Inside the Q3 2025 Lowe’s Earnings Call

Lowe’s earnings for Q3 2025 reflect positive growth YoY, despite ongoing economic issues and uncertainty in consumer demand. Lowe’s found growth opportunities and share gains in key product categories impacting overall results as they focused on strong brand performance and pricing strategies.

Key Q3 2025 Lowe’s Earnings Call Results

- Revenue: $20.8B

- YOY Sales Growth: +3.2%

- YOY Comps: +0.14

- Diluted EPS: $2.88

How did core durables categories shape Lowe’s performance?

In this blog post, we break down Lowe’s market share in major appliances, outdoor power equipment, and power tools, highlighting which products and brands helped boost share, where challenges persisted, and how consumer demand is evolving across the home improvement space. Check out the full report now and read our analysis of the data below.

Lowe’s Earnings Call

Q3 2025 Performance & Lowe's Market Share Trends

SWIPE TO SEE FULL REPORT, CLICK TO EXPAND SLIDES

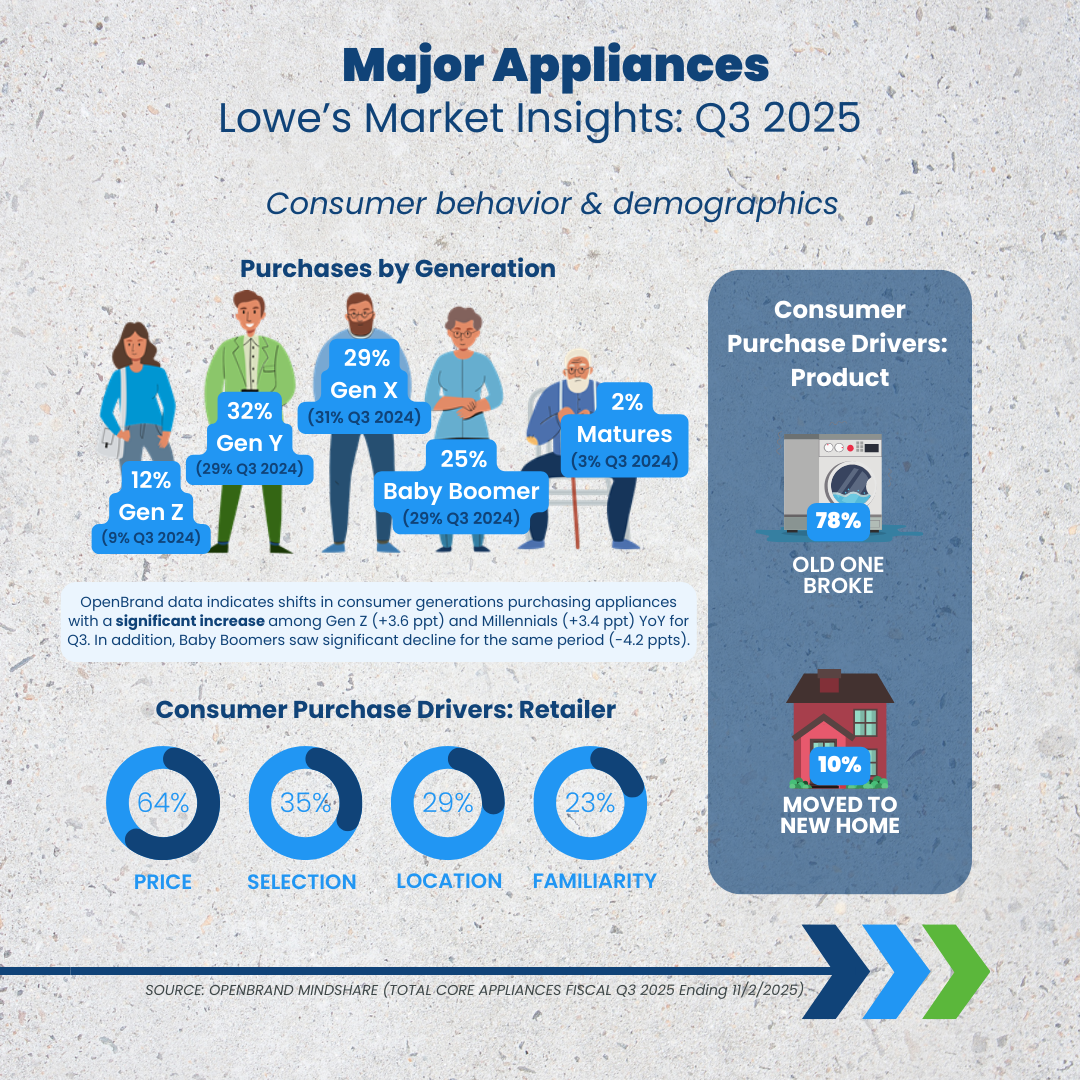

Lowe’s Earnings: Major Appliances Category Influence

Market Leadership Holds, But Home Depot Gaining Ground

In Q3 2025, Lowe’s lost some traction in the major appliances category, decreasing dollar share slightly (-0.3 ppt) year-over-year (YOY), and unit share by -0.5 ppt. They remain market leader but Home Depot is gaining ground.

