (M5): wins the “tablet-as-a-workstation” narrative on silicon + display + connectivity (tandem OLED, Wi‑Fi 7, AI performance emphasis).

Samsung Galaxy Tab S11 Ultra: attacks Apple where Apple is most criticized, multi-window/desktop workflows, via DeX Extended Mode and large-screen-optimized AI tools. - Microsoft Surface Pro 12-inch: differentiates by being a full Windows Copilot+ PC in a tablet form factor, with a lower advertised starting price (though accessories still matter).

- Lenovo Yoga Tab Plus: undercuts premium Android flagships on price while matching “big screen + high refresh + AI story,” which can pull shoppers away from Samsung’s Ultra tier if they don’t need Samsung’s ecosystem.

2) Midrange productivity (where most share battles happen)

iPad Air (M3) vs Galaxy Tab S10 FE+ vs Lenovo Idea Tab Pro

- iPad Air (M3): Apple’s strongest mainstream “do everything” iPad, positioned for Apple Intelligence and keyboard/pen workflows at $599/$799 starting pricing.

- Galaxy Tab S10 FE+ (13.1″): Samsung’s answer to “big iPad Air,” pushing premium design cues + AI features + IP68 into the FE tier.

- Lenovo Idea Tab Pro ($349.99): a disruptive value spec (12.7″ 3K 144Hz + keyboard/pen ecosystem) that can win on price-performance for students and families.

3) Budget tablets: value vs. ecosystem vs. software constraints

Base iPad (A16) vs Amazon Fire HD 10 vs onn.

- Base iPad (A16): Apple’s budget anchor (starts $349, 128GB), often positioned as the best “cheap tablet” if you want long-term polish, but it’s not Apple Intelligence capable, which matters as AI marketing spreads.

- Amazon Fire HD 10: still commonly recommended as “best value for casual use,” with the persistent tradeoff being Fire OS limitations.

- onn.: frequently wins the shelf on “more screen for less money,” offering standard Android 14 on large displays, but with the usual budget-brand question marks around update cadence and premium app performance.

2025 Table Stakes For Competitive Tablets

If you’re evaluating launches/lineups going into 2026, these are the features that clearly moved toward baseline expectations in 2025:

- A real AI story (on-device acceleration and/or OS-level AI features): Apple Intelligence (Air/Pro), Galaxy AI + DeX workflows, Copilot+ PC NPU marketing, Lenovo AI Now/built-in LLM positioning.

- Keyboard + trackpad accessories that feel “laptop-grade” (often with dedicated AI keys): Apple’s new Magic Keyboard for Air , Samsung’s keyboard with Galaxy AI Key, Microsoft’s redesigned Surface keyboard, Lenovo’s 2‑in‑1 keyboard positioning.

- Bigger screens across more price tiers (11–13″+ as normal, not niche): iPad Air 13″, Tab S10 FE+ 13.1″, Idea Tab Pro 12.7″, Yoga Tab Plus 12.7″.

- High refresh rates spreading beyond flagships (90Hz in midrange; 120/144Hz in premium): FE series 90Hz; Lenovo 144Hz; Samsung flagships 120Hz.

- Wi‑Fi 7 as a halo checkbox (flagship and “premium Android” tiers): iPad Pro M5, Tab S11 Ultra, Yoga Tab Plus.

What to watch next (because of the 2025 shifts)

- Amazon’s OS pivot (Android + possibly Vega OS) is the single biggest potential “competition changer,” but it’s also the least certain because it’s reported as an in‑development plan.

- AI gating will keep shaping segmentation: Apple’s choice to keep base iPad “non‑AI” (Apple Intelligence-wise) is a template other brands may follow, AI as an upsell, not a baseline.

- The midrange will stay the bloodiest segment: Samsung FE+, Lenovo Idea Tab Pro, and iPad Air all converged on big screens + productivity positioning, meaning pricing, promos, and accessory bundling will likely decide to share more than raw specs.

Get more information

Visit our Consumer Electronics industry page to learn more about the data we deliver for the Television market – or reach out to our analyst below to ask questions about this report or get specific insights you need.

About the Author

Nick Harpster

Nick Harpster is a Consumer Electronics Analyst at OpenBrand, specializing in Tablets & Detachables, Smartphones, and Monitors. With over five years of experience in analytics, Nick excels at transforming complex data into actionable insights, empowering clients to make informed decisions in a dynamic market.

