Our Notebooks: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and promotional activity captured throughout 2025. The report features data and insights from OpenBrand’s Notebooks category, which feature products sold through the US ecommerce and brick-and-mortar channels.

Read through all the 2025 pricing and promotions insights below or email the report to read later.

You can also check out our 2025 Year-in-Review reports for other Consumer Electronics categories.

Notebooks: 2025 Product Updates

For notebooks, 2025 began with high uncertainty as tariff threats loomed over a category deeply dependent on overseas manufacturing and complex supply chains. Brands scrambled to adjust pricing and SKU strategies in response, especially for high-end gaming and premium consumer laptops, where elasticity was weakest and Copilot+ SKUs were prevalent. While the most aggressive tariffs never fully materialized, the impact was clear: Best Buy saw visible shelf price hikes through the first half of the year, while retailers like Walmart and Amazon largely held the line.

At the same time, shifting consumer preferences drove increased momentum behind sub-14” form factors, with Acer, Asus, and Microsoft embracing smaller, lighter notebooks – even if pricing remains a barrier. Dell re-emerged as a key player in the value segment, embracing aggressive pricing at Walmart and refreshing Alienware with sharper positioning at Best Buy. And yet, the defining trend that didn’t quite land was AI: despite a flood of Copilot+ launches, AI performance failed to resonate with consumers in 2025, leaving the notebook market searching for its next true differentiator.

Tariffs Impacted the Channel Unevenly

The number one issue for the retail channel when entering 2025 was how tariffs would impact the US at a time when foreign production accounts for nearly every notebook and desktop sold domestically. Additionally, given the increased complexity of the former, relocating manufacturing was more challenging than that for the latter. In Q1, new RTX 50 gaming SKUs began receiving price adjustments, fueled by the one-two punch of tariff uncertainty and tight supply of RTX 50 GPUs. Asus was particularly noticeable in this regard, given its position as a traditional first-to-market brand for premium gaming, where demand was less elastic. By March, brands such as HP and Asus were also experiencing increased shelf prices for consumer notebooks, such as HP’s OmniBook Ultra line. Meanwhile, Asus was active in this trend due to a busy H1 2025 full of product launches featuring more expensive Copilot+ CPUs. Lenovo also followed in April with fewer, but at times more drastic, price hikes. Ultimately, by summer these price increases were partly being rolled back as the worst fears of tariffs on China and Southeast Asia didn’t come to fruition.

Amid these price changes, it was notable that Best Buy was the retailer most impacted. Costco and Walmart, on the other hand, managed to largely maintain prices during their 2025 resets. Additionally, Amazon and MFR.com became popular outlets where brands could better protect their margins.

Sub-14” Notebooks Continue Gaining Momentum

While thin-and-light ultrabooks experienced a boost in recent years, 2025 saw consumer notebooks increasingly gravitate toward smaller and lighter notebooks. Acer and Asus offered their thinnest and lightest products to date with the Acer Swift Air 16 and Zenbook A14, with both weighing in under a kilogram in certain configurations. Microsoft also got behind this trend, building off the success of its 14-inch Surface Laptop launch in 2024 with the addition of a 13-inch Surface Laptop over the summer. Challenges remain, however, as these smaller devices frequently come at a steep premium, and Microsoft’s 13-inch model seems like a product in search of a customer, given that the slightly bigger 14-inch model is a better value for only $100 or $200 more.

2026 could be a year that further adds fuel to the fire if reports of Apple launching a new smaller and lighter MacBook that would slot in under the MacBook Air. Under pressure to grow its PC shipments at a time when Apple’s hardware business is mature and potentially at a high water mark, conditions may be perfect for Mac to sell the broader consumer market on the merits of a sub-14” notebook. If Apple succeeds, this could open the door for more Windows notebooks in that size class.