Top Major Appliance Retailers: Q3 2025 Dollar Share Split

- Lowe’s: 37.4%

- Home Depot: 35.6%

- Best Buy: 17%

- Amazon: 3.2%

- Walmart: 2.2%

Here are the product categories that contributed to Lowe’s major appliance share in Q3.

- Ranges: Lowe’s increased dollar share by +4.1 ppts YoY. GE led the range market adding +1.3 ppts categories success at the retailer. In general we are seeing a shift in Lowe’s range shoppers gravitating toward lower priced models.

- Side-by-side Refrigerators: Lowe’s captured nearly 36% unit share, a +4.2 ppts gain YoY trailing Home Depot by +7.7 ppts for the quarter.

- Top Mount Refrigerators: Lowe’s top mount refrigerator dollar share dropped from 43.4% in Q3 2024 to 39.8% in Q3 2025. Frigidaire lost -9.0 ppt in Q3 at Lowe’s as Home Depot picked up +5.4 ppts for the brand.

OpenBrand’s Key Takeaway

Lowe’s strengthened its #1 position in major appliances this quarter, driven by notable YoY gains in ranges and side-by-side refrigerators. As consumers shift toward more affordable models and brands rebalance their portfolios, Lowe’s is capturing disproportionate momentum where the market is moving.

