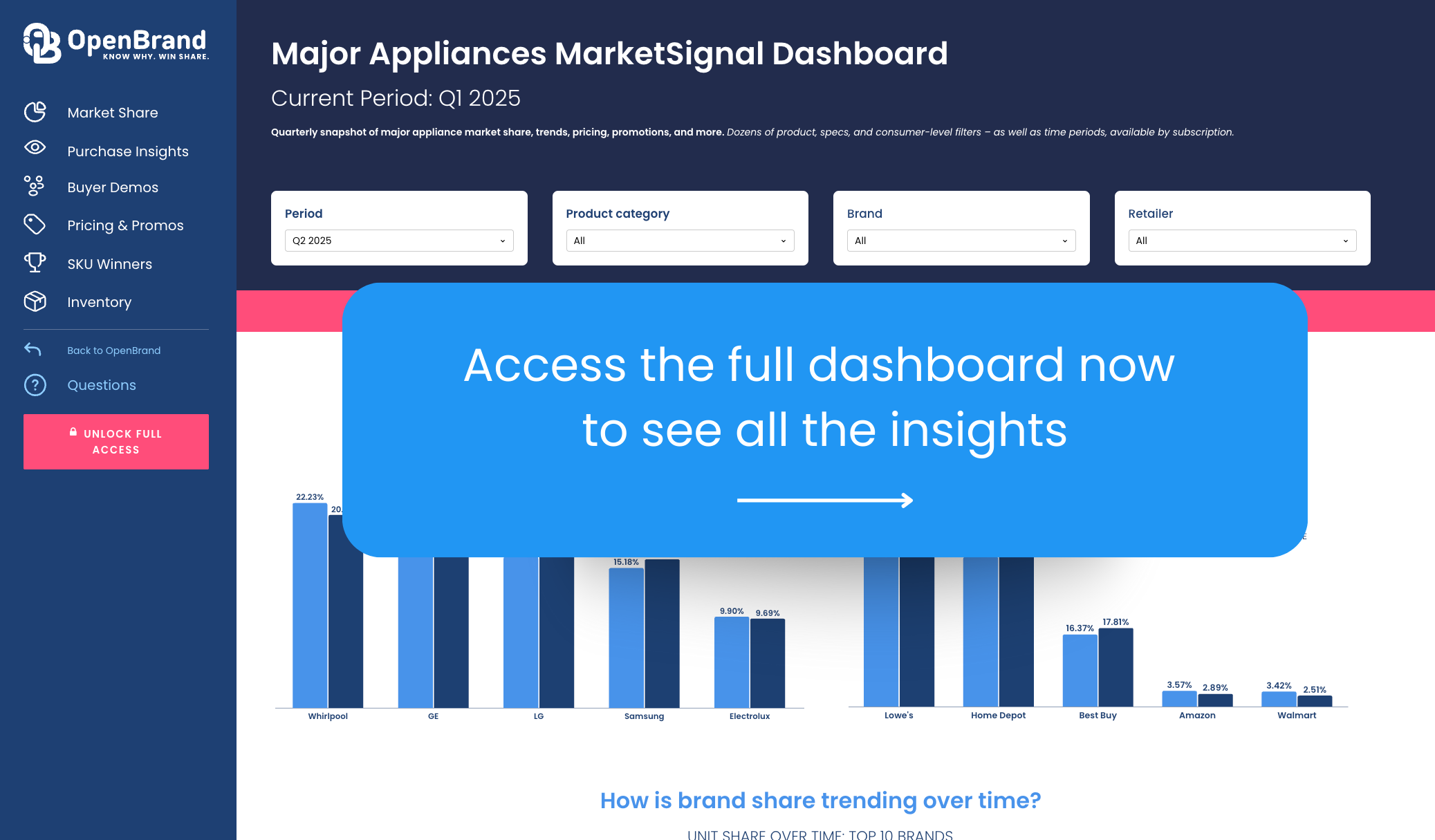

Today OpenBrand announced the launch of MarketSignal, a no-cost dashboard, providing a quarterly data snapshot designed to put critical market trends into every team’s hands.

MarketSignal offers a category view of market share leaders, pricing and promotional dynamics, and consumer behavior, giving users a fast way to benchmark the market and a clear path to unlock deeper, current-quarter insights in the full OpenBrand platform.

MarketSignal reflects OpenBrand’s commitment to bring clarity to the market and to empower better decision-making across the industry. For the first time, anyone in the industry can access a client-level view of the market, including retailer rankings, brand share, pricing trends, and consumer behavior — without a subscription.

By opening a streamlined view at the industry level, MarketSignal provides manufacturers, retailers, and analysts with a transparent look at the forces shaping consumer demand.

“MarketSignal democratizes high-quality market intelligence,” said Greg Munves, CEO at OpenBrand. “In minutes, leaders can benchmark where the market is and see exactly how much more is possible with our full platform — real-time visibility, advanced filtering, and the exportable data they need to act.”

With today’s launch, the MarketSignal dashboard is available for Major Appliances. Plans to increase coverage to more groups of categories over time are already underway, with Outdoor Power Equipment up next.

Q1 2025 Major Appliance Insights from MarketSignal

- Retail leadership: Lowe’s leads with 42.7% of unit share and 41.0% of dollar share, outpacing Home Depot and Best Buy. Home Depot, however, is gaining ground in shopper draw rates.

- Brand performance: Whirlpool (22.2% unit share) and GE (21.4%) hold the top spots, while LG and Samsung remain highly considered by nearly one-third of consumers.

- Online vs. in-store: Brick-and-mortar remains dominant, but online now represents 26.1% of purchases — underscoring the importance of omnichannel pricing and digital merchandising.

Consumer demographics: Millennials (31%) and Gen X (29%) now make up the majority of appliance buyers, signaling a shift toward more digitally influenced shopping journeys. - Purchase drivers: Competitive pricing remains the top factor (58%), followed by product selection (32%) and convenient location (29%).

Inside the dashboard, an “Unlock Full Access” call-to-action guides users to subscribe for current-quarter performance, greater granularity (brand/retailer/sub-category), item-level price & promo analytics, exports, and more.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Price Forecasts for Durables in 2026: Consumer Electronics, Appliances & Home Improvement

Modest inflation will drive incremental durables market growth in the year ahead As short-term…

The State of Consumer Durables: Lessons from 2025 and What’s Ahead

Insights from OpenBrand’s January 2026 webinar As we enter the new year, OpenBrand is reflecting on…

Refrigerators: 2025 Year-In-Review

Our Refrigerators: 2025 Year-in-Review report recaps product launches, placements, pricing and…