Trends in Bloom Webinar: Analyst Insights on Retail Pricing Strategies & Promotions

OpenBrand’s first-ever analyst roundtable webinar, “Trends in Bloom,” brought together six category experts to unpack the top developments shaping the consumer durables landscape in the first half of 2025.

Watch the full webinar now, and check out the key takeaways by category below, allowing you to dive straight into the insights most relevant to your business.

Setting the Stage: How are consumers reacting to tariffs and the current climate?

Before jumping into the key highlights, let’s level the playing field with a few critical data points around consumers’ reactions to the current market.

OpenBrand’s daily MindShare survey revealed consistent shifts in consumer awareness around tariffs and those perceptions are impacting purchase decisions. Here’s what the data shows:

- There is a steady decline (~6 ppt) among those consumers who reported ‘tariffs did not affect their decisions’ from 52.7% in March to 46.9% in May.

- In addition, more consumers reported delaying purchases due to higher prices – 13.8% in March and 191% in May, indicating a clear signal sensitivity is growing.

Consumers are not wrong to be cautious after several months of relatively soft or even deflationary movement in durables; April marked a critical turning point likely tied to the implementation of new US tariffs. OpenBrand’s CPI report for May 2025 revealed:

- Another turning point in durable goods pricing as price growth accelerated for the second consecutive month, rising +0.53% MOM up from +0.35% in April.

- Price growth was driven primarily by an increase in appliances, home improvement and personal care products.

- Appliance prices, which declined slightly in April, rose sharply with a 0.77% gain.

- Home Improvement products saw an increase as well, up from 0.59% in April to 0.81% in May.

- The personal care category reversed its course from a decline in April to an increase of 0.56% in May.

These changes are more than seasonal; they are a result of what we are seeing in the market and many of these increases are just the early signs of costs now being passed on to consumers.

Read on to see how some of the top categories are performing in light of the economic climate and what it means in terms of pricing, promotions and product lineup into fall.

Retail Pricing & Promo Strategies: Printers

A Quiet Spring, But Eyes on Back-to-School

For a category that often sees a seasonal uptick ahead of back-to-school, printer hardware has been unusually quiet this year. Here are a few highlights:

- Only 31 new printer models launched in the U.S. through May, the lowest spring launch count in the last few years.

- Business Printers saw all 17 launches occur in Q1, with nothing new added in April or May.

- Personal & SOHO Printer refreshes also lagged behind prior years.

Pricing & Promotions

So what’s holding things back? A combination of strategic timing and external pressure with tariffs at the top. While pricing has remained mostly stable thus far, the promotional landscape is far more volatile than in years past. Instant savings activity has softened, and we’ve yet to see any breakout promotional moment as we head into the key shopping months.

As we approach back-to-school season, consumers can expect promos to be value-restoring rather than deeply discount-driven, largely due to tariff pressures looming in the market.

Retail Pricing & Promo Strategies: Outdoor Power Equipment (OPE)

Tariff Headwinds, Smart Promotions

Few categories illustrate the impact of tariffs more clearly than outdoor power equipment (OPE). As tariffs ripple the industry, key brands like Stanley Black & Decker, STIHL, Husqvarna, Makita, and Caterpillar are noting the rising costs and moving quickly to adjust operating plans. From supply chain reworks to signaling price hikes ahead, these top brands are making it clear: cost pressures are real and pricing adjustments are underway.

Review of the OpenBrand pricing data highlights the following movement in OPE:

- Walk-behind mowers saw the most significant price increase, with net prices up +10.7% YTD between January to May.

- Other handheld tools like hedge trimmers (+7.5%) and chainsaws (+2.3%) also trended upward.

- Larger equipment like riding mowers and ZTRs actually saw prices drop slightly, reflecting soft demand, excess inventory, or pressure at higher price tiers.

On the promotions front, OPE activity peaked early.

- March brought a flurry of instant savings during spring launch season, led by Greenworks, Worx, EGO, and EcoFlow, but things cooled off by May.

- Deeper promotions were concentrated in very specific areas, namely robotic mowers, generators, and leaf blowers, all products under pressure as a result of slow sell-through, competition, and seasonality.