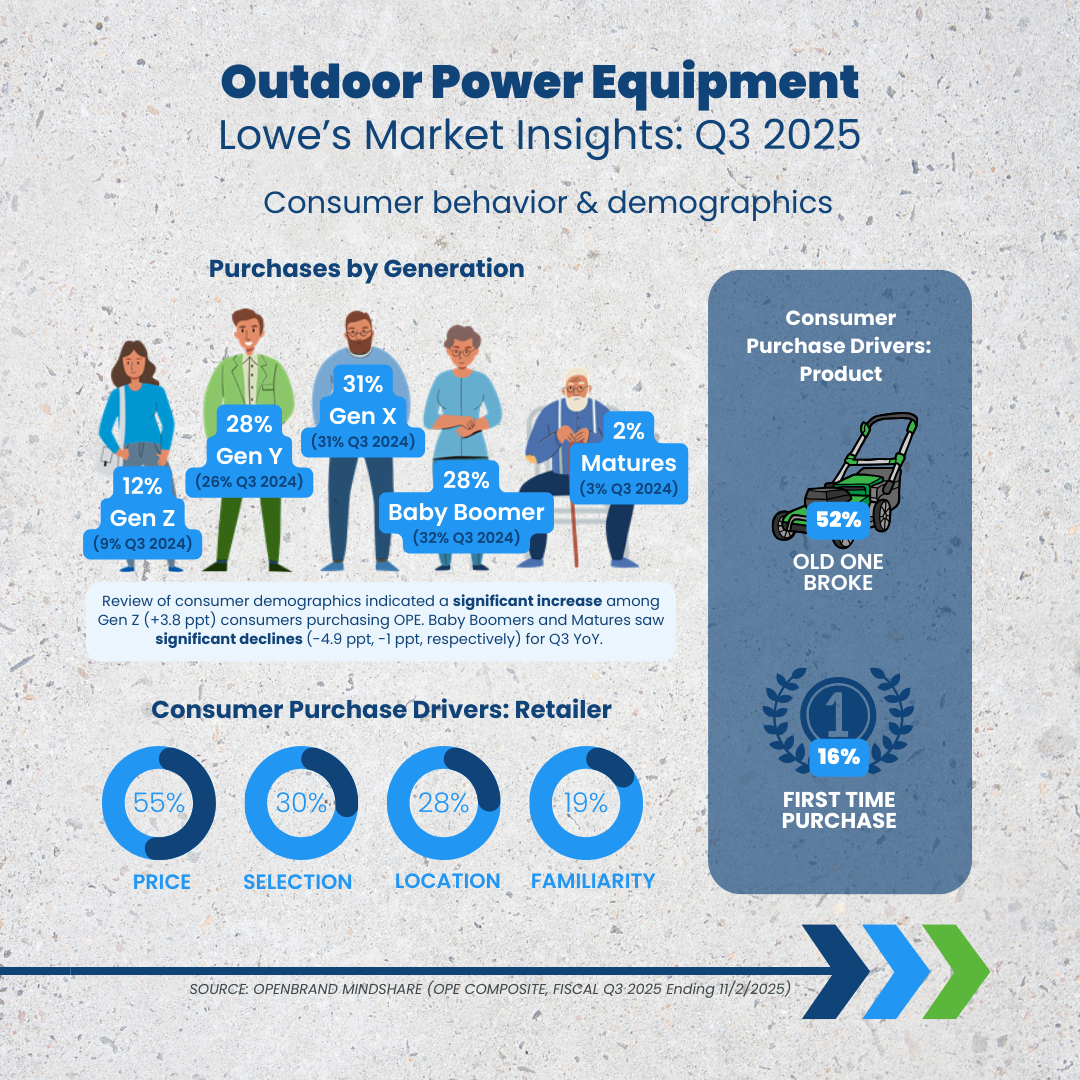

Lowe’s Earnings: Outdoor Power Equipment Category Influence

Q3 saw a +1.0 ppt increase in dollar share for Lowe’s in outdoor power equipment, reaching 39.3%. However, unit share declined by -1.6 ppt YoY.

Top Outdoor Power Equipment Retailers: Q3 2025 Dollar Share Split

- Lowe’s: 39.3%

- Home Depot: 41.0%

- Amazon: 10.1%

- Walmart: 8.5%

- Best Buy: 1.0%

Here are the product categories and brands contributing to Lowe’s outdoor power equipment share. In general Lower’s reported mild weather was a key factor driving demand for outdoor projects.

- ZTR Mowers drove +2.7 ppts for units and +3.3 ppts for dollar share likely due in part to weather as well as strong brand contributions from Toro and Ariens sales in Q3.

- Handhelds continue to be the largest unit volume driver for OPE; Leaf Blowers with 27% and Line Trimmers 25% holding over half of the units sold in Q3.

- Line Trimmers increased dollar share by +4.5 ppts despite unit share remaining relatively flat. These results suggest more customers traded up for premium brands.

OpenBrand’s Key Takeaway

Even with softer unit trends, Lowe’s expanded its dollar share in OPE as consumers shifted toward higher-priced equipment. Strong gains in ZTR mowers and premium line trimmers, combined with continued dominance in handhelds, positioned Lowe’s as a key destination for both volume and value within the category.

