The first quarter of 2025 confirmed what many in the industry suspected — the major appliance market is evolving faster than ever, with shifts in where consumers buy, which brands they trust, and what drives them to purchase.

From the dominance of big-box retailers to the growing share of online sales, the latest data shows a highly competitive environment where leaders are widening their gap and challengers are working to gain ground.

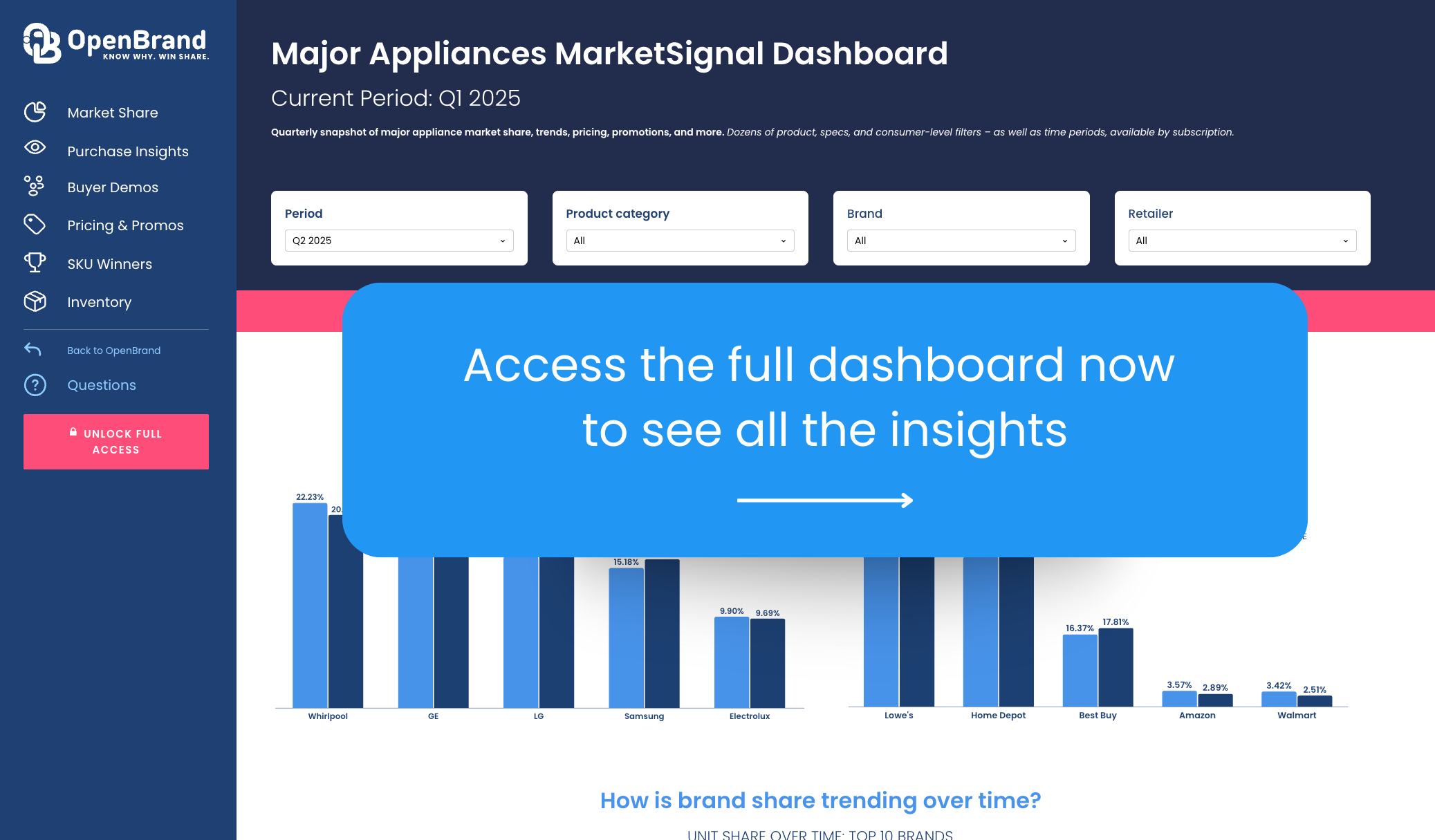

Our public MarketSignal dashboard brings this story to life, offering a deeper, interactive look at retailer rankings, brand share, pricing trends, and consumer behavior.