Tablets & Detachables: 2024 Year-In-Review

The tablet and detachable market evolved steadily in 2024, with manufacturers focusing on refining their hardware and software offerings to cater to a diverse range of users. Tablets increasingly served dual purposes as entertainment hubs and productivity tools, while detachable devices continued to bridge the gap between laptops and tablets, appealing to hybrid work and educational needs.

Read through all the 2024 pricing and promotions insights below or email the report to read later.

Key Product Launches & Updates

Apple’s iPad Lineup Additions

Apple updated its iPad Pro models with the M4 chip, delivering improved performance and power efficiency. The iPad Pro maintained its position as a market leader for creative professionals and power users, with advanced multitasking capabilities introduced in iPadOS 18.

Accompanying its chipset upgrade, the premium flagship tablet from Apple saw its display break into the OLED space, putting pressure on Samsung’s AMOLED displays. Additionally, Apple’s iPad Air 6 upgraded to the M2 chipset, offering improved performance. Available in 11” and 13” sizes, it provides storage options ranging from 128GB to 1TB.

Meanwhile, the iPad mini received incremental updates, emphasizing affordability and education-friendly features. Apple’s discounting saw an increase in 2024 with much more aggressive discounts in the second half of the year with success seen on its older iPad Pro 5 and now aging standard iPad.

Samsung Galaxy Tab Series

Samsung’s flagship Galaxy Tab S10 Ultra was one of the standout tablet releases of 2024, showcasing Samsung’s commitment to premium design, cutting-edge hardware, and AI-driven software enhancements. The Tab S10 Ultra builds on the success of its predecessors, offering a large Super AMOLED display with a 120Hz refresh rate for smooth visuals and vivid colors. Powered by the latest MediaTek chipset, this tablet delivers robust performance suitable for productivity tasks, creative applications, and immersive gaming.

The device also integrates advanced AI capabilities, such as scene optimization for photography and AI-driven multitasking features that enhance user efficiency. Its compatibility with the S Pen remains a highlight, appealing to artists and professionals alike. Samsung has expanded its

One UI ecosystem with updates that enhance cross-device functionality, making the Galaxy Tab S10 Ultra a versatile tool for users deeply integrated into Samsung’s hardware ecosystem. Additionally, Samsung continues to focus on sustainability by introducing recycled materials into its tablet production process.

Beyond the Galaxy Tab S10 Ultra, Samsung refreshed its mid-range Galaxy Tab A series in 2024, targeting budget-conscious consumers with improved displays and better battery life.

Additionally, while the Tab S10 Ultra targeted premium users, the more affordable Tab S10 FE focused on mainstream consumers. These updates ensure that Samsung retains its strong position across all price tiers in the tablet market.

Amazon’s Fire HD 8 (2024 Edition)

Amazon updated its Fire HD 8 tablet, offering it at a competitive price point. The 2024 edition features a 5MP rear camera, with configurations of 3GB RAM and 32GB storage or 4GB RAM and 64GB storage, expandable up to 1TB via microSD. The tablet introduces AI features such as a Writing Assistant, Webpage Summaries, and a Wallpaper Creator, enhancing user experience. Available in multiple colors, the Fire HD 8 caters to budget-conscious consumers seeking a functional tablet for everyday use.

OnePlus Pad 2

OnePlus introduced the Pad 2, featuring a 12.1-inch 3K display, six stereo speakers, and a 9,510mAh battery with 76W SUPERVOOC Flash Charge technology. It includes AI enhancements like AI Speak and Recording Summary. The company continues to offer premium specifications for a competitive price point, often with aggressive discounts or bundles, but struggles with consumer brand recognition in the US, with limited retail placement depth of its own site and Amazon.com.

Acer Iconia X12 Announcement

Acer announced the release of its Iconia X12 tablet at IFA 2024 with its 12.6” 2.5K AMOLED display and 60HZ refresh rate and 400 nits of brightness. The model is expected to be globally available in January 2025 starting at $349.

Hardware & Specifications Trends

Display Innovations

Manufacturers prioritized display quality in 2024, with most high-end tablets featuring high-refresh-rate screens and HDR10+ support. Samsung’s AMOLED panels on the Galaxy Tab S10 and Apple’s Liquid Retina XDR and tandem OLED displays on the iPad Pro set benchmarks for vibrant visuals and color accuracy.

