In early 2025, gaming PCs and Copilot+ PCs became the first segments of the consumer PC channel to feel the impact of newly implemented tariffs. These changes have created a ripple effect across pricing strategies, product availability, and retailer positioning, especially for brands heavily exposed to Asia-based supply chains.

These are not minor adjustments. Gaming desktops and notebooks featuring Nvidia RTX 50 GPUs have been hit with price hikes, some models jumping over $300 almost instantly. The strategic ripple effect has forced companies to urgently revisit pricing models, rethink product availability, and adjust retailer positioning just as they navigate crucial launch windows.

But what’s truly behind these dramatic market shifts, and how can your brand stay ahead of the volatility? As OpenBrand’s category expert in computing, I took a deep dive into the causes behind this volatility and offer strategic recommendations to help brands and retailers successfully navigate the new market reality.

Have a question for our analysts?

Get the market data needed to support your business goals, trend data to guide strategic decisions, and more.

In this blog, we’ll explore:

- Strategic Shockwaves: Immediate Pricing and Inventory Adjustments

- Navigating Uncertainty: Rethinking Your Supply Chain Strategy

- Brand Spotlight: Who’s Adjusting Best, and Why

- Forecasting Tariff Impact in Computing Through 2025

This blog offers a high-level look into these areas. For the full deep dive, download my analyst report now.

Strategic Shockwaves: Immediate Pricing and Inventory Adjustments

Gaming PCs experienced immediate and significant price adjustments.

Halo desktop SKUs such as system integrator prebuilds with RTX 5080 and RTX 5090 GPUs began seeing price increases in excess of $300 in mid-February.

Borderline midrange systems featuring GPUs like RTX 5070 were frequently temporarily discontinued, only to return a couple of weeks later with a $100-$200 price increase in several instances.

This was quickly followed by the notebook retail channel, with adjustments on pre-orders from brands such as HP and Asus.

Navigating Uncertainty: Rethinking Your Supply Chain Strategy

These changes have created a ripple effect across pricing strategies, product availability, and retailer positioning, especially for brands heavily exposed to Asia-based supply chains.

While semiconductors remain exempt from tariffs, displays and other components sourced from Asia remain extremely vulnerable.

If tariff coverage expands, brands may face increased margin pressure or be forced to pass on additional costs to consumers. Brands should consider prioritizing cost-effective component sources, reassessing their global supply chain strategies, and preparing for ongoing volatility.

Brand Spotlight: Who’s Adjusting Best and Why

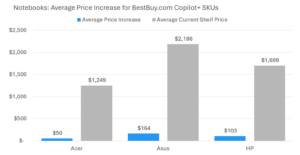

Asus has notably driven price adjustments in the emerging Copilot+ notebook segment, with around 23% of BestBuy.com’s Copilot+ SKUs seeing price hikes. ASUS accounted for all but four price increases. This is a combination of its particularly broad Copilot+ consumer and creator portfolio, coupled with the ongoing RTX 50 notebook launch including several AMD Ryzen AI 300 SKUs.

HP was the first brand to roll out broad price adjustments starting with the OmniBook Ultra Flip, $1,500+ SKUs that received roughly $100 price increases.

In contrast, HP has not increased prices on its original Snapdragon X-powered OmniBook X SKUs. This suggests that Qualcomm notebooks may be less impacted by tariffs.

Given the increasingly competitive landscape between Intel, AMD, and Qualcomm – and soon Nvidia and Mediatek – processor manufacturers willing to provide additional funding could reap massive gains in market share with price-conscious shoppers.

Looking Ahead: Tariff Impact Through 2025

With Back-to-School season only weeks away, the channel will have its first significant test of how shoppers – especially traditionally price conscious Chromebook customers – react to elevated prices and, should demand lessen, what these shoppers will do.

Potential scenarios include:

- Refurbished product purchases: Chromebooks already benefit from a longer-than-usual software support life (eight years from model launch), and merchants such as Best Buy have no shortage of open-box or refurbished products.

- Third-party sellers: With a lower barrier to entry (cost) compared to many Windows devices, price-conscious consumers could turn to 3P sellers able to win the buy box at Amazon or Walmart during key buying periods.

- Budget windows: Notebooks with Intel Core i3’s and AMD Ryzen 3’s have pushed into Chrome’s traditional customer base with aggressive pricing at merchants like Best Buy and Walmart. Consumers might end up opting for Windows if the price advantage for a Chromebook shrinks or altogether disappears.

Tariff impacts will increasingly pressure margins, potentially forcing broader price adjustments across consumer PC segments.

Ultimately, the true test of tariff impacts in the computing space may be if discounts are significantly diminished during Back-to-School.

Get the full report for more insight into tariff impact in computing

Overall, the first wave of tariff-driven price increases has exposed critical vulnerabilities across the gaming PC, Copilot+, and Chromebook segments, with brands and retailers already making tactical adjustments to pricing, assortments, and launch strategies.

For more strategic insights, including detailed breakdowns of specific SKU-level pricing shifts, deeper analysis of consumer reactions across segments like Copilot+ and Chromebooks, and more on upcoming tariff impacts through 2025, download the full analyst report below.

Access the report now

About the Analyst

Avery Bissett

Avery Bissett is an analyst with OpenBrand. He has extensive experience in computing technology, with his research focusing on key market trends and emerging technologies.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Consumer Price Index: Durable and Personal Goods | January 2026

This is the February 2026 release of the OpenBrand Consumer Price Index (CPI) – Durable and…

Price Forecasts for Durables in 2026: Consumer Electronics, Appliances & Home Improvement

Modest inflation will drive incremental durables market growth in the year ahead As short-term…

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…