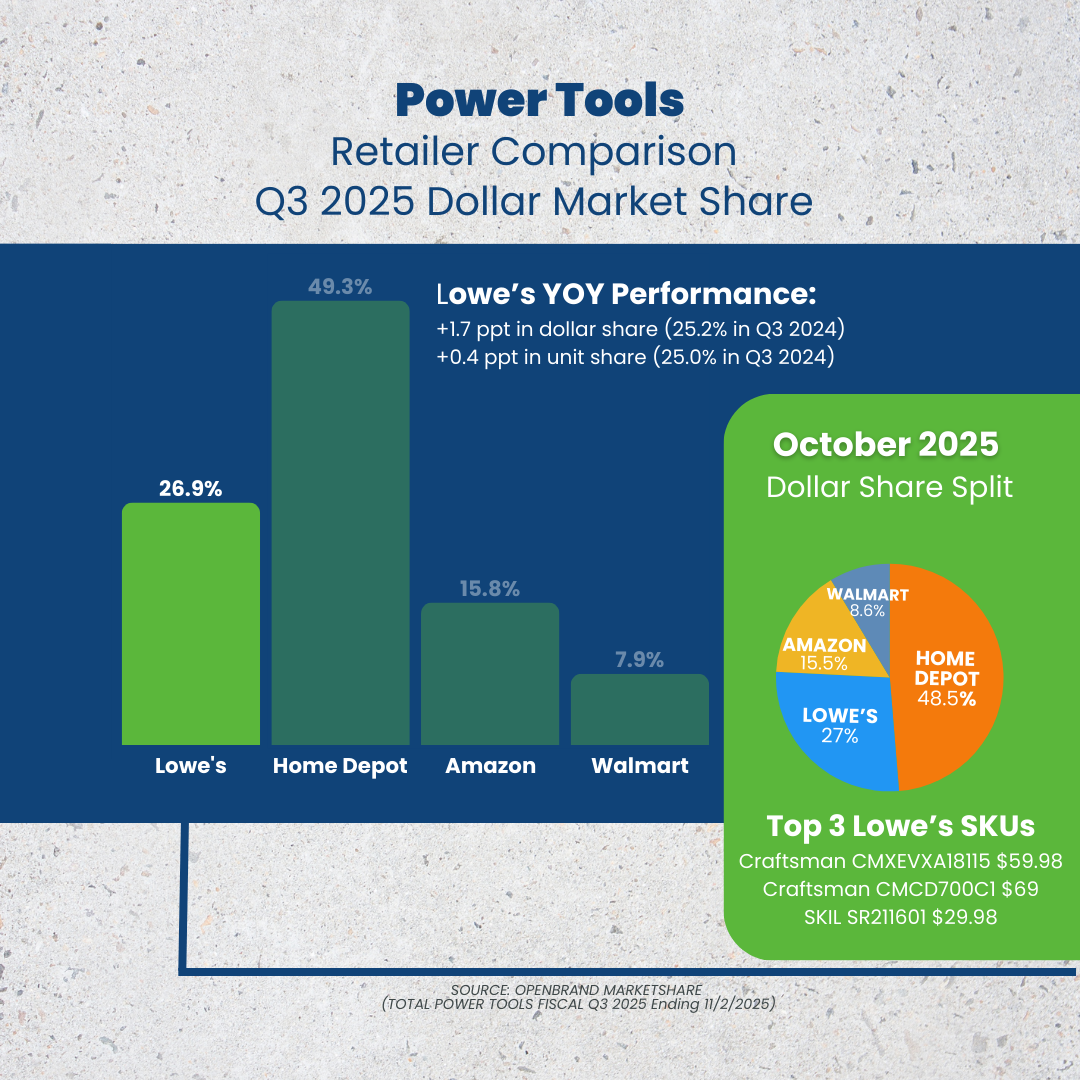

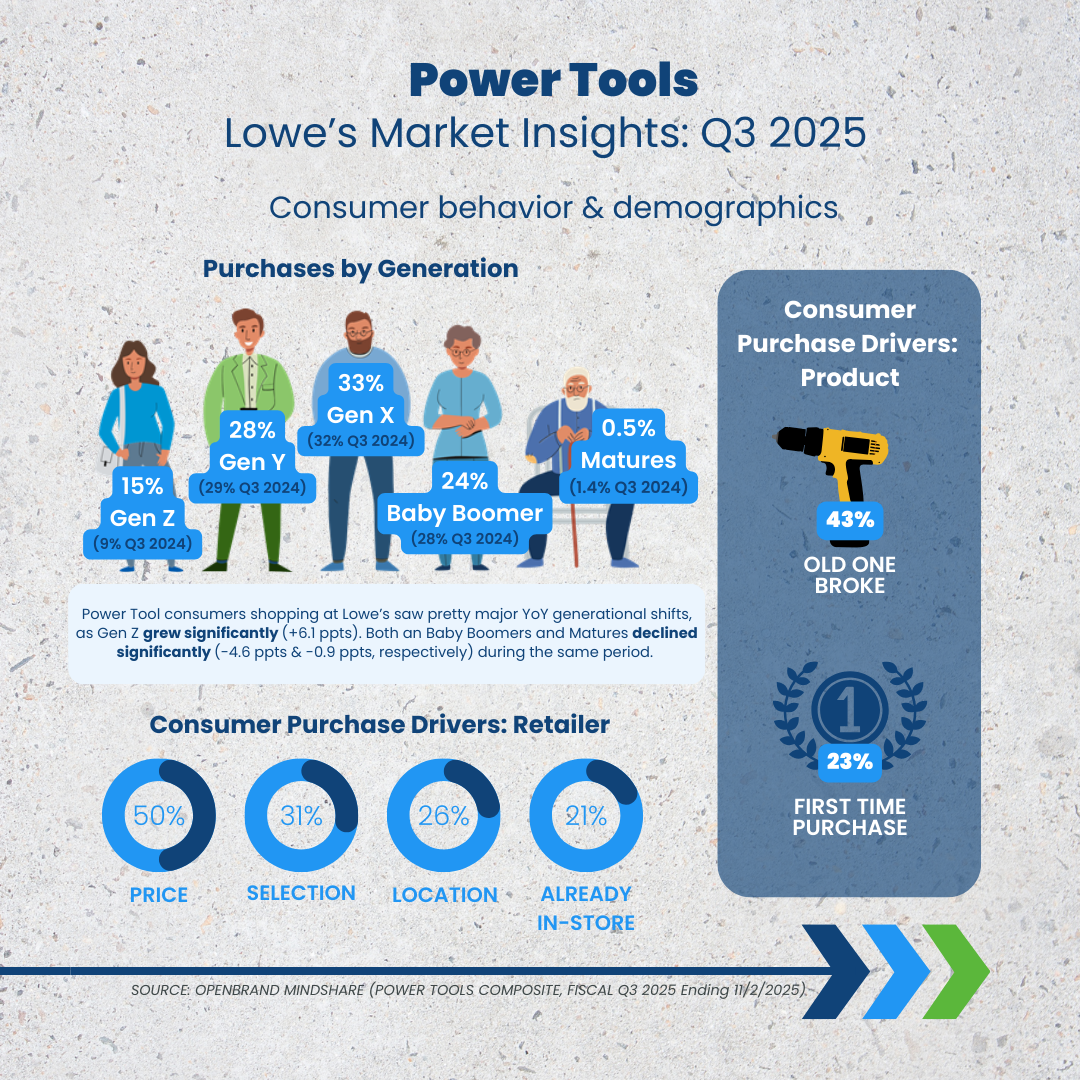

Lowe’s Earnings: Power Tools Category Influence

Q3 2025 saw slight gains for Lowe’s in the power tools category, with a +1.7 ppt increase in dollar share YOY and +0.4 ppt in unit share. Despite the positive results across power tools for Lowe’s, there continues to be a sizable gap (+22.4 ppts) between Lowe’s and the market leader, Home Depot.

Top Power Tools Retailers: Q3 2025 Dollar Share Split

- Home Depot: 49.3%

- Lowe’s: 26.9%

- Amazon: 15.8%

- Walmart: 7.9%

In Q3, Lowe’s saw positive comps in the Tools Division, driven primarily by Hand Tools and Tool Storage. Here are the product categories contributing to Lowe’s power tools share.