Performance Upgrades

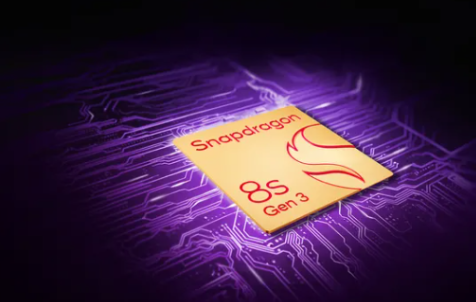

Flagship tablets adopted next-generation processors like Apple’s M4 and Qualcomm’s Snapdragon 8 Gen 3, ensuring smoother multitasking and better support for demanding applications. Mid-range models also saw performance gains, often powered by chips like MediaTek’s Dimensity series.

Battery Life and Charging

Improved battery life became a significant focus, with devices like the Galaxy Tab S10 Ultra offering extended usage times. Fast charging became standard across most tablets, while some models, such as the Supernote A5 X2, prioritized sustainability with easily replaceable batteries.

Detachable Devices and Hybrid Solutions

The line between tablets and laptops blurred further in 2024, as detachable devices gained traction. Microsoft’s Surface Pro 10 offered iterative improvements, maintaining its appeal for professionals who value portability and laptop-grade performance.

Additionally, Microsoft’s Surface Pro with Copilot+ took center stage as a detachable option for consumers featuring Qualcomm’s Snapdragon X Elite chipset and AI functionality. Samsung also expanded its detachable Galaxy Book line, integrating its ecosystem with Galaxy smartphones and tablets.

Emerging Trends

Sustainability and Modular Designs

Sustainability emerged as a growing trend, with devices like the Supernote A5 X2 Manta featuring repairable and upgradeable components. This shift toward modularity reflects consumer demand for devices with longer lifespans and reduced environmental impact. Additionally, there has been success with similar dedicated note taking tablets such as ReMarkable, which has its own endcap featured in-store at Best Buy.

Affordability and Accessibility

Brands like Amazon and Lenovo focused on entry-level and mid-range segments. Amazon’s Fire Max 11 targeted budget-conscious users, while Lenovo’s Tab P series aimed to deliver solid performance at competitive prices, particularly in education and entertainment contexts.

Software Ecosystems

Enhanced software integration became a priority, with Google, Apple, and Samsung building seamless ecosystems that connected tablets, smartphones, and other devices. Features like wireless file sharing, cross-device multitasking, and smart home controls gained prominence.

Outlook for 2025

The tablet and detachable market is set for continued growth in 2025, fueled by advancements in display technology, AI integration, and seamless ecosystem connectivity. Manufacturers are expected to focus on balancing premium features with affordability, catering to the diverse needs of users. As foldable smartphones and thin, lightweight laptops continue to improve and encroach on tablet territory, it will be crucial for tablets to capitalize on their unique strengths and deliver compelling value to remain a top choice for consumers in the coming year.

Get more information

About the Author

Nick Harpster

Nick Harpster is a Consumer Electronics Analyst at OpenBrand, specializing in Tablets & Detachables, Smartphones, and Monitors. With over five years of experience in analytics, Nick excels at transforming complex data into actionable insights, empowering clients to make informed decisions in a dynamic market.

Smartphones: 2024 Year-In-Review

Our smartphone year-in-review report recaps smartphone launches, placements, pricing and advertising and promotional activity captured throughout 2024. The report features data and insights from OpenBrand’s Smartphone categories, which feature products sold through the US ecommerce and brick-and-mortar channels.

Read through all the 2024 pricing and promotions insights below or email the report to read later.

