Our Smartphones: 2025 Year-in-Review report recaps Smartphone launches, placements, pricing and advertising and promotional activity captured throughout 2025. The report features data and insights from OpenBrand’s Smartphone categories, which feature products sold through the US ecommerce and brick-and-mortar channels.

Read through all the 2025 pricing and promotions insights below or email the report to read later.

You can also check out our 2025 Year-in-Review reports for other Consumer Electronics categories.

Smartphone Market: 2025 Product Updates

Activity during 2025 reflected a maturing smartphone market where competitive advantage increasingly came from portfolio building, ecosystem leverage, and disciplined go-to-market execution rather than singular hardware breakthroughs. Leading brands tightened lineup segmentation across entry, midrange, flagship, and foldable tiers, raised baseline configurations and software-support commitments, and used AI features more as an integrated platform layer than a standalone differentiator.

Channel dynamics remained central with carrier financing and trade-in credits supporting premium sell-through, while retailer-led promotions and seasonal tentpoles concentrated deal visibility and helped drive advertising growth in the first half before easing later in the year. Beyond handsets, industry structure continued to shift through carrier consolidation, an expanding MVNO field, and early commercialization of satellite-to-phone services, collectively shaping the competitive context in which 2025’s product strategies played out.

Smartphones: Product Launches in 2025

Smartphone activity in 2025 reflected a market focused on headline hardware breakthroughs and on portfolio refinement, AI platform expansion, and segmentation across price, form factor, and use case. Leading brands used the year to reset entry points, broaden midrange and “value-plus” tiers, and reinforce premium differentiation through design, foldables, and software longevity, while AI increasingly served as a unifying layer rather than a standalone differentiator. Launch timing shifted earlier for several flagship cycles, carrier financing and trade-in support remained central to demand generation, and foldables continued to evolve incrementally toward thinner, more durable, and more diverse form factors. Collectively, 2025 underscored a maturing smartphone market in which competitive advantage hinged on lineup architecture, ecosystem leverage, and disciplined go-to-market execution.

Apple

Apple’s 2025 smartphone activity combined an entry-level reset early in the year with a major fall flagship cycle focused on tighter segmentation, higher base configurations, and expanded carrier-backed affordability. In February, Apple refreshed its lowest-price iPhone by replacing the SE concept with the $599 iPhone 16e, shifting to a modern full-screen OLED design with Face ID, adopting USB-C, and introducing Apple’s first in-house cellular modem (C1) while bringing Apple Intelligence support into the entry lineup via the A18 platform and 128GB base storage. The fall cycle then centered on the iPhone 17 family, with Apple launching four models (iPhone 17, 17 Pro, 17 Pro Max, and the new iPhone Air), raising baseline storage to 256GB across the lineup, and adding a 2TB Pro Max configuration, while maintaining price points aligned to equivalent storage tiers ($799.99 for iPhone 17, $999.99 for Air, $1,099.99 for Pro, and $1,199.99 for Pro Max). Carrier support remained a core go-to-market lever, with trade-in bill credits reaching up to $1,100 from partners such as Verizon and T-Mobile and $830 from AT&T, reinforcing Apple’s strategy of using financing and promotions to sustain upgrade momentum as it broadens its portfolio structure.

Samsung

Samsung’s 2025 activity emphasized portfolio expansion and segmentation around Galaxy AI, spanning mainstream, flagship, and foldable tiers while extending into new form factors. The year began with the Galaxy S25 series launch (S25, S25+, and S25 Ultra) built on Snapdragon 8 Elite for Galaxy, One UI 7/Android 15, and seven years of software and security updates, with pricing from $799 to $1,299 and a focus on AI-driven features and security enhancements. Samsung then broadened its reach in spring by rolling out refreshed Galaxy A-series models (A56, A36, A26) priced from $299 to $499 and introducing “Awesome Intelligence” tools alongside six years of updates, while also targeting enterprise mobility with the rugged Galaxy XCover7 Pro (MIL-STD-810H, IP68, removable battery) and carrier-backed positioning via T-Mobile’s business channels and T-Priority certification. In the premium tier, Samsung added the ultra-thin Galaxy S25 Edge (5.8mm, 163g) as a design-forward flagship alternative priced from $1,099.99, and in July refreshed its foldable lineup with the Galaxy Z Fold7 and Z Flip7 plus a lower-priced Z Flip7 FE, supported by aggressive “free with trade-in” promotions and wide channel availability. In September, Samsung debuted the Galaxy S25 FE to expand its S25 family with a more affordable entry point, a launch timed for IFA 2025. Late in the year, Samsung extended its foldable roadmap by unveiling the Galaxy Z TriFold, a dual-hinge 10” foldable positioned for tablet-like productivity, with an initial Korea launch in December and US timing targeted for Q1 2026 at roughly $2,445 for the 512GB model, reinforcing continued investment in new premium form factors.