- Greenworks, Worx, Ryobi, and EGO were among the most frequently discounted brands.

During Memorial Day, the messaging shifted to value-based promotions: bundled batteries, free tools with purchase, and loyalty-driven incentives that avoided deep discounts.

The big question for summer: can brands maintain this measured approach—or will competition force a deeper dive?

OPE Product Innovation Trends

Innovation in the OPE space this spring has centered on three interwoven themes: autonomy, battery ecosystems, and performance messaging.

Autonomous mowing saw momentum in both the residential and commercial sectors, with brands like Husqvarna and Exmark expanding their portfolios to reflect growing interest in hands-free solutions.

At the same time, manufacturers doubled down on their battery platform strategies, highlighting cross-tool compatibility and bundling incentives to deepen consumer loyalty.

There’s also been a noticeable shift in how products are marketed, with emphasis on power, runtime, and torque as proof points that battery-run OPE can now rival gas in more demanding applications.

Together, these themes point to a long-term vision: one where innovation is more than solely new features, focusing also on reshaping how OPE products are purchased, used, and perceived.

Retail Pricing & Promo Strategies: Major Appliances

Higher Prices, Strategic Discounting

Home appliances are one of the clearest examples of a pricing rebound. After a softer 2024, Spring 2025 saw prices rise across nearly every subcategory. Here are some of the highlights:

- Laundry appliances jumped nearly 7% YoY, surpassing the $1,000 average price point.

- OTR microwaves, dishwashers, and refrigerators followed suit, each seeing meaningful gains ranging +2.4% to +5.8%.

- While range prices fell slightly on a net basis (-2%), pre-discount prices increased, giving brands flexibility to advertise deals while preserving margin.

Promotions also told a tale of two strategies. Samsung and LG leaned into deeper discounts leveraging their premium positioning to attract deal-seekers. In contrast, data revealed legacy value brands like Whirlpool, Frigidaire, and Maytag pulling back, indicating maintaining margin is a higher priority.

Memorial Day 2025 brought some of the strongest appliance deals we’ve seen in months, with Home Depot advertising discounts up to 35% and Lowe’s promoting savings of up to 40% on select products.

Still, behind the scenes, brands are navigating a tightrope between inflation recovery and promotional competitiveness.

Retail Pricing & Promo Strategies: Computing

Mixed Signals, Evolving Strategies

The computing category, particularly notebooks and desktops, is in the midst of a transition.

While inflation is real, pricing trends are far from uniform. Average notebook prices declined slightly year-over-year, yet pricing volatility has surged as tariffs affect new model rollouts, especially in gaming SKUs.

In-store promotions spiked in May due to clearance cycles, while online channels began tapering discounts likely driven by limited supply of newer, higher-priced models.

One clear winner in this environment? Copilot+ notebooks. Over a third of new in-store displays at Best Buy and Costco now feature these AI-enhanced machines, signaling a strong shift toward performance and utility.

Chromebooks, long seen as the back-to-school MVP, are also undergoing a transformation. Prices are up, and discounting has weakened, especially for Windows competitors. This suggests a new pricing normal may be settling in, one where value is measured more in long-term utility than short-term markdowns.

Retail Pricing & Promo Strategies: Tablets

A Split Market Emerges

Tablets are no longer one market: they’re two. This split indicates a clear divide between premium and budget strategies.

On one end, budget brands like Amazon, Lenovo, and Samsung have trimmed average selling prices (ASP), making these models more accessible in a value-conscious climate.

- According to OpenBrand data, ASPs for each were down $23 or more; Amazon (-$23), Lenovo (-$24), and Samsung (-$31).

- Meanwhile, Apple and Microsoft are pushing premium models further up the pricing ladder +$102 and +$162, respectively.

This split is shaping both launch strategy and promotions.

Apple’s latest iPad Pro and Air models launched with higher storage and premium features, while holding (or even increasing) price.

Microsoft’s Surface Pro Copilot+ made waves by slashing its entry price by $200 but compromising display quality and performance.

Spring discounts told a similar story. While overall promotional values rose, percentage discounts actually dropped—meaning brands are applying promos to higher-priced models. Aggressive clearance activity centered on aging iPad Pro models, which saw discounts of up to 47% off.