- Power Drills: DeWalt dominated price bands over $150 with almost half of the unit share within $100-149 range as well. Dewalt was also the mostfrequently discounted Power Tool brand with 30% of instant savings promotions captured diring the quarter. Craftsman held the #1 seller for the category.

- Shop Vac: Craftsman was the top-selling model for the quarter

OpenBrand’s Key Takeaway

Despite the wide competitive gap with Home Depot, Lowe’s posted meaningful Q3 improvements in power tools, boosted by higher-value drill sales and strong comps in hand tools and storage. Heavy consumer response to DeWalt promotions and Craftsman’s leadership in both drills and shop vacs helped reinforce Lowe’s position as a key challenger in the category.

Where Brands & Retailers Should Focus Now

Lowe’s Q3 2025 results reveal how pricing dynamics, shifting consumer preferences, and brand execution shaped performance across major appliances, OPE, and power tools. For brands and retailers competing in the durables space, several clear priorities emerge:

- Win in Value-Driven Segments — Shoppers Are Trading Down in Appliances but Trading Up in OPE: Consumers are navigating inflation by selectively adjusting their spending. In appliances, shoppers gravitated toward lower-priced ranges, boosting share for GE and helping Lowe’s grow the category. Conversely, in OPE, shoppers traded up to premium line trimmers. Brands must align portfolios to support both ends of the value spectrum to maximize ROI.

-

Strengthen Category Fundamentals — Retailers Are Rewarded When Their Core Is Tight: Lowe’s appliance momentum came from strong alignment in high-velocity categories like ranges and side-by-sides, but underperformance in top-mount refrigerators shows how quickly share can shift when category coverage weakens.

Durables growth will depend on disciplined assortment planning and brand-retailer coordination. -

Prioritize Premium & High-Ticket Innovation — Especially Where Consumers Show Momentum: ZTR mowers and higher-priced drills outperformed, signaling that shoppers still spend on premium solutions when the performance delta is clear.

For brands, this means:-

Leaning into features that justify higher price points

-

Ensuring availability in the most in-demand premium tiers

-

Reinforcing value through promotional strategy, not just pricing

-

- Promotions Need Precision, Not Depth: Across categories, Lowe’s growth was supported by targeted promotions, especially in power tools where DeWalt captured 30% of instant-savings activity and drove strong unit share above $150. Strategic timeing around seasonal peaks are critical as well as clear value messaging. Avoid margin-eroding blanket discounts – promotions that are precise, not broad, continue to deliver the best results.

- Cordless & Battery Platforms Remain a Core Growth Engine: With OPE still shifting rapidly toward cordless models, performance in handheld units—like blowers and trimmers—continues to define category volume. Brands that expand battery ecosystems, cross-compatibility, and runtime differentiation will be best positioned to defend and grow share.

- Private Label & National Brands Both Matter: Craftsman remained a top performer in power tools and shop vacs, while Toro and Ariens were critical to OPE growth. At the same time, category softness for brands like Frigidaire in top-mount refrigerators highlights the risk of under-supported core categories. Retailers must nurture both owned and national brands to maintain category momentum and prevent costly leakage to competitors.

Monitor Market Share Signals Beneath the Surface

Lowe’s earnings in Q3 2025 reinforce that gaining market share is not just about carrying the right brands, but understanding exactly which products to promote, when to push value, and how to meet demand with precision.

If you’re looking to understand the nuances of your market, and get the data you need to effectively manage product mix, pricing, and inventory to grow market share, OpenBrand can help.

Request a custom review of the data available for your business to get started.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Price Forecasts for Durables in 2026: Consumer Electronics, Appliances & Home Improvement

Modest inflation will drive incremental durables market growth in the year ahead As short-term…

The State of Consumer Durables: Lessons from 2025 and What’s Ahead

Insights from OpenBrand’s January 2026 webinar As we enter the new year, OpenBrand is reflecting on…

Consumer Price Index: Durable and Personal Goods | December 2025

This is the January 2025 release of the OpenBrand Consumer Price Index (CPI) – Durable and…