Google

Google’s 2025 Pixel activity combined an earlier, AI-forward midrange cycle with an accelerated late-summer flagship launch designed to broaden the portfolio across mainstream, premium, and foldable tiers. In spring, Google introduced the Pixel 9a at $499.99, updating the A-series with a redesigned, flatter rear camera treatment, a larger 6.3” 120Hz OLED, a 5,100mAh battery, Tensor G4 processing, and a seven-year OS/security update commitment. The device’s market rollout slipped slightly due to a component durability issue, launching April 10 in the US and expanding internationally in mid-April. Google then moved its flagship timing earlier than usual by scheduling its Made by Google event for August 20 in New York, where it launched the Pixel 10 family (Pixel 10, 10 Pro, 10 Pro XL, and 10 Pro Fold) powered by the new Tensor G5 built on TSMC’s 3nm process, with broad availability beginning August 28 for the core lineup and October 9 for the foldable. The Pixel 10 generation extended AI-driven features across the range and added a telephoto lens to the base Pixel for the first time, while also introducing Qi2 support tied to Google’s “Pixelsnap” magnetic accessory ecosystem; pricing spanned $799 for Pixel 10 up to $1,799 for the Pro Fold, supported by aggressive carrier and retail incentives including trade-in deals and gift-card bundles.

Motorola

Motorola’s 2025 initiatives centered on scaling its foldable strategy while reinforcing midrange and value coverage, with a consistent emphasis on design differentiation, durability, and an expanded “Moto AI” message. The year included a limited-edition razr+ Paris Hilton collaboration priced at $1,199.99 and sold exclusively through Motorola.com, signaling continued use of fashion-led variants to extend foldable visibility. In spring, Motorola expanded its core foldable portfolio with a three-tier 2025 Razr lineup, the Razr ($699.99), Razr+ ($999.99), and the new flagship Razr Ultra ($1,299.99), adding a titanium hinge, IP48 rating, premium materials like real wood and Alcantara on the Ultra, and broad retail/carrier promotions tied to pre-orders and early availability. Alongside foldables, Motorola refreshed its mainstream line with the Moto G Stylus (2025) at $399.99, adding stronger durability credentials (IP68 and MIL-STD-810H) and performance upgrades while maintaining price, and later pushed into the “thin premium” trend with the under-6mm Moto X70 Air in China (expected globally as the Edge 70) before formally introducing the Edge 70 in Europe and the Middle East with a 5.99mm chassis, Snapdragon 7 Gen 4, and durability certifications (IP68/IP69 and MIL-STD-810H). Motorola also continued style-led product extensions through its Swarovski “Brilliant Collection” bundle (Razr plus Moto Buds Loop) priced at $999.99 with wide US retail placement, and closed the year by teasing a potential shift beyond clamshells toward a book-style foldable form factor for a CES 2026 unveiling.

Others

Other smartphone brands in 2025 focused on portfolio experimentation, selective geographic expansion, and differentiated form factors rather than broad US-centric scale. OnePlus balanced China-first flagship development with international mid-range volume, and emphasized large batteries, hardware controls, and AI features while maintaining uneven US availability. Nothing continued to refine its design-led identity through midrange and sub-brand launches, layering in AI workflows and modular concepts while cautiously expanding North American access ahead of its first true flagship repositioning. Meanwhile, China-based OEMs like Huawei and Oppo pushed the boundaries of foldable design, prioritizing thinner builds, with the Find N5 positioned it as the “world’s thinnest” foldable, multi-fold formats, durability upgrades, and tri-fold devices like the Mate XT Ultimate. Throughout the year, most of these advances remained largely confined to China and select international markets rather than Western carrier channels.

