Early 2025 brought a constant state of change to U.S. policies around international tariffs.

To better understand how consumers responded to these ongoing policy changes, OpenBrand began fielding tariff impact questions in March 2025 using our MindShare consumer survey to monitor how sentiment around purchasing is shifting.

Using these survey results, we conducted a study on consumer purchase behavior in the midst of tariff concerns. The resulting report, Tariff Impact on Durables Goods Purchases, delivers a timely snapshot of exactly how US consumers are reacting, capturing shifting perception and the impact of tariffs on purchase decisions.

The findings reveal the state of consumer awareness and concern with regard to tariffs, especially among active purchasers, and a look at how tariff impact shifts among various demographics. The report also dives into the impact of tariffs on key categories, brands, and retailers.

Current OpenBrand Client? Contact your account manager or email our team to see about accessing the survey data in the OpenBrand dashboard.

Download the full report now or take a look at highlights from the data below.

Overall Tariff Sentiment: March - April 2025

This section of the report looks across all survey respondents to determine the impact of tariffs on the industry in April 2025. The data in this section depicts a week-over-week view, highlighting the alignment between policy announcements and market sentiment shifts, as well as a month-over-month view to show the growth in concerns from March to April.

As tariffs continue to dominate the economic landscape their influence has a growing impact on how consumers purchase durables. Early signs show that consumers are shifting their behavior in ways that could quietly reshape the durables market.

Overall consumer awareness of tariffs increased in April, up 4 percentage points (ppt) month-over-month. There was also an increase in consumers reporting delaying purchases as a result of higher prices, up by 3.8 ppt. As concern grows more consumers in April than March cited they purchased earlier to avoid price increases.

Now let’s take a peek at April week-over-week data to see how consumer responses shifted in tandem with the volatile economy enforcing a variety of tariffs in April.

US Tariff Changes

Timeline Highlights

April 2: Reciprocal tariffs announced

April 3: Auto tariffs begin, Canada announces counter match

April 4: China announces 34% tariff on US imports

April 5: 10% baseline tariff on all countries begins

April 9: Differential tariffs take effect; US announces tariffs on China raised to 125%; Canada counter tariffs go into effect; China retaliates; EU retaliates; differential tariffs paused, 10% tariff remain in effect

April 10: China’s retaliatory tariffs go into effect; EU pauses retaliation

April 11: China announces additional tariffs; Smartphones and other semiconductor products exempt from tariffs

April 12: Chinese tariffs go into effect

Key Takeaway: As policy changes were announced and tariffs took effect (or were paused) in April, awareness of tariffs increased, consumer decisions to delay purchases as a result of tariff concern increased, and more earlier purchases were made to try to get ahead of tariff impact.

Key Tariff Insights by Demographics: March 2025

This section of the report analyzed the 111,000+ March 2025 respondents to determine the perceived impact of tariffs on the industry. This includes responses from both purchasers and non-purchases in Q1. This section delivers the macro-insights businesses need to better understand how tariffs impact their market.

Where the full report dives into data and takeaways for the following demographics, we included below a key takeaway from each to highlight the impact tariffs are having at a high level.

Regionality

Tariffs have a fairly consistent impact regardless of U.S. region, with northeast and midwest coming in slightly higher in terms of tariff awareness and the South had lowest tariff awareness.

