Our MFP Copiers: 2025 Year-in-Review report recaps product launch activity, portfolio shifts, and pricing captured throughout 2025 with comparisons drawn to 2024. The report features data and insights from OpenBrand’s Ink Supplies category, which feature products sold through the US ecommerce and brick-and-mortar channels.

Read through all the 2025 insights below or email the report to read later.

You can also check out our 2025 Year-in-Review reports for other Print categories.

Impact Summary

- Launch activity in the US dealer channel slowed in 2025

- Canon, Sharp, and Kyocera were the major drivers of launch activity

- Pricing continued to increase amid tariff-related challenges

Methodology

The data used in this report is leveraged from the OpenBrand US MFP-Copiers Pricing & Promotions Report and the US Dealer Cost Report between the dates of Q1 2024 and Q4 2025. The data includes all products except production models that were captured in dealer price lists or contracts. The launch activity section, however, includes products that were announced but have not been captured in dealer price lists or contracts to-date. This section also features data from 2019 to 2025. This section also includes the launch of production models.

MFP Copier Product Launch Activity

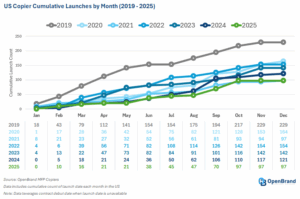

Copier hardware launch activity was steady for most of the year but demonstrated notable upticks toward the latter part of the year with major launches from Canon in September and Sharp in October. With a total of 97 products introduced for the US dealer channel, this year’s launch activity had 20% fewer product launches than last year, tying with 2021 as the slowest year in terms of launch activity.

2025 launch activity was primarily driven by three brands. Canon launched more SKUs than any other brand in 2025 due to its large portfolio and branding overhaul. At the Canon Summit held in September, the OEM continued its imageFORCE expansion with the introduction of 30 models. The launch notably unified Canon’s A3 and A4 dealer-focused office print systems under a single brand, retiring the imageRUNNER ADVANCE DX and imageCLASS X families. In addition to bringing branding under one umbrella, the move served to eliminate channel overlap, strengthen dealer alignment, and simplify portfolio positioning across Canon’s global dealer offering.

With a total of 22 products launched in 2025, Sharp gained second place in terms of launch activity. The most significant introductions were made at the brand’s NEXT 2025 dealer event held in October. During that time, Sharp unveiled 18 new models across its Advanced and Essentials Series models spanning 25ppm to 65ppm in both color and monochrome segments. The introduction represented one of Sharp’s most significant product rollouts in recent years and reinforced its commitment to providing secure, connected, and sustainable print solutions.

Kyocera rounded out the top three with 17 product introductions. The OEM’s most significant launch occurred in June with the introduction of its 10-model EvolutionNext series. The A3 MFP series, which is also known as the TASKalfa MZ7001ci series, comprises six color models (25ppm to 70ppm) and four monochrome configurations (40ppm to 70ppm) and followed previous rollouts in Japan and Europe.

MFP Copier Portfolios

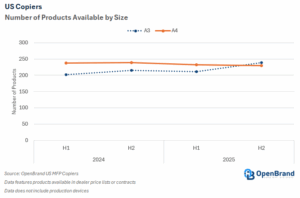

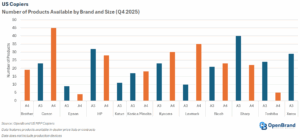

The copier market continues to undergo a significant transformation driven by evolving workplace trends, technological advancements, sustainability efforts, and budget constraints. As such, the market continued to show strength in A4 portfolios but A3 made a notable comeback with key launches and portfolio offerings made available to dealers.

The second half of 2025 brought a notable shift in terms of products available to dealers. Based on products listed in contracts and dealer price lists, the number of A3s offered narrowly surpassed A4s. In 2025, the number of A3s increased by 18% from 202 in 1H 2024 to 239 in 2H 2025 while the number of A4s declined by 4% from 238 to 229.

This shift was driven by portfolio updates, with some vendors continuing to offer new products alongside predecessors. In addition, OpenBrand recently gained access to Katun pricing, driving the overall number of A3 products higher. Looking ahead, however, product counts are expected to normalize once predecessors are phased out of the channel, bringing a return to brands offering more A4s than A3s to their channel partners.

In Q4 2024, brands displayed distinct strategies in balancing their A3 and A4 portfolios. Canon and Lexmark leaned heavily toward A4 devices, with 45 and 35 A4 models, respectively. Brother continued to focus entirely on A4 with 19 models, reinforcing its commitment to the SMB and SOHO segments (as well as its lack of A3 technology or partnerships). Conversely, Toshiba and Xerox prioritized A3 devices, with limited A4 portfolios and 24 and 29 A3 models, respectively. HP maintained a balanced portfolio with 32 A3 and 28 A4 models, while other traditional A3 brands showed similar dual-focus strategies to address diverse market needs.