Smartphones: Impactful Events Changing the 2025 Market

Industry Consolidation and Infrastructure Realignment

US wireless markets saw continued consolidation in 2025, driven by spectrum scarcity, capital intensity, and regulatory pressure. Verizon secured FCC approval for its $20B acquisition of Frontier Communications, re-expanding its fiber footprint across 25 states with commitments to rural broadband investment and accelerated fiber deployment. T-Mobile finalized its $4.3B acquisition of US Cellular’s wireless operations, absorbing roughly 4 million subscribers and spectrum assets while materially strengthening its rural coverage; US Cellular subsequently exited the retail wireless business and rebranded as Array Digital Infrastructure to focus on towers and spectrum monetization. Parallel to these moves, AT&T announced a $23B agreement to acquire low- and mid-band spectrum licenses from EchoStar, effectively ending EchoStar’s ambitions to operate as a fourth national carrier and consolidating additional spectrum into the hands of the top three operators

MVNO Expansion and Nontraditional Entrants

The MVNO landscape expanded with a wave of differentiated, brand-led entrants targeting specific consumer pain points. Klarna entered the US mobile market with a $40/month unlimited 5G plan delivered entirely through its app and powered by AT&T’s network, emphasizing frictionless onboarding and eSIM-only activation. New York Mobile launched on T-Mobile’s network with a niche focus on premium and personalized phone numbers, positioning mobile identity as a form of brand value for businesses and professionals. SmartLess Mobile leveraged celebrity reach and a WiFi-first usage philosophy to offer low-cost, data-light plans on T-Mobile’s network, targeting cost-conscious users who largely avoid traditional “unlimited” models. Trump Mobile also entered the MVNO space with patriotic branding and a bundled device strategy, reflecting the continued influx of celebrity and brand-driven experiments in wireless, though with higher pricing and unresolved hardware questions.

Satellite Connectivity Broadened

Satellite-to-phone connectivity moved from limited, emergency-only positioning toward broader consumer availability in 2025, as US carriers began rolling out direct-to-cell satellite messaging and signaling a roadmap toward richer services. Early in the year, AT&T and Verizon demonstrated cellphone-to-satellite video calling, highlighting ambitions that extend beyond texting to voice, video, and file sharing. Verizon then launched satellite texting to any phone number for select Pixel 9 and Galaxy S25 devices, positioned as the first US carrier rollout of “everyday” satellite messaging outside of SOS use. In parallel, T-Mobile advanced its Starlink partnership from open beta to nationwide availability, offering satellite SMS broadly (including to non-T-Mobile customers) with tiered pricing and plan bundling, then expanded functionality beyond messaging by enabling satellite access to a limited set of Apple apps on iPhone models. Collectively, the year established satellite messaging as an emerging competitive dimension in carrier service portfolios, with interoperability, device compatibility, and a gradual expansion from text toward data-enabled experiences shaping the category’s near-term trajectory.

Smartphones: 2025 Seasonal Sale Events

Timeline of Seasonal Sale Events

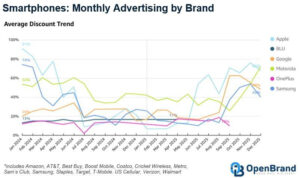

Major promotional events in 2025 showed an active but segmented smartphone deal environment, with mid-year Prime Day expanding in breadth while holiday promotions leaned on broader participation and higher dollar-value incentives rather than uniformly deeper discounting. Amazon’s four-day Prime Day generated more deals than last year, with an average brand discount of 26% and deal activity led by Samsung in count, while Motorola posted the deepest average discount (34%), and Samsung and Google tied for the highest average savings at $265. Merchants responded with overlapping counter-promotions, where Target delivered the deepest average discount during Prime Day week (28%) and Amazon led in average savings ($175), while Walmart remained more modest and skewed toward sub-$100 phones. By Black Friday, smartphone advertising doubled YoY, with Apple still leading ad share (42%) but down sharply YoY as Samsung (32%), Google (13%), and Motorola (11%) expanded presence and the mix shifted toward more prepaid and unlocked offers, respectively. Cyber Week then broadened further, with 40% of tracked online smartphone SKUs promoted, average discount depth easing to 32%, but average promotional values, reflecting heavier dollar-off incentives on higher-priced models and wide participation from Samsung and Google alongside Apple’s more selective discounting.

