Our Desktops: 2025 Year-in-Review report recaps Desktop launches, placements, pricing and advertising and promotional activity captured throughout 2025. The report features data and insights from OpenBrand’s Desktop category, which feature products sold through the US ecommerce and brick-and-mortar channels.

Read through all the 2025 pricing and promotions insights below or email the report to read later.

You can also check out our 2025 Year-in-Review reports for other Consumer Electronics categories.

Desktops: 2025 Product Updates

The first half of 2025 was marked by volatility and uncertainty, with proposed tariffs casting a long shadow over the PC industry and disrupting pricing strategies across the board. While worst-case scenarios around component tariffs were largely avoided, the ripple effects of rising prices and portfolio adjustments defined the early part of the year. Layered on top of constrained supply for next-gen GPUs and a muted reception to new desktop processors, and the result was a lopsided market recovery in which gaming bore the brunt of pricing and availability shocks.

Yet amid the chaos, certain OEMs like MSI and Asus found room to grow, and channel shifts, particularly at Best Buy and Walmart, opened new paths for opportunistic players. As the year closed, tariff pressures eased but left behind a changed retail landscape, where brands leaned harder into marketplace models, mobile silicon crept into desktops, and AI PC hype continued to outpace actual consumer demand.

Tariffs Tossed a Wrench in H1

The first half of 2025 was dominated by macroeconomic uncertainty related to tariffs, and how merchants and brands responded. While the worst case scenarios – most of which involved high tariffs on PC components sourced from China or South East Asia – didn’t fully materialize, price increases and partial rollbacks of them were a consistent theme through the beginning of back-to-school. Coupled with a significant gap between overdue and less elastic demand for new GPUs and insufficient supply of RTX 50 through H1 2025, and unsurprisingly, gaming was the most significantly impacted segment.

Starting with system integrators, then followed by Asus and other OEMs, SKUs at Best Buy started receiving price increases in late Q1. These price hikes generally ranged from 5% to 10%, with particularly sharp increases on lower margin, budget-focused towers. If there was a winner among brands, it was OEMs who found themselves facing SI’s who couldn’t price as aggressively as they did in years past. MSI and Asus were particular winners, with the former gaining in-store placements at Costco at iBuyPower’s expense while the latter faced less competition than normal for its new ROG G700 SKUs. These were later followed by AIOs and consumer towers receiving similar price increases. Exiting 2025, AIOs remain the most vulnerable. While some price increases on consumer and gaming towers have been rolled back, AIOs have been less fortunate, likely due to the difficulty in reshoring production and assembly of devices with display panels. This may change in coming years, however, as Dell was able to shift production of some of its AIOs to Mexico, while HP has been able to pivot out of China to South East Asia in some instances.

Overall, 2025’s tariff rollercoaster could be summed up as “Could be better, could be worse.” Best Buy and to a lesser extent Costco experienced price increases, but these were often partly rolled back by the time BTS arrived. Walmart and Amazon were more able to successfully maintain prices, with the former often finding success in peeling off gaming shoppers from Best Buy and other traditional outlets for gamers.

Best Buy Marketplace

With the benefit of an overdue gaming refresh and the tumultuous post-tariff landscape, Skytech was able to grow its foothold at Best Buy. In-store, it built off of its initial RTX 4070 foothold last year to multiple SKUs, ranging up to an $1,879 King95 placement with an RTX 5070, bringing increased competition across most price bands. Online, Skytech eagerly jumped behind BestBuy.com’s marketplace launch after August and invested in dozens of 2P SKUs (shipped and sold by Skytech at BestBuy.com). By the end of 2025, Skytech’s assortment at BestBuy.com is approaching 200 desktops – larger than CyberPower and iBuyPower’s combined portfolio at BestBuy.com.

While it’s early days for Best Buy’s online marketplace, 2026 is shaping up to be an interesting year as brands follow Skytech’s example. With rising memory costs trending to impact retail shelf prices more than tariffs in 2025, CyberPower and iBuyPower have been reorienting their BestBuy.com portfolios to increasingly leverage 2P SKUs. These debuts are where OpenBrand has first tracked increased shelf prices for CyberPower and Skytech, with the former removing 1P SKUs and then reviving them as 2P placements with a higher price. It’s a logical reaction to protect margins, and one that other brands will likely emulate where possible. The question going forward will be how much volume marketplace SKUs can drive at these higher prices and if consumers are willing to forgo the benefits of 1P fulfillment.

Components: Everything Old Is New Again

2025 saw an uptick of mobile processors in gaming and consumer towers, the culmination of years of sluggish generational uplifts and advancements in desktop processors. After the 2021 launch of Intel’s 12th-generation Alder Lake processors and the venerable LG1700 socket and their favorable reception from the channel, Intel followed up with two fairly modest refreshes and then the underperforming Arrow Lake family in late 2024, which traded raw performance and value for a hard-to-sell boost to efficiency.