MFP Copiers: 2025 Pricing Insights

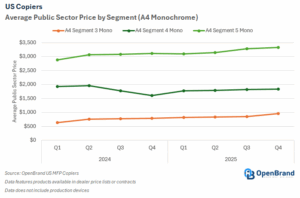

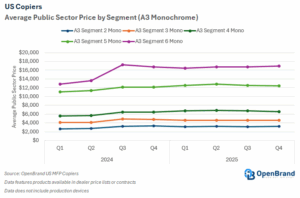

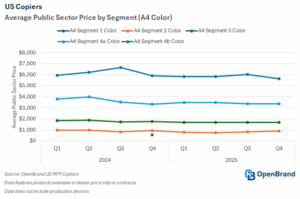

Between Q1 2024 and Q4 2025, public sector pricing trends diverged meaningfully by size and color capability, reflecting the combined impact of tariff-driven increases, shifting demand, and ongoing migration toward A4 devices. A3 segments, particularly color, experienced broad price increases as manufacturers navigated tariff-related pressures, while A3 mono pricing also moved upward at a more uneven pace across tiers. In contrast, A4 color pricing softened across most segments amid competitive pressure and continued substitution, while A4 mono pricing delivered mixed pricing shifts.

Between Q1 2024 and Q4 2025, average A3 color segment public sector prices increased across all tiers, primarily reflecting tariff-related price increases. Segment 1 Color rose by 21%, increasing from $3,698 to $4,474, while Segment 2 Color climbed 31% to $5,581. Segment 3 Color grew by 32%, rising from $5,710 to $7,540. Segment 4a Color experienced the strongest growth at 36%, increasing from $6,527 to $8,899. Segment 4b Color increased by 17%, from $9,338 to $10,955, and Segment 5 Color saw a 14% rise from $12,581 to $14,361.

During the period, average A3 mono segment prices increased across all tiers, although growth varied by segment. Segment 2 Mono rose by 23%, increasing from $2,656 to $3,255. Segment 3 Mono experienced a more modest 13% increase, rising from $4,110 to $4,640. Segment 4 Mono grew by 17%, moving from $5,625 to $6,602, while Segment 5 Mono also increased by 13%, from $11,012 to $12,424. Segment 6 Mono saw the strongest price increase, rising 32% from $12,814 to $16,959.

Average A4 color segment prices showed broad softening over the period, with declines across all reported tiers. Segment 2 Color decreased by 9%, falling from $985 to $896. Segment 3 Color declined 7%, moving from $1,836 to $1,704. Segment 4a Color experienced a larger contraction of 12%, dropping from $3,794 to $3,349. Segment 4b Color also declined, down 5% from $5,944 to $5,649.

Average A4 mono segment prices showed mixed performance across tiers over the period. Segment 3 Mono recorded strong growth, increasing 50% from $634 to $952. Segment 4 Mono declined slightly by 4%, falling from $1,919 to $1,834. In contrast, Segment 5 Mono posted solid growth of 16%, rising from $2,874 to $3,323.

MFP Copiers: 2026 Market Outlook

The copier market is poised for transformative changes in 2026 as manufacturers respond to shifting customer demands, mergers and acquisitions, and global economic pressures. Product launch activity is anticipated to remain steady, likely focusing on alignment with evolving workplace dynamics that prioritize decentralized and cost-effective equipment that will further the shift from A3 to A4.

Pricing trends will be influenced by multiple factors. While competition could drive down costs in some segments, external pressures such as tariffs on raw materials and components could bring more shifts in pricing strategies.Corporate realignments and partnerships are set to reshape the competitive landscape. Xerox’s completed acquisition of Lexmark brings a significant restructuring of both companies’ portfolios and market strategies. This acquisition positions Xerox to expand its presence in the A4 segment, leveraging Lexmark’s established reputation in SMB and enterprise markets. The integration of Ricoh, Toshiba, and OKI’s R&D efforts will likely result in innovative products and enhanced workflow solutions, while the Fujifilm-Konica Minolta joint venture seeks to optimize procurement strategies and reduce operational costs.

Overall, 2026 will be a year of notable change marked by competitive pressures, portfolio realignments, and strategic corporate moves. Manufacturers that effectively navigate pricing complexities, leverage new partnerships, and capitalize on emerging opportunities will be well-positioned for success in this evolving market.

Get more information

Visit our Print industry page to learn more about the data we deliver for the Ink Supplies market – or reach out to our analyst below to ask questions about this report or get specific insights you need.

About the Analyst

Valerie Alde-Hayman

Val is a Senior Analyst at OpenBrand. With over 12 years of experience, she has established a reputation for delivering insightful analysis and thought leadership, while helping organizations navigate the complexities of the print market. With a deep understanding of industry trends and technological advancements, Valerie has contributed significantly to the field, sharing expertise through numerous publications, presentations, and consultations.

Related blogs

Prime Day 2025 for Durables: Shopper Intent, Promotions & Where to Focus

Prime Day 2025 broke the mold. For the first time, Prime Day ran four full days, spanning July 8–11, twice the usual length, and emerged as Amazon’s…

Related blogs

Notebooks: 2025 Year-In-Review

Our Notebooks: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…

Smartphones: 2025 Year-In-Review

Our Smartphones: 2025 Year-in-Review report recaps Smartphone launches, placements, pricing and…

Ranges: 2025 Year-In-Review

Our Ranges: 2025 Year-in-Review report recaps product launches, placements, pricing and advertising…

Tablets & Detachables: 2025 Year-In-Review

Our Tablets: 2025 Year-in-Review report recaps Tablet & Detachable launches, placements,…