- 73 unique deals captured, up from last Prime Day (42) and Big Deals Day (41)

- Overall average discount across brands was 26% off, down 1 ppt YoY and up 1 ppt from October

- Samsung led in deal count (35) and tied Google in average savings ($265), while Motorola led in average discount (34%)

- Amazon’s Prime Day 2025 spurred competing sale events from major online merchants intent to capitalize on increased deal awareness during the week

- 73 unique smartphone deals captured, a 70% increase over last October’s event, but down 4 ppt from July’s Prime Day

- Overall average discount across brands was 28%, up two points YoY

- Google was leading participant, Samsung pushed wide portfolio with foldable, Motorola flexed budget appeal

- Amazon’s Prime Big Deal Days 2025 spurred competing sale events from major online merchants intent to capitalize on increased deal awareness during the week

- Smartphone ads surged back to pre-2022 levels, doubling YoY across carriers and retail

- Apple dominance shrank as Samsung, Google, and Motorola sharply expanded BF presence

- Prepaid & unlocked grew fast, signaling diversification beyond postpaid carrier promos

- 40% of all smartphones were on sale during Cyber Week 2025, over 2x last year’s saturation

- Overall average discount level of 32%, 3 points under last year

- Average promotional value increased to $246 off this year vs. last year’s $167 off average

Quarterly Advertising Activities

Smartphone advertising volumes in 2025 showed sustained year-over-year growth through the first half of the year, followed by a flatter third quarter and a clear mid-year peak. Q1 and Q2 totals increased up to 18% on-year, and Q3 eased to a small 0.3% increase, reflecting stronger promotional activity tied to spring and early-summer retail moments before cooling in late summer. Across all three quarters, Apple and Samsung consistently dominated the landscape with roughly three-quarters of total advertising share, with Apple holding the top position each quarter and key model focus shifting from iPhone 16 and Galaxy S25 promotions in the first half to Apple’s iPhone 17 launch and Samsung’s Galaxy Z-series foldables in Q3. Merchant concentration also remained pronounced, with Best Buy serving as the primary advertising driver each quarter (51%–58% share), far outpacing wireless carriers and mass merchants, underscoring the continued role of major electronics retail promotions in shaping smartphone advertising intensity.

Q1 2025: advertising total up 18% YoY; down 5% QoQ

- Familiar brands remain top advertisers; Apple and Samsung account for 75% of all ads

- Apple’s new iPhone 16 Pro and Samsung’s Galaxy S25+ hold largest share of advertisements and offer largest promotions

- Best Buy remains primary Q1 2025 advertiser with 58% share and ad count > 5x others

Q2 2025: advertising total up 15% YoY; down 5% QoQ

- Familiar brands remain top advertisers; Apple and Samsung account for 74% of all ads

- Apple’s new iPhone 16 Pro and Samsung’s Galaxy S25+ hold largest share of advertisements and offer largest promotions, same QoQ

- Best Buy remains primary Q2 2025 advertiser with 52% share and ad count > 4x others

Q3 2025: advertising total up 0.3% YoY; down 8% QoQ

- Familiar brands remain top advertisers; Apple and Samsung account for 75% of all ads

- Apple’s new iPhones and Samsung’s Galaxy Z-series hold large shares of ad mix and offer largest promotions, same YoY

- Best Buy remains primary Q3 2025 advertiser with 51% share and ad count > 5x others

Smartphone Market: Outlook for 2026

Looking ahead to 2026, the smartphone market is expected to remain structurally mature, with growth driven less by unit expansion and more by portfolio discipline, ecosystem leverage, and service-led differentiation.

Brands are likely to continue refining lineups, tightening entry points, defending the midrange, and sustaining premium pricing through foldables, design-led variants, and extended software commitments, while AI becomes more embedded into everyday workflows rather than marketed as a standalone feature. Foldables are poised to advance incrementally toward thinner, more durable, and more diverse form factors, though adoption will remain price- and region-sensitive.

Earlier launch timing and higher baseline configurations are expected to persist, reinforcing predictable upgrade cycles and supporting ASP stability amid cautious consumer demand. On the channel side, carrier financing, trade-in credits, and promotional intensity will remain central to demand stimulation, while MVNO expansion, satellite-enabled services, and spectrum consolidation continue reshaping the competitive landscape.

Get more information

Visit our Consumer Electronics industry page to learn more about the data we deliver for the Smartphones market – or reach out to our analyst below to ask questions about this report or get specific insights you need.

About the Author

Scott Peterson

Scott is a senior analyst here at OpenBrand. Since 2010, Scott has supported the strategic efforts of the world's top brands, and is recognized for his thought leadership in the industry. Over the years, his insights have been showcased online, in print, and on television, lending authority and expertise to countless productions. Holding previous management positions at both national and specialty retailers forged Scott's deep understanding of the channel and end-user perspectives.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…

Refrigerators: 2025 Year-In-Review

Our Refrigerators: 2025 Year-in-Review report recaps product launches, placements, pricing and…