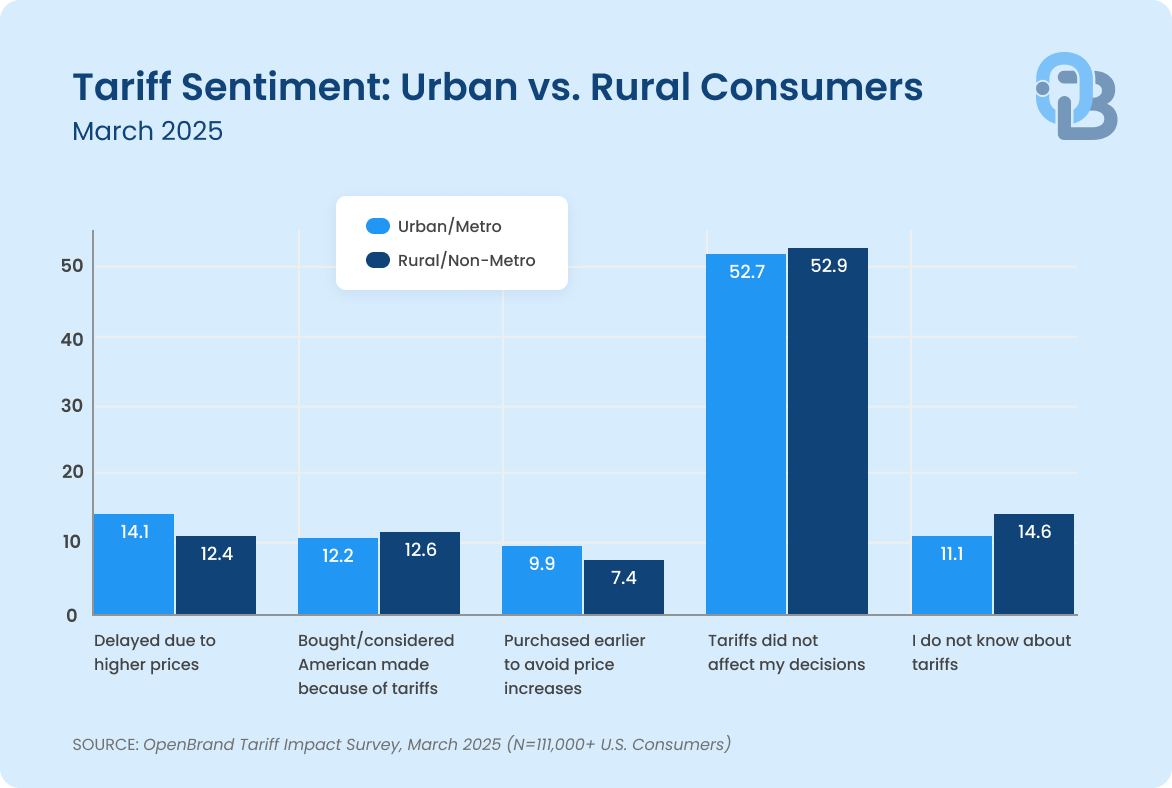

Urban vs. Rural

Urban consumers are slightly more proactive and price-sensitive, as well as slightly more engaged across all influenced behaviors.

GENDER

A higher percentage of females reported tariffs impacting their purchase decision.

HOMEOWNERSHIP

Homeowners are less impacted by tariff news than renters, however they are delaying repairs due to tariff sensitivity.

EMPLOYMENT

Retired consumers are the demographic least impacted by tariff concerns, with 66% of retired consumers state tariffs did not impact purchasing.

PROS & CONTRACTORS

Respondents employed by either a builder or contractor bought or plan to consider more American-made products than those not employed by a builder/contractor.

INCOME

Lower income consumers are more likely to delay purchases due to tariffs; higher income respondents reported purchasing products earlier to avoid higher prices

POLITICAL AFFILIATION

Politically tolerant shoppers are less impacted by tariffs; Politically intolerant consumers are more price sensitive.

AMERICAN-MADE PRODUCTS

Tariffs are having a clear impact on consumer sentiment toward American-made products, with 1 in 5 consumers buying or considering buying more American-made products as a result of tariffs.