Read on for key takeaways from Q1 2025 or access the dashboard to explore the data for yourself.

SOURCE: All data insights in this article cover the rolling four quarter period ending Q1 2025 within the OpenBrand Market Measurement suite. This category covers an aggregate of several products including Refrigerator, Clothes Washer, Clothes Dryer, Dishwasher, Freezer, Free-Standing Range, Cooktop, Wall Oven, Compact Refrigerator, and Built-In Range.

Who are the top major appliances retailers by market share?

The top major appliance retailers in 2025 are Lowe’s and Home Depot, leading in both unit and dollar share.

Major Appliances Retailer Unit Share Winners

| Major Appliance Retailer | Q1 2025 Unit Share |

| Lowe’s | 43% |

| Home Depot | 34% |

| Best Buy | 16% |

Major Appliances Retailer Dollar Share Winners

| Major Appliance Retailer | Q1 2025 Dollar Share |

| Lowe’s | 41% |

| Home Depot | 37% |

| Best Buy | 18% |

OpenBrand’s Q1 Major Appliance Trend Insights

- Lowe’s leads the pack – by far: Lowe’s outpaces Home Depot by nearly 9 percentage points in unit share and more than 5 points in dollar share, underscoring its continued strength with appliance shoppers. Additionally, when we examine the performance/share by store count, Lowe’s overindexes relative to Home Depot and Best Buy. Simply put: Lowe’s accounts for ~23% more appliance units per location than expected (41% units on 33% of locations), while HD and Best Buy under-index by ~22% and ~21%, respectively.

- Best Buy fills a niche for tech-inclined shoppers: While Best Buy falls in third place for share overall, they keep in line with Home Depot regarding performance per store – suggesting its targeted appliance strategy resonates with tech-oriented buyers.

Major Appliance Retailer Draw Rates

Our top market leaders also continue to lead in outlet draw rate, with:

- Lowe’s drawing in 45.20% of all consumers who bought Major Appliances

- Home Depot drawing in 43.11%

- Best Buy follows as the third most-visited outlet, drawing 17.57% of consumers

OpenBrand’s Q1 Major Appliance Trend Insights

- Home Depot is closing the gap in draw rate: Compared to prior years, Home Depot is seeing a significant increase in shoppers over the last several quarters compared to Lowe’s. Additionally, Home Depot also saw gains from a significant YOY draw rate decline at Best Buy.

- Lowe’s remains best on the sales floor: Lowe’s still holds a slight advantage in converting browsing customers into buyers.

For more insights on draw rates — and to see how these retailers compare in closing the consumers they brought in — quarterly major appliances MarketSignal dashboard.

Who leads the major home appliances market share by brand?

The top major appliance brands are Whirlpool, GE, LG, and Samsung, all holding double-digit share in both units and dollars.

Major Appliances Brand Unit Share Winners

| Major Appliance Brand | Q1 2025 Unit Share |

| GE | 19% |

| LG | 17% |

| Samsung | 16% |

| Whirlpool | 15% |

Major Appliances Brand Dollar Share Winners

| Major Appliance Brand | Q1 2025 Dollar Share |

| GE | 20% |

| LG | 19% |

| Samsung | 17% |

| Whirlpool | 12% |

OpenBrand’s Q1 Major Appliance Trend Insights

Trust & reliability outweigh innovation: Whirlpool and GE’s continued strength is notable in a market where Korean brands LG and Samsung have aggressively pursued innovation-led growth. This suggests while drivers like price and variety of product offerings influence purchase decisions most, reliability and consumer trust are still powerful brand assets in the appliance category.