- Flagship Launches

- Foldables Take Center Stage

- Sustainability & Longevity

- Chipset Wars & Performance Upgrades

- Affordable Innovation

- Global Challenges & Geopolitical Impact

- The Rise of AI-Driven Experiences

- Looking Ahead

Summary

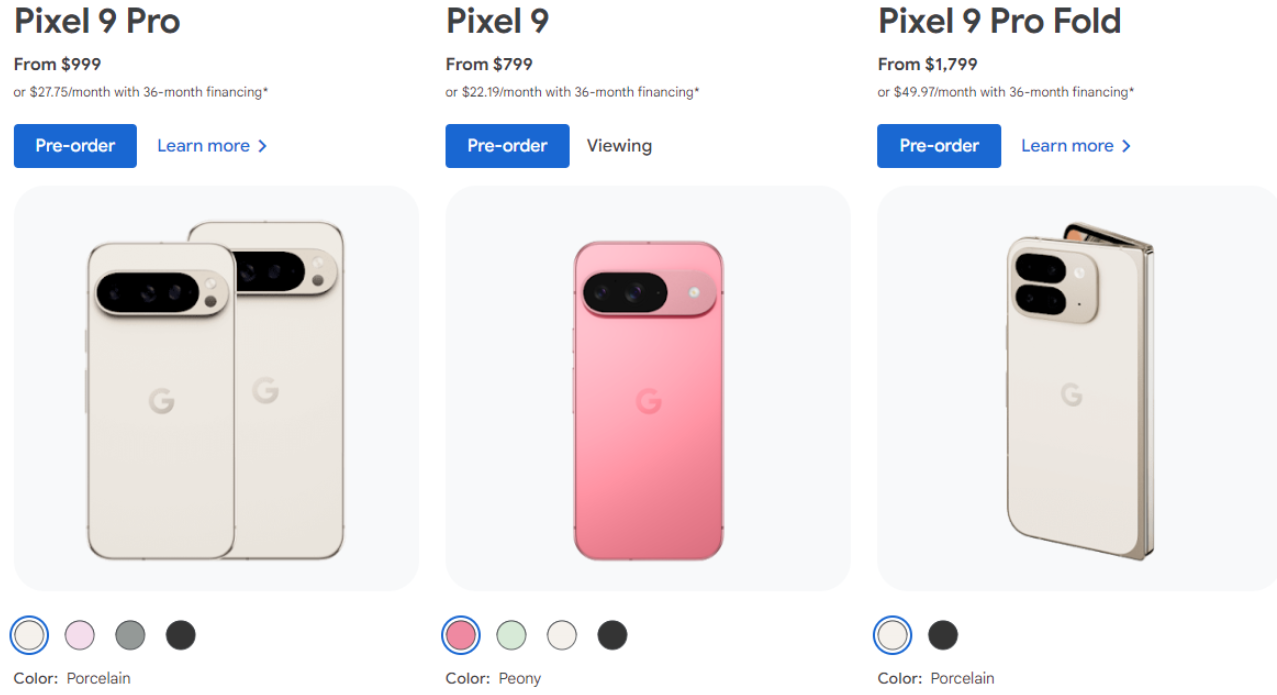

As the year wraps up, the smartphone market has once again seen steady advancements and shifts in priorities. Key flagship releases included Samsung’s Galaxy S24 series, which focused on enhancing AI performance and photography, and Apple’s iPhone 16 lineup, which introduced incremental improvements like a 6x optical zoom in the Pro Max model. Google’s Pixel 9 series emphasized AI-driven features like advanced photo editing, while Xiaomi’s 14 Ultra offered strong competition in mobile photography with its advanced camera hardware.

Each of these flagship models continued to refine established designs and features, signaling a year of steady evolution rather than dramatic change. Brands remained focused on delivering high-quality experiences while finding ways to differentiate in an increasingly competitive landscape.

Flagship Launches: Refinements and Competitive Edge

Samsung continued to lead the flagship market with its Galaxy S24 series, emphasizing improved AI capabilities and computational photography. The Galaxy S24 Ultra, powered by the Snapdragon 8 Gen 3 globally, delivered professional-grade photography and smarter performance, solidifying Samsung’s dominance. Similarly, Apple’s iPhone 16 lineup focused on incremental upgrades, with the Pro Max introducing a 6x optical zoom periscope lens, enhancing its photographic capabilities.

Google made waves with the Pixel 9 series, furthering its AI leadership through its Tensor G3 chip. Features like advanced real-time photo editing and unique computational photography tools like Magic Eraser demonstrated Google's focus on AI as the foundation of its user experience. Meanwhile, Xiaomi’s 14 Ultra set new standards in mobile photography with a 1-inch sensor and superior low-light capabilities, challenging competitors in the premium segment.