Impact on Future Purchase Intent: March 2025

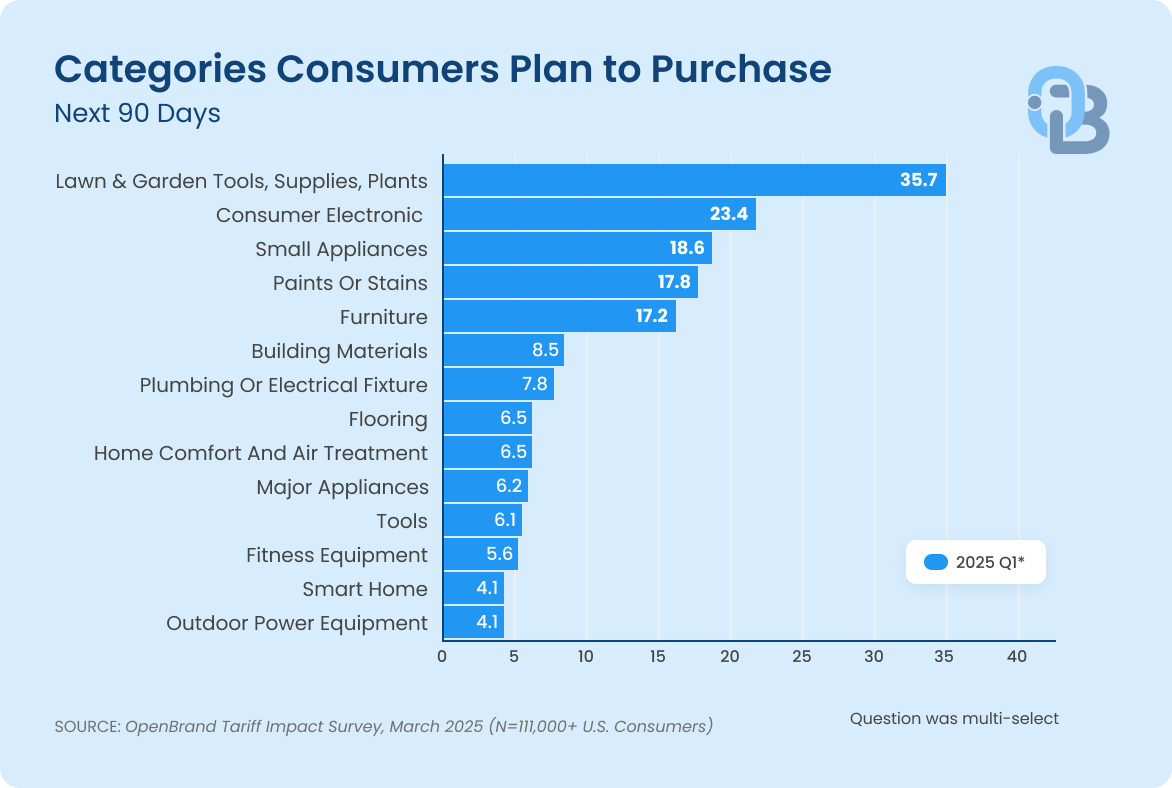

The following includes only those respondents who did not make a purchase from one of the durables categories tracked by OpenBrand’s MindShare Survey. This includes those categories in which respondents will ‘most likely’ purchase in the next 90 days.

Among consumers who did not purchase in Q1, there are still a few categories where tariffs may have less impact on Q2 purchases. Here are the top categories where consumers said they plan to purchase in the next 90 days.

Regardless of tariff influence, Lawn & Garden is on consumers’ minds as the category most likely to purchase in the next 90 days.

For insight into what brands and retailers are top of mind for consumers in Q2, download the full report.

Get the full report for more tariff insights

The key for durable goods businesses is to remain adaptive and attentive.

Specifically, paying attention to consumer sentiment toward tariffs and preparing to pivot messaging, pricing, and inventory management to align with shifts in consumer demand. Strategic emphasis on value, timing, and American-made goods may prove essential in maintaining consumer trust and driving sales in a volatile environment.

To take a deeper look into how tariffs are impacting consumers, download the full report.

Report Contents

- Tariff insights for April 2025

- Additional takeaways and data around key demographics

- Brands & retailers consumers are most likely to purchase

- What brands and retailers can do to accelerate purchasing

- Impact summary

Other Resources for Navigating Tariff Uncertainty

OpenBrand will continue to gather tariff impact survey data daily and will refresh reporting on how consumer trends shift as US policies evolve. If you’d like access to the data for a specific category, contact us at winshare@openbrand.com.

Here are additional solutions OpenBrand delivers to help brands and retailers stay ahead of tariff uncertainty and market shifts.

- OpenBrand Consumer Price Index for Durable and Personal Goods: additional pricing intelligence that can help you stay informed as tariffs and inflation impact the market

- Economic Forecasting Solutions: Know how the market is changing – before it changes. Forecasting available for pricing, retail channel sales, shipments, and BYO data.

- Competitive Intelligence: From real-time pricing and promotions data to store-level inventory tracking, our competitive intelligence data helps you stay ahead of competitor movement and understand why the market is changing, as it changes.

- Market Measurement: Monitor share changes down to the SKU and analyze how your consumers perceive your brand.

Report Methodology

This report is based on U.S. consumer tracking survey data conducted starting March 1, which captured daily responses from consumers in order to understand market perception of tariff impact in the midst of ongoing U.S. policy changes. In March and April the total sample was 150k respondents. The survey was focused on overall awareness and understanding of how tariffs might influence purchasing decisions. To ensure representation, respondents were balanced against the U.S. Census around key demographics (including age, gender, income, etc.). Findings were then analyzed to identify key trends and differences across consumer population segments, products, and purchase intents. We continue to gather our tariff impact survey data daily and will refresh reporting on how consumer trends shift as US policies evolve.

Download the full report now for a deeper look into how tariffs impact consumer purchasing

Read our latest blog post and insights

How Disruption in BLS Data Collection May Impact Accurate Price Change Measurement

Appliance CPI Volatility: Signal or Measurement Noise?Recent data reveal a striking divergence…

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Price Forecasts for Durables in 2026: Consumer Electronics, Appliances & Home Improvement

Modest inflation will drive incremental durables market growth in the year ahead As short-term…

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…