Brand Consideration Rates

When purchasing major appliances, almost a third of all consumers consider these top four brands in their purchase.

| Major Appliance Brand | Brand Consideration Rate |

| LG | 31.8% |

| Samsung | 31.79% |

| GE | 27.69% |

| Whirlpool | 27.05% |

Interestingly, while Whirlpool holds 15.76% of the market in unit share, they have a consideration rate that nearly matches LG and GE.

OpenBrand’s Q1 Major Appliance Trend Insights

- LG and Samsung lead all brands in consideration: Each approaches one-third of consumers, while GE and Whirlpool follow close behind at just over a quarter.

- Whirlpool has an opportunity to improve: High consideration rates don’t always translate to market share — Whirlpool in particular over-indexes on consideration relative to sales, signaling potential opportunity if conversion strategies are improved.

Explore the drivers and promotions data that may impact low conversion rates in our quarterly major appliances MarketSignal dashboard.

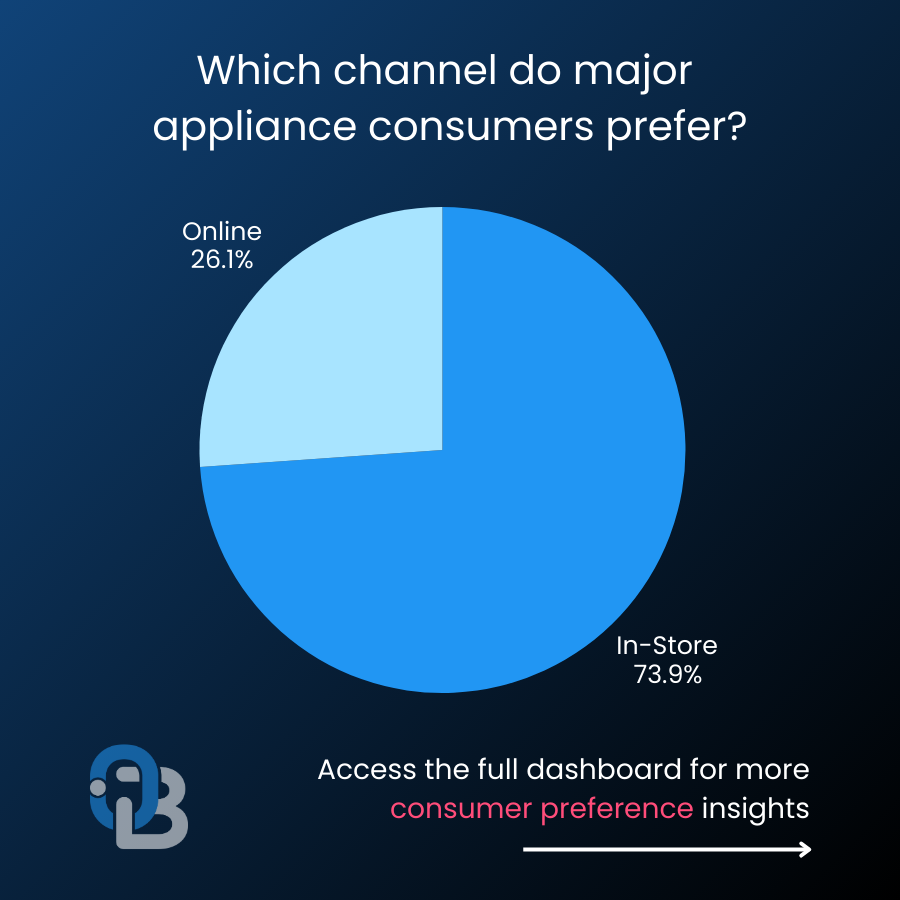

How are online and in-store sales trending for the Major Appliance market?