Foldables Take Center Stage

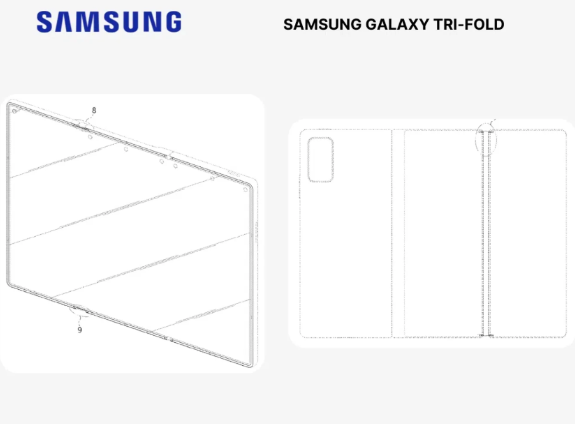

The foldable smartphone market expanded significantly in 2024, with Samsung continuing to lead the segment. The Galaxy Z Fold 6 and Z Flip 6 brought thinner bezels, improved durability, and better battery life, reinforcing Samsung’s position. Meanwhile, affordable foldable models like Samsung's Galaxy Z Flip FE, Motorola's Razr 50 Lite, and Honor's Magic V Lite made the technology accessible to a wider audience, accelerating adoption.

Google entered the foldable space with the Pixel Fold, leveraging its software expertise to deliver a polished user experience. The growing competition in foldables signaled the category's transition from niche to mainstream, with innovation driving consumer interest.

As the race for maintaining the crown on the ever improving and evolving foldable technology continues, there have been rumors that we will see some trifoldable options or even rollables available in the US from Samsung.

Sustainability & Longevity

Sustainability emerged as a critical theme in 2024, with brands like Fairphone leading the charge. The Fairphone 5 exemplified this shift, offering modular, repairable designs and eco-friendly materials. Major brands, including Samsung, Google, and Xiaomi, committed to extended software support, with promises of four to five years of updates, aligning with consumer demands for durability and reducing e-waste.

Chipset Wars & Performance Upgrades

The year saw fierce competition in the chipset space, with Qualcomm’s Snapdragon 8 Gen 3 and Snapdragon 8 Elite and MediaTek’s Dimensity 9300 and 9400 setting new benchmarks for performance and efficiency. These processors enabled advanced AI features, including real-time photo editing and high-fidelity gaming, elevating the user experience in flagship devices. The growing demand for cutting-edge processing power underscored the importance of hardware innovation in maintaining competitive advantage.

Affordable Innovation

2024 was a pivotal year for making premium features more accessible. Devices like Google’s Pixel 9a and Samsung’s Galaxy Z Flip FE brought high-end specs, including advanced cameras and foldable displays, to more affordable price points. These devices catered to budget-conscious consumers while maintaining quality, expanding market reach for manufacturers.

Global Challenges & Geopolitical Impact

The smartphone market navigated complex global challenges, including inflation, fluctuating currency values, and geopolitical tensions. Chinese manufacturers like Huawei faced continued trade restrictions but showcased resilience with innovative launches like the Mate 60 Pro, featuring a proprietary 7nm Kirin chip. Rising costs of components, such as Qualcomm’s Snapdragon 8 Elite, forced brands to rethink pricing strategies, impacting affordability in some regions.

The Rise of AI-Driven Experiences

Artificial intelligence played a transformative role in smartphones this year, with manufacturers integrating AI into every aspect of the user experience. From Google’s contextual photo editing to Samsung’s enhanced portrait deblurring, AI-driven features became essential differentiators. The growing reliance on AI underscored its importance as a key driver of innovation across the industry.

Looking Ahead

Flagship launches, foldable adoption, and AI innovation defined the landscape, while sustainability and affordability gained traction as pivotal trends. With 2025 on the horizon, the industry is poised for further breakthroughs and continued evolution in response to consumer needs and global challenges. As the smartphone market concludes another year, looking forward to 2025 begs the question of will longer contract lengths and increasing price points on smartphones continue to slow consumers’ upgrades, or if the upcoming year will spark enough innovation to draw consumers in for the latest must have smartphones.

Get more information

About the Author

Nick Harpster

Nick Harpster is a Consumer Electronics Analyst at OpenBrand, specializing in Tablets & Detachables, Smartphones, and Monitors. With over five years of experience in analytics, Nick excels at transforming complex data into actionable insights, empowering clients to make informed decisions in a dynamic market.