The response from brands and retailers has increasingly resulted in less momentum to update to the latest Intel processor. 14th-generation Intel processors and older Ryzen chips have become the de facto choice for entry-level, mainstream, and even premium $1,500+ shelf price gaming desktops. Examples include Walmart.com’s iBuyPower $1,699 SMA7N5701 ($1,399 after discounts) that pairs a Ryzen 7 8700F with an RTX 5070 or Best Buy’s $1,099 CyberPower GXi3200BSTV10 ($929 after discounts to start 2026) that pairs an i5 14400F and an RTX 5060. This response was also at times mirrored for non-gaming SKUs, with Intel 13th and 14th generation processors being popular choices for entry-level towers and Dell largely avoiding new processors for its AIOs and sticking with Core Ultra 100.

These trends have opened up the door to two specific chip segments in 2025: mobile processors for towers and AMD and its X3D chips. Asus and Acer both launched budget, reduced footprint gaming towers that used older Intel laptop processors. Both the former’s TUF T500 and the latter’s Nitro 20 (currently available in non-US markets) uses Intel’s i5 13420H and i7 13620H from 2023. While HP has yet to make any US market announcements, it recently began offering the Omen 16L in China with the Intel i7 14650HX. This trend was also seen to a lesser extent in consumer towers, where Asus’ V500 desktops also used Intel 13th generation mobile processors. AMD has also gained shelf share with key channel partners amid Intel’s stagnation, growing its foothold in mainstream gaming with its Ryzen 7000 and Ryzen 8000 processors particularly, while X3D SKUs continue to slowly grow in premium price bands. While the latter’s impact remains limited, momentum is growing as key OEMs like Lenovo adopt X3D SKUs at merchants like Best Buy.

For 2026, it’s unclear if these trends will strengthen. While it will be a quiet year for desktop processors, Intel also reported earlier this year that its older processes are at capacity due to demand from notebooks and desktops, which could force brands to allocate this limited supply toward notebooks. And for AMD, it figures to have a strong advantage for desktops given that Intel appears to be opting for only a minor Arrow Lake refresh in H1, with Nova Lake not expected to arrive in volume until 2027.

Dell Tries to Reinvent Channel Strategy

Dell’s consumer channel performance in recent quarters has been uneven as the overall company struggled to adapt to the post-Covid landscape and ever increasing commodification of PCs. In response, Dell has overhauled its retail channel strategy to be more price competitive and even going as far as to work directly with Walmart. This reversal of historical trends – Dell had not done business with Walmart directly since at least Covid, if not ever – could lay the foundations for a comeback in 2026. It started with a quartet of consumer desktops over the summer (two towers and two AIOs) that received aggressive discounts in Q3, to the point that it was at times matching or beating out HP’s competing SKUs in value. The company has also worked closely with Costco as part of the club store’s Costco Next program to steer additional traffic to Dell.com deals. Finally, Dell also leaned into the SMB refresh with the launch of its Dell essential PCs, which save costs on minor features (connectivity, for example) while maintaining core components.

For Walmart, this has coincided with increased ecommerce appeal for gaming desktops. Its offers frequently undercut similar deals at Best Buy and Costco, which are slowly shifting consumer perception of Walmart. Whereas it used to be a destination for $500 consumer desktops, it’s increasingly a retailer of interest for those seeking a $1,000+ gaming tower. If it can use its volume to force brands to keep costs down in 2026 as the industry grapples with exploding memory prices, Walmart will be well positioned to continue slowly and steadily gaining market share.

Consumers Remain Lukewarm on AI PCs

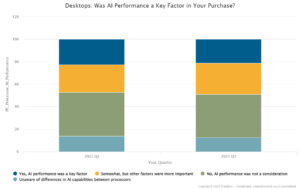

After a year and a half of Copilot+ PCs, and consumers remain at best lukewarm around the broader AI PC segment and processor differentiation. In Q3 2025, barely one-fifth of desktop purchasers in OpenBrand’s MindShare consumer tracking survey cited AI performance as a key factor in their purchase. Almost double (38%) did not consider AI performance at all. Perhaps more concerning, however, is that Q3’s results showed no improvement compared to Q2. This could rapidly change if local AI applications find their killer app, but in the meantime AI PC processors are not driving consumer purchases.

Desktops: 2026 Outlook

2026 is shaping up to be a particularly challenging year for desktops. Tight memory supply and skyrocketing component costs will likely impact channel pricing and assortments more than tariffs did in H1 2025. For gaming, this could offer OEMs with better supply infrastructure and supplier relationships a chance to catch up with leaner system integrators that will not be able to maintain their rock bottom pricing. For consumers, Dell’s arrival at Walmart in 2025 will likely be built upon, potentially putting pressure on AI, which has maintained a strong presence in AIOs and towers at the big box giant.

Get more information

Visit our Consumer Electronics industry page to learn more about the data we deliver for the Desktops market – or reach out to our analyst below to ask questions about this report or get specific insights you need.

About the Author

Avery Bissett

Avery Bissett is an analyst with OpenBrand. He has extensive experience in computing technology, with his research focusing on key market trends and emerging technologies.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…

Refrigerators: 2025 Year-In-Review

Our Refrigerators: 2025 Year-in-Review report recaps product launches, placements, pricing and…