The goal? Clear room for a more premium-focused lineup moving into fall.

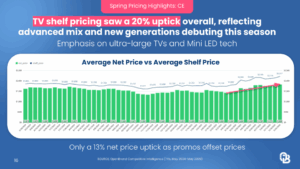

Retail Pricing & Promo Strategies: TVs

Price Rises But Deals Still Drive Behavior

The TV market is booming — literally and figuratively.

This spring brought a wave of ultra-large formats, Mini LED innovation, and premium OLED debuts.

Shelf prices rose 20%, but thanks to elevated promotional activity, net prices only climbed 13% YoY, a testament to how crucial deals remain in this category.

TCL and Hisense were especially aggressive, using events like the Super Bowl and Memorial Day to launch compelling offers, including BOGOs and bundled value adds (e.g. Free projectors or 55” bonus TVs). Promotions during this time approached Black Friday levels, averaging 26% off with over $600 in average promotional value.

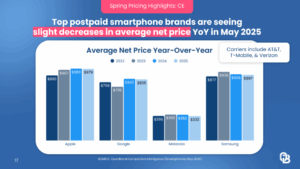

Retail Pricing & Promo Strategies: Smartphones

Trade-Ins & Familiarity Lead Behavior

Smartphone promotions followed in a similar suit as televisions.

Average prices dipped slightly YoY as brands continued to lean heavily into trade-in bonuses to offset any sign of tariff-driven cost increases. Apple, Samsung, and Motorola each offered limited-time boosts to get shoppers to upgrade before summer.

Consumer behavior data collected from OpenBrand’s MindShare survey showed shoppers gravitating toward familiar brands like Samsung and Apple, another example which signaled a desire for stability in a volatile economy.

Looking Ahead: Outlook for the Second Half of 2025

As we enter summer and back-to-school, all eyes are on how brands manage cost pressure, inventory, and value perception. Promotions are likely to remain targeted and strategic, not broad-based. In addition, as some segments like printers and gaming PCs are in a holding pattern for now, the pace of refreshes is expected to pick up as we move toward Prime Day and into fall.

Meanwhile, Walmart is seeing a rise in shoppers especially in computing and tablets, thanks to modest pricing increases and reliable availability. Retailers who can offer consistency, as well as a compelling value story, stand to benefit most in today’s climate.

Final Thoughts: Growth Through Alignment

As senior analyst Valerie Alde-Hayman closed out the webinar, she left us with a simple takeaway: the market is changing, and brands need to change with it.

Alignment across pricing, promotions, product timing, and inventory strategy is essential to staying competitive in today’s market..

As the market evolves, so should your strategy. This new season brings change and opportunity. In a landscape shaped by shifting prices, cautious consumers, and rising competitive pressure, success depends on having the right intelligence at the right time.

Let our data guide your next move.

If you’re navigating where to focus, when to promote, or how to win in a tariff-tangled, value-driven world, backing your retail pricing and promotions strategy with data is a must. OpenBrand is the edge you need.

See how we can support your strategy through data.

Request a custom brand report now.

Valerie Alde-Hayman

Val is a Senior Analyst at OpenBrand. With over 12 years of experience, she has established a reputation for delivering insightful analysis and thought leadership, while helping organizations navigate the complexities of the print market. With a deep understanding of industry trends and technological advancements, Valerie has contributed significantly to the field, sharing expertise through numerous publications, presentations, and consultations.

Related blogs

Explore Our Data

Free Quarterly Dashboards

Explore category-level data dashboards, built to help you track category leaders, pricing dynamics, and consumer demand – with no subscription or fee.

Related blogs

Business Printer Hardware: 2025 Year-In-Review

Our Business Printers: Printer Hardware 2025 Year-in-Review report recaps product launch activity,…

Headphones: 2025 Year-In-Review

Our Headphones: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…

Refrigerators: 2025 Year-In-Review

Our Refrigerators: 2025 Year-in-Review report recaps product launches, placements, pricing and…

Notebooks: 2025 Year-In-Review

Our Notebooks: 2025 Year-in-Review report recaps launches, placements, pricing and advertising and…