Expanding Focuses for Dell

In response to increased pressure from HP and Lenovo in recent years and a tumultuous period of organizational changes, Dell’s strategy in 2025 noticeably changed for retail. While it continued to retain its focus on Dell.com and merchants like Best Buy, it started doing direct business with Walmart. Its laptops began popping up over the summer at Walmart.com, and even though they have yet to debut in stores, their impact was noticeable. Its portfolio of eight laptops ranging from $299 to $699 was aimed at Walmart’s value-oriented shoppers that would otherwise likely be buying HP, Asus or Lenovo notebooks. These were backed up with the substantial discounts needed to stand out at Walmart, indicating to the channel that Dell is focused on taking back volume it lost, even if it’s at the expense of ASPs and margins. These notebooks mirrored Dell’s desktop strategy of using older processors while retaining premium touches such as 2K displays (instead of the traditional FHD).

Dell’s new focus on competitive pricing was mirrored with Alienware. At Best Buy, its Alienware Aurora 16 and 16X notebooks were among the first to launch in-store, and surprisingly were among the lowest priced SKUs for RTX 5060. Impressively, in some cases this was done without dropping premium features such as 2.5K displays at a price where most brands top out at 2K. This strategy also affected Walmart, where Alienware’s $1,459 Aurora 16 has been heavily discounted to $899 during the holidays. If Dell continues investing in this strategy, it could emulate HP’s success in growing notebook volume with ultra-aggressive pricing during key periods at Walmart.

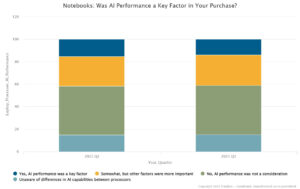

Consumers Remain Lukewarm on AI PCs

After a year and a half of Copilot+ PCs, and consumers remain at best lukewarm around the broader AI PC segment and processor differentiation. In Q3 2025, only 14% of notebook purchasers in OpenBrand’s MindShare consumer tracking survey cited AI performance as a key factor in their purchase. Almost triple (43%) did not consider AI performance at all. Perhaps more concerning, however, is that Q3’s results showed no improvement compared to Q2. There’s also relatively few easy converts, with only 15% of notebook buyers being unaware of differences in AI capabilities between processors. This could rapidly change if local AI applications find their killer app, but in the meantime AI PC processors are not driving consumer purchases.

New Form Factors

While every CES and every year has its unorthodox ideas and form factors, 2025 seemed to lean into this trend more than usual. Lenovo was the primary actor, with the launch of its ThinkBook Plus Gen 6 Rollable and ThinkBook VertiFlex Concept. The former is a $3,000+ commercial device that can expand its display vertically, while the latter was an IFA concept that allowed users to rotate the display between landscape and portrait. More interestingly, Lenovo appears far from done, with reports of a rollable gaming notebook potentially being revealed at CES 2026. Ultimately, the clamshell continues to reign supreme, but sooner or later alternative form factors may catch on, as the smartphone market has found with foldables.

Notebooks Market: 2026 Outlook

2026 will be a more challenging year than 2025.

The PC industry faces a memory shortage that has the potential to increase channel shelf prices even more than tariffs ultimately did in H1 2025, and the tailwind of Windows 10 EOL will peter out sooner or later. Bigger brands are best positioned to navigate this price increase due to their greater ability to leverage scale in negotiations, but smaller brands like Asus and Acer have increasingly been more willing to take risks with product design in recent cycles.

Zooming out, Windows itself will face a shifting landscape. Chrome OS will migrate toward Aluminium OS, and Apple seems all but set to launch a lower priced MacBook that is more affordable than the MacBook Air. With the latter, it could also upend the merchant landscape if it debuts at Walmart – where Apple has been testing demand for sub-$600 notebooks with a heavily discounted M1 MacBook Air – rather than solely Best Buy.

Get more information

Visit our Consumer Electronics industry page to learn more about the data we deliver for the Notebooks market – or reach out to our analyst below to ask questions about this report or get specific insights you need.

About the Author

Avery Bissett

Avery Bissett is an analyst with OpenBrand. He has extensive experience in computing technology, with his research focusing on key market trends and emerging technologies.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…

Refrigerators: 2025 Year-In-Review

Our Refrigerators: 2025 Year-in-Review report recaps product launches, placements, pricing and…