In Q1 2025, brick-and-mortar stores continued to dominate, though online purchases have carved out over a quarter of the market:

- In-store: 73.89% of purchases

- Online: 26.11% of purchases

OpenBrand’s Q1 Major Appliance Trend Insights

Online Can’t Be Ignored: While in-store remains the dominant channel, the online segment’s 26% share underscores the need for brands to maintain omnichannel pricing consistency and invest in digital merchandising. Retailers that have streamlined buy-online-pickup-in-store (BOPIS) processes are capturing a disproportionate share of online sales growth.

Major Appliance Consumer Demographics

OpenBrand delivers census-balanced market insights that highlight the typical Major Appliance customer.

As of Q1 2025, Major Appliance consumers showed the following traits:

- 75.14% of purchasers are homeowners, 21.94% are renters

- 56.27% of purchasers are married

- 60.21% of purchases were made with males only in the buying process; 39.79% were made with female only

- 60.37% of purchases were made by Millennials or Gen Xers

- 31.03% were Millennials

- 29.34% were Gen X

OpenBrand’s Q1 Major Appliance Trend Insights

Major appliance consumers skew younger: Millennials lead as the largest buying segment for the category with Gen X right behind. Millennials and Gen Z have grown significantly as key purchasers while Boomers and Matures saw significant decline overall.

Millennial preferences drive today’s market: Additionally, the uptick in Millennial purchasers signals a shift toward more digitally influenced buying journeys as well as an increasing interest in smart or energy-efficient features.

Major Appliance Purchase Drivers

Why do consumers select a specific retailer for purchase? The most mentioned reasons for purchasing major appliances at a specific retailer were:

Why consumers select a specific retailer

- Competitive price — 57.85%

- Good selection of products — 31.69%

- Convenient location — 29.33%

- Previous experience with store — 26.57%

OpenBrand’s Q1 Major Appliance Trend Insights

The importance of sales floor variety: Price remains the top driver, but “good selection” is gaining as an important differentiator. This suggests assortment planning and inventory visibility are becoming competitive levers, especially as consumers increasingly compare options online before visiting a store. With millennials making up the largest demographic buyer segment, the endless aisle is more important than ever, providing increased options.

Appliance Industry Outlook and Emerging Trends

What’s next for the US Major Appliance market in 2025?

Looking beyond Q1 2025, several factors are shaping the major appliance market:

Tariff impacts add risk: Potential changes to trade policy and tariffs on imported appliances add risk to pricing strategies, supply chains, and promotional planning. Review our breakdown of the latest tariff impacts on Consumer Durables.

Seasonal discounting holds steady: Black Friday and holiday promotions are expected to remain stable in 2025, reinforcing the importance of discount-driven buying events as volume drivers.

Economic sensitivity impacts customer demand: With inflationary pressures moderating but still present, consumers remain price-conscious. Expect promotional activity to stay elevated through 2025.

Housing market connection: Appliance demand continues to track closely with housing activity — a rebound in new home starts or existing home sales could quickly lift volumes.

Energy efficiency demand increases: Regulatory changes and rising energy costs are pushing more brands to highlight efficiency features, which could sway both consideration and purchase decisions.

Digital disruption favors online sales: The steady growth of online sales and BOPIS means retailers with superior digital experiences will likely gain share in the next 12 months.

Get more insight into Major Appliance market trends

The market insights don’t stop here.

For more retail sales data, market share, and insights on the major appliance industry, access our public major appliances MarketSignal quarterly dashboard now – no paid subscription required.

To see insights for other industries or find out how we can help power growth for your business, contact us today.

Ashley Jefferson

Ashley is the Demand Generation Manager at OpenBrand. She's a seasoned marketing professional with over 9 years of experience creating content and driving results for B2B SaaS companies.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…

Refrigerators: 2025 Year-In-Review

Our Refrigerators: 2025 Year-in-Review report recaps product launches, placements, pricing and…

Notebooks: 2025 Year-In-Review

Our Notebooks: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…